Jack Henry & Associates, Inc. Reports Fourth Quarter and Full Year Fiscal 2024 Results

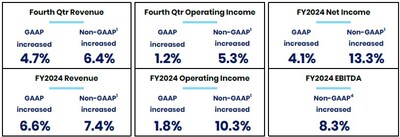

Jack Henry & Associates reported its Q4 and full year fiscal 2024 results. GAAP revenue for Q4 increased by 4.7% to $559.9 million, and for the fiscal year, it rose by 6.6% to $2.22 billion. Non-GAAP adjusted revenue for Q4 grew by 6.4% to $553.2 million, and for the fiscal year, it was up by 7.4% to $2.2 billion. GAAP EPS for Q4 was $1.38, up from $1.34 in the prior year, while fiscal year EPS was $5.23 compared to $5.02 last year. Full-year guidance for fiscal 2025 projects revenue between $2.369 billion and $2.391 billion, with a GAAP EPS range of $5.78 to $5.87.

Services and support revenue increased by 1.5% for Q4 and 5.0% for the fiscal year. Processing revenue saw a rise of 9.2% for Q4 and 8.9% for the year. Operating income for Q4 was up by 1.2% to $125.6 million and for the year it grew by 1.8% to $489.4 million. Net income for Q4 increased by 3.4% to $101.1 million and by 4.1% to $381.8 million for the year.

The company highlighted robust technology spending and demand for innovative solutions as key factors driving growth. Cash and cash equivalents at the end of the fiscal year were $38 million, with an outstanding debt of $150 million related to credit facilities.

Jack Henry & Associates ha riportato i risultati del quarto trimestre e dell'intero anno fiscale 2024. Le entrate GAAP per il quarto trimestre sono aumentate del 4,7% a $559,9 milioni, e per l'anno fiscale, sono cresciute del 6,6% a $2,22 miliardi. Le entrate regolate non GAAP per il quarto trimestre sono aumentate del 6,4% a $553,2 milioni, e per l'anno fiscale, sono salite del 7,4% a $2,2 miliardi. L'EPS GAAP per il quarto trimestre è stato di $1,38, rispetto a $1,34 dell'anno precedente, mentre l'EPS per l'anno fiscale è stato di $5,23 rispetto a $5,02 dell'anno scorso. La previsione per l'intero anno fiscale 2025 stima entrate tra $2,369 miliardi e $2,391 miliardi, con un intervallo di EPS GAAP di $5,78 a $5,87.

Le entrate da servizi e supporto sono aumentate dell'1,5% per il quarto trimestre e del 5,0% per l'anno fiscale. Le entrate da elaborazione hanno visto un aumento del 9,2% per il quarto trimestre e dell'8,9% per l'anno. Il reddito operativo per il quarto trimestre è salito dell'1,2% a $125,6 milioni e per l'anno è cresciuto dell'1,8% a $489,4 milioni. L'utile netto per il quarto trimestre è aumentato del 3,4% a $101,1 milioni e del 4,1% a $381,8 milioni per l'anno.

L'azienda ha evidenziato come spese tecnologiche robuste e la domanda di soluzioni innovative siano fattori chiave per la crescita. Alla fine dell'anno fiscale, la liquidità e le equivalenti ammontavano a $38 milioni, con un debito di $150 milioni relativo a linee di credito.

Jack Henry & Associates reportó sus resultados del cuarto trimestre y del año fiscal completo 2024. Los ingresos GAAP para el cuarto trimestre aumentaron un 4.7% a $559.9 millones, y para el año fiscal, crecieron un 6.6% a $2.22 mil millones. Los ingresos ajustados no GAAP para el cuarto trimestre crecieron un 6.4% a $553.2 millones, y para el año fiscal, aumentaron un 7.4% a $2.2 mil millones. El EPS GAAP para el cuarto trimestre fue de $1.38, en comparación con $1.34 del año anterior, mientras que el EPS del año fiscal fue de $5.23 frente a $5.02 del año pasado. La orientación de ingresos para el año fiscal 2025 proyecta ingresos entre $2.369 mil millones y $2.391 mil millones, con un rango de EPS GAAP de $5.78 a $5.87.

Los ingresos por servicios y soporte aumentaron un 1.5% para el cuarto trimestre y un 5.0% para el año fiscal. Los ingresos por procesamiento vieron un aumento del 9.2% para el cuarto trimestre y del 8.9% para el año. El ingreso operativo para el cuarto trimestre aumentó un 1.2% a $125.6 millones y para el año creció un 1.8% a $489.4 millones. El ingreso neto para el cuarto trimestre aumentó un 3.4% a $101.1 millones y un 4.1% a $381.8 millones para el año.

La empresa destacó el gasto tecnológico robusto y la demanda de soluciones innovadoras como factores clave que impulsan el crecimiento. Al final del año fiscal, el efectivo y equivalentes ascendieron a $38 millones, con una deuda pendiente de $150 millones relacionada con líneas de crédito.

잭 헨리 & 어소시에이츠는 2024 회계연도 4분기 및 전체 연도 결과를 보고했습니다. 4분기 GAAP 수익은 4.7% 증가하여 5억 5천 9백 90만 달러에 달했으며, 회계 연도 전체 수익은 6.6% 증가하여 22억 2천만 달러에 이르렀습니다. 4분기 비 GAAP 조정 수익은 6.4% 증가하여 5억 5천 3백 20만 달러에 달했으며, 회계 연도 전체는 7.4% 증가하여 22억 달러에 이르렀습니다. 4분기 GAAP EPS는 $1.38로 지난해의 $1.34에서 증가하였고, 회계 연도 EPS는 작년의 $5.02에 비해 $5.23로 증가했습니다. 2025 회계연도 전체에 대한 전망은 수익이 23억 6천9백만 달러에서 23억 9천1백만 달러 사이가 될 것으로 보이며, GAAP EPS는 $5.78에서 $5.87 사이가 될 것으로 예상됩니다.

서비스 및 지원 수익은 4분기에 1.5%, 회계 연도 전체에 5.0% 증가했습니다. 처리 수익은 4분기에 9.2%, 연도 전체에 8.9% 증가했습니다. 4분기 운영 소득은 $125.6 백만으로 1.2% 증가했고, 연간으로는 $489.4 백만으로 1.8% 증가했습니다. 4분기 순이익은 $101.1 백만으로 3.4% 증가했으며, 연간으로는 $381.8 백만으로 4.1% 증가했습니다.

회사는 강력한 기술 지출과 혁신적인 솔루션에 대한 수요가 성장을 이끄는 주요 요인이라고 강조했습니다. 회계 연도 종료 시 현금 및 현금성 자산은 $3800만 달러였으며, 신용 시설과 관련된 미결제 부채는 $1억 5천만 달러였습니다.

Jack Henry & Associates a annoncé ses résultats du quatrième trimestre et de l'année fiscale complète 2024. Les revenus GAAP pour le quatrième trimestre ont augmenté de 4,7 % pour atteindre 559,9 millions de dollars, tandis que pour l'année fiscale, ils ont progressé de 6,6 % pour atteindre 2,22 milliards de dollars. Les revenus ajustés non GAAP pour le quatrième trimestre ont crû de 6,4 % pour atteindre 553,2 millions de dollars, et pour l'année fiscale, ils ont augmenté de 7,4 % pour atteindre 2,2 milliards de dollars. Le BPA GAAP pour le quatrième trimestre était de 1,38 $, contre 1,34 $ l'an dernier, tandis que le BPA pour l'année fiscale était de 5,23 $ par rapport à 5,02 $ l'année précédente. Les prévisions pour l'année fiscale 2025 prévoient des revenus compris entre 2,369 milliards de dollars et 2,391 milliards de dollars, avec une fourchette de BPA GAAP de 5,78 $ à 5,87 $.

Les revenus des services et du support ont augmenté de 1,5 % pour le quatrième trimestre et de 5,0 % pour l'année fiscale. Les revenus de traitement ont vu une augmentation de 9,2 % pour le quatrième trimestre et de 8,9 % pour l'année. Le bénéfice d'exploitation pour le quatrième trimestre a augmenté de 1,2 % pour atteindre 125,6 millions de dollars et pour l'année, il a crû de 1,8 % pour atteindre 489,4 millions de dollars. Le bénéfice net pour le quatrième trimestre a augmenté de 3,4 % pour atteindre 101,1 millions de dollars et de 4,1 % pour atteindre 381,8 millions de dollars sur l'année.

L'entreprise a mis en avant des dépenses technologiques robustes et la demande de solutions innovantes comme des facteurs clés de la croissance. À la fin de l'année fiscale, la trésorerie et les équivalents de trésorerie s'élevaient à 38 millions de dollars, avec une dette en cours de 150 millions de dollars liée aux lignes de crédit.

Jack Henry & Associates hat die Ergebnisse für das vierte Quartal und das gesamte Finanzjahr 2024 bekanntgegeben. Der GAAP-Umsatz für das vierte Quartal stieg um 4,7 % auf 559,9 Millionen USD, und für das Finanzjahr erhöhte er sich um 6,6 % auf 2,22 Milliarden USD. Der bereinigte Umsatz nach Non-GAAP stieg im vierten Quartal um 6,4 % auf 553,2 Millionen USD, und für das Finanzjahr stieg er um 7,4 % auf 2,2 Milliarden USD. Das GAAP-EPS für das vierte Quartal lag bei 1,38 USD, gegenüber 1,34 USD im Vorjahr, während das EPS für das Finanzjahr 5,23 USD betrug im Vergleich zu 5,02 USD im letzten Jahr. Die Prognose für das gesamte Finanzjahr 2025 erwartet einen Umsatz zwischen 2,369 Milliarden USD und 2,391 Milliarden USD, mit einem GAAP-EPS-Bereich von 5,78 USD bis 5,87 USD.

Die Einnahmen aus Dienstleistungen und Support stiegen um 1,5 % im vierten Quartal und um 5,0 % für das Finanzjahr. Die Einnahmen aus der Verarbeitung verzeichneten einen Anstieg von 9,2 % im vierten Quartal und von 8,9 % im Gesamtjahr. Das Betriebsergebnis stieg im vierten Quartal um 1,2 % auf 125,6 Millionen USD und für das Jahr um 1,8 % auf 489,4 Millionen USD. Der Nettogewinn stieg im vierten Quartal um 3,4 % auf 101,1 Millionen USD und um 4,1 % auf 381,8 Millionen USD für das Jahr.

Das Unternehmen hob hervor, dass kräftige Technologieausgaben und die Nachfrage nach innovativen Lösungen entscheidende Faktoren für das Wachstum sind. Zum Ende des Finanzjahres beliefen sich die liquiden Mittel und Zahlungsmitteläquivalente auf 38 Millionen USD, bei einer ausstehenden Verschuldung von 150 Millionen USD im Zusammenhang mit Kreditfazilitäten.

- GAAP revenue increased by 4.7% in Q4 and by 6.6% for the fiscal year.

- Non-GAAP adjusted revenue increased by 6.4% in Q4 and by 7.4% for the fiscal year.

- GAAP EPS was $1.38 for Q4 and $5.23 for the fiscal year, showing growth from the previous year.

- Operating income grew by 1.2% in Q4 and by 1.8% for the fiscal year.

- Net income increased by 3.4% in Q4 and by 4.1% for the fiscal year.

- Full-year fiscal 2025 guidance projects revenue growth and a strong EPS range.

- Strong technology spending and demand for innovative solutions.

- Cost of revenue increased by 6.0% in Q4 and by 6.6% for the fiscal year.

- Research and development expenses rose by 3.6% in Q4 and by 3.9% for the fiscal year.

- Selling, general, and administrative expenses increased by 6.4% in Q4 and by 18.3% for the fiscal year.

Insights

Jack Henry's Q4 and full-year fiscal 2024 results show solid growth despite a challenging macroeconomic environment. The company reported a

The company's core business segments all showed growth, with the payments segment leading at

However, operating margins saw a slight compression, with GAAP operating margin decreasing from

Jack Henry's performance indicates a robust demand for financial technology solutions in the banking sector. The company's strong growth in processing revenue (up

The record sales bookings achieved in both Q4 and the full fiscal year, along with a near all-time high sales pipeline, indicate that financial institutions are continuing to invest in technology upgrades despite economic uncertainties. This trend is likely driven by the need to enhance digital capabilities and improve operational efficiencies in response to changing customer expectations and competitive pressures.

Looking ahead, Jack Henry's fiscal 2025 guidance projects continued growth, with revenue expected to increase to between

Fourth quarter summary:

- GAAP revenue increased

4.7% and GAAP operating income increased1.2% for the fiscal three months ended June 30, 2024, compared to the prior fiscal year quarter. - Non-GAAP adjusted revenue increased

6.4% and non-GAAP adjusted operating income increased5.3% for the fiscal three months ended June 30, 2024, compared to the prior fiscal year quarter.1 - GAAP EPS was

$1.38 $1.34

Fiscal year summary:

- GAAP revenue increased

6.6% and GAAP operating income increased1.8% for the fiscal year ended June 30, 2024, compared to the prior fiscal year. - Non-GAAP adjusted revenue increased

7.4% and non-GAAP adjusted operating income increased10.3% for the fiscal year ended June 30, 2024, compared to the prior fiscal year.1 - GAAP EPS was

$5.23 $5.02 - Cash and cash equivalents were

$38 million $12 million - Debt outstanding related to credit facilities was

$150 million $275 million

Full year fiscal 2025 guidance:2

Current | ||

GAAP | Low | High |

Revenue | ||

Operating margin | 23.0 % | 23.2 % |

EPS | ||

Non-GAAP3 | ||

Adjusted revenue | ||

Adjusted operating margin | 22.7 % | 22.8 % |

According to Greg Adelson, President and CEO, "We are very pleased to report overall strong financial performance results for the fourth quarter and full 2024 fiscal year. We produced record revenue and operating income in fiscal year 2024 along with our highest-ever sales bookings in both the fourth quarter and fiscal year. Technology spending remains robust with significant demand for our innovative solutions. Even with record sales bookings, we continued to replenish and keep our sales pipeline near its all-time high. We are well positioned for future growth as we continue to invest in innovation, execute on our strategy, and deliver for our clients and shareholders." |

1 See tables below on page 4 reconciling non-GAAP financial measures to GAAP.

2 The full fiscal year guidance assumes no acquisitions or dispositions are made during fiscal year 2025.

3 See tables below on page 8 reconciling fiscal year 2024 GAAP to non-GAAP guidance.

4 See table below on page 14 reconciling net income to non-GAAP EBITDA.

Operating Results

Revenue, operating expenses, operating income, and net income for the three months and fiscal year ended June 30, 2024, compared to the three months and fiscal year ended June 30, 2023, were as follows:

Revenue | |||||||||||

(Unaudited, In Thousands) | Three Months Ended June 30, | % | Year Ended June 30, | % | |||||||

2024 | 2023 | 2024 | 2023 | ||||||||

Revenue | |||||||||||

Services and Support | $ 316,739 | $ 311,931 | 1.5 % | $ 1,275,954 | $ 1,214,701 | 5.0 % | |||||

Percentage of Total Revenue | 56.6 % | 58.3 % | 57.6 % | 58.5 % | |||||||

Processing | 243,173 | 222,703 | 9.2 % | 939,589 | 863,001 | 8.9 % | |||||

Percentage of Total Revenue | 43.4 % | 41.7 % | 42.4 % | 41.5 % | |||||||

REVENUE | $ 559,912 | $ 534,634 | 4.7 % | $ 2,215,543 | $ 2,077,702 | 6.6 % | |||||

- Services and support revenue increased for the three months ended June 30, 2024, primarily driven by growth in data processing and hosting revenue of

11.5% . The increase in services and support revenue was partially offset by the decrease in deconversion revenue quarter over quarter. Processing revenue increased for the three months ended June 30, 2024, primarily driven by growth in card revenue of8.3% and transaction and digital revenue of14.0% . Other drivers were increases in payment processing and remote capture and ACH revenues. - Services and support revenue increased for the fiscal year ended June 30, 2024, primarily driven by growth in data processing and hosting revenue of

10.9% . Other drivers were increases in software usage, consulting, and hardware revenues. The increase in services and support revenue was partially offset by the decrease in deconversion revenue fiscal year over fiscal year. Processing revenue increased for the fiscal year ended June 30, 2024, primarily driven by growth in card revenue of6.2% and transaction and digital revenue of17.7% . Other drivers were increases in payment processing, remote capture and ACH, and other processing revenues. - For the three months ended June 30, 2024, core segment revenue increased

3.0% , payments segment revenue increased7.7% , complementary segment revenue increased2.7% , and corporate and other segment revenue increased5.8% . For the three months ended June 30, 2024, non-GAAP adjusted core segment revenue increased4.4% , non-GAAP adjusted payments segment revenue increased8.4% , non-GAAP adjusted complementary segment revenue increased6.0% , and non-GAAP adjusted corporate and other segment revenue increased6.3% (see revenue lines of segment break-out tables on pages 5 and 6 below). - For the fiscal year ended June 30, 2024, core segment revenue increased

6.4% , payments segment revenue increased6.6% , complementary segment revenue increased5.9% , and corporate and other segment revenue increased14.3% . For the fiscal year ended June 30, 2024, non-GAAP adjusted core segment revenue increased7.1% , non-GAAP adjusted payments segment revenue increased6.7% , non-GAAP adjusted complementary segment revenue increased7.7% , and non-GAAP adjusted corporate and other segment revenue increased14.4% (see revenue lines of segment break-out tables on pages 6 and 7 below).

Operating Expenses and Operating Income | ||||||||||||

(Unaudited, In Thousands) | Three Months Ended June 30, | % | Year Ended June 30, | % | ||||||||

2024 | 2023 | 2024 | 2023 | |||||||||

Cost of Revenue | $ 327,272 | $ 308,868 | 6.0 % | $ 1,299,477 | $ 1,219,062 | 6.6 % | ||||||

Percentage of Total Revenue5 | 58.5 % | 57.8 % | 58.7 % | 58.7 % | ||||||||

Research and Development | 39,892 | 38,498 | 3.6 % | 148,256 | 142,678 | 3.9 % | ||||||

Percentage of Total Revenue5 | 7.1 % | 7.2 % | 6.7 % | 6.9 % | ||||||||

Selling, General, and Administrative | 67,122 | 63,069 | 6.4 % | 278,419 | 235,274 | 18.3 % | ||||||

Percentage of Total Revenue5 | 12.0 % | 11.8 % | 12.6 % | 11.3 % | ||||||||

OPERATING EXPENSES | 434,286 | 410,435 | 5.8 % | 1,726,152 | 1,597,014 | 8.1 % | ||||||

OPERATING INCOME | $ 125,626 | $ 124,199 | 1.2 % | $ 489,391 | $ 480,688 | 1.8 % | ||||||

Operating Margin5 | 22.4 % | 23.2 % | 22.1 % | 23.1 % | ||||||||

- Cost of revenue increased for the three months ended June 30, 2024, primarily due to higher direct costs generally consistent with increases in the related revenue, higher personnel costs, and increased internal licenses and fees. Cost of revenue increased for the fiscal year ended June 30, 2024, primarily due to increased personnel costs, higher direct costs generally consistent with increases in the related revenue, and increased internal licenses and fees.

- Research and development expense increased for the three months ended June 30, 2024, primarily due to higher consulting and other professional services (net of capitalization) and increased cloud consumption costs (net of capitalization). Research and development expense increased for the fiscal year ended June 30, 2024, primarily due to higher cloud consumption (net of capitalization) and increased personnel costs (net of capitalization) related to the Jack Henry Platform and Payrailz, LLC ("Payrailz").6

- Selling, general, and administrative expense increased for the three months ended June 30, 2024, primarily due to higher personnel costs, including increased commissions, payroll taxes, and medical benefits expenses. Selling, general, and administrative expense increased for the fiscal year ended June 30, 2024, primarily due to higher personnel costs, including the voluntary employee departure incentive payment (VEDIP) program7 and commissions expenses.

Net Income

(Unaudited, In Thousands, Except Per Share Data) | Three Months Ended June 30, | % | Year Ended June 30, | % | |||||||

2024 | 2023 | 2024 | 2023 | ||||||||

Income Before Income Taxes | $ 130,384 | $ 123,950 | 5.2 % | $ 498,019 | $ 474,574 | 4.9 % | |||||

Provision for Income Taxes | 29,311 | 26,177 | 12.0 % | 116,203 | 107,928 | 7.7 % | |||||

NET INCOME | $ 101,073 | $ 97,773 | 3.4 % | $ 381,816 | $ 366,646 | 4.1 % | |||||

Diluted earnings per share | $ 1.38 | $ 1.34 | 3.3 % | $ 5.23 | $ 5.02 | 4.2 % | |||||

- Effective tax rates for the three months ended June 30, 2024, and 2023, were

22.5% and21.1% , respectively. Effective tax rates for the fiscal year ended June 30, 2024, and 2023, were23.3% and22.7% , respectively.

According to Mimi Carsley, CFO and Treasurer, "For both the fourth quarter and the fiscal year, our private cloud and processing services continued to drive robust revenue growth. These key areas of revenue had strong, organic revenue growth of |

5 Operating margin is calculated by dividing operating income by revenue. Operating margin plus operating expense components as a percentage of total revenue may not equal

6 On August 31, 2022, the Company acquired all the equity interest in Payrailz.

7 The VEDIP program was a Company voluntary separation program offered to certain eligible employees beginning in July 2023.

Impact of Non-GAAP Adjustments

The tables below show our revenue, operating income, and net income for the three months ended June 30, 2024, and fiscal year ended June 30, 2024, compared to the three months ended June 30, 2023, and fiscal year ended June 30, 2023, excluding the impacts of deconversions, the VEDIP program expense,* the (gain)/loss on sale of assets, net, and the acquisition.

On August 31, 2022, the Company acquired all the equity interest in Payrailz (the "acquisition"). Payrailz related revenue, operating expenses, operating income, and net income excluded in the tables below in the column for the year ended June 30, 2024, include Payrailz activity for the first two months of the fiscal year only.

(Unaudited, In Thousands) | Three Months Ended June 30, | % | Year Ended June 30, | % | |||||||

2024 | 2023 | 2024 | 2023 | ||||||||

GAAP Revenue** | $ 559,912 | $ 534,634 | 4.7 % | $ 2,215,543 | $ 2,077,702 | 6.6 % | |||||

Adjustments: | |||||||||||

Deconversion revenue | (6,693) | (14,733) | (16,554) | (31,775) | |||||||

Revenue from acquisition | — | — | (1,945) | — | |||||||

NON-GAAP ADJUSTED REVENUE** | $ 553,219 | $ 519,901 | 6.4 % | $ 2,197,044 | $ 2,045,927 | 7.4 % | |||||

GAAP Operating Income | $ 125,626 | $ 124,199 | 1.2 % | $ 489,391 | $ 480,688 | 1.8 % | |||||

Adjustments: | |||||||||||

Operating income from deconversions | (5,594) | (13,054) | (13,146) | (27,513) | |||||||

VEDIP program expense* | — | — | 16,443 | — | |||||||

Operating loss from acquisition | — | — | 2,237 | — | |||||||

(Gain)/loss on sale of assets, net | — | 2,816 | — | (4,567) | |||||||

NON-GAAP ADJUSTED OPERATING INCOME | $ 120,032 | $ 113,961 | 5.3 % | $ 494,925 | $ 448,608 | 10.3 % | |||||

Non-GAAP Adjusted Operating Margin*** | 21.7 % | 21.9 % | 22.5 % | 21.9 % | |||||||

GAAP Net Income | $ 101,073 | $ 97,773 | 3.4 % | $ 381,816 | $ 366,646 | 4.1 % | |||||

*The VEDIP program expense for the fiscal year ended June 30, 2024, was related to a Company voluntary separation program offered to certain eligible employees beginning in July 2023. |

**GAAP revenue is comprised of services and support and processing revenues (see page 2). Reducing services and support revenue by deconversion revenue for the three months ended June 30, 2024, and 2023 which was |

Reducing services and support revenue by deconversion revenue for the year ended June 30, 2024, and 2023, which was |

***Non-GAAP adjusted operating margin is calculated by dividing non-GAAP adjusted operating income by non-GAAP adjusted revenue. |

(Unaudited, In Thousands) | Three Months Ended June 30, | % | Year Ended June 30, | % | |||||||

2024 | 2023 | 2024 | 2023 | ||||||||

GAAP Net Income | $ 101,073 | $ 97,773 | 3.4 % | $ 381,816 | $ 366,646 | 4.1 % | |||||

Adjustments: | |||||||||||

Net income from deconversions | (5,594) | (13,054) | (13,146) | (27,513) | |||||||

VEDIP program expense* | — | — | 16,443 | — | |||||||

Net loss from acquisition | — | — | 4,656 | — | |||||||

(Gain)/loss on sale of assets, net | — | 2,816 | — | (4,567) | |||||||

Tax impact of adjustments** | 1,343 | 2,456 | (1,909) | 7,699 | |||||||

NON-GAAP ADJUSTED NET INCOME | $ 96,822 | $ 89,991 | 7.6 % | $ 387,860 | $ 342,265 | 13.3 % | |||||

*The VEDIP program expense for the fiscal year ended June 30, 2024, was related to a Company voluntary separation program offered to certain eligible employees beginning in July 2023. |

**The tax impact of adjustments is calculated using a tax rate of |

The tables below show the segment break-out of revenue and cost of revenue for each period presented, as adjusted for the items above, and include a reconciliation to non-GAAP adjusted operating income presented above.

Three Months Ended June 30, 2024 | |||||||||

(Unaudited, In Thousands) | Core | Payments | Complementary | Corporate | Total | ||||

GAAP REVENUE | $ 172,040 | $ 212,593 | $ 155,149 | $ 20,130 | $ 559,912 | ||||

Non-GAAP adjustments* | (2,407) | (2,367) | (1,777) | (142) | (6,693) | ||||

NON-GAAP ADJUSTED REVENUE | 169,633 | 210,226 | 153,372 | 19,988 | 553,219 | ||||

GAAP COST OF REVENUE | 69,900 | 111,787 | 64,295 | 81,290 | 327,272 | ||||

Non-GAAP adjustments* | (415) | (66) | (188) | — | (669) | ||||

NON-GAAP ADJUSTED COST OF REVENUE | 69,485 | 111,721 | 64,107 | 81,290 | 326,603 | ||||

GAAP SEGMENT INCOME | $ 102,140 | $ 100,806 | $ 90,854 | $ (61,160) | |||||

Segment Income Margin** | 59.4 % | 47.4 % | 58.6 % | (303.8) % | |||||

NON-GAAP ADJUSTED SEGMENT INCOME | $ 100,148 | $ 98,505 | $ 89,265 | $ (61,302) | |||||

Non-GAAP Adjusted Segment Income Margin** | 59.0 % | 46.9 % | 58.2 % | (306.7) % | |||||

Research and Development | 39,892 | ||||||||

Selling, General, and Administrative | 67,122 | ||||||||

Non-GAAP adjustments unassigned to a segment*** | (430) | ||||||||

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 433,187 | ||||||||

NON-GAAP ADJUSTED OPERATING INCOME | $ 120,032 | ||||||||

*Revenue non-GAAP adjustments for all segments were deconversion revenue. Cost of revenue non-GAAP adjustments for all segments were deconversion costs. |

**Segment income margin is calculated by dividing segment income by revenue. Non-GAAP adjusted segment income margin is calculated by dividing non-GAAP adjusted segment income by non-GAAP adjusted revenue. |

***Non-GAAP adjustments unassigned to a segment were selling, general, and administrative deconversion costs. |

Three Months Ended June 30, 2023 | |||||||||

(Unaudited, In Thousands) | Core | Payments | Complementary | Corporate | Total | ||||

GAAP REVENUE | $ 167,085 | $ 197,466 | $ 151,059 | $ 19,024 | $ 534,634 | ||||

Non-GAAP adjustments* | (4,676) | (3,510) | (6,330) | (217) | (14,733) | ||||

NON-GAAP ADJUSTED REVENUE | 162,409 | 193,956 | 144,729 | 18,807 | 519,901 | ||||

GAAP COST OF REVENUE | 69,554 | 106,699 | 59,673 | 72,942 | 308,868 | ||||

Non-GAAP adjustments* | (256) | (82) | (269) | (3) | (610) | ||||

NON-GAAP ADJUSTED COST OF REVENUE | 69,298 | 106,617 | 59,404 | 72,939 | 308,258 | ||||

GAAP SEGMENT INCOME | $ 97,531 | $ 90,767 | $ 91,386 | $ (53,918) | |||||

Segment Income Margin | 58.4 % | 46.0 % | 60.5 % | (283.4) % | |||||

NON-GAAP ADJUSTED SEGMENT INCOME | $ 93,111 | $ 87,339 | $ 85,325 | $ (54,132) | |||||

Non-GAAP Adjusted Segment Income Margin | 57.3 % | 45.0 % | 59.0 % | (287.8) % | |||||

Research and Development | 38,498 | ||||||||

Selling, General, and Administrative | 63,069 | ||||||||

Non-GAAP adjustments unassigned to a segment** | (3,885) | ||||||||

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 405,940 | ||||||||

NON-GAAP ADJUSTED OPERATING INCOME | $ 113,961 | ||||||||

*Revenue non-GAAP adjustments for all segments were deconversion revenues. Cost of revenue non-GAAP adjustments for all segments were deconversion costs. |

**Non-GAAP adjustments unassigned to a segment were selling, general, and administrative deconversion costs of |

Year Ended June 30, 2024 | |||||||||

(Unaudited, In Thousands) | Core | Payments | Complementary | Corporate | Total | ||||

GAAP REVENUE | $ 817,708 | $ 618,211 | $ 88,886 | ||||||

Non-GAAP adjustments* | (7,292) | (7,781) | (3,217) | (209) | (18,499) | ||||

NON-GAAP ADJUSTED REVENUE | 683,446 | 809,927 | 614,994 | 88,677 | 2,197,044 | ||||

GAAP COST OF REVENUE | 287,349 | 442,084 | 256,007 | 314,037 | 1,299,477 | ||||

Non-GAAP adjustments* | (1,065) | (3,573) | (903) | (24) | (5,565) | ||||

NON-GAAP ADJUSTED COST OF REVENUE | 286,284 | 438,511 | 255,104 | 314,013 | 1,293,912 | ||||

GAAP SEGMENT INCOME | $ 375,624 | $ 362,204 | $ (225,151) | ||||||

Segment Income Margin | 58.4 % | 45.9 % | 58.6 % | (253.3) % | |||||

NON-GAAP ADJUSTED SEGMENT INCOME | $ 397,162 | $ 371,416 | $ 359,890 | ||||||

Non-GAAP Adjusted Segment Income Margin | 58.1 % | 45.9 % | 58.5 % | (254.1) % | |||||

Research and Development | 148,256 | ||||||||

Selling, General, and Administrative | 278,419 | ||||||||

Non-GAAP adjustments unassigned to a segment** | (18,468) | ||||||||

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 1,702,119 | ||||||||

NON-GAAP ADJUSTED OPERATING INCOME | $ 494,925 | ||||||||

*Revenue non-GAAP adjustments for the Core, Complementary, and Corporate and Other segments were deconversion revenue. Revenue non-GAAP adjustments for the Payments segment were deconversion revenue of |

**Non-GAAP adjustments unassigned to a segment were selling, general, and administrative VEDIP expenses, deconversion costs, and acquisition costs of |

Year Ended June 30, 2023 | |||||||||

(Unaudited, In Thousands) | Core | Payments | Complementary | Corporate | Total | ||||

GAAP REVENUE | $ 767,309 | $ 583,586 | $ 77,762 | ||||||

Non-GAAP adjustments* | (10,924) | (7,924) | (12,649) | (278) | (31,775) | ||||

NON-GAAP ADJUSTED REVENUE | 638,121 | 759,385 | 570,937 | 77,484 | 2,045,927 | ||||

GAAP COST OF REVENUE | 276,818 | 420,880 | 237,758 | 283,606 | 1,219,062 | ||||

Non-GAAP adjustments* | (913) | (303) | (807) | (23) | (2,046) | ||||

NON-GAAP ADJUSTED COST OF REVENUE | 275,905 | 420,577 | 236,951 | 283,583 | 1,217,016 | ||||

GAAP SEGMENT INCOME | $ 372,227 | $ 345,828 | |||||||

Segment Income Margin | 57.3 % | 45.1 % | 59.3 % | (264.7) % | |||||

NON-GAAP ADJUSTED SEGMENT INCOME | $ 362,216 | $ 333,986 | |||||||

Non-GAAP Adjusted Segment Income Margin | 56.8 % | 44.6 % | 58.5 % | (266.0) % | |||||

Research and Development | 142,678 | ||||||||

Selling, General, and Administrative | 235,274 | ||||||||

Non-GAAP adjustments unassigned to a segment** | 2,351 | ||||||||

NON-GAAP TOTAL ADJUSTED OPERATING EXPENSES | 1,597,319 | ||||||||

NON-GAAP ADJUSTED OPERATING INCOME | $ 448,608 | ||||||||

*Revenue non-GAAP adjustments for all segments were deconversion revenue. Cost of revenue non-GAAP adjustments for all segments were deconversion costs. |

**Non-GAAP adjustments unassigned to a segment were the selling, general, and administrative gain on sale of assets, net, and deconversion costs of |

The table below shows our GAAP to non-GAAP guidance for the fiscal year ending June 30, 2025. Fiscal year 2025 non-GAAP guidance excludes the impacts of deconversion revenue and related operating expenses and assumes no acquisitions or dispositions are made during the fiscal year.

For comparison and reconciliation, the table below also shows fiscal 2024 reported results, fiscal 2024 results adjusted for fiscal 2025 comparison, and fiscal 2024 acquisition activity. Fiscal 2024 non-GAAP guidance excluded the impacts of deconversion revenue and related operating expenses, acquisition revenue and costs related to the August 31, 2022, Payrailz acquisition, and costs related to the July 2023 VEDIP program.

GAAP to Non-GAAP GUIDANCE (In Millions, | Annual FY25 | Adjusted for | Reported | Acquisition | |||||||

Low | High | FY24 | FY24 | FY24 | |||||||

GAAP REVENUE | $ 2,369 | $ 2,391 | $ 2,216 | $ 2,216 | $ — | ||||||

Growth | 6.9 % | 7.9 % | |||||||||

Deconversions* | $ 16 | $ 16 | $ 17 | $ 17 | $ — | ||||||

Acquisition** | $ 2 | $ (2) | |||||||||

NON-GAAP ADJUSTED REVENUE*** | $ 2,353 | $ 2,375 | $ 2,199 | $ 2,197 | $ 2 | ||||||

Non-GAAP Adjusted Growth | 7.0 % | 8.0 % | |||||||||

GAAP OPERATING EXPENSES | $ 1,823 | $ 1,836 | $ 1,726 | $ 1,726 | $ — | ||||||

Growth | 5.6 % | 6.4 % | |||||||||

Deconversion costs* | $ 3 | $ 3 | $ 3 | $ 3 | $ — | ||||||

Acquisition costs** | — | — | $ — | $ 4 | $ (4) | ||||||

VEDIP Program**** | — | — | $ 16 | $ 16 | $ — | ||||||

NON-GAAP ADJUSTED OPERATING EXPENSES*** | $ 1,820 | $ 1,833 | $ 1,706 | $ 1,702 | $ 4 | ||||||

Non-GAAP Adjusted Growth | 6.7 % | 7.4 % | |||||||||

GAAP OPERATING INCOME | $ 546 | $ 555 | $ 489 | $ 489 | $ — | ||||||

Growth | 11.6 % | 13.3 % | |||||||||

GAAP OPERATING MARGIN | 23.0 % | 23.2 % | 22.1 % | 22.1 % | |||||||

NON-GAAP ADJUSTED OPERATING INCOME*** | $ 533 | $ 542 | $ 493 | $ 495 | $ (2) | ||||||

Non-GAAP Adjusted Growth | 8.2 % | 9.9 % | |||||||||

NON-GAAP ADJUSTED OPERATING MARGIN | 22.7 % | 22.8 % | 22.4 % | 22.5 % | |||||||

GAAP EPS***** | $ 5.78 | $ 5.87 | $ 5.23 | $ 5.23 | $ — | ||||||

Growth | 10.6 % | 12.3 % | |||||||||

Non-GAAP EPS***** | $ 5.65 | $ 5.74 | $ 5.26 | $ 5.31 | $ (0.05) | ||||||

Growth | 7.3 % | 9.0 % | |||||||||

*Deconversion revenue and related operating expenses are based on estimates for the year ended June 30, 2025, based on the lowest actual recent historical results. See the Company's Form 8-K filed with the Securities and Exchange Commission on August 12, 2024. |

**Excluded acquisition revenue and costs are for the first two months of fiscal year ended June 30, 2024 only (see "Impact of Non-GAAP Adjustments" on page 4). |

***GAAP to Non-GAAP revenue, operating expenses, and operating income may not foot due to rounding. |

****This cost relates to the group of employees who participated in a Company VEDIP program offered in July 2023 to certain employees of a specified minimum age who had reached a specified minimum number of years of service with the Company. |

*****The GAAP to Non-GAAP EPS reconciliation table is below on page 15. |

Balance Sheet and Cash Flow Review

- Cash and cash equivalents were

$38 million $12 million - Trade receivables were

$333 million $361 million - The Company had

$150 million $275 million - Deferred revenue decreased to

$389 million $400 million - Stockholders' equity increased to

$1,842 million $1,609 million

*See table below for Net Cash Provided by Operating Activities and on page 14 for Return on Average Shareholders' Equity. Tables reconciling the non-GAAP measures Free Cash Flow and Return on Invested Capital (ROIC) to GAAP measures are also on page 14. See the Use of Non-GAAP Financial Information section below for the definitions of Free Cash Flow and ROIC. |

The following table summarizes net cash from operating activities:

(Unaudited, In Thousands) | Year Ended June 30, | ||

2024 | 2023 | ||

Net income | $ 381,816 | $ 366,646 | |

Depreciation | 46,342 | 48,720 | |

Amortization | 153,562 | 142,006 | |

Change in deferred income taxes | (909) | (48,199) | |

Other non-cash expenses | 32,714 | 24,094 | |

Change in receivables | 28,219 | (12,067) | |

Change in deferred revenue | (10,797) | (10,547) | |

Change in other assets and liabilities* | (62,906) | (129,094) | |

NET CASH FROM OPERATING ACTIVITIES | $ 568,041 | $ 381,559 | |

*For the year ended June 30, 2024, includes the change in prepaid expenses, prepaid cost of product and other of |

The following table summarizes net cash from investing activities:

(Unaudited, In Thousands) | Year Ended June 30, | ||

2024 | 2023 | ||

Payment for acquisitions, net of cash acquired* | $ — | $ (229,628) | |

Capital expenditures | (58,118) | (39,179) | |

Proceeds from dispositions | 904 | 27,939 | |

Purchased software | (7,130) | (1,685) | |

Computer software developed | (167,175) | (166,120) | |

Purchase of investments | (8,646) | (1,000) | |

NET CASH FROM INVESTING ACTIVITIES | $ (240,165) | $ (409,673) | |

*During first quarter fiscal 2023, the Company completed its acquisition of Payrailz. |

The following table summarizes net cash from financing activities:

(Unaudited, In Thousands) | Year Ended June 30, | ||

2024 | 2023 | ||

Borrowings on credit facilities* | $ 475,000 | $ 810,000 | |

Repayments on credit facilities and financing leases | (600,000) | (650,060) | |

Purchase of treasury stock | (28,055) | (25,000) | |

Dividends paid | (155,877) | (147,237) | |

Net cash from issuance of stock and tax related to stock-based compensation | 7,097 | 3,867 | |

NET CASH FROM FINANCING ACTIVITIES | $ (301,835) | $ (8,430) | |

*The Company's acquisition of Payrailz during first quarter fiscal 2023 was primarily funded by new borrowings under the Company's credit facilities. |

Use of Non-GAAP Financial Information

Generally Accepted Accounting Principles (GAAP) is the term used to refer to the standard framework of guidelines for financial accounting in

We believe non-GAAP financial measures help investors better understand the underlying fundamentals and true operations of our business. Adjusted revenue, adjusted operating income, adjusted operating margin, adjusted segment income, adjusted segment income margin, adjusted cost of revenue, adjusted operating expenses, adjusted net income, and non-GAAP EPS eliminate one-time deconversion revenue and associated costs, the effects of acquisitions and divestitures, the VEDIP program expense, and the gain on sale of assets, net, all of which management believes are not indicative of the Company's operating performance. Such adjustments give investors further insight into our performance. Non-GAAP EBITDA is defined as net income attributable to the Company before the effect of interest expense, taxes, depreciation, and amortization, adjusted for net income before the effect of interest expense, taxes, depreciation, and amortization attributable to eliminated one-time deconversions, acquisitions and divestitures, the VEDIP program expense, and the gain on sale of assets, net. Free cash flow is defined as net cash from operating activities, less capitalized expenditures, internal use software, and capitalized software, plus proceeds from the sale of assets. ROIC is defined as net income divided by average invested capital, which is the average of beginning and ending long-term debt and stockholders' equity for a given period. Management believes that non-GAAP EBITDA is an important measure of the Company's overall operating performance and excludes certain costs and other transactions that management deems one time or non-operational in nature; free cash flow is useful to measure the funds generated in a given period that are available for debt service requirements and strategic capital decisions; and ROIC is a measure of the Company's allocation efficiency and effectiveness of its invested capital. For these reasons, management also uses these non-GAAP financial measures in its assessment and management of the Company's performance.

Non-GAAP financial measures used by the Company may not be comparable to similarly titled non-GAAP measures used by other companies. Non-GAAP financial measures have no standardized meaning prescribed by GAAP and therefore, are unlikely to be comparable with calculations of similar measures for other companies.

Any non-GAAP financial measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP measures. Reconciliations of the non-GAAP financial measures to related GAAP measures are included.

About Jack Henry & Associates, Inc.®

Jack HenryTM (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity — offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 48 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at www.jackhenry.com.

Statements made in this news release that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because forward-looking statements relate to the future, they are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, those discussed in the Company's Securities and Exchange Commission filings, including the Company's most recent reports on Form 10-K and Form 10-Q, particularly under the heading Risk Factors. Any forward-looking statement made in this news release speaks only as of the date of the news release, and the Company expressly disclaims any obligation to publicly update or revise any forward-looking statement, whether because of new information, future events or otherwise.

Quarterly Conference Call

The Company will hold a conference call on August 21, 2024, at 7:45 a.m. Central Time, and investors are invited to listen at www.jackhenry.com. A webcast replay will be available approximately one hour after the event at ir.jackhenry.com/corporate-events-and-presentations and will remain available for one year.

Condensed Consolidated Statements of Income (Unaudited) | |||||||||||

(In Thousands, except per share data) | Three Months Ended June 30, | % | Year Ended June 30, | % | |||||||

2024 | 2023 | 2024 | 2023 | ||||||||

REVENUE | $ 559,912 | $ 534,634 | 4.7 % | $ 2,215,543 | $ 2,077,702 | 6.6 % | |||||

Cost of Revenue | 327,272 | 308,868 | 6.0 % | 1,299,477 | 1,219,062 | 6.6 % | |||||

Research and Development | 39,892 | 38,498 | 3.6 % | 148,256 | 142,678 | 3.9 % | |||||

Selling, General, and Administrative | 67,122 | 63,069 | 6.4 % | 278,419 | 235,274 | 18.3 % | |||||

EXPENSES | 434,286 | 410,435 | 5.8 % | 1,726,152 | 1,597,014 | 8.1 % | |||||

OPERATING INCOME | 125,626 | 124,199 | 1.2 % | 489,391 | 480,688 | 1.8 % | |||||

Interest income | 8,647 | 5,176 | 67.1 % | 25,012 | 8,959 | 179.2 % | |||||

Interest expense | (3,889) | (5,425) | (28.3) % | (16,384) | (15,073) | 8.7 % | |||||

Interest Income (Expense), net | 4,758 | (249) | (2,010.8) % | 8,628 | (6,114) | (241.1) % | |||||

INCOME BEFORE INCOME TAXES | 130,384 | 123,950 | 5.2 % | 498,019 | 474,574 | 4.9 % | |||||

Provision for Income Taxes | 29,311 | 26,177 | 12.0 % | 116,203 | 107,928 | 7.7 % | |||||

NET INCOME | $ 101,073 | $ 97,773 | 3.4 % | $ 381,816 | $ 366,646 | 4.1 % | |||||

Diluted net income per share | $ 1.38 | $ 1.34 | $ 5.23 | $ 5.02 | |||||||

Diluted weighted average shares outstanding | 73,069 | 73,027 | 73,025 | 73,096 | |||||||

Consolidated Balance Sheet Highlights (Unaudited) | |||||||||||

(In Thousands) | June 30, | % | |||||||||

2024 | 2023 | ||||||||||

Cash and cash equivalents | $ 38,284 | $ 12,243 | 212.7 % | ||||||||

Receivables | 333,033 | 361,252 | (7.8) % | ||||||||

Total assets | 2,924,481 | 2,773,826 | 5.4 % | ||||||||

Accounts payable and accrued expenses | $ 226,084 | $ 191,785 | 17.9 % | ||||||||

Current and long-term debt | 150,000 | 275,000 | (45.5) % | ||||||||

Deferred revenue | 388,932 | 399,729 | (2.7) % | ||||||||

Stockholders' equity | 1,842,364 | 1,608,510 | 14.5 % | ||||||||

Calculation of Non-GAAP Earnings Before Income Taxes, Depreciation and Amortization (Non-GAAP EBITDA) | |||||||||||

Three Months Ended June 30, | % | Year Ended June 30, | % | ||||||||

(in thousands) | 2024 | 2023 | 2024 | 2023 | |||||||

Net income | $ 101,073 | $ 97,773 | $ 381,816 | $ 366,646 | |||||||

Net interest | (4,758) | 249 | (8,628) | 6,114 | |||||||

Taxes | 29,310 | 26,177 | 116,203 | 107,928 | |||||||

Depreciation and amortization | 50,690 | 48,377 | 199,904 | 190,726 | |||||||

Less: Net income before interest expense, taxes, depreciation | (5,594) | (10,238) | 3,412 | (32,081) | |||||||

NON-GAAP EBITDA | $ 170,721 | $ 162,338 | 5.2 % | $ 692,707 | $ 639,333 | 8.3 % | |||||

*The fiscal fourth quarter 2024 adjustments for net income before interest expense, taxes, depreciation and amortization were for deconversions. The fiscal year 2024 adjustments | |||||||||||

Calculation of Free Cash Flow (Non-GAAP) | Year Ended June 30, | ||||||||||

(in thousands) | 2024 | 2023 | |||||||||

Net cash from operating activities | $ 568,041 | $ 381,559 | |||||||||

Capitalized expenditures | (58,118) | (39,179) | |||||||||

Internal use software | (7,130) | (1,685) | |||||||||

Proceeds from sale of assets | 904 | 27,939 | |||||||||

Capitalized software | (167,175) | (166,120) | |||||||||

FREE CASH FLOW | $ 336,522 | $ 202,514 | |||||||||

Calculation of the Return on Average Shareholders' Equity | June 30, | ||||||||||

(in thousands) | 2024 | 2023 | |||||||||

Net income (trailing four quarters) | $ 381,816 | $ 366,646 | |||||||||

Average stockholder's equity (period beginning and ending balances) | 1,725,437 | 1,495,066 | |||||||||

RETURN ON AVERAGE SHAREHOLDERS' EQUITY | 22.1 % | 24.5 % | |||||||||

Calculation of Return on Invested Capital (ROIC) (Non-GAAP) | June 30, | ||||||||||

(in thousands) | 2024 | 2023 | |||||||||

Net income (trailing four quarters) | $ 381,816 | $ 366,646 | |||||||||

Average stockholder's equity (period beginning and ending balances) | 1,725,437 | 1,495,066 | |||||||||

Average current maturities of long-term debt (period beginning | 45,000 | 34 | |||||||||

Average long-term debt (period beginning and ending balances) | 167,500 | 195,000 | |||||||||

Average invested capital | $ 1,937,937 | $ 1,690,100 | |||||||||

ROIC | 19.7 % | 21.7 % | |||||||||

GAAP to Non-GAAP EPS Reconciliation Table | |||||||

Actual Non-GAAP EPS | Pretax | Net of Tax | FY24 | Pretax | Net of Tax | FY24 Adjusted | |

GAAP EPS | |||||||

Excluded Activity, net of Tax: | |||||||

Deconversion | |||||||

VEDIP* | |||||||

Acquisition** | n/a | n/a | |||||

Non-GAAP EPS | |||||||

FY25 Guidance | |||||||

GAAP EPS | |||||||

Excluded Activity, net of Tax: | |||||||

Deconversion*** | |||||||

Non-GAAP EPS | |||||||

*This cost relates to the group of employees who participated in a Company VEDIP program offered in July 2023 to certain employees of a specified minimum age who had reached a specified minimum number of years of service with the Company. |

**Excluded acquisition revenue and costs are for the first two months of fiscal year ended June 30, 2024 only (see "Impact of Non-GAAP Adjustments" on page 4). |

***We are not aware of any other discreet adjustments at this time. Deconversion revenue and related operating expenses are based on estimates for the year ended June 30, 2025, based on the lowest actual recent historical results. See the Company's Form 8-K filed with the Securities and Exchange Commission on August 12, 2024. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/jack-henry--associates-inc-reports-fourth-quarter-and-full-year-fiscal-2024-results-302226819.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/jack-henry--associates-inc-reports-fourth-quarter-and-full-year-fiscal-2024-results-302226819.html

SOURCE Jack Henry & Associates, Inc.