New Intuit QuickBooks Small Business Index Annual Report: US Small Business Credit Card Spending Increases 20% Post Pandemic Amid Inflation and Funding Challenges

- Small businesses are increasingly depending on credit cards, with current spending 20% higher than pre-pandemic levels. Monthly credit card payments are up by 26% on average. Small business employment rates declined in the US and Canada in 2023. Access to funding remains a challenge for small businesses, with roughly half being self-funded by the owner. Rising costs are the number-one challenge for small businesses in the US, Canada, and the UK.

- None.

Insights

Analyzing...

Inaugural report provides insights & analysis of the current state of small business in the US,

2023 Intuit QuickBooks Small Business Index Annual Report (Graphic: Business Wire)

THE STATE OF SMALL BUSINESS

The report finds that in 2023, while overall employment levels have trended upward in the US,

-

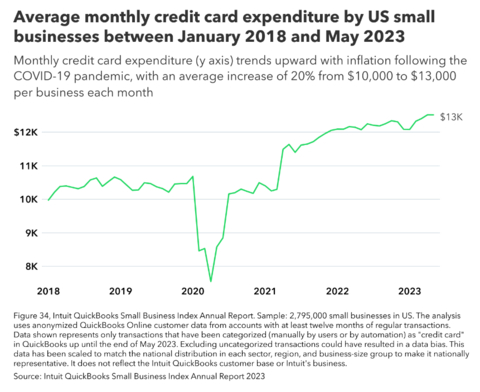

With elevated inflation and high-interest rates, small businesses have increasingly depended on their credit cards, with the current spending being

20% higher, on average, than they were before the pandemic. At the same time, their monthly credit card payments, which include interest charges, are up by26% on average. -

These pressures are affecting jobs: small business employment rates declined in the first five months of 2023 in the US and in seven of the first eight months of 2023 in

Canada . Similarly, in theUK , small business job vacancy growth rates declined in all of the first eight months of 2023. -

The rise of the solopreneur (non-employer businesses) shows entrepreneurship is stronger than ever; however, in the US and

Canada fewer new businesses are creating jobs, a concerning trend because in the US, more than a third of all jobs are with small businesses while inCanada and theUK it’s more than two in five. -

Access to funding is essential for small business growth, but roughly half of small businesses in the US,

Canada , and theUK are self-funded by the owner. New businesses and businesses owned by women or members of underrepresented racial groups often face greater funding challenges. -

Despite inflation declining over the past year, small businesses in the US,

Canada , and theUK say rising costs are still the number-one challenge they face.

FRESH INSIGHTS ON US SMALL BUSINESSES

- Small business employment/hiring: In January 2023, US small businesses with one to nine employees employed 12.8 million people, but this dropped to 12.7 million by March 2023. Since that low point, employment has rebounded to 13.1 million as of September 2023 (source: Intuit QuickBooks Small Business Index).

-

Small business contributions to the economy:

98% of all US businesses are small businesses;36% of all US workers are employed by small businesses; new businesses create jobs 1.6 times faster than the national average. -

Rise of the solopreneur (non-employer businesses): In 2005, there were 2.1 million applications for new businesses in the US; in 2020, there were 4.3 million applications. Over the same period, the number of new businesses with employees fell from

10% in 2005 to roughly8% in 2020, which could potentially weaken the pipeline for future job creation. -

Small business finances: Monthly small business credit card spending is currently

20% higher, on average, than before the pandemic, equivalent to$3,000 29% higher, equivalent to$4,000 -

Small business access to funding: While

58% of small business owners surveyed have used their own savings to fund their business, only22% report ever getting funding from a commercial lender. Small businesses owned by underrepresented racial groups are twice as likely to say “getting funding” is their number one challenge. New small businesses (0-5 years old) are 7 times more likely to say “getting funding” is their number one challenge compared to older small businesses (21+ years). -

Higher use of digital tools and technology: Among small businesses using digital tools (such as software, apps, social media, and e-commerce) to manage 8 or more different areas of their business,

55% report revenue growth and20% report workforce growth while, among those only managing up to two areas with digital tools, this drops to31% and7% , respectively.

Leading global economist and Arnold C. Harberger Professor of Economics at the University of

Intuit CEO Sasan Goodarzi said: “Becoming an entrepreneur is a bold decision. Given the significant impact new and growing small businesses have on job creation, innovation, and the economy, policymakers and industry leaders should be equally bold in creating an environment where small businesses can grow and thrive. We remain focused on working across the industry to create new and innovative ways to serve our customers and help solve their most pressing challenges.”

Based on the research and insights from the report, Intuit has developed a set of recommendations for policymakers, accountants advising their small business clients, and entrepreneurs starting and running small businesses. These concrete, actionable recommendations can help policymakers foster an environment conducive to small business growth and resilience; accountants provide guidance to their clients in responding to the challenges and trends identified in the report; and small business owners set their businesses up for success.

For more insights, check out the Intuit QuickBooks Small Business Index Annual Report here. To stay up to date on the latest monthly Index releases, visit the Intuit QuickBooks Small Business Index interactive hub.

ABOUT THE REPORT

RIGOROUS METHODOLOGY

The report’s findings are based on a new analysis by Ufuk Akcigit, Raman Singh Chhina, Seyit M. Cilasun, Javier Miranda, Eren Ocakverdi, and Nicolas Serrano-Velarde of four data sources, in partnership with Intuit QuickBooks data analysts:

-

Intuit QuickBooks Small Business Index: recent employment and hiring trends among small businesses in the US,

Canada , and theUK . Methodology details available here. -

Intuit QuickBooks customer data: anonymised, aggregated and reweighted/adjusted to reflect the wider population of small businesses in the US,

Canada , andUK , not Intuit’s business, to provide new insight into small business access to credit, credit card expenditure, and payments against credit card balances during the recent inflationary period. Sample: 3.4 million small businesses; 2,795,000 in US; 305,000 inCanada ; 313,000 inUK . -

Intuit QuickBooks Small Business Insights: regular online surveys of small businesses with up to 100 employees, commissioned by Intuit QuickBooks in the US,

Canada , andUK every three to four months. Total sample size for April 2023 wave of surveys: 5,175 (comprising 2,805 small businesses in the US; 1,210 small businesses inCanada ; and 1,160 small businesses in theUK ). -

Official statistics and other external sources, including publicly available data from: the

U.S. Census Bureau; Federal Financial Institutions Examination Council, Bank Holding Company (US); National Federation of Independent Businesses (US); Statistics Canada; Office for National Statistics (UK ), Department for Business, Energy & Industrial Strategy (UK );

New insights from the analysis of this data comprise four major topic areas in the Intuit QuickBooks Small Business Index Annual Report:

-

Long-term small business employment trends and the critical role small businesses play in the US, Canadian, and

UK economies, including: job creation, the rise in self-employment, and the COVID-19 pandemic’s contribution to new business growth. Source: official statistics. - Recent trends in small business employment since the COVID-19 pandemic, in four phases: initial downturn due to the spread of the virus; recovery period as small businesses adapted and new businesses were created; second downturn coinciding with higher inflation and interest rates; and, lately, early signs of a second rebound, particularly in the US. Source: Intuit QuickBooks Small Business Index.

-

Small business access to funding: why small businesses need funding, where they get it, how they use it, and which businesses face the greatest challenges obtaining it — with a close examination of the impact of inflation on small business finances, using anonymised data from QuickBooks customers in the US,

Canada , andUK . Source: Intuit QuickBooks customer data and Intuit QuickBooks Small Business Insights survey (see sample details above). -

The state of small business in the US,

Canada , andUK today: combining a new analysis of official statistics with survey data from more than 5,000 small businesses, including 2,325 QuickBooks customers. Source: Intuit QuickBooks Small Business Insights survey (see sample details above).

The full methodology is provided in the appendix of the Intuit QuickBooks Small Business Index Annual Report.

ABOUT PROFESSOR UFUK AKCIGIT

Ufuk Akcigit is the Arnold C. Harberger Professor of Economics at the University of

As a macroeconomist, Akcigit’s research centers on economic growth, technological creativity, innovation, entrepreneurship, productivity, and firm dynamics. His research has been repeatedly published in the top economics journals, cited by numerous policy reports, and the popular media. The contributions of Akcigit’s research has been recognised by the National Science Foundation with the CAREER Grant (NSF's most prestigious awards in support of early-career faculty), Kaufmann Foundation's Junior Faculty Grant, and Kiel Institute Excellence Award, among many other institutions. In 2019, Akcigit was named the winner of the Max Plank-Humboldt Research Award (endowed with

ABOUT INTUIT

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231005219424/en/

Media:

Intuit QuickBooks

Dan Mahoney

Dan_Mahoney@intuit.com

Jen Garcia

Access Communications

Jeng@accesstheagency.com

Source: Intuit Inc.