Lianhe Sowell Debuts on Nasdaq, Accelerating Business Growth Ambitions and Industry Revolution

Lianhe Sowell International Group (NASDAQ: LHSW) made its Nasdaq debut on April 3, 2025, raising $8 million in gross proceeds. The machine vision solutions provider leverages nine foundational technologies, including advanced image processing, sound imaging, and video analysis capabilities.

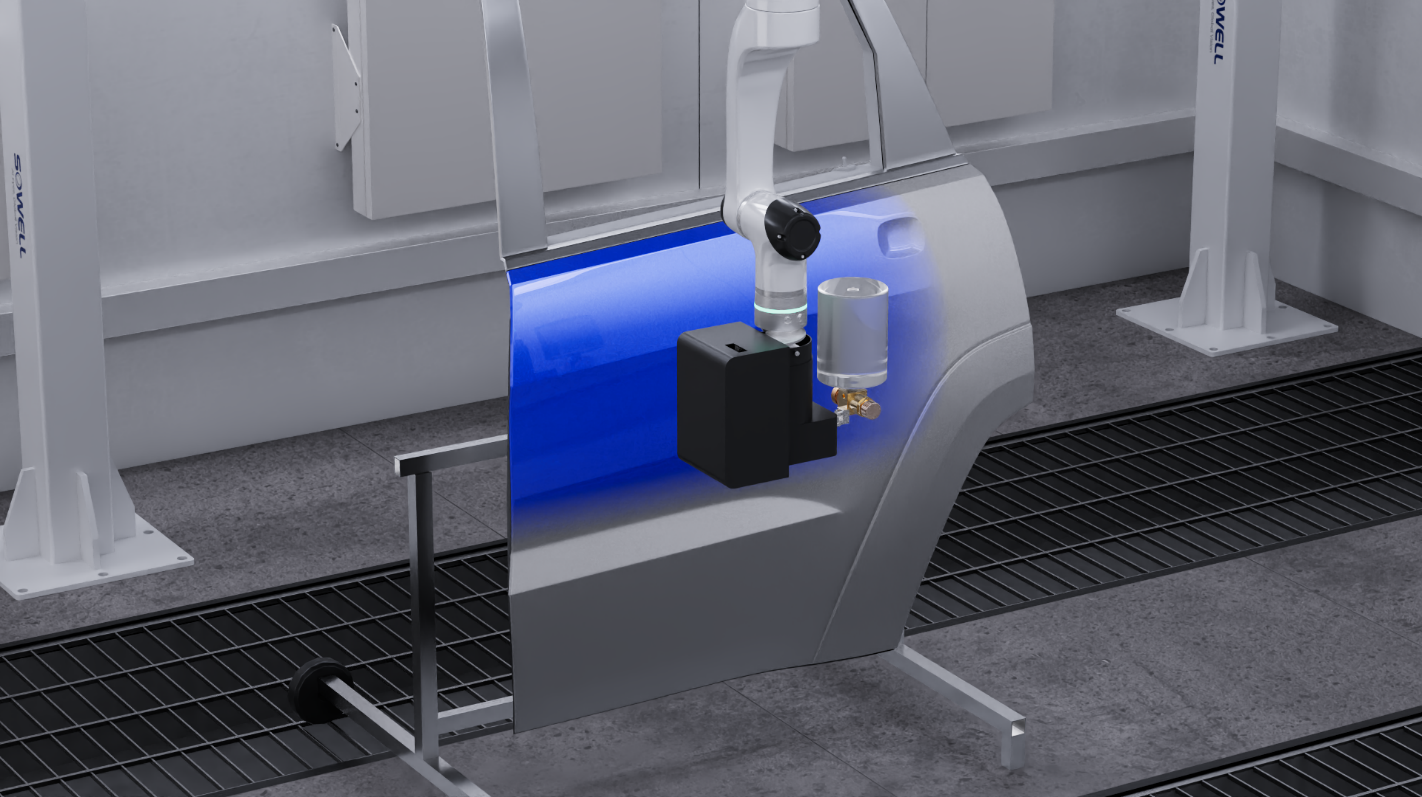

The company's key technologies include micron-level defect detection with 0.1mm accuracy, phased-array sound field mapping, and neural network-based real-time behavior analysis. Their flagship Nine-Axis Linkage Spray Painting Robots demonstrate versatile applications in automotive and industrial settings.

Financially, LHSW reported strong performance with revenue of $36.6 million for fiscal year ended March 2024, marking a 180% year-over-year increase. Net income grew by 75% in the same period. The company plans to allocate 45% of IPO proceeds to expand its spray-painting robot business, aiming to achieve an annual production capacity of 4,000-8,000 robotic units by 2028.

Lianhe Sowell International Group (NASDAQ: LHSW) ha debuttato al Nasdaq il 3 aprile 2025, raccogliendo 8 milioni di dollari in proventi lordi. Il fornitore di soluzioni per la visione artificiale sfrutta nove tecnologie fondamentali, tra cui l'elaborazione avanzata delle immagini, l'imaging sonoro e le capacità di analisi video.

Le tecnologie chiave dell'azienda includono la rilevazione di difetti a livello micron con un'accuratezza di 0,1 mm, la mappatura del campo sonoro a matrice a fasi e l'analisi del comportamento in tempo reale basata su reti neurali. I loro robot per la verniciatura a spruzzo a nove assi dimostrano applicazioni versatili nei settori automobilistico e industriale.

Dal punto di vista finanziario, LHSW ha riportato performance solide con entrate di 36,6 milioni di dollari per l'anno fiscale concluso a marzo 2024, segnando un aumento del 180% rispetto all'anno precedente. Il reddito netto è cresciuto del 75% nello stesso periodo. L'azienda prevede di destinare il 45% dei proventi dell'IPO per espandere la sua attività di robot per verniciatura a spruzzo, puntando a raggiungere una capacità produttiva annuale di 4.000-8.000 unità robotiche entro il 2028.

Lianhe Sowell International Group (NASDAQ: LHSW) hizo su debut en Nasdaq el 3 de abril de 2025, recaudando 8 millones de dólares en ingresos brutos. El proveedor de soluciones de visión por computadora aprovecha nueve tecnologías fundamentales, incluyendo procesamiento avanzado de imágenes, imagenología sonora y capacidades de análisis de video.

Las tecnologías clave de la empresa incluyen detección de defectos a nivel micrón con una precisión de 0,1 mm, mapeo de campo sonoro en matriz de fases y análisis de comportamiento en tiempo real basado en redes neuronales. Sus robots de pintura a spray de enlace de nueve ejes demuestran aplicaciones versátiles en entornos automotrices e industriales.

Financieramente, LHSW reportó un sólido desempeño con ingresos de 36,6 millones de dólares para el año fiscal que terminó en marzo de 2024, marcando un aumento del 180% interanual. El ingreso neto creció un 75% en el mismo período. La empresa planea destinar el 45% de los ingresos de la OPI para expandir su negocio de robots de pintura a spray, con el objetivo de alcanzar una capacidad de producción anual de 4,000 a 8,000 unidades robóticas para 2028.

리안허 소웰 인터내셔널 그룹 (NASDAQ: LHSW)는 2025년 4월 3일 나스닥에 데뷔하며 800만 달러의 총 수익을 올렸습니다. 이 기계 비전 솔루션 제공업체는 고급 이미지 처리, 음향 이미징 및 비디오 분석 기능을 포함한 9가지 기본 기술을 활용하고 있습니다.

회사의 주요 기술에는 0.1mm 정확도로 미세 결함을 감지하는 기술, 위상 배열 음장 매핑 및 신경망 기반 실시간 행동 분석이 포함됩니다. 그들의 주력 제품인 9축 링크 스프레이 페인팅 로봇은 자동차 및 산업 환경에서 다양한 응용 프로그램을 보여줍니다.

재무적으로 LHSW는 2024년 3월에 종료된 회계연도에 3,660만 달러의 수익을 보고하며 전년 대비 180% 증가를 기록했습니다. 같은 기간 동안 순이익은 75% 증가했습니다. 회사는 IPO 수익의 45%를 스프레이 페인팅 로봇 사업 확장에 할당할 계획이며, 2028년까지 연간 4,000-8,000대의 로봇 생산 능력을 달성하는 것을 목표로 하고 있습니다.

Lianhe Sowell International Group (NASDAQ: LHSW) a fait ses débuts sur le Nasdaq le 3 avril 2025, levant 8 millions de dollars de produits bruts. Le fournisseur de solutions de vision par machine exploite neuf technologies fondamentales, y compris le traitement d'images avancé, l'imagerie sonore et les capacités d'analyse vidéo.

Les technologies clés de l'entreprise incluent la détection de défauts au niveau micron avec une précision de 0,1 mm, la cartographie du champ sonore à réseau de phases et l'analyse du comportement en temps réel basée sur des réseaux neuronaux. Leurs robots de peinture à pulvérisation à liaison à neuf axes démontrent des applications polyvalentes dans les secteurs automobile et industriel.

Sur le plan financier, LHSW a rapporté de solides performances avec des revenus de 36,6 millions de dollars pour l'exercice clos en mars 2024, marquant une augmentation de 180 % par rapport à l'année précédente. Le revenu net a augmenté de 75 % pendant la même période. L'entreprise prévoit d'allouer 45 % des produits de l'IPO pour développer son activité de robots de peinture à pulvérisation, visant à atteindre une capacité de production annuelle de 4 000 à 8 000 unités robotiques d'ici 2028.

Lianhe Sowell International Group (NASDAQ: LHSW) feierte am 3. April 2025 sein Debüt an der Nasdaq und erzielte einen Bruttoerlös von 8 Millionen Dollar. Der Anbieter von Maschinenvisionslösungen nutzt neun grundlegende Technologien, darunter fortschrittliche Bildverarbeitung, Schallbildgebung und Videoanalysefähigkeiten.

Zu den Schlüsseltechnologien des Unternehmens gehören die Mikron-genaue Fehlererkennung mit einer Genauigkeit von 0,1 mm, die Phased-Array-Schallfeldkartierung und die auf neuronalen Netzen basierende Echtzeitanalyse des Verhaltens. Ihre Flaggschiff-Neun-Achsen-Verbundspritzlackierroboter zeigen vielseitige Anwendungen in der Automobil- und Industriebranche.

Finanziell berichtete LHSW von einer starken Leistung mit Einnahmen von 36,6 Millionen Dollar für das am 31. März 2024 endende Geschäftsjahr, was einem 180%igen Anstieg im Vergleich zum Vorjahr entspricht. Der Nettogewinn wuchs im gleichen Zeitraum um 75%. Das Unternehmen plant, 45% der Erlöse aus dem Börsengang für die Expansion seines Spritzlackierroboter-Geschäfts zu verwenden, mit dem Ziel, bis 2028 eine jährliche Produktionskapazität von 4.000-8.000 Roboter-Einheiten zu erreichen.

- Successful IPO raising $8 million in gross proceeds

- Strong revenue growth of 180% YoY to $36.6 million

- Net income growth of 75% YoY

- Planned production capacity expansion to 4,000-8,000 robots annually by 2028

- Relatively small IPO size of $8 million may limit growth potential

- Heavy dependence on automotive sector poses concentration risk

Insights

Lianhe Sowell's Nasdaq debut represents a milestone financing event for this machine vision solutions provider, though with noteworthy characteristics. The

The company's financial performance shows impressive momentum with

The capital allocation strategy assigns

Investors should consider both the validation provided by successful Nasdaq listing and the execution challenges in scaling manufacturing operations while navigating competitive pressures in China's industrial automation sector. The concentrated focus on automotive applications presents both market opportunity and potential concentration risk worth monitoring.

Lianhe Sowell's core technological portfolio demonstrates considerable technical depth across critical machine vision domains. Their image processing technology achieving micron-level detection with 0.1mm accuracy and 0.5-second inspection speeds represents industrial-grade precision suitable for demanding manufacturing environments where quality control is paramount.

The integration of sound imaging technology using phased-array principles for industrial monitoring shows forward-thinking application of acoustic analysis beyond conventional visual systems. Similarly, their neural network-based video analysis capabilities align with industry trends toward AI-enhanced safety monitoring and process optimization.

The company's flagship Nine-Axis Linkage Spray Painting Robots represent their most distinctive technological offering, combining machine vision with advanced robotics. This integration addresses a specific high-value manufacturing challenge—precision spray painting—with potential applications beyond automotive to adjacent industrial processes like welding and polishing.

The technological architecture appears well-positioned for China's industrial modernization push, particularly as labor costs rise and quality requirements increase. However, the hardware-centric business model may face margin pressures typical in manufacturing environments. The planned production scaling to 4,000-8,000 robotic units annually represents significant operating leverage if market demand materializes as anticipated, though execution risks remain in transitioning from technology development to scaled manufacturing.

SHENZHEN, China, April 03, 2025 (GLOBE NEWSWIRE) -- Lianhe Sowell International Group Ltd (NASDAQ: LHSW), a company providing machine vision solutions, officially went public on the Nasdaq stock exchange on April 3, 2025, raising total gross proceeds of

Technological Excellence Anchored in Innovation

Serving industrial clients for more than 17 years, Lianhe Sowell’s achievements in the industrial machine vision sector is rooted in its nine foundational technologies, which integrate advanced algorithms and hardware-software synergies to deliver precision-driven solutions. The company’s core expertise spans:

- Image Processing Technology: Enabling micron-level defect detection in electronics manufacturing through real-time analysis of surface imperfections, achieving accuracy down to 0.1mm with inspection speeds as rapid as 0.5 second.

- Sound Imaging Technology: Deploying phased-array principles to map spatial sound fields, enhancing safety monitoring in industrial settings by detecting anomalies like equipment malfunctions or hazardous noises.

- Video Analysis and Recognition Technology: Utilizing neural networks for real-time behavior analysis in high-risk environments, such as identifying safety violations in chemical plants or optimizing traffic flow via intelligent transportation systems.

- Nine-Axis Robotic Integration: Combining machine vision with agile 6-axis robotics for applications like automotive spray painting, the company’s flagship Nine-Axis Linkage Spray Painting Robots achieve great precision. The technology's versatile capabilities can potentially be applied to various industrial spray-painting scenarios, enabling automation across multiple production processes.

Strategic Growth Fueled by US IPO Proceeds

The company’s recent US IPO has injected critical capital to accelerate its growth roadmap. A significant portion of the proceeds is earmarked for scaling production of its Nine-Axis robots, which will contribute to the plan to complete the set-up and assembling of the robot production line. This planned facility aims to produce 4,000 – 8,000 robotic units annually by 2028, targeting the automotive repair industry and adjacent sectors like welding and polishing.

In addition, Lianhe Sowell also plans to use proceeds raised from the IPO to invest in its machine vision business including industrial machine vision, face recognition, AI behavior analysis, weak current intelligence and electronic customs clearance, in order to fund research and development of new products and market expansion, according to its filing.

Financial Strengths and Future Expansion

Lianhe Sowell’s IPO marks a pivotal step in its development. The company has demonstrated robust financial performance, sustaining rapid growth during the fiscal year ended March 31, 2024. From March 2023 to March 2024, it achieved revenue of

Post-IPO, Lianhe Sowell plans to allocate

Company: Lianhe Sowell International Limited

Contact Person: Iris Wu

Email: sowellrobot@sowellrobot.com

Website: http://www.sowellrobot.com/

Telephone: +86 19154951787

City: Shenzhen, China

Photos accompanying this announcement are available at :

https://www.globenewswire.com/NewsRoom/AttachmentNg/96234652-530e-4c47-b398-10a630316c24

https://www.globenewswire.com/NewsRoom/AttachmentNg/f83e5629-cc2c-46c4-ba70-8f73073c5f60