Intuit QuickBooks Entrepreneurship in 2024 Report: Majority of Americans Believe Starting a Business Better Way to Build Wealth Than Buying a House

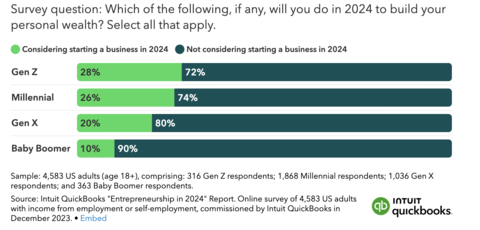

Nearly a Quarter Surveyed Considering Starting a Business in 2024

Greatest Impact on Business Formation and Growth

Despite the increased interest in AI, hiring skilled workers was rated as the number one way to drive growth by respondents who were small business owners, followed by investing in social media and ecommerce. Interestingly, these came ahead of securing financing or loans – often perceived as a key to business growth. Other key findings that could influence business formation and growth include:

-

Tax returns turning into businesses: Nearly a third (

32% ) of small businesses created since 2020 were funded in part by tax refunds. Given this, the size of 2024 tax refunds will likely impact business growth and formation, with65% of respondents saying a smaller return will make it harder for them to start a business or side hustle. -

Inflation’s ongoing impact: Over the past three years, more than half (

57% ) of respondents who started a business said boosting their income amid inflation influenced their decision to launch a business venture – equal to the amount who cited the COVID-19 pandemic as a reason. Additionally, respondents noted that inflation is the number one challenge to small business growth in 2024 followed by higher interest rates which make it more expensive to borrow money. -

Generational differences in investment: The data show that younger entrepreneurs are more likely to invest for growth in 2024 than older generations, with

88% of Gen Z small business owners looking to expand ecommerce or physical locations to boost revenue in 2024 compared to66% of Gen X and Baby Boomers. Additionally,76% of Gen Z small business owners and80% of Millennial small business owners want to hire in the new year compared to just58% of Gen X and Baby Boomers.

Credit Cards Critical to Small Business Cash Flow

The survey reinforced recent findings from the 2023 Intuit QuickBooks Small Business Index Annual Report, which demonstrated the reliance small businesses increasingly have on credit cards to manage cash flow. Of small businesses surveyed,

-

Emergency funding is the primary use of credit cards: Among all small business owners surveyed who are currently using credit cards,

59% say this is “an emergency or temporary source of funding.” -

Credit card balances a concern in 2024: Overall, almost one in four (

24% ) small businesses don’t believe they will be able to pay off their credit card balances in 2024 without paying interest. -

High open credit utilization and interest rates: More than half (

51% ) have used50% or more of their available credit limit and76% have used30% or more of available credit. Over40% of respondents indicated the APR on their business credit cards was20% or higher. -

Business vs. personal card usage trends: In general, personal credit cards are more popular than business credit cards, with

70% of respondents revealing they use them. Personal credit cards are most popular among freelancers and solopreneurs, while small businesses with employees are more likely to use business credit cards.

Defining Success in 2024

The report also reveals what success looks like in 2024 amid inflation concerns and what financial thresholds small business owners need to reach to feel successful. The survey showed that

-

Success means increasing revenue for small businesses: Among small business owners,

42% said that increasing revenue is their primary goal in the year ahead, indicating the importance that financial growth has for small businesses. -

A high bar to quit day jobs: Of the 1,000 side-hustle business owners surveyed, nearly two-thirds (

62% ) would quit their day job if they were able to earn$100,000 -

Millennials put a higher price on success: By generation, Millennial respondents have the highest bar for success in 2024, saying they will need to earn

$288,000 $126,000

The full report and additional data insights from Intuit QuickBooks are available here.

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231219808087/en/

Intuit QuickBooks:

Dan Mahoney

dan_mahoney@intuit.com

Jen Garcia

Jeng@accesstheagency.com

Source: Intuit Inc.