NRSInsights’ August 2024 Retail Same-Store Sales Report

NRSInsights released its August 2024 Retail Same-Store Sales Report, showing a 5.1% year-over-year increase in same-store sales. Key highlights include:

- Units sold increased 4.7% year-over-year

- Average transactions per store rose 1.8% year-over-year

- Average prices for top 500 items increased 3.5% year-over-year

The report noted strong growth in back-to-school categories and baking supplies. NRS' network comprises 32,300 active POS terminals in approximately 28,100 independent retail stores, processing $19.8 billion in sales through 1.4 billion transactions in the past 12 months.

NRSInsights ha pubblicato il suo Rapporto di Vendite nei Negozi Comparabili di Agosto 2024, mostrando un aumento del 5,1% rispetto all'anno precedente nelle vendite negli stessi negozi. I punti salienti includono:

- Le unità vendute sono aumentate del 4,7% anno su anno

- Le transazioni medie per negozio sono cresciute dell'1,8% anno su anno

- I prezzi medi per i primi 500 articoli sono aumentati del 3,5% anno su anno

Il rapporto ha evidenziato una forte crescita nelle categorie di ritorno a scuola e nei fornimenti da forno. La rete di NRS comprende 32.300 terminali POS attivi in circa 28.100 negozi al dettaglio indipendenti, elaborando vendite per 19,8 miliardi di dollari attraverso 1,4 miliardi di transazioni negli ultimi 12 mesi.

NRSInsights publicó su Informe de Ventas en Tiendas Comparables de Agosto de 2024, mostrando un aumento del 5,1% en comparación con el año anterior en las ventas de las mismas tiendas. Los aspectos destacados incluyen:

- Las unidades vendidas aumentaron un 4,7% interanual

- Las transacciones promedio por tienda crecieron un 1,8% interanual

- Los precios promedio de los 500 artículos principales aumentaron un 3,5% interanual

El informe señaló un fuerte crecimiento en las categorías de regreso a clases y en suministros de repostería. La red de NRS comprende 32,300 terminales POS activos en aproximadamente 28,100 tiendas minoristas independientes, procesando 19.8 mil millones de dólares en ventas a través de 1.4 mil millones de transacciones en los últimos 12 meses.

NRSInsights는 2024년 8월 소매 동종 매장 판매 보고서를 발표했으며, 동종 매장 판매에서 전년 대비 5.1% 증가를 보였습니다. 주요 사항은 다음과 같습니다:

- 판매된 단위 수가 전년 대비 4.7% 증가했습니다

- 매장당 평균 거래 수가 전년 대비 1.8% 증가했습니다

- 상위 500개 품목의 평균 가격이 전년 대비 3.5% 증가했습니다

보고서는 개학 시즌과 베이킹 재료 카테고리에서 강력한 성장세를 보였다고 언급했습니다. NRS의 네트워크는 32,300개의 활성 POS 단말기로 구성되어 있으며, 약 28,100개의 독립 소매점에서 지난 12개월 동안 1,400억 달러의 매출을 14억 건의 거래를 통해 처리했습니다.

NRSInsights a publié son Rapport de Ventes au Détail des Magasins Comparables d'Août 2024, montrant une augmentation de 5,1 % par rapport à l'année précédente des ventes dans les mêmes magasins. Les points clés incluent :

- Les unités vendues ont augmenté de 4,7 % par rapport à l'année précédente

- Les transactions moyennes par magasin ont augmenté de 1,8 % par rapport à l'année précédente

- Les prix moyens des 500 articles les plus vendus ont augmenté de 3,5 % par rapport à l'année précédente

Le rapport a noté une forte croissance dans les catégories de rentrée scolaire et de fournitures de pâtisserie. Le réseau NRS comprend 32 300 terminaux de point de vente actifs dans environ 28 100 magasins de détail indépendants, traitant 19,8 milliards de dollars de ventes à travers 1,4 milliard de transactions au cours des 12 derniers mois.

NRSInsights hat seinen August 2024 Bericht über die Einzelhandelsverkäufe in vergleichbaren Geschäften veröffentlicht, der einen Jahresvergleich von 5,1% Wachstum bei den Verkäufen im selben Geschäft zeigt. Die wichtigsten Punkte sind:

- Die verkauften Einheiten stiegen um 4,7 % im Jahresvergleich

- Die durchschnittlichen Transaktionen pro Geschäft stiegen im Jahresvergleich um 1,8 %

- Die Durchschnittspreise für die 500 besten Artikel stiegen im Jahresvergleich um 3,5 %

Der Bericht vermerkt ein starkes Wachstum in den Kategorien Schulanfang und Backzutaten. Das Netzwerk von NRS umfasst 32.300 aktive POS-Terminals in rund 28.100 unabhängigen Einzelhandelsgeschäften, die im vergangenen Jahr 19,8 Milliarden Dollar Umsatz durch 1,4 Milliarden Transaktionen verarbeitet haben.

- Same-store sales increased 5.1% year-over-year

- Units sold increased 4.7% year-over-year

- Average number of transactions per store increased 1.8% year-over-year

- Strong growth in back-to-school categories and baking supplies

- NRS network processed $19.8 billion in sales through 1.4 billion transactions in the past 12 months

- Candy/Gum/Mints and Sweet Snacks categories continued to decline year-over-year

- Inflationary pressure increased to 3.5% in August, up from 2.5% in July

Insights

The August 2024 retail same-store sales report from NRSInsights reveals a significant improvement in the retail sector. The

The

NRS network's outperformance of the U.S. Commerce Department's retail data by an average of 3 percentage points over the past year highlights the strength of independent, urban retailers in the current economic climate. This trend could indicate a shift in consumer shopping habits towards local, smaller format stores.

The August report unveils intriguing consumer behavior shifts. The surge in school-related categories like Office Supply and Writing Tools, alongside the growth in Cookie Snacks and Variety Packs, reflects a return to pre-pandemic routines. This trend suggests a normalization of daily life and could indicate broader economic recovery.

Interestingly, the continued decline in Candy/Gum/Mints and Sweet Snacks categories year-over-year might signal a shift towards healthier eating habits or budget-conscious decisions amid inflation. The rise in Baking Staples and related categories could indicate a persistent trend of at-home cooking, possibly as a cost-saving measure.

The robust performance of urban, independent retailers compared to broader retail data suggests a potential long-term shift in shopping preferences. This could have significant implications for CPG companies' distribution strategies and urban commercial real estate markets. The data underscores the importance of these small-format stores in reaching diverse, urban consumers.

August same-store sales increased

NEWARK, N.J., Sept. 09, 2024 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative same-store sales results for August 2024.

As of August 31, 2024, the NRS retail network comprised approximately 32,300 active terminals nationwide, scanning purchases at independent retailers including bodegas, convenience stores, liquor stores, grocers, tobacco, and sundries sellers nationwide, predominantly serving urban consumers.

August Retail Same-Store Sales Highlights

(Same-store sales, unit sales, transactions, and average price data throughout this release refer to August 2024 and are compared to August 2023 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month.)

- SALES

- Same-store sales increased

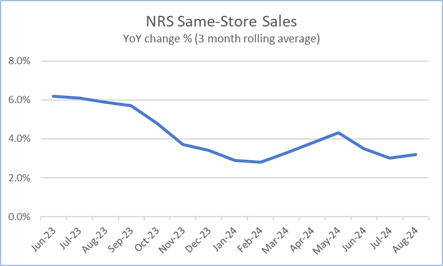

5.1% year-over-year. In the previous month (July 2024), same-store sales had increased1.2% year-over-year. - Same-store sales increased

1.7% compared to the previous month (July 2024). Same-store sales in July 2024 had decreased (1.9)% compared to the previous month (June 2024). - For the three months ended August 31, 2024, same-store sales increased

3.2% compared to the same three months a year ago.

- Same-store sales increased

- UNITS SOLD

- The number of units sold increased

4.7% year-over-year. In the previous month (July 2024), the number of items sold had increased2.2% year-over-year. - Units sold increased

1.3% compared to the previous month (July 2024). Units sold in July 2024 had decreased (1.7)% compared to the previous month (June 2024).

- The number of units sold increased

- TRANSACTIONS PER STORE

- The average number of transactions per store increased

1.8% year-over-year. In the previous month (July 2024), transactions decreased (0.6)% year-over-year. - Transactions increased

1.5% compared to the previous month (July 2024). Transactions in July 2024 had decreased (1.9)% compared to the previous month (June 2024).

- The average number of transactions per store increased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased during August 2024 increased

3.5% year-over-year, an increase from the2.5% year-over-year increase recorded in July 2024.

- A dollar-weighted average of prices for the top 500 items purchased during August 2024 increased

Retail Trade Comparative Data

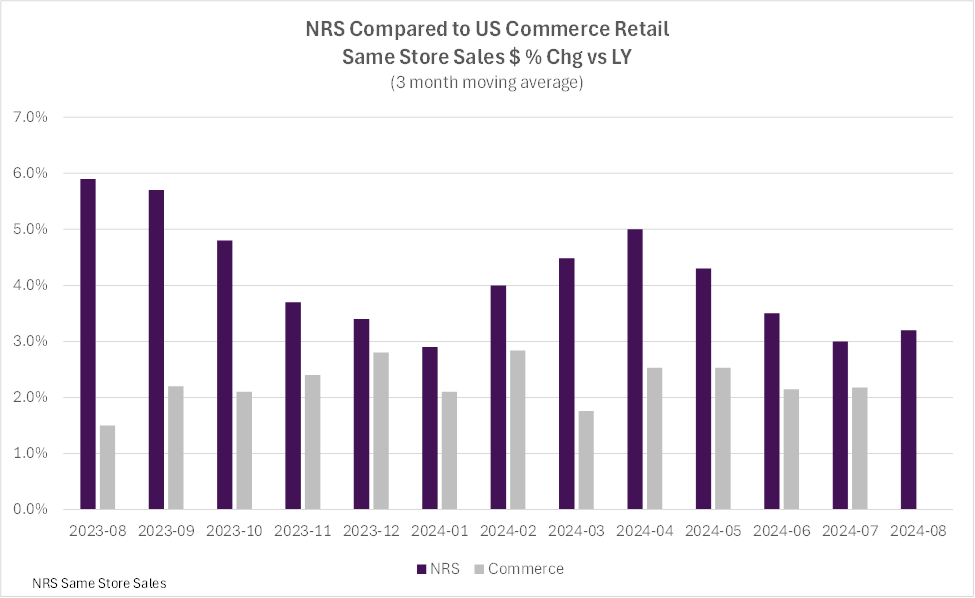

The table below provides historical comparative data with the U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service:

Over the past twelve months, the NRS network’s three-month moving average same-store sales have outpaced the US Commerce Department’s Advance Monthly Retail Trade data, excluding food services, by

The NRSInsights data in the chart above have not been adjusted to reflect inflation, demographic distributions, seasonal buying patterns, item substitution, days per month, or other factors that may facilitate comparisons to other periods, to other same-store retail sales data, or to the U.S. Commerce Department’s retail data.

Commentary from Suzy Silliman (SVP, Data Strategy and Sales at NRS)

“NRS’ year over year rate of same-store sales growth jumped to

“August is back-to-school month for many universities and K-12 districts. We saw not only the expected sales growth versus July but also a robust increase versus August 2023, most notably in school-related categories including Office Supply, Writing Tools, and Computer/Printer accessories.

“Cookie Snacks and Variety Packs, convenient options for school lunches, also realized strong year-over-year growth, as did sales of Baking Staples, Extracts/Herbs/Spices/Seasoning, Baking Mixes and Baking Supplies.

“On the other hand, sales of the Candy/Gum/Mints and Sweet Snacks categories continued to decline year-over-year.

“While our measure of inflationary pressure increased in August for the second consecutive month, rising to

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of August 2024 with August 2023 are derived from approximately 196 million transactions processed through the approximately 19,100 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of August 2024 with July 2024 are derived from approximately 253 million transactions processed through approximately 27,000 stores.

Same-store data comparisons for the three months ended August 31, 2024 with the year-ago three months are derived from approximately 557 million scanned transactions processed through those stores that were in the NRS network in both quarters.

NRS POS Network

The NRS network comprises approximately 32,300 active POS terminals operating in approximately 28,100 independent retail stores. Its platform predominantly serves small-format, independent, retail stores including convenience stores, bodegas, liquor stores, grocers, tobacco, and sundries sellers. The network includes retailers in all 50 states as well as the District of Columbia, and in 200 of the 210 designated market areas (DMAs) in the United States. NRS’ POS terminals processed

About National Retail Solutions (NRS):

National Retail Solutions operates the largest point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Suzy Silliman

SVP, Data Strategy and Sales at NRS

National Retail Solutions

suzy.silliman@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #

Attachments