Hannan Announces Drilling Update and Private Placement Financing to Raise C$2.5 Million

Rhea-AI Summary

Hannan Metals announces a non-brokered private placement financing to raise up to C$2.5 million by issuing up to 7,142,857 units at C$0.35 per unit. Each unit includes one common share and one-half of a common share purchase warrant, exercisable at C$0.50 for two years. Proceeds will fund exploration in Peru and Chile and for general corporate purposes.

In drilling updates, Hannan reported a 150 km x 40 km gold-copper belt discovery at the Valiente Project in Peru, including multiple porphyry and epithermal targets. At the San Martin Project, Hannan found a high-grade copper-silver system similar to Kupferschiefer deposits. Drill permits and environmental certifications are in progress, with drilling expected in August 2024. Additional exploration is planned for the Valiente, San Martin West, and Cerro Rolando projects in Peru and Chile.

Positive

- Hannan raised up to C$2.5 million through a non-brokered private placement.

- Discovery of a 150 km x 40 km gold-copper belt at Valiente Project, Peru.

- High-grade copper-silver system found at San Martin Project, Peru.

- Environmental permit and drill permits progressing well for San Martin Project.

- Drilling expected to commence in August 2024 at San Martin Project.

Negative

- Securities issued under the offering will be subject to a four-month hold period.

- San Martin Project still requires water use permit, which may delay drilling initiation.

- Potential risk of forced conversion of warrants based on stock performance.

News Market Reaction 1 Alert

On the day this news was published, HANNF declined 5.19%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

VANCOUVER, BC / ACCESSWIRE / June 4, 2024 / Hannan Metals Limited ("Hannan" or the "Company") (TSXV:HAN)(OTC PINK:HANNF) announces a non-brokered private placement financing (the "Offering") of up to 7,142,857 units of the Company (the "Units") at a price of C

Finder's fees may be payable on a portion of the Offering. Certain insiders of the Company will participate in the Offering.

All securities to be issued pursuant to the Offering will be subject to a four-month hold period under applicable securities laws in Canada. The Offering is subject to certain conditions customary for transactions of this nature, including, but not limited to, the receipt of all necessary approvals, including the approval of the Exchange.

The Company plans to use the net proceeds to fund exploration expenditures at the Company's Peruvian and Chilean projects, as well as for general working capital and corporate purposes.

Drilling Updates

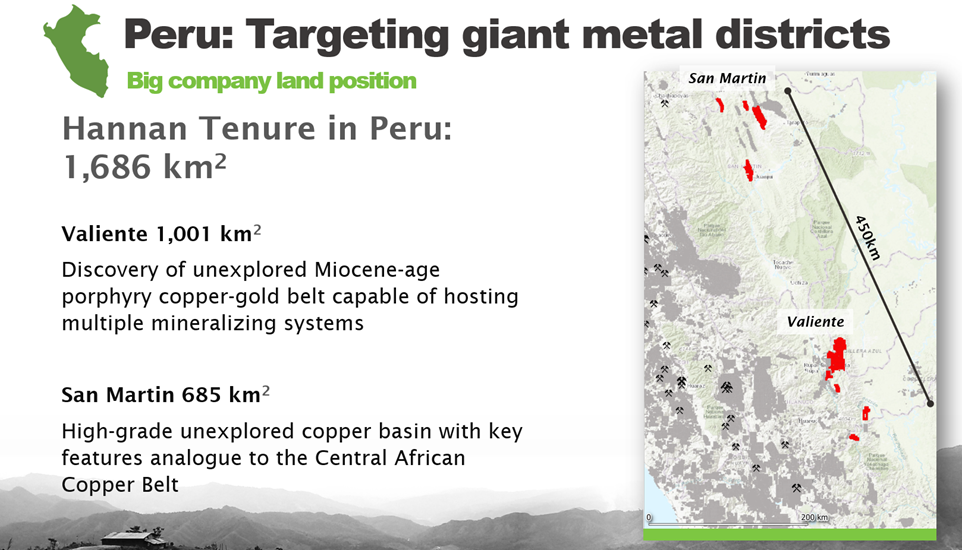

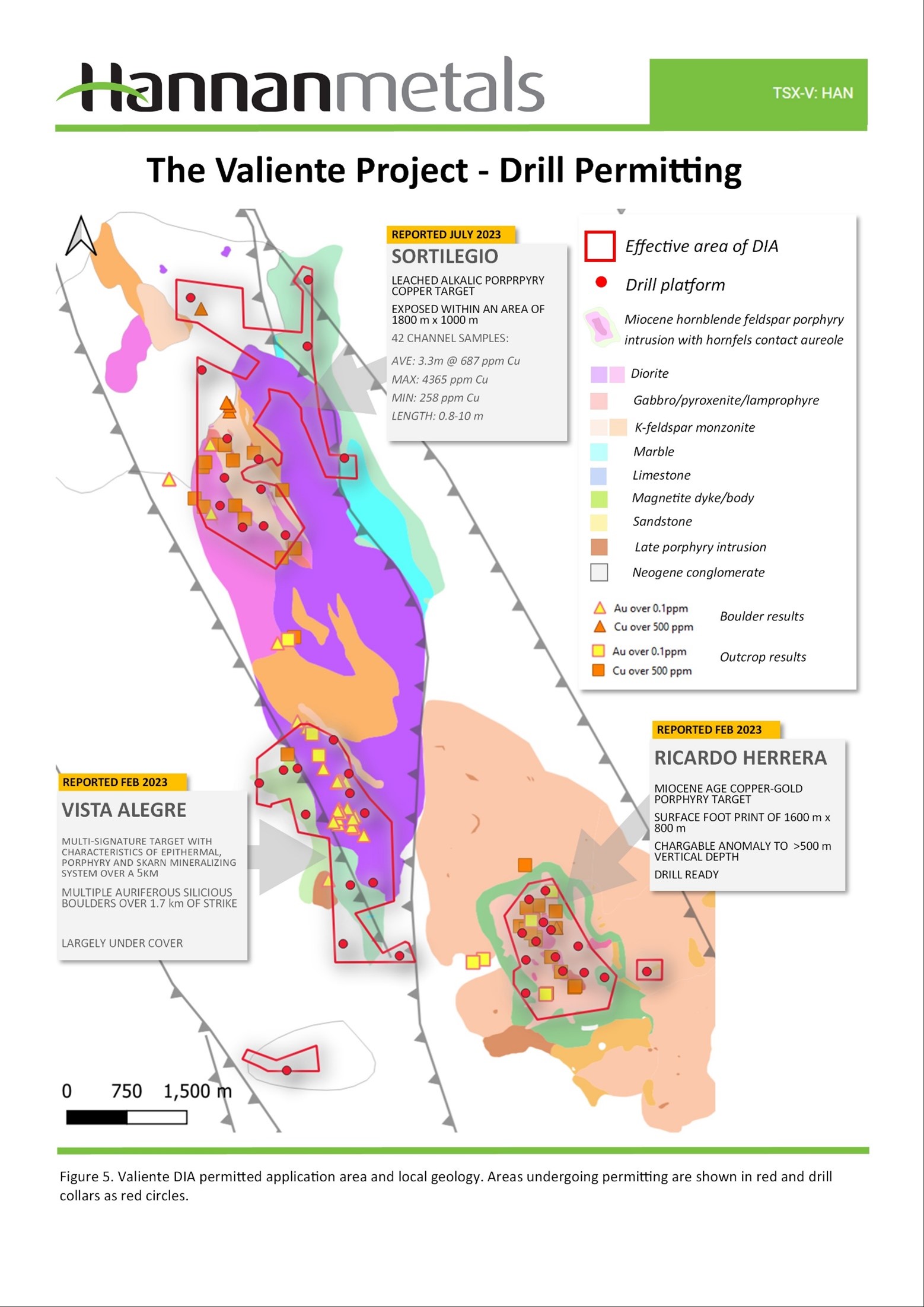

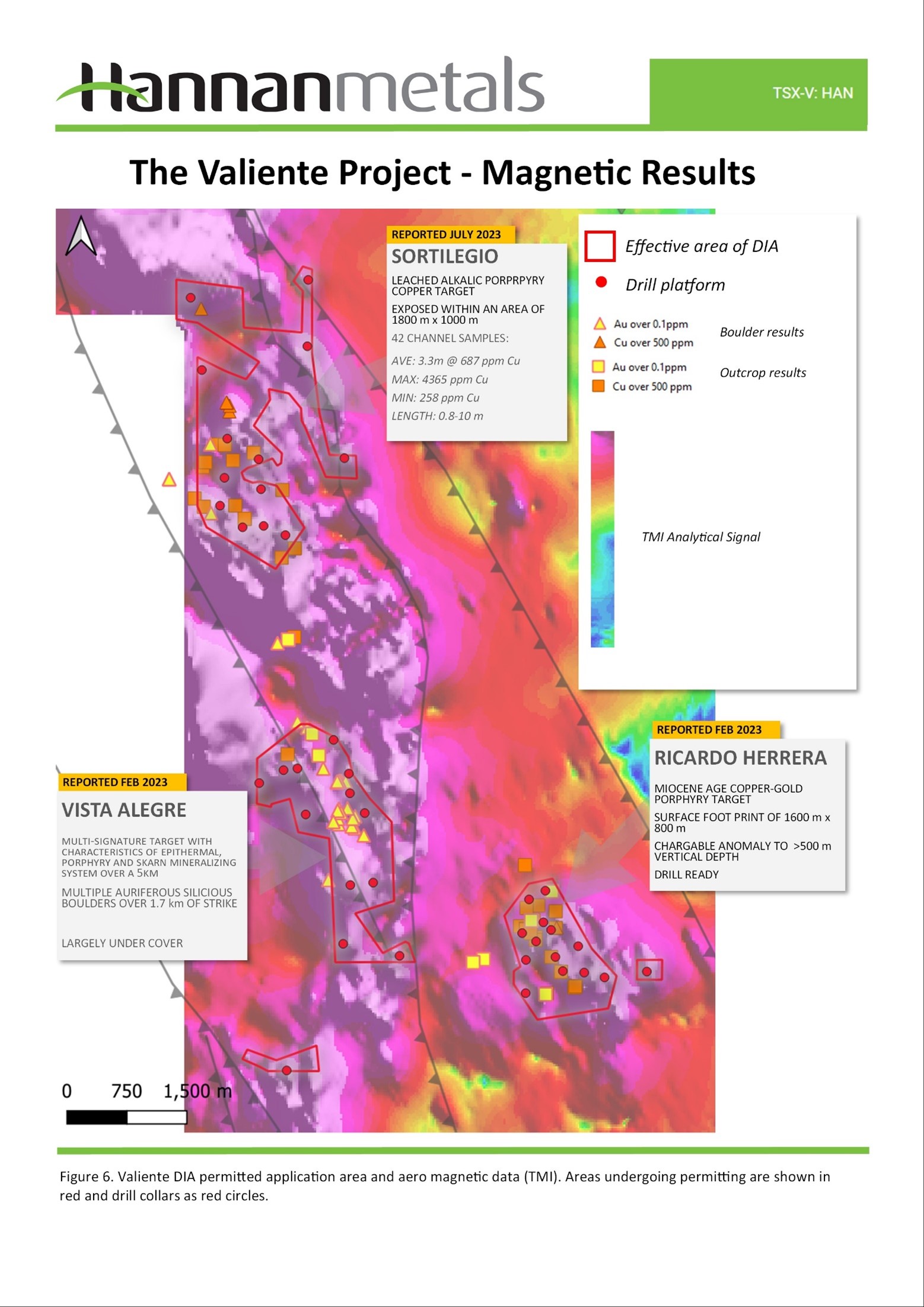

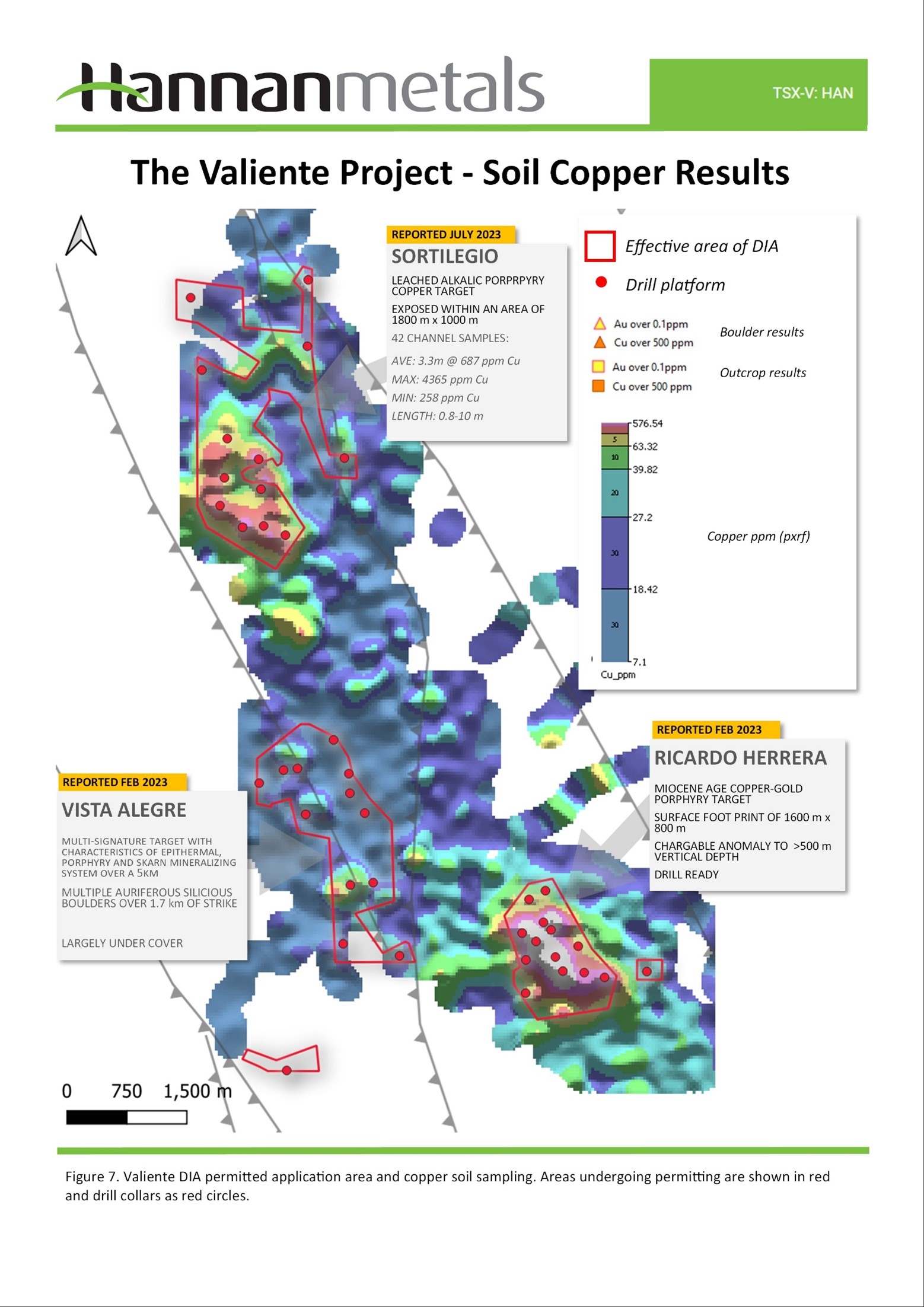

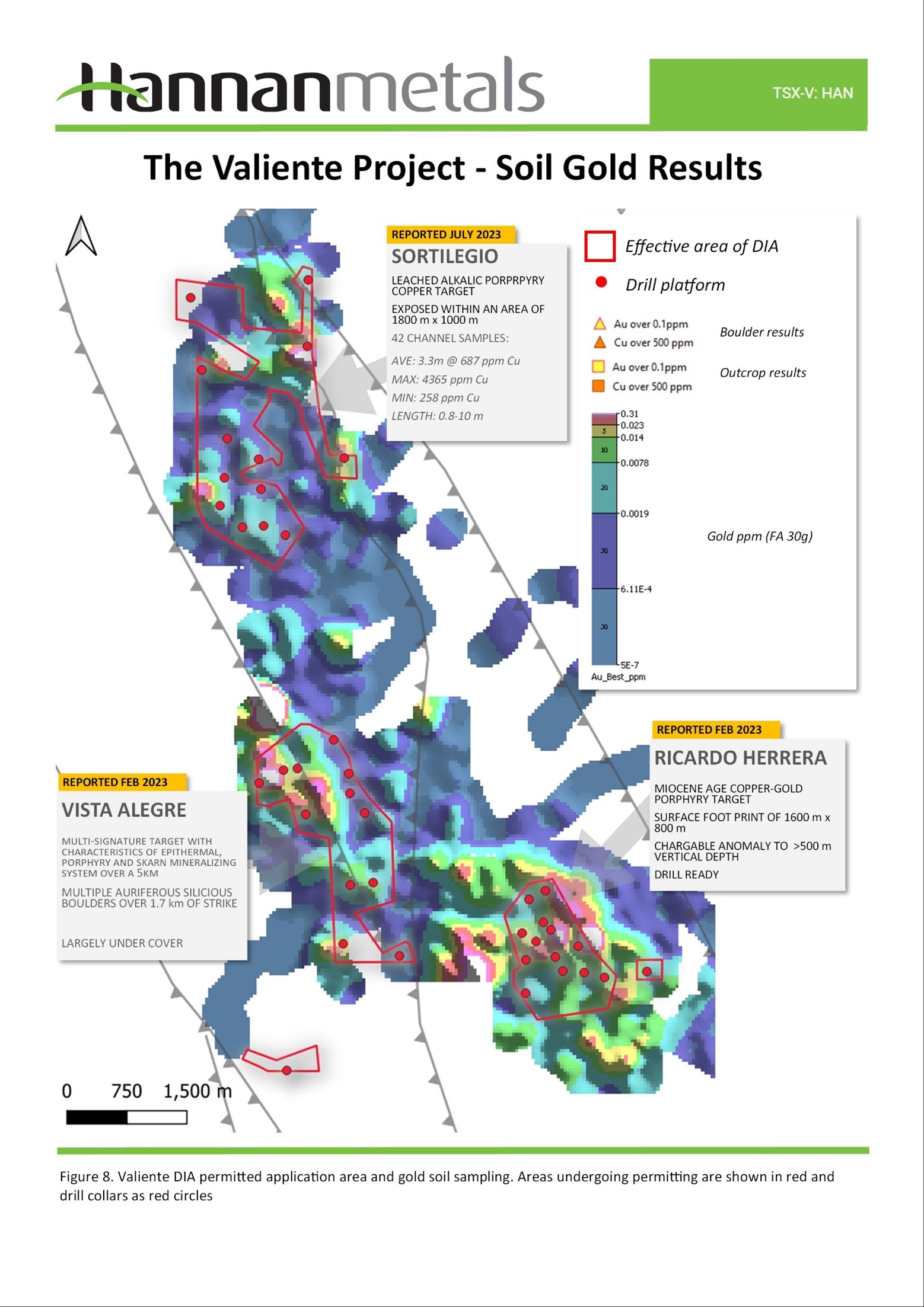

At the Valiente Project, Hannan has discovered a Miocene-age porphyry-epithermal gold-copper mineralized belt that extends over 150 km by 40 km in area, located in central-eastern Peru. Within this belt a clustered porphyry/epithermal camp has emerged where five porphyry copper-gold targets and associated skarns have now been discovered (Ricardo Herrera, Sortilegio, Divisoria, Previsto Central and Previsto North), and two epithermal prospects (Vista Alegre and Previsto East).

At the San Martin Project located 400 km NNE of Valiente, Hannan has discovered a basin-scale high-grade sediment-hosted copper-silver system that extends over 200 km x 100 km along the foreland region of the eastern Andes Mountains. Mineralization is geologically similar to the vast Kupferschiefer deposits in Eastern Europe. Sediment-hosted stratiform copper-silver deposits are among the two most important copper sources in the world, the other being copper porphyries.

Hannan's strategy is to geologically derisk targets and sequentially drill permit these targets, such that the Company will be drilling multiple targets over these vast frontier areas over the next years.

San Martin (JOGMEC JV - Peru)

- The environmental permit, the Declaracion de Impacto Ambiental ("DIA") for 40 drill platforms was received from the Ministry of Mines in Peru during January 2024. The DIA is the primary environmental certification required to allow low impact mineral exploration programs, that includes drilling programs, to proceed at the San Martin copper-silver project in Peru.

- The Authorization to Initiate activities from the General Directorate of Mining from the Ministry of Mines ("DGM"), is now in a process that takes 1 to 3 months, and then the Water Use Permit (1 month duration) will be sought from the Peru National Water Authority ("ANA") which should see drill rigs on the ground in San Martin in August 2024.

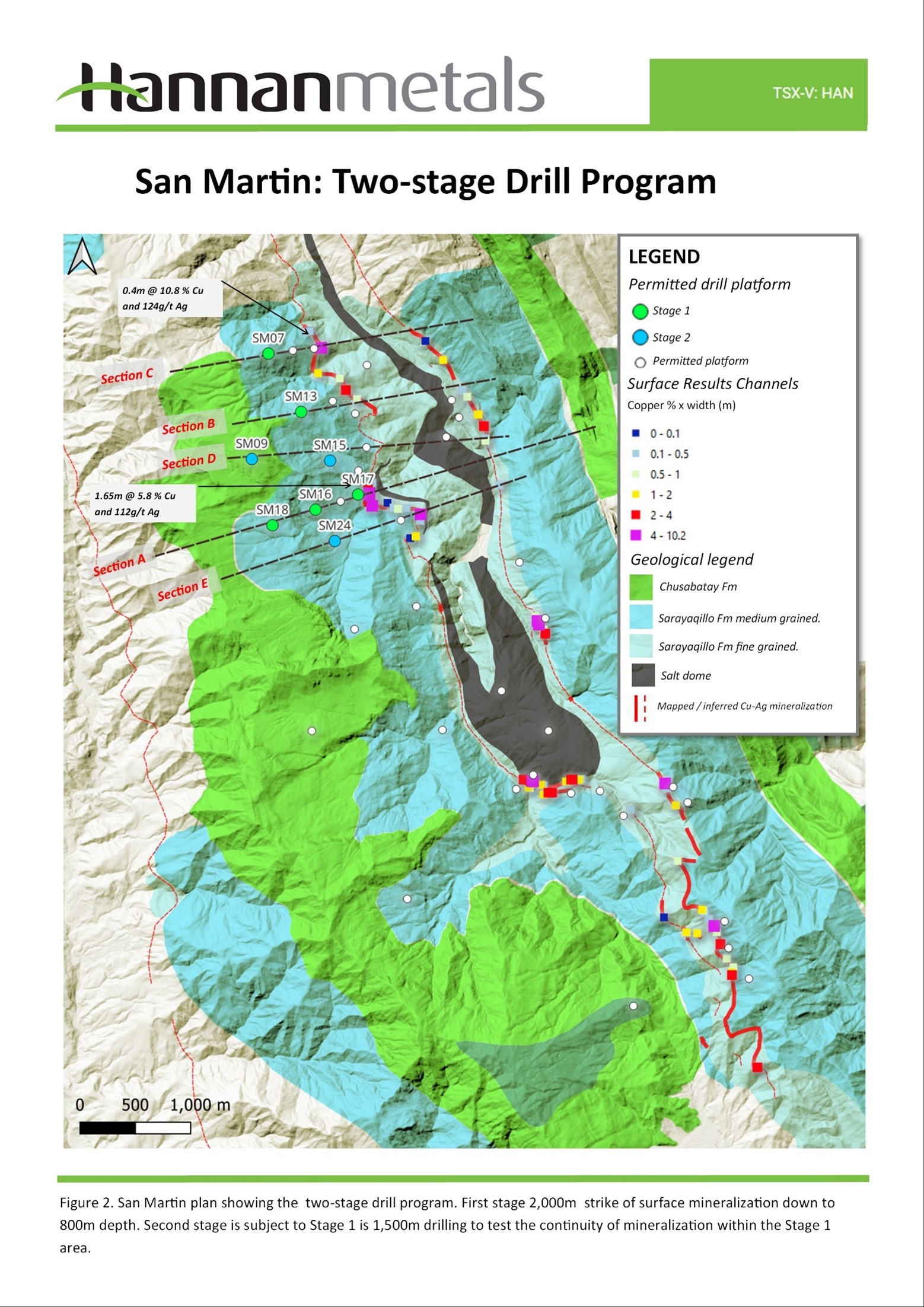

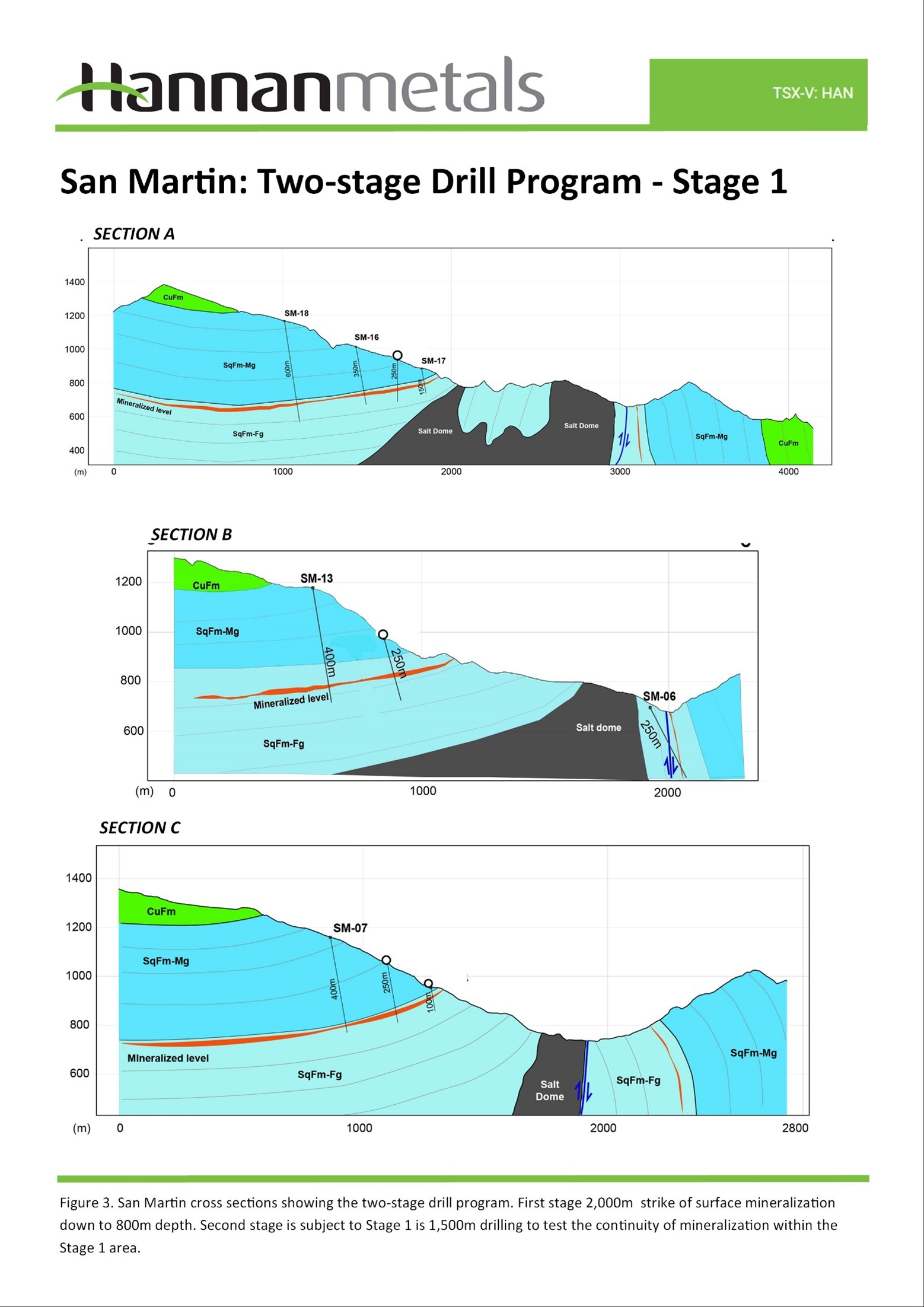

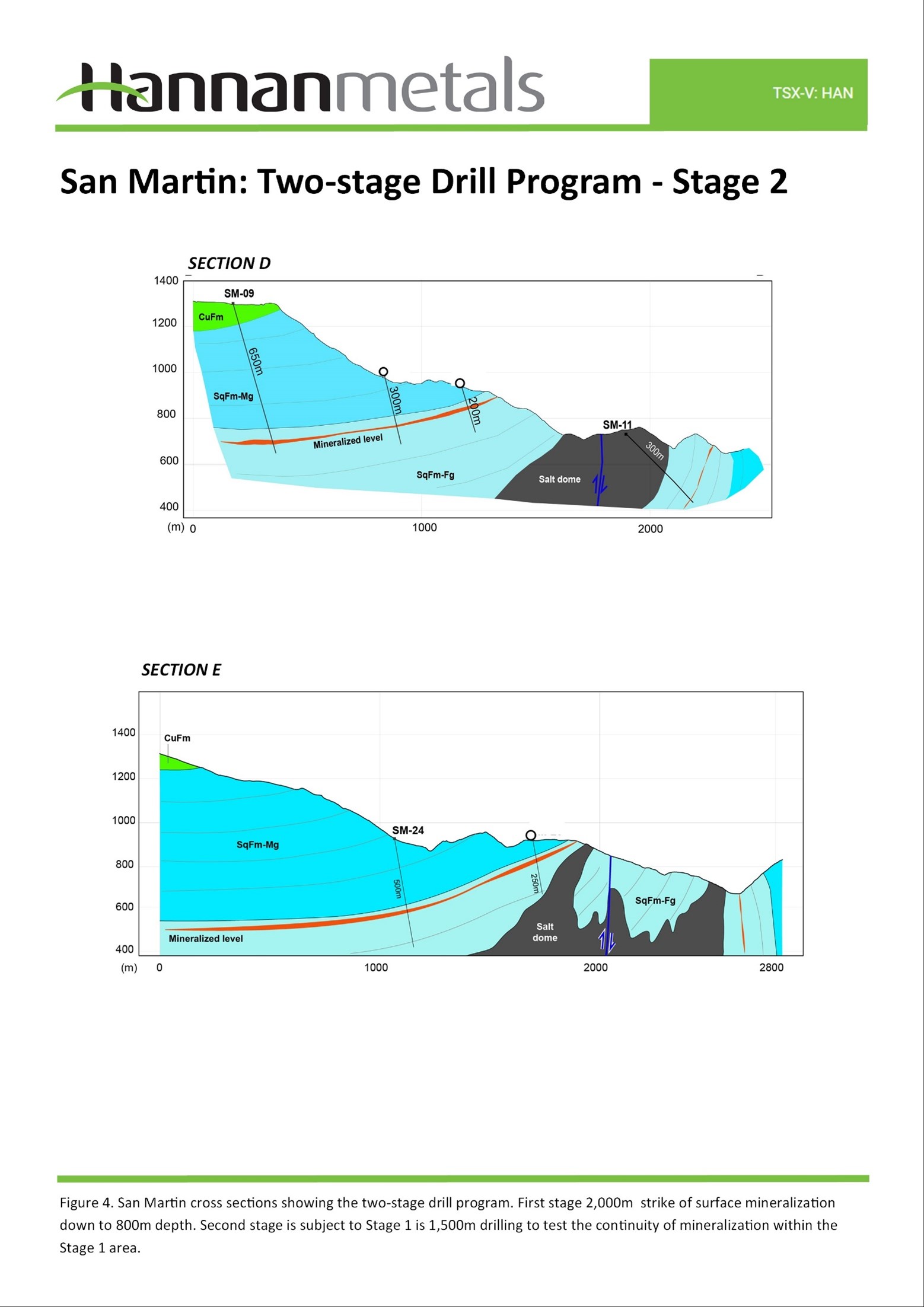

- A two-stage drill program is planned:

- First stage: A 2,000m diamond drilling program over a 2 km strike of mapped surface mineralization down to 800m depth (Figures 2 and 3).

- Second stage: Subject to Stage 1, a further 1,500m drill program to test the continuity of mineralization (Figures 2 to 4).

- Subject to results in Stage 1 or Stage 2 additional areas may be tested within the 7 km long permitted area.

San Martin West (JOGMEC JV - Peru)

- Environmental data collection to support a new DIA application at San Martin West has commenced and will be completed in the coming 2 months.

- The environmental data is being collected at San Martin West over an outcropping copper-silver mineralization trend that has been mapped for over 2.3 km of strike including 5.8m at

3.1% copper and 65 g/t silver from surface (previously reported).

Valiente Peru (Hannan

- The DIA application for the Belen area was submitted in late January 2024. Hannan has already started to receive observations and feedback from the relevant authorities. Drill permitting times in Peru appears to be improving and the social support from the project remains strong.

- The permit area contains two outcropping porphyry targets (Ricardo Herrera and Sortilegio) and one zone with signatures of both porphyry-epithermal and skarn mineralization (Vista Alegre) (Figures 5 to 8).

- Hannan is planning a 70-line km pole-dipole induced polarization geophysical survey and regional LiDAR survey across the three porphyry targets areas to define drill targets.

Cerro Rolando Chile (Hannan has option to earn

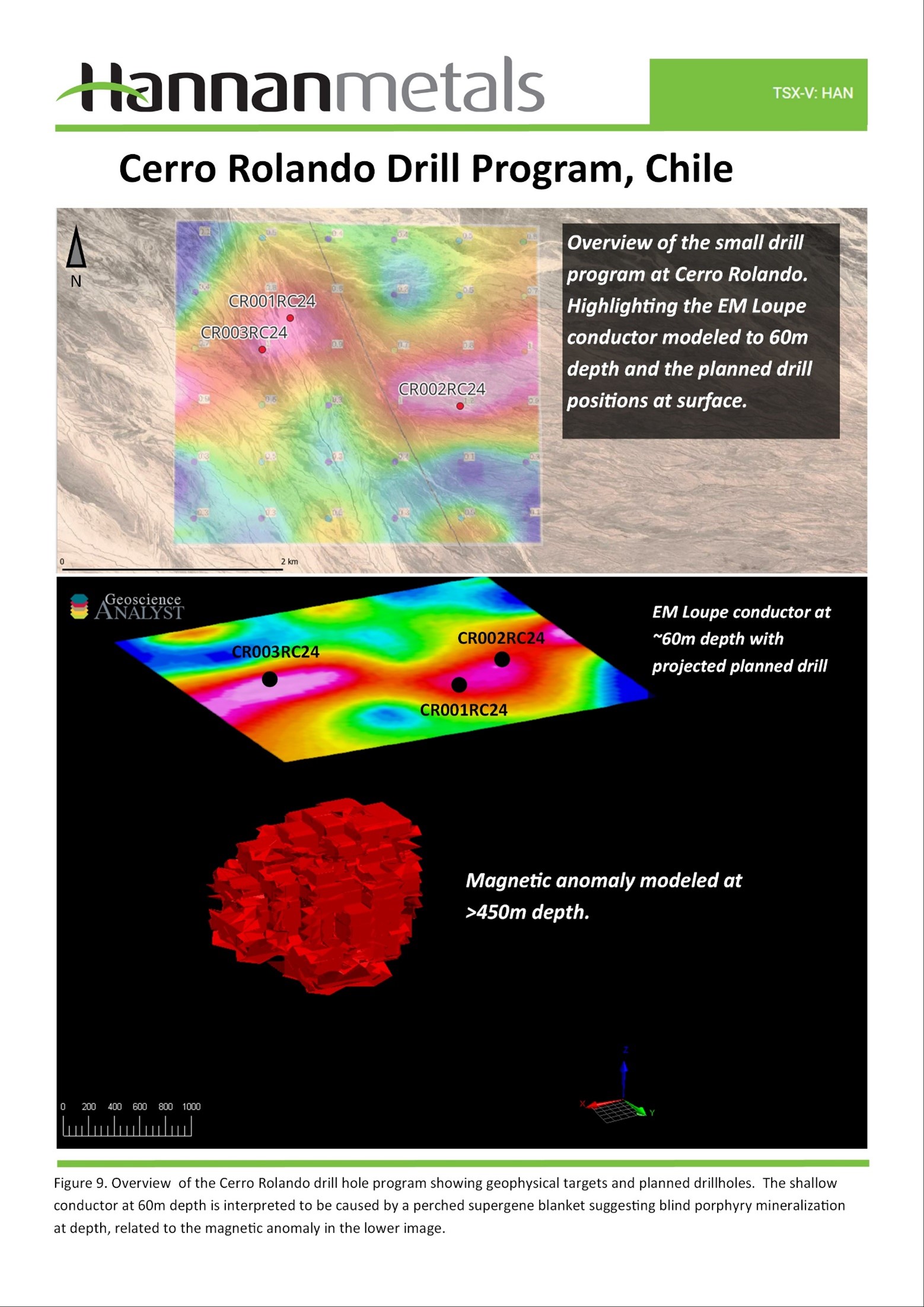

- Hannan is in the process of permitting a small drill program to test a shallow conductor at the Cerro Rolando Project in Chile. The conductor has been modeled to a depth of 60m and may represent a perched supergene blanket from a mineralized porphyry at depth.

- A community contract is in the process of being signed with final drill approval anticipated during August 2024. Permitting for 3 platforms has been made with a minimum contract requirement for one 100m deep hole to test the shallow conductor.

- The conductor is 10m to 15m thick and open to the E and W. It directly overlays a magnetic anomaly that is modeled to 450m depth (Figure 9)

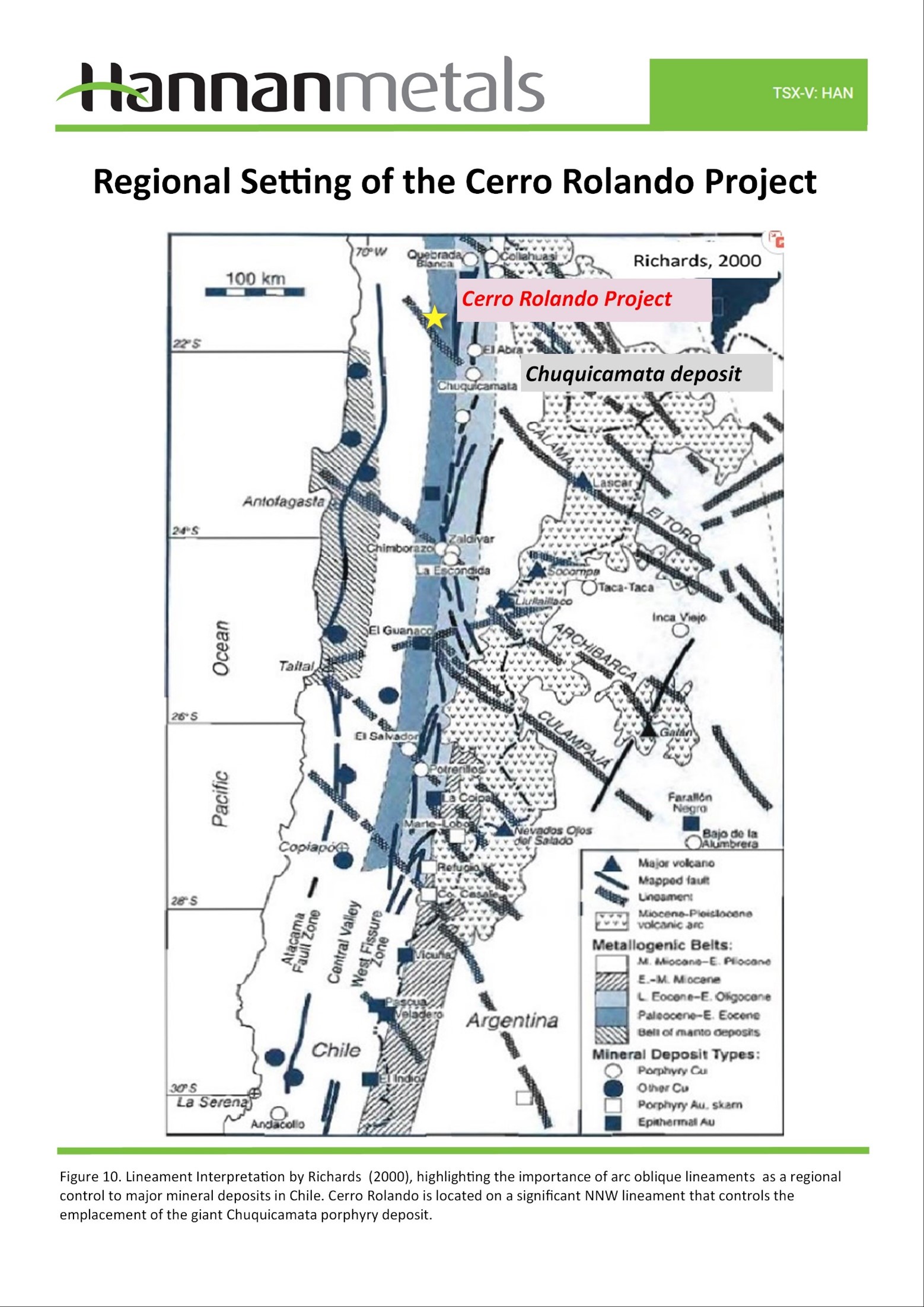

- The drill target is located at a regional significant NNW lineament that controls the emplacement of the giant Chuquicamata deposit (Figure 10).

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or the securities laws of any state of the United States and may not be offered or sold within the United States (as defined in Regulation S under the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

About Hannan Metals Limited (TSX.V:HAN) (OTCPK: HANNF)

Hannan Metals Limited is a natural resources and exploration company developing sustainable resources of metal needed to meet the transition to a low carbon economy. Over the last decade, the team behind Hannan has forged a long and successful record of discovering, financing, and advancing mineral projects in Europe and Latin America. Hannan is a top ten in-country explorer by area in Peru and has recently optioned a copper-porphyry project in Northern Chile. Mr. Michael Hudson, FAusIMM, Hannan's Chairman and CEO, a Qualified Person as defined in National Instrument 43-101, has reviewed and approved the technical disclosure contained in this news release.

On behalf of the Board, "Michael Hudson" Michael Hudson, Chairman & CEO | Further Information 1305 - 1090 West Georgia St., Vancouver, BC, V6E 3V7 Mariana Bermudez, Corporate Secretary, |

Forward Looking Statements. Certain disclosure contained in this news release may constitute forward-looking information or forward-looking statements, within the meaning of Canadian securities laws. These statements may relate to this news release and other matters identified in the Company's public filings. In making the forward-looking statements the Company has applied certain factors and assumptions that are based on the Company's current beliefs as well as assumptions made by and information currently available to the Company. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. These risks and uncertainties include but are not limited to: timing and successful completion of the Offering; the intended use of proceeds from the Offering; the political environment in which the Company operates continuing to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases; the Company's expectations regarding its mineral projects; market conditions, the preliminary nature of the Company's operations; risks related to negative publicity with respect to the Company or the mining industry in general; planned work programs; permitting; and community relations. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news.

Figure 1: Location of Hannan's Peruvian Projects

SOURCE: Hannan Metals Ltd.

View the original press release on accesswire.com