Prospera Energy Inc. Announces a 508% increase in the 2023 Proven Developed Producing (PDP) Reserve Valuation

CALGARY, Alberta, March 14, 2024 (GLOBE NEWSWIRE) -- Prospera Energy Inc. (“Prospera” or the “Company”) (TSX.V: PEI, OTC: GXRFF, FRA: OF6B, OF6B.SG, OF6B.F, OF6B.BE).

Prospera Energy Inc. (“PEI”) is pleased to announce a

PEI’s December 31, 2023, year-end reserves were independently assessed by InSite Petroleum Consultants Ltd. (“InSite”) in accordance with COGEH standards. The Insite report confirmed a current recovery rate of

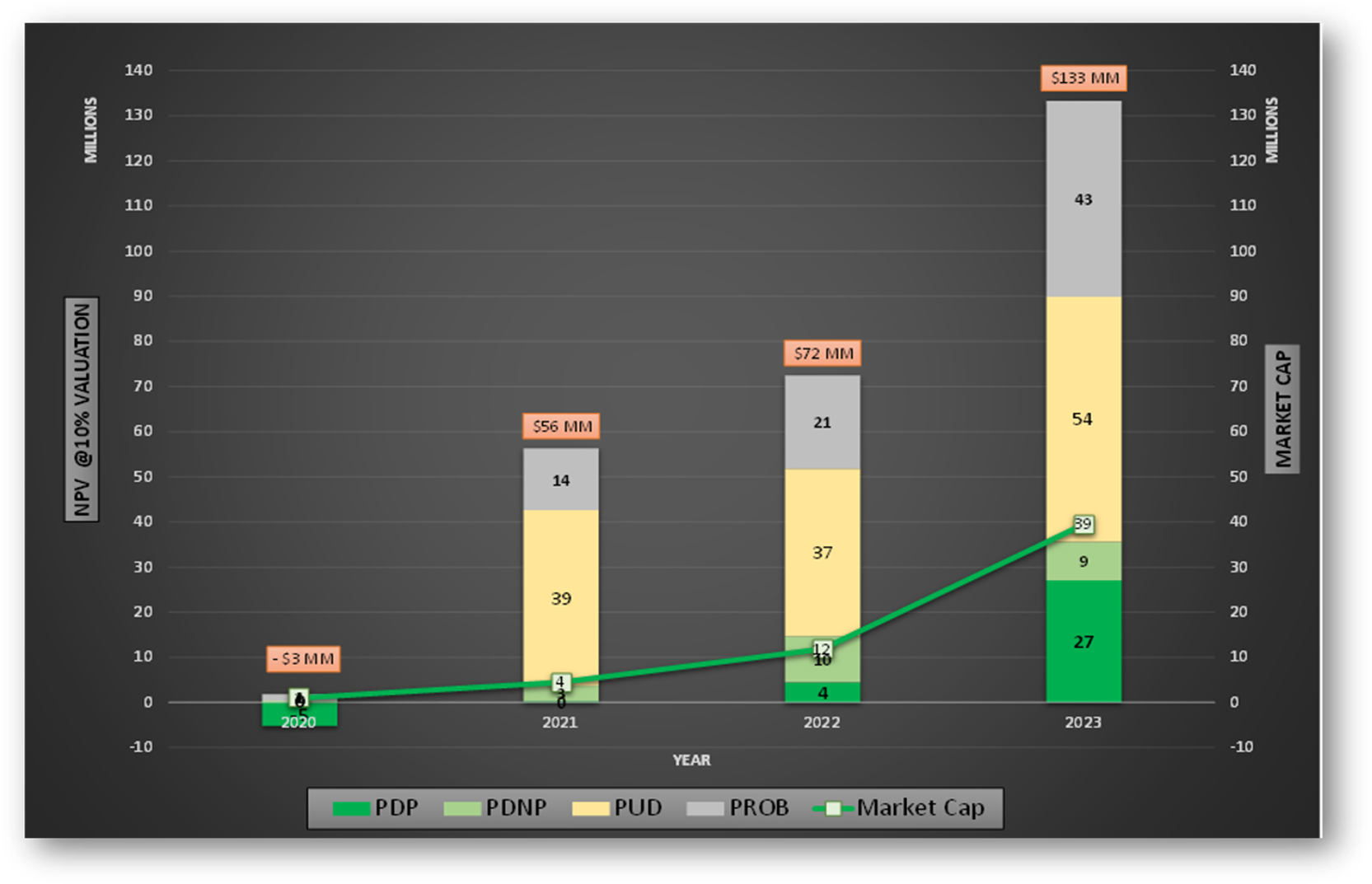

The 2023 Reserves Report demonstrates substantial upside for PEI, with highlights as follows:

- PDP reserves increased

508% from 4.4MM$ to 27.1MM$ at a discount rate of10% . - 2P reserves increased by 60.8MM$ from 72.5MM$ to 133.3MM$ at a discount rate of

10% . - Total proved and probable reserves value increased by

25% from 4,306 to 5,403 Mboe (97% liquids). - The reserve life index increased by

6% from 28 to 30 years. - PEI elected to apply modest price of 79$/bbl (WCS) for NPV estimation, allowing for substantial NPV appreciation if oil price sustains.

- 2024 TPP F&D costs of

$5.7 /boe (4.3x recycle ratio). - Net asset value per share:

- TP of

$0.21 & TPP of$0.31

- TP of

NI 51-101 Table 2.1.1

The following table discloses, in the aggregate, the Corporation’s gross and net proved and probable reserves estimated using forecast prices and costs by product type. “Forecast prices and costs” means future prices and costs in the InSite Report that are generally accepted as being a reasonable outlook of the future or fixed or currently determinable future ,prices or costs to which the Corporation is bound.

| Prospera Energy Inc. Summary of Oil and Gas Reserves as of December 31, 2023 | ||||||||

| Reserves Category | Light and Medium Oil (Mbbl) | Heavy Oil (Mbbl) | Solution Gas (MMcf) | Gas (MMcf) | ||||

| Gross | Net | Gross | Net | Gross | Net | Gross | Net | |

| Proved Developed Producing | 232 | 200 | 1,044 | 994 | 50 | 19 | 70 | 65 |

| Proved Developed Non-Producing | 23 | 20 | 305 | 301 | 25 | 19 | 58 | 54 |

| Proved Undeveloped | 99 | 80 | 1,934 | 1,855 | 32 | 32 | ||

| Total Proved | 354 | 300 | 3,283 | 3,149 | 106 | 69 | 128 | 119 |

| Total Probable | 266 | 218 | 1,364 | 1,231 | 30 | 20 | 555 | 498 |

| Total Proved + Probable | 620 | 518 | 4,647 | 4,380 | 136 | 89 | 683 | 617 |

Gross reserves are the working interest share only. Net reserves are the working interest gross reserves plus all royalty interest reserves receivable less all royalty burdens payable. Conventional natural gas (solution) includes all gas produced in association with light, medium and heavy crude oil.

Remaining Reserves

Remaining reserves of oil and gas have been determined as of December 31, 2023. A summary of property gross and total company reserves follows:

| Prospera Energy Inc. | ||||

| Summary of Reserves as of December 31, 2023 | ||||

| Proved Developed Producing | Total Proved Plus Probable | |||

| Oil – Mbbl | ||||

| Property Gross | 1,748 | 7,311 | ||

| Company WI | 1,276 | 5,267 | ||

| Company Net | 1,194 | 4,898 | ||

| Gas – MMcf | ||||

| Property Gross | 145 | 987 | ||

| Company WI | 120 | 819 | ||

| Company Net | 84 | 706 | ||

| BOEs – MBOE | ||||

| Property Gross | 1,772 | 7,476 | ||

| Company WI | 1,296 | 5,403 | ||

| Company Net | 1,208 | 5,015 | ||

Product Prices

The InSite base product price forecast, effective January 1, 2024, was used for this evaluation, a copy of which is included in the InSite Report. To estimate actual received prices, adjustments were made to crude oil and by-products prices for quality and transportation tariffs. Similarly, adjustments were made to gas prices for heating value and transportation. It is assumed that the adjustment factors and increments will remain constant throughout the forecasts. Revenue data provided by the Company was used to quantify price adjustments. If such data was unavailable, typical values for the area were used to estimate price adjustments. Risks of political and economic uncertainties could affect future results and could cause results to differ materially from those expressed in this evaluation.

Economic Results

Summarized as follows is the NPV of the Corporation’s future net revenue attributable to the reserves categories previously tabulated, estimated using forecast prices and costs, before deducting future income tax expenses, and without discount and using discount rates of

| Prospera Energy Inc. NPV of Future Net Revenue as of December 31, 2023 NPV before Income Taxes (M$C) | ||||||||

| Proved Developed Producing | Total Proved | Proved Plus Probable | ||||||

| Undiscounted | 0 | % | 30,905 | 131,261 | 209,549 | |||

| Discounted | 5 | % | 29,857 | 108,092 | 164,900 | |||

| 10 | % | 27,051 | 89,920 | 133,312 | ||||

| 15 | % | 24,407 | 76,147 | 110,652 | ||||

| 20 | % | 22,196 | 65,581 | 93,893 | ||||

Future operating costs are based on historical data. Wherever unavailable, they were estimated from analogous operations in the vicinity of the properties. The inflation of capital and operating costs is assumed to be

InSite has included cost estimates of well abandonment and reclamation for all existing wells, regardless of reserves assignment, and undeveloped locations assigned reserves. Estimates have been prepared based on historical costs and published guidance from provincial liability management or rating. It is understood that all abandonment and reclamation costs of wells and facilities have been accounted for by the Company.

After Tax Results

As mandated by NI 51-101, after tax results are shown in the various tables of the InSite Report. After-tax calculations at the company level incorporated tax legislation and tax pool details for the Company, complying with the guidelines and philosophy of NI 51-101 in all material aspects. All future capital cost estimates herein have been categorized by tax pool definitions and used to supplement the year-end tax pool information provided by the Company. The year-end tax pool, as provided by the Company, is summarized below:

- Canadian Oil and Gas Property Expense (COGPE)

$11,902,793 - Canadian Development Expense (CDE)

$19,743,881 - Capital Cost Allowance (CCA Class 8,10,13,41,45)

$2,274. - Non-Capital Losses (

100% )$8,846,004

Qualification

To prepare their evaluation, a technical presentation of properties was made by the Company to InSite. Data required by them was sourced from the Company, industry references and regulatory bodies. Neither field inspection nor environmental review of these properties were conducted by InSite, nor deemed necessary. Generally accepted engineering methods were employed to estimate reserves and forecast production. The InSite Report follows the Practice Standards and Guidelines of the Association of Professional Engineers and Geoscientists of Alberta (APEGA) and adheres in all material aspects to the business practices, evaluation procedures, and reserve definitions contained within NI 51-101 and the COGEH Handbook.

Production & Development

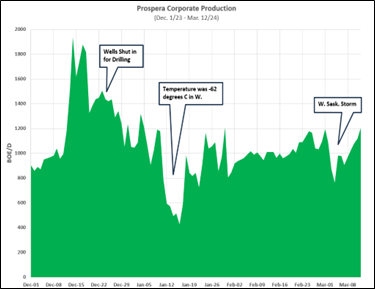

As per the Corporate Production Diagram (above) Prospera attained peaks rates of approximately 1,800 boepd in late December 2023. Additional production was shut-in to complete the drilling program. A combination of shut-in and new production from horizontal wells provided the capacity at an estimated 2,200 boepd. However, in January (as shown), the freezing weather conditions reduced existing production to an average of 900 boepd and curtailed shut-in and new well production. Compared to 2022, 2023 corporate production rebounded much quicker from these wintry weather conditions due to infrastructure improvements. Currently Prospera is producing 1,200 boepd with an additional 500 boepd to bring online.

The success from PEI’s 2023 drilling program supports the 2024 robust development plan to drill vertical / directional / horizontal wells in the medium oil property and horizontals in the core Saskatchewan assets. Furthermore, PEI also has planned to pilot a pressure support scheme to further improve recovery. The 2024 development plan is to be funded through a combination of cash flow and non-dilutive credit facilities to be secured against the 27MM$ of PDP reserves value. PEI’s robust 2024 capital development and acquisition plan is to achieve a 2024 year-end exit target rate of 5,000 boepd.

About Prospera

Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF, FRA: OF6B) is a publicly traded energy company based in Western Canada, specializing in the exploration, development, and production of crude oil and natural gas. Prospera is primarily focused on optimizing hydrocarbon recovery from legacy fields through environmentally safe and efficient reservoir development methods and production practices. Prospera was restructured in the first quarter of 2021 to become profitable and in compliance with regulatory, environmental, municipal, landowner, and service stakeholders.

The company is in the midst of a three-stage restructuring process aimed at prioritizing cost effective operations while appreciating production capacity and reducing liabilities. Prospera has completed the first phase by optimizing low hanging opportunities, attaining free cash flow, while bringing operation to safe operating condition, all while remaining compliant. Currently, Prospera is executing phase II of the restructuring process, the horizontal transformation intended to accelerate growth and capture the significant oil in place (400 million bbls). These horizontal wells allow PEI to reduce its environmental and surface footprint by eliminating the numerous vertical well leases along the lateral path. Phase III of Prospera’s corporate redevelopment strategy is to optimize recovery through EOR applications. Furthermore, Prospera will pursue its acquisition strategy to diversify its product mix and expand its core area. Its goal is to attain

PEI continues to apply efforts to minimize its environmental footprint. Also, efforts to reduce and eventually eliminate emissions, alongside pursuing innovative ESG methods to enhance API quality, thereby achieving higher margins and eliminating the need for diluents.

For Further Information:

Shawn Mehler, PR

Email: investors@prosperaenergy.com

Website: www.prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will,” “may,” “should,” “anticipate,” “expects” and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward- looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1f5bbad9-207d-4acf-ba37-888fb01c7b1e

https://www.globenewswire.com/NewsRoom/AttachmentNg/f70f9e28-3e34-45bc-83f0-e2780a4ccbfe