Prospera Energy Inc. 2024 Corporate Update

CALGARY, Alberta, April 25, 2024 (GLOBE NEWSWIRE) -- Prospera Energy Inc. (“Prospera” or the “Company”) (TSX.V: PEI, OTC: GXRFF, FRA: OF6B, OF6B.SG, OF6B.F, OF6B.BE).

Prospera Energy Inc. announces that the filing of its audited annual financial statements, management's discussion and analysis and related CEO and CFO certifications for the financial year ended December 31, 2023 (the "Required Filings"), will be delayed beyond the filing deadline of April 29, 2024, and as a result is in default of its obligations under Part 4 of National Instrument 51-102 Continuous Disclosure Obligations. The delay in the completion of the Required Filings is because of PEI’s auditors requesting additional time to complete the audit which contain complex business transactions including GORR financing & improved policies for its decommissioning liability estimates.

The Corporation has made an application to the Alberta Securities Commission (the "ASC") for a management cease trade order (the "MCTO"), which would restrict all trading in securities of the Corporation, whether direct or indirect, by management of the Corporation. The MCTO does not generally affect the ability of shareholders who are not insiders of the Corporation to trade their securities. There is no certainty that the MCTO will be granted.

The Corporation is working expeditiously with its auditor, Crowe MacKay LLP, to complete the audit as soon as possible. Prospera plans to remedy the default and file the Required Filings as soon as it is able to do so and expects such filing to occur on or prior to May 31, 2024. The Corporation also intends to satisfy the provisions of the alternate information guidelines of Section 10 of National Policy 12-203 Management Cease Trade Orders as long as it is in default of the filing requirements.

The Corporation confirms that there are no insolvency proceedings against it as of the date of this press release. The Corporation also confirms that there is no other material information concerning the affairs of the Corporation that has not been generally disclosed as of the date of this press release.

GORR Financing

The company is the in process of completing a 10+M$ GORR financing, which will be used for a combination of working capital and 2024 infill development to add approximately 1,500+ Boepd. Prospera is also in the process of finalizing Farm-in financing which will also contribute to the production increase. Additional information to be provided later. GORR financing terms are as follows:

| Issuer: | Prospera Energy Inc. (“Prospera” or the “Company”). |

| Issue: | GORR Financing with Buy Back |

| GORR %: | |

| Offering Amount: | |

| Effective Annual Return % | |

| Term: | 2 Years |

| Buy Back Premium: | |

| Total Repaid: | |

| Participation: | Calculated on a pro-rata basis |

| Use of Proceeds: | Prospera intends to use the net proceeds of the Offering for Takeout of the previous GORR financing, drilling & completions + general working capital |

| Offering Basis: | Private placement offering |

| Target Close Date: | On or before May 15th, 2024 |

Interested investors should contact the company directly for additional information. PEI is targeting to consolidate the long-term debt on its balance sheet at the end of 2024 with a senior secured debt facility.

Production Update

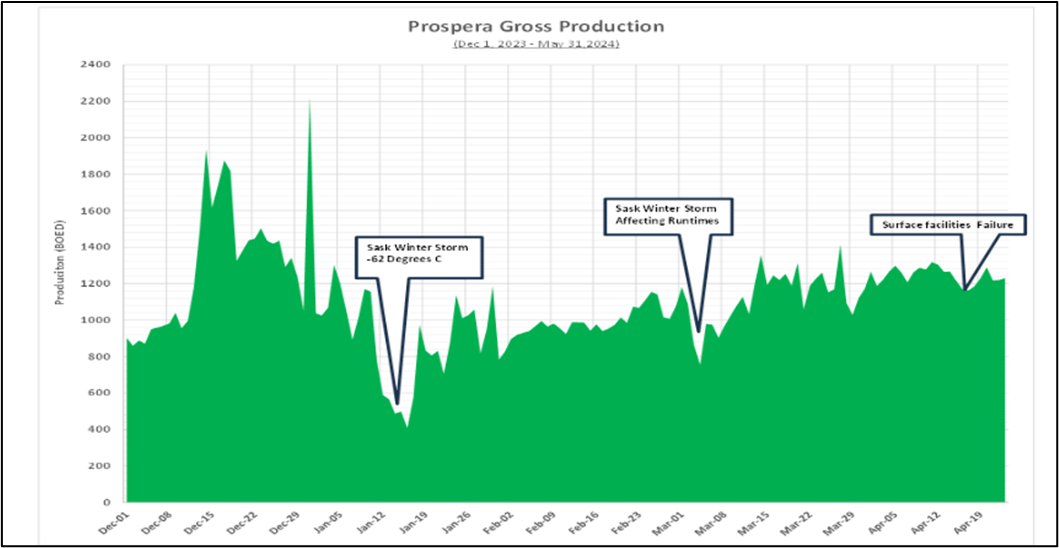

Prospera production has been steadily increasing from the cold weather conditions and maintaining 1,250+ Boepd. Reservoir management measures are being implemented to redirect randomly disposed water and the magnitude of injection to attain the production capability of approximately 1,800 – 2,000 Boepd. These steps involve measurement / monitoring equipment maintenance and pipeline repairs that are awaiting warm weather conditions. Moderate management of injection is resulting in a positive response in oil cuts, especially in the newly drilled horizontal wells. Management is encouraged by the results that could appreciate production substantially.

Development Update

Prospera intends to continue with the 2024 infill development plan which is an extension of 2023 drilling results that exceeded expectations in both AB medium-light and SK heavy oil. Drilling capital is being dedicated specifically to drilling and development. Exceptional performing medium-light oil drills are a priority with 6-10 wells. Anticipating, multi-lateral wells in SK heavy oil fields with 10+ wells. These developments are expected to increase production by 1,500+ Boepd and add significant cash flow that can transition Prospera to increased profitability by year end 2024.

Arrears / Settlements

Prospera optimization and development has been steadily appreciating production and improving infrastructure to safe operating conditions. However, 15MM$ of historical accounts payable arrears (prior to restructuring), cold weather conditions, lower prices and aged infrastructure have attributed to higher accounts payable balances not being addressed in a timely manner. However, March and April 2024 average production rates were substantially higher than the previous year and expected to increase further. With PEI’s expectation of continued strong production and a robust commodity price outlook, the company expects to resolve most of the outstanding AP arrears over the next 4-6 months. This reduction will take place with existing production and optimization. The 2024 development plan is expected to accelerate AP arrears reduction and propel Prospera to increased net income and improved liquidity metrics.

About Prospera

Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF, FRA: OF6B) is a publicly traded energy company based in Western Canada, specializing in the exploration, development, and production of crude oil and natural gas. Prospera is primarily focused on optimizing hydrocarbon recovery from legacy fields through environmentally safe and efficient reservoir development methods and production practices. Prospera was restructured in the first quarter of 2021 to become profitable and in compliance with regulatory, environmental, municipal, landowner, and service stakeholders.

The company is in the midst of a three-stage restructuring process aimed at prioritizing cost effective operations while appreciating production capacity and reducing liabilities. Prospera has completed the first phase by optimizing low hanging opportunities, attaining free cash flow, while bringing operation to safe operating condition, all while remaining compliant. Currently, Prospera is executing phase II of the restructuring process, the horizontal transformation intended to accelerate growth and capture the significant oil in place (400 million bbls). These horizontal wells allow PEI to reduce its environmental and surface footprint by eliminating the numerous vertical well leases along the lateral path. Phase III of Prospera’s corporate redevelopment strategy is to optimize recovery through EOR applications. Furthermore, Prospera will pursue its acquisition strategy to diversify its product mix and expand its core area. Its goal is to attain

PEI continues to apply efforts to minimize its environmental footprint. Also, efforts to reduce and eventually eliminate emissions, alongside pursuing innovative ESG methods to enhance API quality, thereby achieving higher margins and eliminating the need for diluents.

For Further Information:

Shawn Mehler, PR

Email: investors@prosperaenergy.com

Website: www.prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the future operations of the Corporation and other statements that are not historical facts. Forward-looking statements are often identified by terms such as “will,” “may,” “should,” “anticipate,” “expects” and similar expressions. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding future plans and objectives of the Corporation, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

Although Prospera believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Prospera can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Prospera. As a result, Prospera cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward- looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and Prospera does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/12a07157-010a-4a24-ac67-c81a7a2034e4