Engine Gaming & Media, Inc. Reports First Quarter Fiscal Year 2022 Financial Results

Engine Gaming and Media (NASDAQ: GAME) reported a 92% year-over-year revenue increase in FY Q1’2022, reaching

- Q1 FY 2022 revenue of $14.3 million, a 92% increase YoY.

- 22% sequential revenue growth compared to Q4 FY 2021.

- Advertising revenue rose 84% YoY to $10.0 million.

- Game development revenue surged 320% YoY.

- Net loss decreased but still at $(1.3) million.

- Adjusted EBITDA loss increased to $(5.0) million.

Insights

Analyzing...

FY Q1’2022 Revenue of

Sequential Quarterly revenue growth of

Cash position of

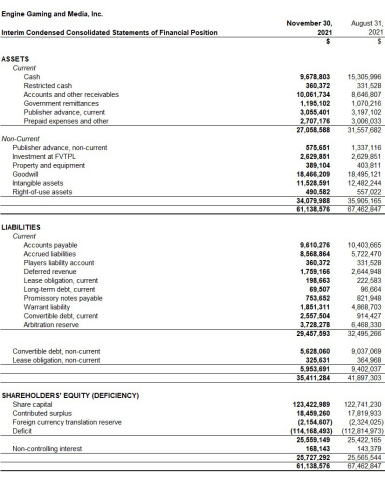

(Graphic: Business Wire)

Total revenue for FY Q1’2022 was

For the 1st quarter ended

For the 1st quarter ended

The Company had cash of

Key segment revenue growth that contributed to the strong revenue performance:

-

Software-as-a-Service: SaaS revenue for FY Q1’22 was

$2.1 million $1.4 million 45% YoY and,7% higher than sequential FY Q4’21 of$2.0 million -

Advertising: Advertising revenue for FY Q1’22 was

$10.0 million 84% YoY, with FY Q1’21 revenues of$5.5 million 14% quarter-over-quarter, with FY Q4’21 revenues of$8.8 million -

Games Development : Game development revenues for FY Q1’22 was$2.1 million 320% YoY, with FY Q1’21 revenues of$0.5M 157% quarter-over-quarter, with FY Q4’21 revenues of$0.8 million

Recent highlights from the Company’s operating businesses include:

-

Frankly Media - Frankly Media renewed its digital media agreement with its largest radio station operator that serves hundreds of owned and operated stations delivering premium content to over a quarter billion people each month. In addition, Frankly renewed its advertising representation agreement with

Westwood One , which offers nationally syndicated sports, news and entertainment content to more than 250 million monthly listeners across an audio network of over 7,000+ affiliated broadcast radio stations and media partners. Lastly, advertising CPMs and RPMs increased by25% and75% respectively year-over-year -

Sideqik - Sideqik’s leading influencer marketing and social commerce platform continues to scale, signing a multi-year extension with leading gaming hardware brand HyperX, recently acquired by HP, as well as onboarding global apparel leader Nike and multinational computer and phone hardware company

ASUS to its long list of partners and clients. -

Stream Hatchet - Stream Hatchet released its new sponsorship measurement technology, which contextualizes brand activations instream, providing partners tools to track, measure, and optimize activations within live-streaming environments, such as logo impressions on platforms like YouTube and Twitch. A major esports and

AAA game publisher has already begun to utilize this new technology. In addition, Stream Hatchet has continued to grow its expanding client list, including StreamElements, the fastest growing provider of production, monetization, audience engagement, sponsorship, and influencer marketing tools and services for livestreams across Twitch, YouTube Live, Facebook Gaming, and Trovo. - UMG Gaming - UMG Gaming’s greatly enhanced production of Microsoft’s Gears Esports competition series debuted on the official Xbox Channel, driving over 250,000 of hours watched within the first split. In addition, Thrustmaster, a leading peripheral manufacturer, has joined Gears Esports, naming the ESWAP x PRO CONTROLLER as the official controller of Gears Esports, as well as taking title sponsorship of Play of the Day moments.

-

Eden Games - Eden continues to extend its expertise in mobile gaming’s motorsport category, beginning development on a variety of different racing experiences with major game partners. In addition, Eden has received substantial interest from numerous parties since announcing its strategic process. -

Winview - Since releasing, Pregame, a game mode that enables players to compete in game-of-skill contests prior to the start of a live sporting event, thus complementing its live play-along experience, player engagement has increased by

30% +.

The Company also announced the addition of highly respected private equity fund manager

Additionally, the Company will host a conference call on

Non-IFRS Measures

The Company reports earnings before interest, taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA, which are not financial measures calculated and presented in accordance with International Financial Reporting Standards ("IFRS") and therefore may not be comparable to similar measures presented by other issuers. EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute to net income (loss) or any other financial measures of performance or liquidity calculated and presented in accordance with IFRS. The Company defines Adjusted EBITDA as EBITDA, adjusted to exclude certain non-cash charges and other items that we do not believe are reflective of our ongoing operating results. The Company utilizes Adjusted EBITDA internally for purposes of forecasting, determining compensation, and assessing the performance of our business, therefore, we believe this measure provides useful supplemental information that may assist investors in assessing an investment in the Company.

The following unaudited table presents the reconciliation of net loss to Adjusted EBITDA for the three months ended

This earnings release should be read in conjunction with the Company’s Interim Condensed Consolidated Financial Statements and accompanying notes that will be made available on Engine’s investor relations site on

About

Cautionary Statement on Forward-Looking Information

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Engine to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "estimates", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. In respect of the forward-looking information contained herein, Engine has provided such statements and information in reliance on certain assumptions that management believed to be reasonable at the time. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements stated herein to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Accordingly, readers should not place undue reliance on forward-looking information contained in this news release.

The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. Engine does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither the

View source version on businesswire.com: https://www.businesswire.com/news/home/20220113005894/en/

Investors

Ryan.Lawrence@icrinc.com

332-242-4321

Media

jgoldfarb@sloanepr.com

212-446-1869

Source: