Foremost Lithium Confirms 25.92 Metres of Lithium Mineralization Including 1.09% Li2O Across 10 Metres at its Zoro Property, Manitoba Canada

Highlights at the Company’s Maiden Resource at Dyke 1 include:

- Drill hole FL24-010 confirmed

1.09% Li2O over 9.88 m starting at 177.57 m - Drill Hole FL 24-009 confirmed

1.03% Li2O over 7.96 m starting at 233.04 m - Hole FL24-009 confirmed

1.52% Li2O over 5.02 m starting at 233.98 m

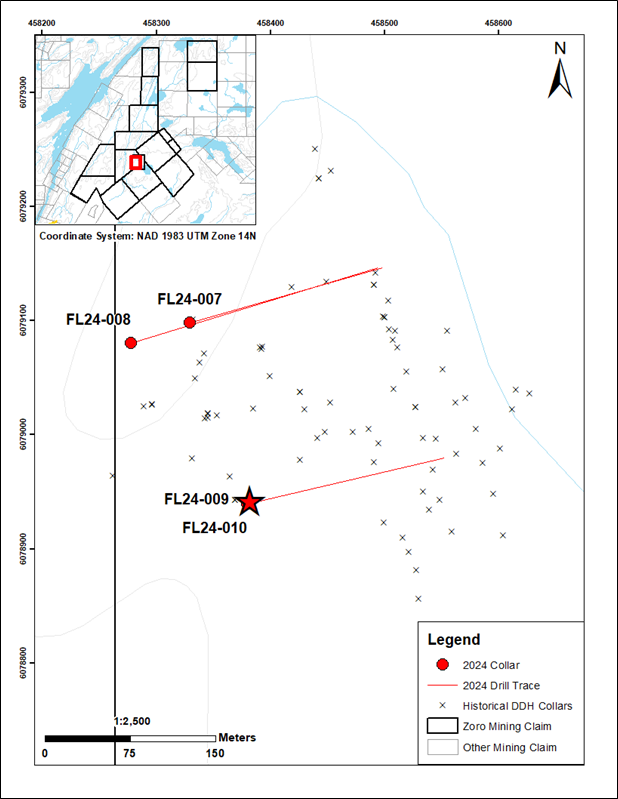

VANCOUVER, British Columbia, April 08, 2024 (GLOBE NEWSWIRE) -- Foremost Lithium Resource & Technology Ltd. (NASDAQ: FMST) (CSE: FAT) (“Foremost Lithium”, “Foremost” or the “Company”), a North American hard-rock lithium exploration company, is pleased today to provide a drilling progress update for its 2024 winter drill program on its Zoro Property located in the Snow Lake region of Manitoba. The Company reports that 2 holes targeting Dyke 1 (see figure 1 below) have been completed with assay results confirming lithium mineralization spanning a cumulative length of 25.92m. Highlights in drill holes FL24-009 and FL24-010 include

“We are very encouraged as we continue to expand the lithium mineralization on our maiden resource,” states Jason Barnard, President and CEO of Foremost Lithium. “Foremost Lithium is striving to become a premier supplier of North America’s lithium feedstock. Further resource development along with our continued business development, such as planned infrastructure, will pave the way to our continued growth. Dyke 1 currently contains 24,000 tons of lithium carbonate which, when converted, would be able to manufacture roughly 400,000 car batteries to power electric vehicles. With the potential to increase resource as drilling progresses – and as government regulation, such as the current U.S. administration’s Inflation Reduction Act, incentivizes U.S. domestic supply – we look forward to future upside for our Company and shareholders.”

Figure 1 - Zoro Dyke 1 Location Map Indicating Drill Hole Locations

Dyke 1 Drill Results

Drill results for the 2 drill holes completed at the Dyke 1 spodumene pegmatite are reported below in Tables 1 and 2. These holes primarily target the depth extension of the pegmatite body. Results include:

- Drill hole FL24-009 intersected 7.96 m of spodumene-bearing pegmatite returning

1.03% Li2O starting at a depth of 233.04 m - Drill hole FL24-009 intersected 5.02 m of spodumene-bearing pegmatite returning

1.52% Li2O starting at a depth of 235.98 m - Drill hole FL24-010 intersected 9.88 m of spodumene-bearing pegmatite returning

1.09% Li2O starting at a depth of 77.57 m - Drill hole FL24-010 intersected 5.37 m of spodumene-bearing pegmatite returning

1.34% Li2O starting at a depth of 180.73 m

These intersections mark a development in the understanding of the Dyke 1 spodumene pegmatite, revealing previously untested mineralization at depth. The assay results confirm the presence of a well-mineralized zone, suggesting the potential for an expanded resource base within this sub-section of the pegmatite body, as well as continued drilling indicates the potential of mineralization outside of the current resource estimate for Dyke 1.

Table 1 – 2024 Drilling Summary

| Hole ID | Target | Core Size | Hole Depth (m) | Grid | Northing | Easting | Elevation | Azimuth | Dip | Analytical Results |

| FL24-001 | Dyke 8 | NQ | 124 | NAD83 / UTM zone 14N | 6080344 | 6080344 | 290 | 68 | -55 | Pending |

| FL24-002 | Dyke 8 | NQ | 179 | NAD83 / UTM zone 14N | 6080311 | 6080311 | 290 | 68 | -65 | Pending |

| FL24-003 | Dyke 8 | NQ | 124.98 | NAD83 / UTM zone 14N | 6080391 | 6080391 | 290 | 77 | -55 | Pending |

| FL24-004 | Dyke 8 | NQ | 149 | NAD83 / UTM zone 14N | 6080251 | 6080251 | 290 | 100 | -65 | Pending |

| FL24-005 | Dyke 8 | NQ | 119 | NAD83 / UTM zone 14N | 6080201 | 6080201 | 288 | 93 | -45 | Pending |

| FL24-006 | Dyke 8 | NQ | 125 | NAD83 / UTM zone 14N | 6080116 | 6080116 | 288 | 102 | -45 | Pending |

| FL24-007 | Dyke 1 | NQ | 248 | NAD83 / UTM zone 14N | 6079098 | 6079098 | 276.6 | 74 | -45 | Pending |

| FL24-008 | Dyke 1 | NQ | 394 | NAD83 / UTM zone 14N | 6079080 | 6079080 | 277.1 | 73 | -55 | Pending |

| FL24-009 | Dyke 1 | NQ | 308 | NAD83 / UTM zone 14N | 6078940 | 6078940 | 284.9 | 77 | -55 | Received |

| FL24-010 | Dyke 1 | NQ | 288.88 | NAD83 / UTM zone 14N | 6078940 | 6078940 | 284.9 | 77 | -45 | Received |

Table 2 – 2024 Pegmatite Interval Assay Results (Drill Holes FL24-009 & FL24-010)

| Hole number | Intersection | |||

| From (m) | To (m) | Width (m) | Li2O% | |

| FL24-010 | 176.22 | 186.1 | 9.88 | 1.09 |

| incl. | 176.22 | 179.48 | 3.26 | 1.08 |

| incl. | 180.73 | 186.1 | 5.37 | 1.34 |

| FL24-009 | 197.01 | 205 | 7.99 | 0.92 |

| and | 223.07 | 241 | 17.93 | 0.61 |

| incl. | 233.04 | 241 | 7.96 | 1.03 |

| incl. | 235.98 | 241 | 5.02 | 1.52 |

Analytical results are still pending on the remaining drill core to date and will be reported upon analysis.

Exploration Strategy

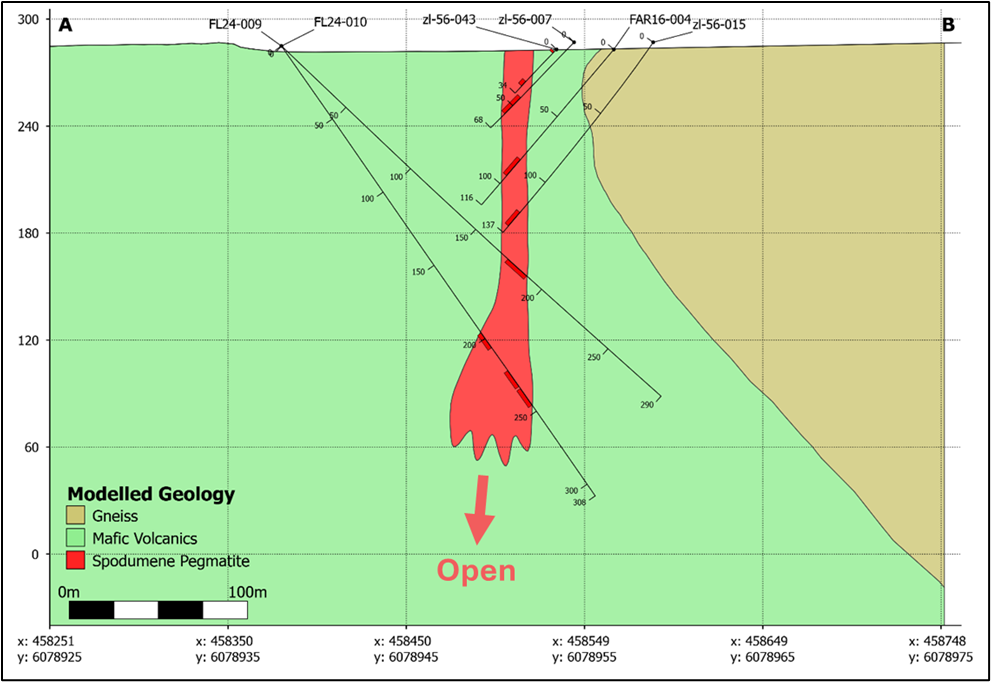

Foremost remains focused on advancing its lithium projects to meet the growing demand for lithium, which is essential for electric vehicles and the stationary storage batteries market. Foremost will continue its exploration efforts at Dyke 1, with additional drilling planned to further define and expand the known zones of mineralization. A geological cross-section of FL24-009 and FL24-010 is presented in Figure 2 below. These mineralized drill intercepts confirm an extension of Zoro Dyke 1 in a zone that was previously unexplored. The pegmatite remains open at depth along its southern extension.

The extension of Dyke 1 to the southeast and at greater depths has emerged as a priority based on a detailed analysis of geological data. The Company’s drilling efforts are expanding southward, aiming to explore and potentially increase the resource estimate by identifying new mineralized zones. This approach leverages advanced geological expertise, aiming to maximize the potential for resource expansion.

Figure 2 – Zoro (Dyke 1) Cross Section of FL24-009, FL24-010 & Historical Drilling

Data Verification / Quality Assurance and Quality Control

Due to the vertical orientation and variable nature of mineralization at the Company’s Dyke 1 deposit, the reported drill intersection lengths, derived from linear measurements along the drill core, may not accurately represent the true width of the mineralized zones. Best practice drilling techniques and geological interpretation are being utilized to intersect mineralization in an orientation that approximates the true width as closely as feasible. Detailed geological modelling and analysis are being conducted to refine these estimates and achieve a more precise characterization of the mineralized body’s true dimensions.

Sample collection, handling, preparation and analysis are monitored with the implementation of chain-of-custody procedures and quality assurance-quality control (QA-QC) programs that follow industry best practices. All samples were submitted to SGS Labs in Burnaby, BC, for determination of lithium via sodium peroxide fusion.

Qualified Person

Technical information in this news release has been reviewed and approved by Matthew Carter, P.Geo., who is a Qualified Person as identified by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects and as defined by the Securities and Exchange Commission’s Regulation S-K 1300 Rules for Disclosure by Registrants Engaged in Mining Operations.

About Foremost Lithium

Foremost Lithium (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0) (WKN: A3DCC8) is a hard-rock lithium exploration company focused on empowering the North American clean energy economy. Foremost’s strategically located lithium properties extend over 43,000 acres in Snow Lake, Manitoba, and hosts a property in a known active lithium camp situated on over 11,400 acres in Quebec called Lac Simard South.

Foremost’s four flagship Lithium Lane Projects as well as its Lac Simard South project are located at the tip of the NAFTA superhighway to capitalize on the world's growing EV appetite, strongly positioning the Company to become a premier supplier of North America's lithium feedstock. As the world transitions towards decarbonization, the Company's objective is the extraction of lithium oxide (Li₂O), and to subsequently play a role in the production of high-quality lithium hydroxide (LiOH), to help power lithium-based batteries, critical in developing a clean-energy economy. Foremost Lithium also has the Winston Gold/Silver Property in New Mexico USA. Learn More at www.foremostlithium.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostlithium.com

Investor Relations

Lucas A. Zimmerman

Managing Director

MZ Group - MZ North America

(949) 259-4987

FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social media:

Twitter: @foremostlithium (now X)

Linkedin: https://www.linkedin.com/company/foremost-lithium-resource-technology/

Facebook: https://www.facebook.com/ForemostLithium

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (as defined under applicable securities laws), based on management's best estimates, assumptions, and current expectations. Such statements include but are not limited to, statements with respect to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable, plans for future exploration and development of the Company's properties and the acquisition of additional exploration projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates" "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: risks related to the receipt of all necessary regulatory and third party approvals for the proposed operations of the Company's business and exploration activities, risks related to the Company's exploration properties; risks related to international operations; risks related to general economic conditions, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of commodities including lithium and gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in reserves; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of exploration, development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in jurisdictions in which the Company operates. . Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward-looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. For forward-looking statements in this news release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward-looking information contained herein to reflect future results, events, or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company's most recent filings under its profile at www.sedarplus.com for further information respecting the risks affecting the Company and its business. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/369263b9-4cdd-41bd-8266-58788df36607

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d03bd63-c9ae-4686-b873-44ae20fe70e5