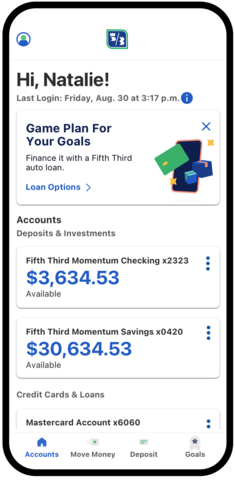

Fifth Third Bank Launches Redesigned, Enhanced Mobile App

Updates include navigation changes, ability to bring new features to customers faster

New

“Mobile is our customers’ channel of choice,” said

“This app is built on modern, cloud-based architecture. This enables Fifth Third to bring new features and functionalities to customers even faster,” added

The app is optimized for Fifth Third Momentum® Banking, an everyday banking solution, which has innovative features like goal saving that can be scheduled or automated; Early Pay1, which is early direct deposit; and MyAdvance2, which allows customers to borrow from their future paychecks if they’re enrolled in direct deposit.

What’s new in the app?

- The bottom navigation is customized based on a customer’s most used features. For example, checking customers will see money movement and mobile check deposit while customers who only have a Fifth Third loan will see their statement and documents.

- Validation screens to inform customers when their transaction is complete.

- Design, icons, and illustration.

- Transaction details including merchant contact information such as website, email, and phone number, plus a map to show customers exactly where the purchase was made.

To learn more, visit 53.com or to download the app, visit the

About Fifth Third

Fifth Third is a bank that’s as long on innovation as it is on history. Since 1858, we’ve been helping individuals, families, businesses, and communities grow through smart financial services that improve lives. Our list of firsts is extensive, and it’s one that continues to expand as we explore the intersection of tech-driven innovation, dedicated people, and focused community impact. Fifth Third is one of the few

1 Early Pay: Access to funds for Early Pay are dependent on submission of direct deposit by payer and can be up to two days prior to date of scheduled payment. Standard fraud prevention restrictions apply.

2 MyAdvance: Fifth Third MyAdvance is an expensive form of credit. We may be able to offer other options that are less expensive and more appropriate for customer needs. MyAdvance is a short-term form of credit that allows eligible Fifth Third personal checking customers to take an advance on their next qualified direct deposit. Additional terms and conditions apply.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221116005120/en/

Beth.Oates@53.com | 313-230-9002

Christopher.Doll@53.com | 513-534-2345

Source: