FICO Data: UK Credit Card Customers Showing Signs of Financial Stress

Worrying trends developing amongst established credit card users as missed payments rise

FICO data shows average credit card balances are higher among accounts open one to five years than all card accounts. (Graphic: Business Wire)

Highlights

-

Established vintage of

UK credit card accounts is 83 percent more likely to have missed two payments inFebruary 2023 than the average of all card accounts -

The average balance value predicted to not be paid by the Established group is 69 percent higher than for all card accounts for

February 2023 -

The percentage of accounts with three missed payments is nearly 94 percent higher amongst Established card holders than for all card accounts for

February 2023

FICO monitors card use and payment performance and has analysed the performance of different groups of card holders as the pressures of the cost of living crisis increase. In particular, FICO has looked at the Established group – accounts that have been open from one to five years.

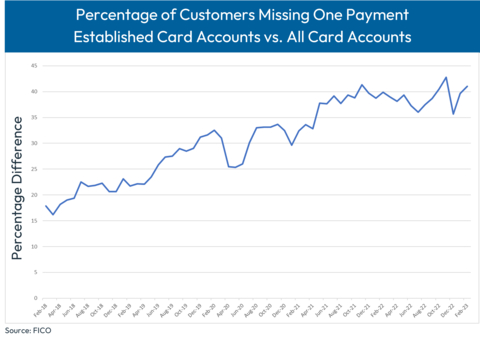

Tracking the difference month on month over a five-year period, the percentage of customers missing one, two and three payments as well as the balance of these missed payments compared to the overall balance are all increasing significantly, as seen by the percentages below:

- The percentage of Established accounts with one missed payment is 41 percent higher than all account vintages. It was 18 percent higher in 2018.

- The percentage of Established accounts with two missed payments is more than 83 percent higher than all account vintages. It was 53 percent higher five years ago.

-

The percentage of Established accounts with three missed payments is nearly 94 percent higher. It was 66 percent higher in

February 2018 .

Vintage Analysis

In line with the higher late payments, the percentage of payments that are less than the minimum due are also considerably higher for the Established group; in

Another key factor is that as customers miss payments, those on a promotional rate will probably have to pay interest, even if they were on a 0 percent balance transfer. As FICO has seen with the increased delinquency for the Established group, average interest per active account is also higher and currently stands 19 percent higher, having risen steeply since

Balance at Risk

FICO’s benchmarking also tracks the “balance at risk” for a customer. This predicts how much of the credit card balance is expected to not get paid. When comparing the Established pool to the overall population during the pandemic, reduced spend opportunities and higher savings lowered the balance at risk. However, since

All of these trends will be of concern to risk managers. Customers who have taken advantage of promotional offers in the past may now be struggling to transfer these balances elsewhere and are left with higher balances, on a high interest rate with a higher minimum due each month. One of the main themes of the FCA Consumer Duty which comes into force in July is around identifying and supporting vulnerable customers just like these. Proactive treatment and support — such as specific collections treatment, loan consolidation or alternative product offerings with a lower APR attached — are all areas issuers can consider in order to meet the requirements set out in the Consumer Duty.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in nearly 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Learn more at https://www.fico.com

FICO and TRIAD are registered trademarks of

View source version on businesswire.com: https://www.businesswire.com/news/home/20230419005092/en/

For further comment on the FICO

FICO

ficoteam@harrisonsadler.com

0208 977 9132

Source: FICO