Entrée Announces Drill Results from Hugo North Extension and Heruga Deposits

Entrée Resources (ERLFF) has announced significant drill results from its Hugo North Extension (HNE) and Heruga deposits in Mongolia. The company reported results from eleven underground diamond drill holes completed between 2022-2024 at HNE, with notable highlights including:

- UGD 578: 164m at 1.61% copper equivalent (CuEq), including 72m at 2.89% CuEq

- UGD 807C: 465.5m at 1.51% CuEq, including 188.5m at 2.50% CuEq

- UGD 815: 224m at 2.05% CuEq

- UGD 852: 351.2m at 1.53% CuEq, including 104m at 2.65% CuEq

At Heruga, drill hole EJD0099 returned 409.9m at 0.58% CuEq, including 230m at 0.79% CuEq, marking the first drilling at this deposit in over 12 years. The 2024 drilling program at HNE included 4,652.1m of surface drilling and 6,221.1m of underground drilling.

Entrée Resources (ERLFF) ha annunciato risultati significativi dai suoi depositi di Hugo North Extension (HNE) e Heruga in Mongolia. L'azienda ha riportato risultati da undici fori di perforazione sotterranei completati tra il 2022 e il 2024 presso HNE, con evidenze notevoli tra cui:

- UGD 578: 164m a 1,61% equivalenti di rame (CuEq), inclusi 72m a 2,89% CuEq

- UGD 807C: 465,5m a 1,51% CuEq, inclusi 188,5m a 2,50% CuEq

- UGD 815: 224m a 2,05% CuEq

- UGD 852: 351,2m a 1,53% CuEq, inclusi 104m a 2,65% CuEq

Presso Heruga, il foro di perforazione EJD0099 ha restituito 409,9m a 0,58% CuEq, inclusi 230m a 0,79% CuEq, segnando la prima perforazione in questo deposito dopo oltre 12 anni. Il programma di perforazione 2024 presso HNE ha incluso 4.652,1m di perforazione superficiale e 6.221,1m di perforazione sotterranea.

Entrée Resources (ERLFF) ha anunciado resultados de perforación significativos de sus depósitos de Hugo North Extension (HNE) y Heruga en Mongolia. La compañía informó resultados de once agujeros de perforación de diamante subterráneos completados entre 2022 y 2024 en HNE, con aspectos destacados notables que incluyen:

- UGD 578: 164m a 1,61% equivalente de cobre (CuEq), incluyendo 72m a 2,89% CuEq

- UGD 807C: 465,5m a 1,51% CuEq, incluyendo 188,5m a 2,50% CuEq

- UGD 815: 224m a 2,05% CuEq

- UGD 852: 351,2m a 1,53% CuEq, incluyendo 104m a 2,65% CuEq

En Heruga, el agujero de perforación EJD0099 devolvió 409,9m a 0,58% CuEq, incluyendo 230m a 0,79% CuEq, marcando la primera perforación en este depósito en más de 12 años. El programa de perforación 2024 en HNE incluyó 4.652,1m de perforación en superficie y 6.221,1m de perforación subterránea.

Entrée Resources (ERLFF)는 몽골의 Hugo North Extension (HNE) 및 Heruga 광산에서 중요한 시추 결과를 발표했습니다. 이 회사는 2022년부터 2024년까지 HNE에서 완료된 11개의 지하 다이아몬드 시추 홀의 결과를 보고했으며, 주목할 만한 하이라이트는 다음과 같습니다:

- UGD 578: 164m에서 1.61% 구리 등가물(CuEq), 72m에서 2.89% CuEq 포함

- UGD 807C: 465.5m에서 1.51% CuEq, 188.5m에서 2.50% CuEq 포함

- UGD 815: 224m에서 2.05% CuEq

- UGD 852: 351.2m에서 1.53% CuEq, 104m에서 2.65% CuEq 포함

Heruga에서, 시추 홀 EJD0099는 0.58% CuEq에서 409.9m, 0.79% CuEq에서 230m을 포함하여 반환했으며, 이는 이 광산에서 12년 이상 만에 첫 번째 시추입니다. HNE에서의 2024년 시추 프로그램은 4,652.1m의 표면 시추와 6,221.1m의 지하 시추를 포함했습니다.

Entrée Resources (ERLFF) a annoncé des résultats de forage significatifs de ses dépôts de Hugo North Extension (HNE) et Heruga en Mongolie. L'entreprise a rapporté des résultats de onze trous de forage souterrains en diamant réalisés entre 2022 et 2024 à HNE, avec des points forts notables, notamment :

- UGD 578 : 164m à 1,61% équivalent cuivre (CuEq), y compris 72m à 2,89% CuEq

- UGD 807C : 465,5m à 1,51% CuEq, y compris 188,5m à 2,50% CuEq

- UGD 815 : 224m à 2,05% CuEq

- UGD 852 : 351,2m à 1,53% CuEq, y compris 104m à 2,65% CuEq

À Heruga, le trou de forage EJD0099 a retourné 409,9m à 0,58% CuEq, y compris 230m à 0,79% CuEq, marquant le premier forage dans ce dépôt en plus de 12 ans. Le programme de forage 2024 à HNE a inclus 4 652,1m de forage de surface et 6 221,1m de forage souterrain.

Entrée Resources (ERLFF) hat bedeutende Bohrergebnisse aus seinen Lagerstätten Hugo North Extension (HNE) und Heruga in der Mongolei bekannt gegeben. Das Unternehmen berichtete über Ergebnisse von elf unterirdischen Diamantbohrlöchern, die zwischen 2022 und 2024 bei HNE abgeschlossen wurden, mit bemerkenswerten Höhepunkten, darunter:

- UGD 578: 164m bei 1,61% Kupferäquivalent (CuEq), einschließlich 72m bei 2,89% CuEq

- UGD 807C: 465,5m bei 1,51% CuEq, einschließlich 188,5m bei 2,50% CuEq

- UGD 815: 224m bei 2,05% CuEq

- UGD 852: 351,2m bei 1,53% CuEq, einschließlich 104m bei 2,65% CuEq

Bei Heruga lieferte das Bohrloch EJD0099 409,9m bei 0,58% CuEq, einschließlich 230m bei 0,79% CuEq, was die erste Bohrung in diesem Lager nach über 12 Jahren markiert. Das Bohrprogramm 2024 bei HNE umfasste 4.652,1m Oberflächenbohrungen und 6.221,1m Untergrundbohrungen.

- Strong drill results with high-grade copper mineralization at Hugo North Extension

- Promising results from first Heruga drilling in 12 years showing deposit extension potential

- Extensive drilling program completed in 2024 with 10,873.2m total drilling

- Significant 2025 drilling program planned with 17,379m total proposed drilling

- Three 2023 surface drill holes will not be assayed due to technical issues

- Several 2024 drill holes encountered difficulties and didn't reach target depth

- Planned 2024 Heruga drilling program (8,785m) cancelled due to drill rig availability

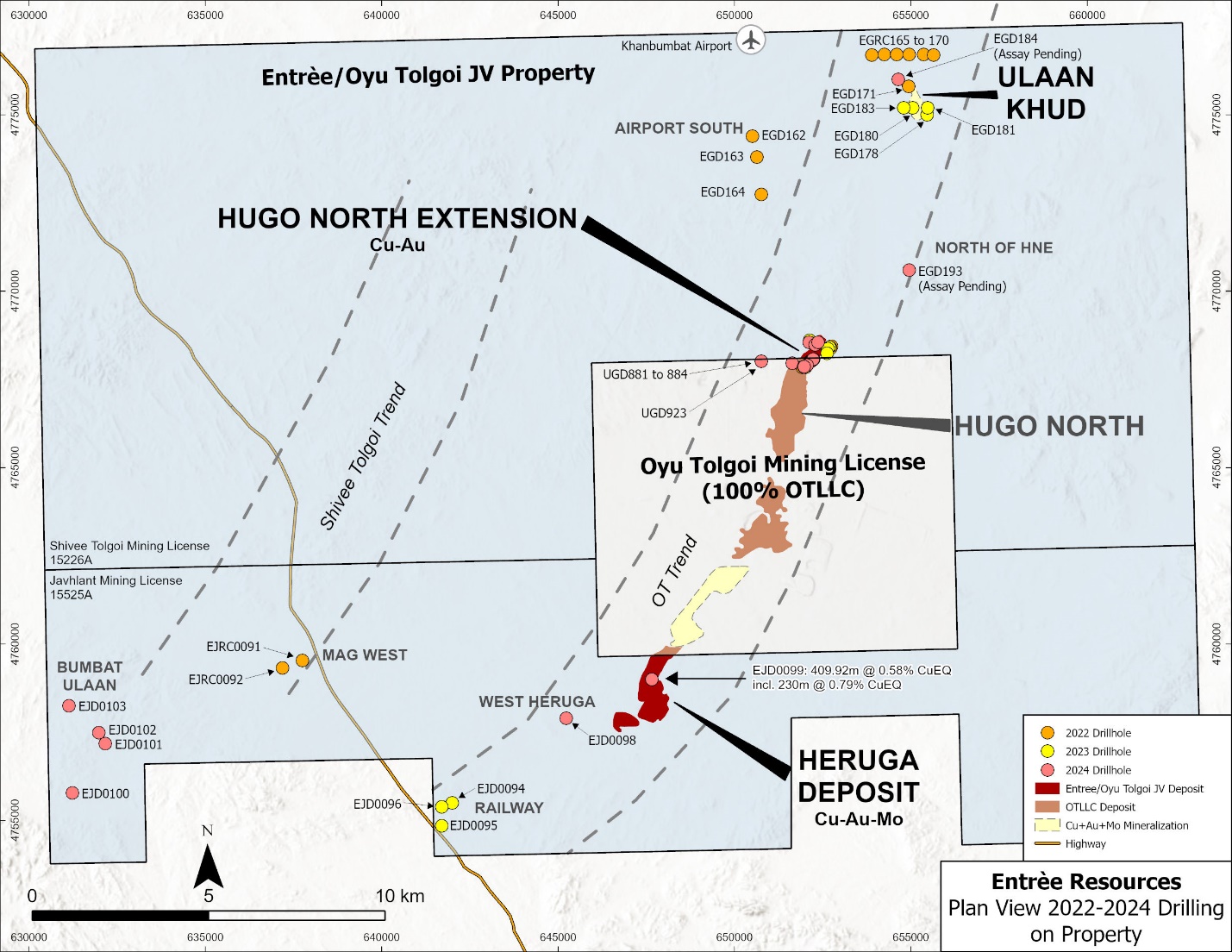

VANCOUVER, British Columbia, Feb. 27, 2025 (GLOBE NEWSWIRE) -- Entrée Resources Ltd. (TSX:ETG; OTCQB:ERLFF – the “Company” or “Entrée”) is pleased to provide analytical results for eleven underground diamond drill holes (“DDH”) completed in 2022 – 2024 at the Hugo North Extension (“HNE”) deposit on the Entrée/Oyu Tolgoi joint venture property (the “Entrée/Oyu Tolgoi JV Property”) in Mongolia. Analytical results are also provided for one DDH completed at the western edge of the Heruga copper-gold-molybdenum deposit and five DDH from the 2024 regional drilling campaign.

One underground DDH from the 2023 drilling program at HNE, two surface DDH and eight underground DDH from the 2024 drilling program at HNE, and two 2024 regional DDH are pending analytical results. These results will be reported as they become available from the Company’s joint venture partner Oyu Tolgoi LLC (“OTLLC”).

DRILL HOLE HIGHLIGHTS

HNE Underground Drill Holes

- UGD 578: 164 m grading

1.61% copper equivalent (“CuEq”), including 72 metres (“m”) grading2.89% CuEq. - UGD 807C: 465.5 m grading

1.51% CuEq, including 188.5 m grading2.50% CuEq. - UGD 815: 224 m grading

2.05% CuEq. - UGD 852: 351.2 m grading

1.53% CuEq, including 104 m grading2.65% CuEq.

Heruga Drill Hole

- EJD0099: 409.9 m grading

0.58% CuEq, including 230 m grading0.79% CuEq.

Note: Copper equivalent for HNE and Heruga are defined below Table 1, where full details on the drill hole assay intervals are also found.

Stephen Scott, Entrée’s President and CEO commented, “We are very pleased to be able to report additional results from drilling completed in 2022, 2023, and 2024. UGD578, which was drilled in 2022 for geotechnical purposes and not assayed until 2024, has returned outstanding results. The results from the 2023 underground drilling reported in this update are some of the best we’ve received since HNE deposit drilling restarted in 2022. We are also excited to see very promising results from the first hole drilled at the Heruga deposit in more than 12 years. This hole is further west than any previous drilling and demonstrates that more work is needed to fully understand the deposit’s true potential”.

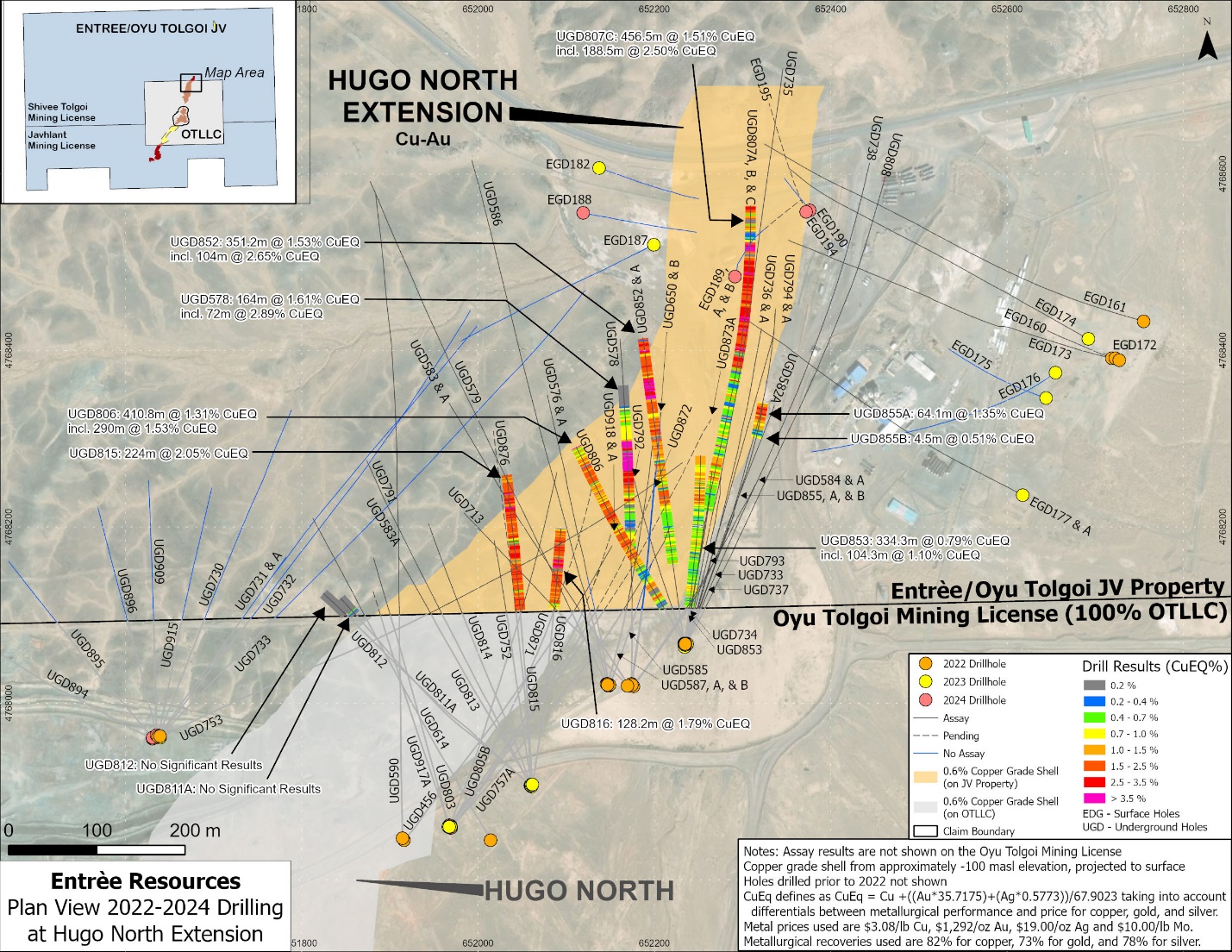

HNE DRILLING RESULTS

The new drill hole analytical results from the HNE deposit include eleven underground DDH completed during 2022, 2023, and 2024 (Table 1). This includes drill hole UGD 578 from 2022 that was previously classified by OTLLC as a geotechnical hole that would not be analyzed. Four underground DDH from 2023 and six underground DDH from 2024 are also reported. These holes were all collared from existing infrastructure on the Oyu Tolgoi mining licence and drilled to the north or northwest onto the Entrée/Oyu Tolgoi JV Property, targeting mineralization within the existing footprint of the HNE deposit.

OTLLC has informed Entrée that three of the 2023 surface drill holes (EGD175, EGD176 and EGD182) that were noted by the Company on July 18, 2024 as “pending analytical results” will not be assayed since they were used purely for geotechnical and metallurgical purposes or were abandoned prior to reaching the target depth. A total of two surface DDH and eight underground DDH from the 2024 drilling program at HNE are still pending analytical results and will be reported as they become available from OTLLC.

Mineralized intervals from the eleven DDH at HNE recently made available by OTLLC are summarized in Table 1 and are shown on Figure 1.

Table 1: Underground Drill Results from 2022, 2023, and 2024 Drilling at the HNE Deposit1

| Drill Hole | Year | From (m) | To (m) | Length2 (m) | Copper (%) | Gold (ppm) | Silver (ppm) | CuEq3 (%) |

| UGD578 | 2022 | 150 | 314 | 164 | 1.36 | 0.42 | 3.25 | 1.61 |

| Including | 206 | 278 | 72 | 2.42 | 0.80 | 5.89 | 2.89 | |

| UGD807C | 2023 | 205.1 | 661.6 | 456.5 | 1.19 | 0.56 | 3.16 | 1.51 |

| including | 420 | 608.5 | 188.5 | 1.95 | 0.94 | 5.23 | 2.50 | |

| UGD812 | 2023 | no | significant | assays | ||||

| UGD815 | 2023 | 298 | 522 | 224 | 1.75 | 0.50 | 4.50 | 2.05 |

| UGD816 | 2023 | 293.1 | 421.3 | 128.2 | 1.63 | 0.24 | 4.18 | 1.79 |

| UGD806 | 2024 | 111.2 | 522 | 410.8 | 1.18 | 0.20 | 2.86 | 1.31 |

| including | 210 | 500 | 290 | 1.38 | 0.22 | 3.29 | 1.53 | |

| UGD811A | 2024 | no | significant | assays | ||||

| UGD852 | 2024 | 125 | 476.2 | 351.2 | 1.31 | 0.36 | 4.03 | 1.53 |

| including | 368 | 476.2 | 104 | 2.06 | 1.01 | 7.22 | 2.65 | |

| UGD853 | 2024 | 92 | 426.3 | 334.3 | 0.70 | 0.13 | 2.19 | 0.79 |

| including | 322 | 426.3 | 104.3 | 0.89 | 0.33 | 4.45 | 1.10 | |

| UGD855A | 2024 | 420.1 | 484.2 | 64.1 | 1.16 | 0.29 | 4.30 | 1.35 |

| UGD855B | 2024 | 424.2 | 428.7 | 4.5 | 0.44 | 0.11 | 1.09 | 0.51 |

- Analytical results are length weighted averages, only for the portions of the drill holes on the Entrée/Oyu Tolgoi JV Property.

- Lengths reported are drilled lengths. Approximate true widths are variable depending on the orientation of the drill hole. Several of the holes are geotechnical holes drilled subparallel to the trend of the porphyry. Other holes are drilled across the trend of the porphyry at varying orientations with estimated true widths ranging between approximately

20% and70% of the drilled lengths. - CuEq at HNE is calculated by the formula CuEq = Cu + ((Au * 35.7175) + (Ag * 0.5773)) / 67.9023, taking into account differentials between metallurgical performance and price for copper, gold and silver. Metal prices used are US

$3.08 /lb Cu, US$1,292.00 /oz Au, and US$19.00 /oz Ag. Metallurgical recoveries used are82% for copper,73% for gold and78% for silver.

Figure 1: Plan View of Newly Released Assay Intervals and Locations of 2022-2024 Drill Holes

Eight of the ten 2023/2024 underground DDH with newly reported significant assays were drilled at moderate dips towards the north or northwest and after crossing onto the Entrée/Oyu Tolgoi JV Property intersected significant grades of copper and gold within the potential Lift 2 footprint of HNE. Drill holes UGD811A and 812 both reported no significant results; however, these holes had intersected the mineralized footprint on the Oyu Tolgoi mining licence, prior to crossing onto the Entrée/Oyu Tolgoi JV Property. Drill hole UGD578 (from 2022) was drilled horizontally towards the north, targeting the base of Lift 1, for geotechnical purposes, and intersected a wide interval of significant copper and gold mineralization.

The holes drilled into the mineralized porphyry intersected predominantly phyllic and potassic altered quartz monzodiorite, cut by occasional intervals of unmineralized biotite-granodiorite dikes (generally less than 10 m in drilled width). Total sulphide content is variable but averages around

2024 HNE DRILLING INFORMATION

The 2024 in-fill diamond drilling program at HNE included seven surface holes and 25 underground holes. As at January 27, 2025, a total of 4,652.1 m of surface drilling had been completed and 6,221.1 m of underground drilling had been completed on the Entrée/Oyu Tolgoi JV Property.

The 2024 underground holes were all collared from existing infrastructure on the Oyu Tolgoi mining licence and crossed onto the Entrée/Oyu Tolgoi JV Property. Several of the holes were drilled as “daughter holes” (wedges) from a “parent hole” at varying distances along the hole. Underground holes were designed to achieve multiple objectives; as in-fill holes within the mineralized footprint of Lift 2 to support the next mineral resource estimate update; for geotechnical purposes with many holes drilled outside of (west of) the mineralized footprint; and for metallurgical purposes.

All seven 2024 surface holes were collared vertically above, or just west of the mineralized footprint of HNE and drilled subvertically, or steeply to the east targeting Lift 2, or for geotechnical purposes. Three of the holes (EGD188, 190, 194) encountered drilling difficulties and did not reach the target depth, while two holes (EGD189, 189A) were drilled outside of the HNE footprint for geotechnical purposes. Drill holes EDG189B and EDG195 were drilled almost vertically through the northern portion of the HNE deposit and continued for almost 200 m below the base of Lift 2. Analytical results for the latter two surface holes are still pending.

Ten of the 2024 underground drill holes, denoted in Table 3 as having “no sampling”, were drilled from underground drill stations on the Oyu Tolgoi mining licence to the west of the mineralized footprint and were drilled mainly for geotechnical purposes to support infrastructure development.

Tables 2 and 3 summarize the drill hole details for 2024 HNE surface and underground drilling, respectively, and Figure 1 shows the locations of the 2022-2024 HNE drill holes and the significant assay intervals discussed in this press release.

Table 2: HNE 2024 Surface Drilling

| Drill Hole | UTM EAST | UTM NORTH | Elevation (masl) | Length (m) | Azimuth (degrees) | Dip (degrees) | Assay Status |

| EGD188 | 652119.1 | 4768556 | 1172.885 | 1,012.4 | 101 | -83 | No sampling |

| EGD189 | 652291.1 | 4768484 | 1173.33 | 730.3 | 4 | -89 | No sampling |

| EGD189A | 652291.1 | 4768484 | 1173.33 | 712.3 | 37 | -87 | No sampling |

| EGD189B | 652291.1 | 4768484 | 1173.33 | 598.4 | 44 | -85 | Pending |

| EGD190 | 652376 | 4768559 | 1179 | 525.9 | 320 | -86 | No sampling |

| EGD194 | 652372 | 4768557 | 1178.99 | 30.9 | 334 | -85 | No sampling |

| EGD195 | 652372.2 | 4768557 | 1178.99 | 1041.9 | 332 | -87 | Pending |

| Total Surface | 4652.1 |

Notes: Holes EGD188, 190, 194 did not reach the target depth; holes EGD189, 189A were drilled outside of the mineralized footprint for geotechnical purposes; azimuth and dip information is taken from down-hole survey results, generally at about 15-30 m along the hole.

Table 3: HNE 2024 Underground Drilling1

| Drill Hole | UTM EAST | UTM NORTH | Elevation (masl) | Length2 (m) | Length JV Property2 (m) | Azimuth (degrees) | Dip (degrees) | Assay Status | |

| UGD806 | 652234.7 | 4768067 | -76.31 | 522 | 425.6 | 330 | -60 | Complete | |

| UGD811A | 652059.3 | 4767907 | -80.8141 | 342.5 | 46.8 | 318 | -57 | Complete | |

| UGD852 | 652233.7 | 4768068 | -76.198 | 476.5 | 420.3 | 352 | -44 | Complete | |

| UGD852A | 652233.7 | 4768068 | -76.198 | 4.4 | 4.4 | 352 | -43 | Complete | |

| UGD853 | 652234.6 | 4768066 | -76.405 | 426.3 | 334.8 | 6.5 | -62 | Complete | |

| UGD855 | 652236.1 | 4768066 | -76.22 | 473.7 | 393.3 | 20 | -55 | Pending | |

| UGD855A | 652236.1 | 4768066 | -76.22 | 64.1 | 64.1 | 20 | -55 | Complete | |

| UGD855B | 652236.1 | 4768066 | -76.22 | 4.5 | 4.5 | 20 | -55 | Complete | |

| UGD871 | 651968.5 | 4767859 | -180.585 | 555.5 | 198.9 | 28 | -37 | Pending | |

| UGD872 | 651968.5 | 4767859 | -180.604 | 600 | 194.7 | 27 | -45 | Pending | |

| UGD873A | 651969.5 | 4767859 | -180.667 | 562.5 | 280.7 | 38 | -33 | Pending | |

| UGD876 | 652060.8 | 4767908 | -80.055 | 461 | 237.5 | 355 | -27 | Pending | |

| UGD881 | 650757.6 | 4768019 | -50.805 | 635 | 541.0 | 333 | -48 | No sampling | |

| UGD882 | 650757.2 | 4768018 | -50.727 | 748 | 620.3 | 302 | -35 | No sampling | |

| UGD883 | 650755.8 | 4768019 | -51.725 | 941.8 | 808.9 | 294 | -19 | No sampling | |

| UGD884 | 650756.4 | 4768019 | -51.77 | 750 | 405.2 | 279 | -25 | No sampling | |

| UGD894 | 651631.2 | 4767960 | -127.278 | 308 | 43.8 | 295 | 11 | No sampling | |

| UGD895 | 651631.1 | 4767961 | -126.75 | 271 | 92.6 | 319 | 16 | No sampling | |

| UGD896 | 651635.8 | 4767964 | -127.875 | 266 | 130.8 | 346 | 0 | No sampling | |

| UGD909 | 651635.5 | 4767964 | -128.053 | 291 | 158.8 | 360 | -5 | No sampling | |

| UGD915 | 651637.9 | 4767963 | -128.306 | 288.1 | 152.2 | 10 | -5 | No sampling | |

| UGD917A | 651967.2 | 4767862 | -180.531 | 418.6 | 41.0 | 343 | -50 | Pending | |

| UGD918 | 651968.9 | 4767861 | -180.214 | 449.7 | 65.7 | 35 | -40 | Pending | |

| UGD918A | 651968.9 | 4767861 | -180.214 | 67.6 | 67.6 | 35 | -40 | Pending | |

| UGD923 | 650762.7 | 4768019 | -51.77 | 589.4 | 487.6 | 33 | -47 | No sampling | |

| Total Underground JV Property | 6,221.1 | ||||||||

- Holes UGD881 to 884, 894 to 896, 909, 915, and 923 were drilled outside of the mineralized footprint for geotechnical purposes; azimuth and dip information is approximate, taken from down-hole survey results, generally at about 0-30 m from the collar of the hole.

- All underground holes were collared from existing infrastructure on the Oyu Tolgoi mining licence and crossed onto the Entrée/Oyu Tolgoi JV Property. “Length” includes metres drilled on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. “Length JV Property” is metres drilled on the Entrée/Oyu Tolgoi JV Property after crossing the licence boundary. OTLLC did not charge the Company for, or provide the Company with analytical results from, metres drilled on the Oyu Tolgoi mining licence.

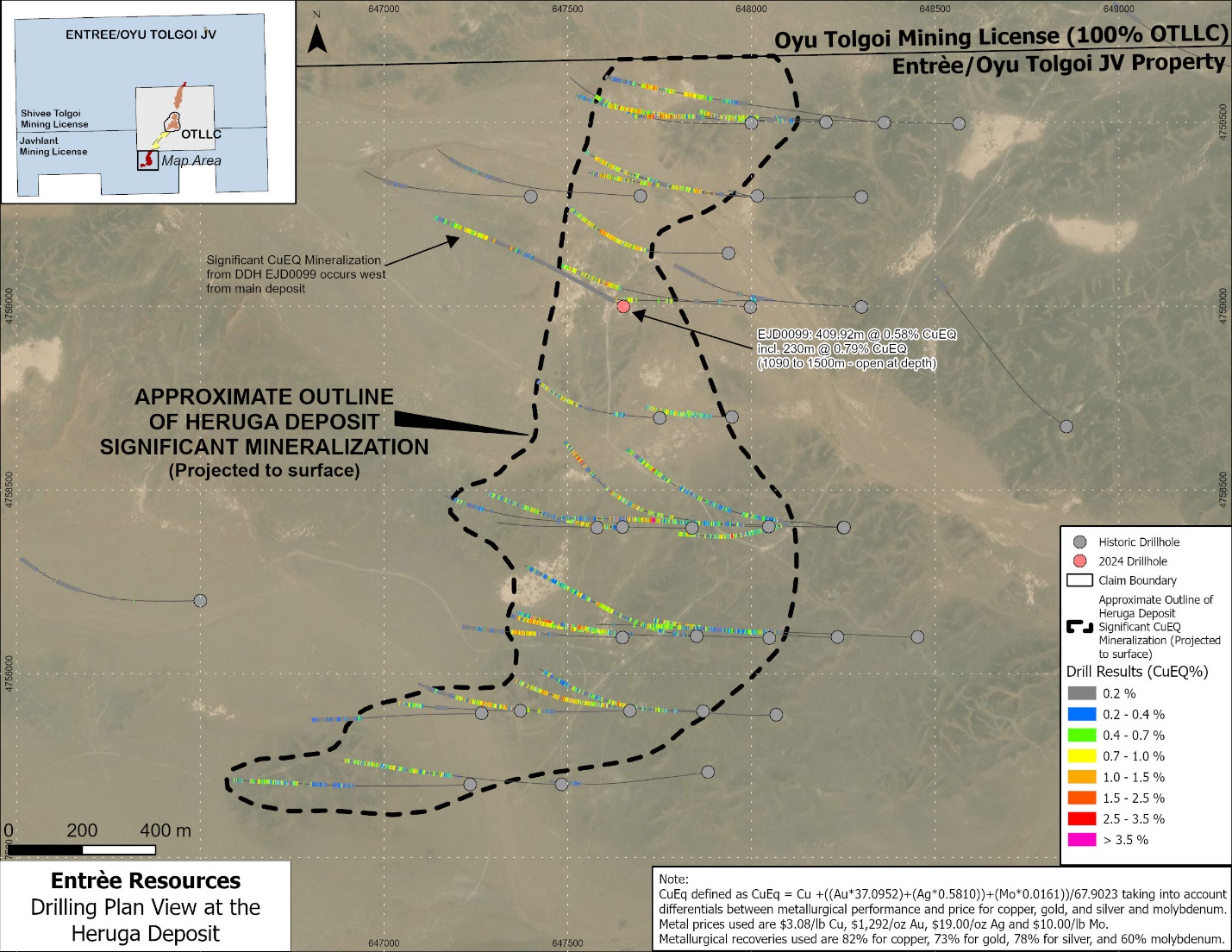

2024 HERUGA DEPOSIT AND REGIONAL DRILLING RESULTS

During the 2024 drilling campaign one drill hole (EJD0099) was drilled at the western edge of the Heruga copper-gold-molybdenum deposit to test possible extensions of mineralization to the west (Table 4 and Figure 2 below).

EJD0099 is the first hole drilled at the Heruga deposit since 2012 and is located several hundred metres west of the majority of the previous drilling in the northern half of the deposit. Although the copper-gold-molybdenum mineralization first appears in drill hole EJD0099 around 872 m drilled depth, the mineralization is discontinuous, due to the intrusion of several >20 m thick andesitic dikes, which are essentially devoid of any mineralization. Consistent copper-gold-molybdenum mineralization starts at approximately 1,090 m drilled depth, within an interbedded sequence of conglomerate, ignimbrite, augite-basalt and quartz-monzonite diorite, cut by occasional unmineralized andesitic dikes, and continues until the end of the hole at 1,500 m, where it remained in strong copper-gold mineralization (Table 4). The grades across this interval appear to be consistent with the average grade of the overall Heruga deposit (1,400 Mt grading

Table 4: Results from 2024 Diamond Drilling at the Heruga Deposit1

| Drill Hole | From (m) | To (m) | Length2 (m) | Gold (ppm) | Copper (%) | Silver (ppm) | Molybdenum (ppm) | CuEq3 (%) | |

| EJD0099 | 1090.08 | 1500 | 409.92 | 0.32 | 0.36 | 0.93 | 184.21 | 0.58 | |

| including | 1092 | 1322 | 230 | 0.37 | 0.51 | 1.12 | 275.53 | 0.79 |

- Analytical results are length weighted averages.

- Lengths reported are drilled lengths. Estimated true widths of the intercepts range between approximately

20% to30% of the drilled lengths. - CuEq at Heruga is calculated by the formula CuEq = Cu + ((Au * 37.0952) + (Ag * 0.5810) + (Mo * 0.0161)) / 67.9023, taking into account differentials between metallurgical performance and price for copper, gold, silver and molybdenum. Metal prices used are US

$3.08 /lb Cu, US$1,292.00 /oz Au, US$19.00 /oz Ag and$10 /lb Mo. Metallurgical recoveries used are82% for copper,73% for gold,78% for silver and60% for molybdenum.

Figure 2: Plan View of Heruga Deposit Drilling

OTLLC had also proposed approximately 8,785 m of diamond drilling in five surface holes on the Heruga deposit in 2024 to increase ore body knowledge and support an Order of Magnitude Study. The drilling was ultimately cancelled due to drill rig availability. No Heruga deposit drilling is currently planned for 2025.

In 2024 OTLLC also completed one DDH testing the West Heruga target and four drill holes testing the Bumbat Ulaan target (see Table 5 and Figure 3 below).

Drill hole EJD0098 tested the West Heruga target, located approximately 1.85 km west of the Heruga deposit. The drill hole was drilled to a depth of approximately 640 m, but no significant anomalies were intersected. During 2024, a gravity survey was conducted in this area to map subsurface geology and structures of the West Heruga area, resulting in a cluster of several significant gravity anomalies (up to 0.4 mGa), coinciding with areas of mapped, Devonian-aged favorable lithologies including augite-basalts. Integrated interpretation of geology and geophysical data is ongoing.

Further west, at the Bumbat Ulaan IP target, four shallow DDH (EJD0100 to EJD0103) tested IP anomalies in predominately Carboniferous sequences, including basaltic flows and lava with areas of granodiorite. The holes were all drilled to 300 m, but no significant assays were returned.

Table 5: 2024 Regional Drilling

| Drill Hole | UTM EAST | UTM NORTH | Elevation (masl) | Length (m) | Target | Azimuth (degrees) | Dip (degrees) | Assay Status |

| EGD193 | 654949.9 | 4770595 | 1194.714 | 1,200 | North of HNE | 272 | -71 | Pending |

| EGD184 | 654638.7 | 4775998 | 1173.408 | 1,127.9 | Ulaan Khud | 89 | -71 | Pending |

| EJD0100 | 631225.8 | 4755784 | 1269.749 | 300 | Bumbat Ulaan | 0 | -90 | Complete |

| EJD0101 | 632161.6 | 4757184 | 1272.889 | 300 | Bumbat Ulaan | 84 | -75 | Complete |

| EJD0102 | 631985 | 4757496 | 1281.309 | 300 | Bumbat Ulaan | 276 | -89 | Complete |

| EJD0103 | 631130.4 | 4758258 | 1267.651 | 300 | Bumbat Ulaan | 0 | -90 | Complete |

| EJD0099 | 647651.4 | 4758999 | 1164.618 | 1500 | Heruga | 300 | -70 | Complete |

| EJD0098 | 645231.7 | 4757899 | 1175.56 | 639.9 | West Heruga | 250 | -70 | Complete |

| Total Regional | 5,389.8 | |||||||

Figure 3: Plan View of 2022 to 2024 Regional Drill Holes

2025 HNE AND REGIONAL DRILLING UPDATES

OTLLC plans to continue drilling at HNE and testing the regional prospects during 2025. At HNE drill holes will be focused on targeting gaps in the geological model. A total of five surface drill holes totaling 9,050 m and 19 underground drill holes totaling 8,329 m are proposed. For the regional program, OTLLC is proposing to drill nine DDH totaling 8,520 m, comprised of two holes at Railway (1,600 m), two holes at Heruga West (2,180 m), two holes at Ductile Shear (1,940 m), and three holes at Ulaan Khud (2,800 m).

SAMPLE PREPARATION AND ANALYSIS, QAQC AND QUALIFIED PERSON

Drill core from the ten drill holes reported for HNE and for the regional drill holes was geologically and geotechnically logged at site by OTLLC. The HNE and regional surface drill holes were collared with PQ diameter core (123 mm) and often reduced to HQ (96 mm) core diameter at depth. Underground holes at HNE were collared using HQ diameter and occasionally reduced to NQ (76 mm) at depth. All core was saw-cut on site before being bagged and shipped to the laboratory. Sample lengths generally averaged approximately 2.0 m and core recovery was recorded as being very good (>

Core from HNE and the regional drilling was shipped to ALS Laboratory (“ALS”) in Ulaanbaatar, Mongolia, for sample preparation. ALS is independent of OTLLC, Rio Tinto and Entrée. At ALS the samples were crushed to <2mm and pulverized to 75μm, then the pulps were shipped directly to ALS in Perth for analyses. Samples were analyzed for gold by ICP-MS. Samples above approximately 0.03 g/t gold were further analyzed for gold by a 30-gram fire assay with an ICP finish. Samples were also analyzed for copper, silver and molybdenum, along with eight additional elements by 4-acid digestion, ICP-MS/AES multi-element analysis. Copper samples greater than approximately

OTLLC follows a rigorous quality assurance/quality control (“QAQC”) program for the sampling programs that includes the regular insertion of standards, blanks and duplicates into the sample stream. The QP is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to in this disclosure.

The scientific and technical information that forms the basis for parts of this press release was reviewed and approved by Robert Cinits (P.Geo.), who is a Qualified Person (“QP”) as defined by National Instrument 43-101. For further information on the Entrée/Oyu Tolgoi JV Property, see the Company’s Technical Report, titled “Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report”, with an effective date of October 8, 2021, available on the Company’s website at www.EntreeResourcesLtd.com, and on SEDAR+ at www.sedarplus.ca.

ABOUT ENTRÉE RESOURCES LTD.

Entrée Resources Ltd. is a well-funded Canadian mining company with a unique carried joint venture interest on a significant portion of one of the world’s largest copper-gold projects – the Oyu Tolgoi project in Mongolia. The Oyu Tolgoi project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by Entrée’s joint venture partner OTLLC and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC. Rio Tinto owns

FURTHER INFORMATION

David Jan

Investor Relations

Entrée Resources Ltd.

Tel: 604-687-4777 | Toll Free: 1-866-368-7330

E-mail: djan@EntreeResourcesLtd.com

This News Release contains forward-looking information within the meaning of applicable Canadian securities laws with respect to corporate strategies and plans; requirements for additional capital; uses of funds and projected expenditures; expected timing and scope of a new resource model for Hugo North (including Hugo North Extension) Lifts 1 and 2; the estimation of mineral reserves and resources; potential for additional Hugo North (including Hugo North Extension) underground lifts; potential size of a mineralized zone; potential expansion of mineralization; potential discovery of new mineralized zones; potential metallurgical recoveries and grades; plans for future exploration and/or development programs and budgets; anticipated business activities; and future financial performance.

In certain cases, forward-looking information can be identified by words such as "plans", "expects" or "does not expect", "is expected", "budgeted", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". While the Company has based this forward-looking information on its expectations about future events as at the date that such information was prepared, the information is not a guarantee of Entrée’s future performance and is based on numerous assumptions regarding present and future business strategies; the correct interpretation of agreements, laws and regulations; the commencement and conclusion of arbitration proceedings, including the potential benefits, timing and outcome of arbitration proceedings; the potential benefits, timing and outcome of discussions with the Government of Mongolia, Erdenes Oyu Tolgoi LLC, OTLLC, and Rio Tinto; the future ownership of the Shivee Tolgoi and Javkhlant mining licences; that the Company will continue to have timely access to detailed technical, financial, and operational information about the Entrée/Oyu Tolgoi JV Property, the Oyu Tolgoi project, and government relations to enable the Company to properly assess, act on, and disclose material risks and opportunities as they arise; local and global economic conditions and the environment in which Entrée will operate in the future, including commodity prices, projected grades, projected dilution, anticipated capital and operating costs, including inflationary pressures thereon resulting in cost escalation, and anticipated future production and cash flows; the anticipated location of certain infrastructure and sequence of mining within and across panel boundaries; the construction and continued development of the Oyu Tolgoi underground mine; the status of Entrée’s relationship and interaction with the Government of Mongolia, Erdenes Oyu Tolgoi LLC, OTLLC, and Rio Tinto; and the Company’s ability to operate sustainably, its community relations, and its social licence to operate.

With respect to the construction and continued development of the Oyu Tolgoi underground mine, important risks, uncertainties and factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking information include, amongst others, an uncertain and unstable global economic and political environment, including China U.S. tensions and the indirect impacts of war in Ukraine and conflict in the Middle East, which could lead to falling commodity prices, trade actions (including increased tariffs, retaliations, and sanctions), and government efforts to exert more control over natural resources or to protect domestic economies by changing contractual, regulatory, or tax measures; the impacts of climate change and the transition to a low-carbon future; the nature of the ongoing relationship and interaction between OTLLC, Rio Tinto, Erdenes Oyu Tolgoi LLC and the Government of Mongolia with respect to the continued operation and development of Oyu Tolgoi; the continuation of undercutting in accordance with the mine plans and designs in OTFS23; applicable taxes and royalty rates; the future ownership of the Shivee Tolgoi and Javkhlant mining licences; the amount of any future funding gap to complete the Oyu Tolgoi project and the availability and amount of potential sources of additional funding; the timing and cost of the construction and expansion of mining and processing facilities; inflationary pressures on prices for critical supplies for Oyu Tolgoi resulting in cost escalation; the ability of OTLLC or the Government of Mongolia to deliver a domestic power source for Oyu Tolgoi (or the availability of financing for OTLLC or the Government of Mongolia to construct such a source) within the required contractual timeframe; sources of interim power; OTLLC’s ability to operate sustainably, its community relations, and its social license to operate in Mongolia; the impact of changes in, changes in interpretation to or changes in enforcement of, laws, regulations and government practises in Mongolia; delays, and the costs which would result from delays, in the development of the underground mine; the anticipated location of certain infrastructure and sequence of mining within and across panel boundaries; projected commodity prices and their market demand; and production estimates and the anticipated yearly production of copper, gold and silver at the Oyu Tolgoi underground mine.

Other risks, uncertainties and factors which could cause actual results, performance or achievements of the Company to differ materially from future results, performance or achievements expressed or implied by forward-looking information include, amongst others, unanticipated costs, expenses or liabilities; discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries; the impacts of geopolitics on trade and investment; trade tensions between the world’s major economies; development plans for processing resources; matters relating to proposed exploration or expansion; mining operational and development risks, including geotechnical risks and ground conditions; regulatory restrictions (including environmental regulatory restrictions and liability); risks related to international operations, including legal and political risk in Mongolia; risks related to the potential impact of global or national health concerns; risks associated with changes in the attitudes of governments to foreign investment; risks associated with the conduct of joint ventures, including the ability to access detailed technical, financial and operational information; risks related to the Company’s significant shareholders, and whether they will exercise their rights or act in a manner that is consistent with the best interests of the Company and its other shareholders; inability to upgrade Inferred mineral resources to Indicated or Measured mineral resources; inability to convert mineral resources to mineral reserves; conclusions of economic evaluations; fluctuations in commodity prices and demand; changing foreign exchange rates; the speculative nature of mineral exploration; the global economic climate; dilution; share price volatility; activities, actions or assessments by Rio Tinto or OTLLC and by government stakeholders or authorities including Erdenes Oyu Tolgoi LLC and the Government of Mongolia; the availability of funding on reasonable terms; the impact of changes in interpretation to or changes in enforcement of laws, regulations and government practices, including laws, regulations and government practices with respect to mining, foreign investment, strategic deposits, royalties and taxation; the terms and timing of obtaining necessary environmental and other government approvals, consents and permits; the availability and cost of necessary items such as water, skilled labour, transportation and appropriate smelting and refining arrangements; unanticipated reclamation expenses; changes to assumptions as to the availability of electrical power, and the power rates used in operating cost estimates and financial analyses; changes to assumptions as to salvage values; ability to maintain the social license to operate; accidents, labour disputes and other risks of the mining industry; global climate change; global conflicts; natural disasters; the impacts of civil unrest; breaches of the Company’s policies, standards and procedures, laws or regulations; increasing societal and investor expectations, in particular with regard to environmental, social and governance considerations; the impacts of technological advancements; title disputes; limitations on insurance coverage; competition; loss of key employees; cyber security incidents; misjudgements in the course of preparing forward-looking information; and those factors discussed in the Company’s most recently filed MD&A and in the Company’s Annual Information Form for the financial year ended December 31, 2022, dated March 31, 2023 filed with the Canadian Securities Administrators and available at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company is under no obligation to update or alter any forward-looking information except as required under applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6076c30-b35f-4975-be90-143490bd8c02

https://www.globenewswire.com/NewsRoom/AttachmentNg/0fa08c30-d4a7-45b2-a939-6c71866163e4

https://www.globenewswire.com/NewsRoom/AttachmentNg/f1bcb1bd-67d3-44e1-b2e7-2de32ad927ec