Envela Reports Second Quarter 2024 Financial Results

Rhea-AI Summary

Envela (NYSE American:ELA) reported its Q2 2024 financial results, with quarterly revenue of $45.3 million and earnings per diluted share of $0.06. The Commercial Division achieved a record revenue of $13.3 million, up 16.2% year-over-year. The Consumer Division faced challenges due to new store costs and softness in bullion demand. Overall, gross margin improved to 25.1% from 21.1% in the prior-year quarter. Operating income decreased slightly to $1.9 million. The company's cash position stood at $17.3 million, with total stockholders' equity growing to $50.2 million. Envela continued its share repurchase program, buying back 152,089 shares for $715,000 during the quarter.

Positive

- Commercial Division revenue increased 16.2% year-over-year to $13.3 million

- Overall gross margin improved to 25.1% from 21.1% in the prior-year quarter

- Total stockholders' equity grew to $50.2 million from $47.3 million year-over-year

- Commercial Division pre-tax operating income increased 285.7% to $2.0 million

- Company reduced long-term debt to $14.3 million from $14.9 million at the end of 2023

Negative

- Overall quarterly revenue decreased to $45.3 million from $51.1 million in the prior-year quarter

- Operating income decreased to $1.9 million from $2.1 million year-over-year

- Consumer Division revenue decreased 19.3% to $32.0 million

- Consumer Division reported a pre-tax operating loss of $101,000 compared to income of $1.5 million in the prior-year quarter

- Cash and cash equivalents decreased to $17.3 million from $18.4 million year-over-year

News Market Reaction 1 Alert

On the day this news was published, ELA gained 7.19%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

DALLAS, TX / ACCESSWIRE / August 7, 2024 / Envela Corporation (NYSE American:ELA) ("Envela" or the "Company"), today reported financial results for its second quarter ended June 30, 2024. The Company reported quarterly revenue of

Management Commentary

"We are thrilled to share that our Commercial Division achieved a new revenue record for the June quarter, totaling

"In the second quarter of 2024, our Commercial Division continued to achieve solid operating results. We have continued to focus on maintaining operational discipline while providing best-in-class service to our clients," said John DeLuca, Envela's CFO. "Our Consumer Division results were moderated by the impact of new store costs, softness of demand for bullion and new store inventory carry. While the softness in bullion demand has magnified the revenue decline, its overall impact on gross margin is tempered due to thin trading margins. We are also crystallizing strategies to streamline the store opening process to reduce associated costs and time to open."

Commercial Division

"During the quarter, we were able to maintain our momentum and grow our fee-for-service relationships, which allows for further diversification from inventory-related revenue streams. We are committed to offering our customers a broad array of service and support options while advancing a circular economy. Our recent growth has been fueled by strong demand for solutions that mitigate environmental impacts and enhance sustainability. Through customer expansion and by building upon robust relationships with our existing customers through additional services, we not only improve the reach of e-waste recycling but also unlock new revenue opportunities from recycled materials critical to clean energy technologies. We remain committed to investing in and streamlining our operations as we focus on delivering lasting value to our partners while achieving success on both the top and bottom lines." - Tommy McGuire, Head of Envela's Commercial Division

Consumer Division

"We entered 2024 with high ambitions for our retail expansion, and we've been truly blown away by the positive responses from our customers. They love everything about our stores-from the thoughtful design and knowledgeable staff to innovative features like Bijoux Exchange. Today's shoppers are savvy and seek value, which is why we work tirelessly to offer exceptional deals to help our customers stretch their dollars. What truly sets our stores apart is our commitment to client engagement; our experts and services are at the heart of our store experience. Our goal is to bring experts and great deals to more communities, and we are excited to launch stores in the San Antonio community as we expand our footprint in Texas. We sincerely appreciate our associates for their support as we continue to grow. We hope our new flagship stores will inspire even more support for resale and contribute to making luxury more sustainable." - Allison DeStefano, Head of Envela's Consumer Division.

Second Quarter 2024 Financial Highlights

Envela will report more complete earnings information within its Form 10-Q.

Second Quarter 2024 Consolidated Operating Highlights

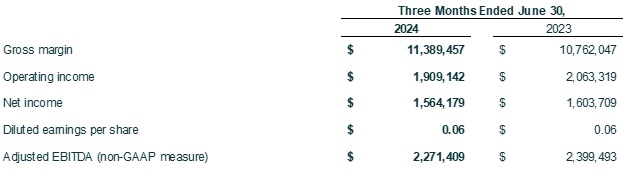

Second quarter revenue was

$45.3 million compared to$51.1 million in the prior-year quarter.Despite the decreased revenue, second quarter gross margin improved to

25.1% of quarterly revenue, compared to21.1% in the prior-year quarter.Second quarter selling, general and administrative expenses were

$9.1 million compared to$8.4 million in the prior-year quarter.Second quarter operating income decreased to

$1.9 million , or4.2% of revenue, compared to$2.1 million , or4.0% of revenue for the prior-year quarter.Second quarter net income was

$1.6 million , or$0.06 per basic and diluted share, compared to$1.6 million or$0.06 per basic and diluted shared in the prior-year quarter.Second quarter Adjusted EBITDA was

$2.3 million or5.0% of revenue, compared to$2.4 million or4.7% of revenue in the prior-year quarter.Cash and cash equivalents decreased to

$17.3 million at June 30, 2024, compared to$18.4 million at June 30, 2023.Total stockholders' equity grew to

$50.2 million at June 30, 2024, compared to$47.3 million at June 30, 2023.

Second Quarter Consumer Division Operating Highlights

Consumer Division revenue was

$32.0 million for the second quarter of 2024, a decrease of19.3% compared to revenue of$39.6 million in the prior-year quarter. Revenues continue to be heavily impacted by bullion demand along with the incremental impact of new store allocated inventory which should moderate as they ramp up over the upcoming quarters.Consumer Division gross margin increased to

12.6% in the second quarter of 2024 compared to10.3% in the prior-year quarter, which is a result of a higher mix of non-bullion revenue streams.Operating expenses increased

61.5% to$4.1 million in the second quarter of 2024 compared to$2.6 million in the prior-year quarter, primarily reflecting the investment in bringing the new stores online along with the impact of full store operating costs in the later part of the quarter.Consumer Division pre-tax operating loss in the second quarter of 2024 was

$101 thousand compared to pre-tax operating income of$1.5 million in the prior-year quarter.

Second Quarter Commercial Division Operating Highlights

Commercial Division revenue was

$13.3 million for the second quarter of 2024, an increase of16.2% compared to revenue of$11.5 million in the prior-year quarter. Revenues continue to strengthen as they continue to build upon new and existing relationships while focusing on diversification of revenue streams to enhance margins.Commercial Division gross margin decreased to

55.4% in the second quarter of 2024 compared to58.2% in the prior-year quarter, which correlates to margins associated with shredded electronic scrap grades that occurred during quarter.Operating expenses decreased

12.8% to$5.4 million in the second quarter of 2024 compared to$6.1 million in the prior-year quarter and is a carry forward of our strategy to maintain a disciplined production and overhead expense structure.Commercial Division pre-tax operating income in the second quarter of 2024 was

$2.0 million , an increase of285.7% compared to$521 thousand in the prior-year quarter. The resulting pre-tax operating margin was15.1% for the second quarter of 2024, increasing from a4.5% margin for the prior-year quarter.

Balance Sheet, Cash Flow and Liquidity

Cash and cash equivalents decreased to

$17.3 million from$17.9 million on December 31, 2023.The Company reduced its long-term debt to

$14.3 million at June 30, 2024, compared to$14.9 million on December 31, 2023.Total shareholders' equity increased to

$50.2 million at June 30, 2023, compared to$48.3 million on December 31, 2023.For the six-month period ended June 30, 2024, consolidated operating cash flows totaled

$3.0 million .

Share Repurchase Program

During the quarter ended June 30, 2024, the Company repurchased 152,089 shares of common stock at a cost of

Investor Relations

Our quarterly investor presentations can be viewed at https://envela.com/presentations/.

About Envela®

Envela is a leading provider of re-commerce services at the forefront of the circular economy. The Company is comprised of primarily two key business segments: Consumer and Commercial. The Consumer segment operates retail stores and online sites that offer premium brands and luxury hard assets, while the Commercial segment provides personalized re-commerce technology solutions to meet the needs of our varied clientele, including Fortune 500 companies. We execute with passion and meticulous attention to detail, focusing on our strengths rather than trying to be everything to everyone.

At Envela, we Reuse, Recycle, and Reimagine. To learn more, visit Envela.com and follow our social media channels on Twitter, Instagram, Facebook, and LinkedIn.

Cautionary Statement Regarding Forward-Looking Information

This press release contains statements that may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995's safe harbor provisions, including statements regarding future events and developments; potential expansions, purchases and acquisitions; potential future success of business lines and strategies; and management's expectations, beliefs, plans, estimates and projections relating to the future. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects" and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management's then current views and assumptions and, as a result, are subject to certain risks and uncertainties, which could cause the Company's actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company's Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company's filings with the SEC. By making these statements, the Company undertakes no obligation to update these statements for revisions or changes after the date of this release except as required by law.

Investor Relations Contact:

Andrew Stacey

ir@envelacorp.com

972-587-4030

SOURCE: Envela Corporation

View the original press release on accesswire.com