DoubleVerify Research Reveals Retail Media is an Opportunity for Safe Engagement Despite Some Viewability Challenges

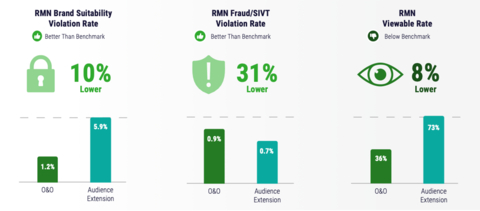

DoubleVerify (DV) has unveiled findings from its eighth annual Global Insights Report, highlighting the potential and challenges of retail media networks (RMNs) in digital advertising. The report analyzed over one trillion impressions from more than 2,000 brands across 100 markets. Key findings show that RMNs outperformed in terms of brand suitability and ad fraud, with fraud rates 31% lower and brand suitability violations 10% lower than DV benchmarks. However, RMNs have viewability issues, with a viewable rate 8% below the DV benchmark, particularly in Owned & Operated (O&O) inventory. Despite lower viewability, O&O inventory showed high engagement rates, 183% above DV's attention baseline. The report covers data from January to December 2023 and includes insights from a global survey of 1,000 advertisers.

- RMNs have 31% lower fraud rates than DV's overall fraud benchmark.

- Brand suitability violations in RMNs are 10% lower than the DV benchmark.

- O&O inventory in RMNs shows engagement rates 183% higher than DV's attention baseline.

- RMNs leverage rich first-party data, enhancing ad targeting and performance.

- Viewability across RMNs is 8% lower than the DV viewability benchmark.

- O&O inventory in RMNs has a low average viewable rate of 36%.

Insights

The latest findings from DoubleVerify reveal a mixed bag for retail media networks (RMNs). On one hand, RMNs are excelling in brand suitability and ad fraud metrics, showing fraud rates nearly

However, the viewability rates present a more complex picture. RMN's owned and operated (O&O) inventory shows a viewable rate of just

For retail investors, this information is a double-edged sword. While high engagement and low fraud are certainly positives, the lower viewability needs to be factored into any investment decision. The upcoming deprecation of cookies might amplify the significance of first-party data, further positioning RMNs as highly valuable in the advertising ecosystem.

DoubleVerify's report is noteworthy for its implications on the financial health and attractiveness of retail media networks (RMNs). The key takeaway is the superior performance in brand suitability and reduced ad fraud rates, which can translate into better monetization opportunities and thus higher revenues for companies leveraging these networks. Fewer fraudulent interactions mean more efficient use of ad budgets, which directly impacts the bottom line positively.

However, the viewability issue cannot be ignored. With the viewability rates for owned and operated (O&O) inventory lagging behind, there could be concerns about the reach and visibility of ads. Yet, the high engagement rates might mitigate this issue by ensuring that the ads that do get viewed have a stronger impact. This could reassure advertisers about the quality of engagement they're getting for their money.

From a long-term perspective, the shift towards first-party data as cookies phase out might further enhance the value proposition of RMNs. Retailers with significant consumer data can offer better-targeted advertising solutions, making them more competitive and possibly leading to increased ad spend on these platforms.

Retail media exceeds benchmarks on brand suitability, fraud, and engagement, potentially fueling higher-performing ads

(Graphic: Business Wire)

A retail media network (RMN) is an advertising channel offered by a retailer that leverages their first-party consumer data to target audiences on their own properties and extended networks. RMNs combine two types of inventory for advertisers: Owned & Operated (O&O)—ads that run on the retailer's own sites or apps; and audience extension—ads that use the retailer's first-party data to reach shoppers across the web.

Brand Suitability & Ad Fraud

DV’s findings reveal that RMNs over-index for media quality in terms of brand suitability and ad fraud, with fraud rates nearly one-third (

“As retail media investments surge, these are encouraging numbers,” said Mark Zagorski, CEO of DoubleVerify. “In addition to being rich in first-party data, RMNs see lower fraud and brand suitability violations than do other environments. Ultimately, better media quality equates to better ad performance.”

Viewability & Engagement

While RMNs saw better than average brand suitability and fraud rates, viewability across RMNs is

Regardless, the low viewability score of O&O RMN inventory should not be a cause for concern. DV discovered that O&O inventory effectively targets shoppers when they are most likely to engage, resulting in engagement rates

“The distinct roles of audience extension and O&O inventory in RMNs necessitate a nuanced understanding of KPIs,” added Zagorski. “While audience extension ads boast higher viewability and exposure, it’s important not to overlook the high user engagement profile of O&O inventory.”

Method: The report employs DV technology to analyze over one trillion impressions, both pre and post-bid, and offers a detailed market-by-market analysis for

For more information about DV, visit: www.doubleverify.com.

About DoubleVerify

DoubleVerify (“DV”) (NYSE: DV) is the industry’s leading media effectiveness platform that leverages AI to drive superior outcomes for global brands. By creating more effective, transparent ad transactions, DV strengthens the digital advertising ecosystem, ensuring a fair value exchange between buyers and sellers of digital media.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240521475203/en/

Press Contact:

Chris Harihar, chris@crenshawcomm.com

Source: DoubleVerify

FAQ

What are the key findings of DoubleVerify's Global Insights Report 2023?

How do retail media networks perform in terms of ad fraud?

What is the viewability rate for Owned & Operated inventory in RMNs?

How does engagement in RMNs compare to other networks?