Dine Brands Global, Inc. Reports Third Quarter 2021 Results

Third Quarter 2021 Domestic Average Weekly Unit Sales for Both Brands Exceed Pre-Pandemic Levels

Both Brands Outperformed Their Respective Categories for the

Company Declared Dividend for the Fourth Quarter 2021 and Announced Intent to Resume Share Repurchases

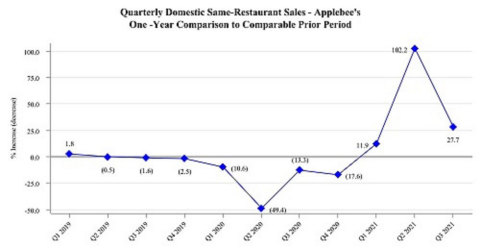

Historical Domestic System-Wide Comparable Same-Restaurant Sales Relative to the Prior Year (Graphic: Business Wire)

“This was another strong quarter for Dine Brands. We recorded a second consecutive period of both IHOP and Applebee’s beating their competitive sets, average weekly sales for both brands exceeded 2019 pre-pandemic levels, and we delivered a

Domestic System-Wide Comparable Same-Restaurant Sales Relative to the Third Quarter of 2020

| Domestic Same-Restaurant Sales (Fiscal Month) | ||||||||

July |

|

August |

|

September |

|

Q3 2021 |

||

| Applebee's |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

| IHOP |

|

|

|

|

|

|

|

|

-

Applebee’s year-over-year comparable same-restaurant sales increased

27.7% for the third quarter of 2021.

-

IHOP’s comparable same-restaurant sales increased

40.1% for the third quarter of 2021.

- Both brands outperformed their respective categories in the third quarter of 2021 relative to the third quarter of 2020, according to Black Box Intelligence™.

Domestic System-Wide Comparable Same-Restaurant Sales Relative to the Third Quarter of 2019

| Domestic Same-Restaurant Sales (Fiscal Month) | ||||||||

July |

August |

September |

Q3 2021 |

|||||

| Applebee's |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

| IHOP |

|

|

( |

|

( |

|

( |

|

-

Applebee’s year-over-year comparable same-restaurant sales increased

12.5% for the third quarter of 2021 compared to an increase of10.5% for the second quarter of 2021.

-

IHOP’s comparable same-restaurant sales decreased

0.4% for the third quarter of 2021 compared to a decrease of3.4% for the second quarter of 2021.

- Both brands outperformed their respective categories in the third quarter of 2021 relative to the third quarter of 2019, according to Black Box Intelligence™.

Domestic Average Weekly Sales Comparison Relative to the Third Quarter of 2019

| Average Weekly Unit Sales Recovery Comparisons | |||||||

| Average Weekly Domestic Unit Sales (in thousands) | |||||||

Q3 2021 |

Q3 2019 |

% of Pre-Pandemic Sales Recovered |

|||||

| Applebee's |

|

|

|

|

|

||

|

|

|

|

|

|||

| IHOP |

|

|

|

|

|

||

Off-Premise Sales Growth Comparison Relative to the Third Quarter of 2020

-

Applebee’s off-premise comparable same-restaurant sales for the third quarter of 2021 increased by

3.3% .

-

Applebee’s off-premise sales accounted for

27.5% of sales mix for the third quarter of 2021.

-

IHOP’s off-premise comparable same-restaurant sales for the third quarter of 2021 decreased by

3.2% .

-

IHOP’s off-premise sales accounted for

23.3% of sales mix for the third quarter of 2021.

Third Quarter of 2021 Summary

-

GAAP earnings per diluted share of

$1.33 $0.60

-

Adjusted earnings per diluted share of

$1.55 $0.80

-

General and administrative expenses for the third quarter of 2021 were

$43.7 million $36.9 million

-

Consolidated adjusted EBITDA for the third quarter of 2021 was

$63.3 million $42.7 million

- Development activity by Applebee’s and IHOP franchisees for the third quarter of 2021 resulted in the opening of 11 new restaurants on a gross basis.

First Nine Months of 2021 Summary

-

GAAP earnings per diluted share of

$4.52 $6.34 $124.5 million

-

Adjusted earnings per diluted share of

$5.22 $1.40

-

General and administrative expenses for the first nine months of 2021 were

$122.9 million $105.4 million

-

Consolidated adjusted EBITDA for the first nine months of 2021 was

$193.2 million $116.5 million

-

The Company generated adjusted free cash flow of

$146.1 million $35.6 million

-

Cash flows from operating activities for the first nine months of 2021 were

$145.6 million $36.7 million

- Development activity by Applebee’s and IHOP franchisees for the first nine months of 2021 resulted in the opening of 31 new restaurants on a gross basis.

Cash Position

As of

As of

As of

As of

GAAP Effective Tax Rate

The Company’s effective tax rate for the third quarter of 2021 was a

Capital Return to Shareholders

On

As of

Financial Performance Guidance for 2021

The Company’s guidance assumes there are no significant disruptions to its business due to COVID-19 during the fourth quarter of fiscal 2021. The projections are as of this date. The Company assumes no obligation to update or supplement this information.

-

The Company reiterates expectations for general and administrative expenses for 2021 to range between approximately

$168 million $178 million

-

The Company reiterates expectations for capital expenditures for 2021 to be approximately

$19 million $7 million

-

Consolidated adjusted EBITDA is expected to range between approximately

$245 million $250 million

Third Quarter of 2021 Earnings Conference Call Details

Dine Brands will host a conference call to discuss its results on

A live webcast of the call will be available on www.dinebrands.com and may be accessed by visiting Events and Presentations under the site’s Investors section. Participants should allow approximately ten minutes prior to the call’s start time to visit the site and download any streaming media software needed to listen to the webcast. A telephonic replay of the call may be accessed from

About

Based in

Forward-Looking Statements

Statements contained in this press release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify these forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “goal” and other similar expressions. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. These factors include, but are not limited to: uncertainty regarding the duration and severity of the ongoing COVID-19 pandemic and its ultimate impact on the Company; the effectiveness of related containment measures; general economic conditions; our level of indebtedness; compliance with the terms of our securitized debt; our ability to refinance our current indebtedness or obtain additional financing; our dependence on information technology; potential cyber incidents; the implementation of restaurant development plans; our dependence on our franchisees; the concentration of our Applebee’s franchised restaurants in a limited number of franchisees; the financial health of our franchisees; our franchisees’ and other licensees’ compliance with our quality standards and trademark usage; general risks associated with the restaurant industry; potential harm to our brands’ reputation; possible future impairment charges; the effects of tax reform; trading volatility and fluctuations in the price of our stock; our ability to achieve the financial guidance we provide to investors; successful implementation of our business strategy; the availability of suitable locations for new restaurants; shortages or interruptions in the supply or delivery of products from third parties or availability of utilities; the management and forecasting of appropriate inventory levels; development and implementation of innovative marketing and use of social media; changing health or dietary preference of consumers; risks associated with doing business in international markets; the results of litigation and other legal proceedings; third-party claims with respect to intellectual property assets; our ability to attract and retain management and other key employees; compliance with federal, state and local governmental regulations; risks associated with our self-insurance; natural disasters, pandemics, epidemics, or other serious incidents; our success with development initiatives outside of our core business; the adequacy of our internal controls over financial reporting and future changes in accounting standards; and other factors discussed from time to time in the Corporation’s Annual and Quarterly Reports on Forms 10-K and 10-Q and in the Corporation’s other filings with the

Non-GAAP Financial Measures

This press release includes references to the Company's non-GAAP financial measure “adjusted net income available to common stockholders”, “adjusted earnings per diluted share (Adjusted EPS)”, “Adjusted EBITDA” and “Adjusted free cash flow.” Adjusted EPS is computed for a given period by deducting from net income or loss available to common stockholders for such period the effect of any closure and impairment charges, any gain or loss related to debt extinguishment, any intangible asset amortization, any non-cash interest expense, any gain or loss related to the disposition of assets, and other items deemed not reflective of current operations. This is presented on an aggregate basis and a per share (diluted) basis. Adjusted EBITDA is computed for a given period by deducting from net income or loss for such period the effect of any closure and impairment charges, any interest charges, any income tax provision or benefit, any non-cash stock-based compensation, any depreciation and amortization, any gain or loss related to the disposition of assets and other items deemed not reflective of current operations. “Adjusted free cash flow” for a given period is defined as cash provided by operating activities, plus receipts from notes and equipment contracts receivable, less capital expenditures. Management may use certain of these non-GAAP financial measures along with the corresponding

Consolidated Statements of Comprehensive Income (Loss) (In thousands, except per share amounts) (Unaudited) |

||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||||||

|

|

|

||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||||

Revenues: |

|

|

|

|

||||||||||||

Franchise revenues: |

|

|

|

|

||||||||||||

Royalties, franchise fees and other |

$ |

90,417 |

|

$ |

69,820 |

|

$ |

265,138 |

|

$ |

191,915 |

|

||||

Advertising revenues |

70,709 |

|

51,932 |

|

203,918 |

|

142,750 |

|

||||||||

Total franchise revenues |

161,126 |

|

121,752 |

|

469,056 |

|

334,665 |

|

||||||||

Company restaurant sales |

35,275 |

|

27,353 |

|

109,418 |

|

75,427 |

|

||||||||

Rental revenues |

31,273 |

|

26,194 |

|

84,797 |

|

78,910 |

|

||||||||

Financing revenues |

1,045 |

|

1,344 |

|

3,266 |

|

4,237 |

|

||||||||

Total revenues |

228,719 |

|

176,643 |

|

666,537 |

|

493,239 |

|

||||||||

Cost of revenues: |

|

|

|

|

||||||||||||

Franchise expenses: |

|

|

|

|

||||||||||||

Advertising expenses |

70,709 |

|

51,932 |

|

203,918 |

|

142,750 |

|

||||||||

Bad debt (credit) expense |

(1,962 |

) |

2,845 |

|

(4,246 |

) |

8,416 |

|

||||||||

Other franchise expenses |

6,922 |

|

5,858 |

|

20,197 |

|

15,999 |

|

||||||||

Total franchise expenses |

75,669 |

|

60,635 |

|

219,869 |

|

167,165 |

|

||||||||

Company restaurant expenses |

33,867 |

|

28,303 |

|

101,510 |

|

79,774 |

|

||||||||

Rental expenses: |

|

|

|

|

||||||||||||

Interest expense from finance leases |

822 |

|

1,106 |

|

2,677 |

|

3,453 |

|

||||||||

Other rental expenses |

23,645 |

|

19,692 |

|

63,359 |

|

61,121 |

|

||||||||

Total rental expenses |

24,467 |

|

20,798 |

|

66,036 |

|

64,574 |

|

||||||||

Financing expenses |

113 |

|

123 |

|

356 |

|

393 |

|

||||||||

Total cost of revenues |

134,116 |

|

109,859 |

|

387,771 |

|

311,906 |

|

||||||||

Gross profit |

94,603 |

|

66,784 |

|

278,766 |

|

181,333 |

|

||||||||

General and administrative expenses |

43,704 |

|

36,873 |

|

122,891 |

|

105,351 |

|

||||||||

Interest expense, net |

15,721 |

|

16,844 |

|

47,956 |

|

49,143 |

|

||||||||

Impairment and closure charges |

443 |

|

168 |

|

5,024 |

|

124,521 |

|

||||||||

Amortization of intangible assets |

2,664 |

|

2,659 |

|

8,015 |

|

8,240 |

|

||||||||

Loss on disposition of assets |

1,299 |

|

1,087 |

|

1,436 |

|

2,630 |

|

||||||||

Income before income taxes |

30,772 |

|

9,153 |

|

93,444 |

|

(108,552 |

) |

||||||||

Income tax (provision) benefit |

(7,661 |

) |

865 |

|

(15,368 |

) |

6,119 |

|

||||||||

Net income (loss) |

$ |

23,111 |

|

$ |

10,018 |

|

$ |

78,076 |

|

$ |

(102,433 |

) |

||||

Net income (loss) available to common stockholders: |

|

|

|

|

||||||||||||

Net income (loss) |

$ |

23,111 |

|

$ |

10,018 |

|

$ |

78,076 |

|

$ |

(102,433 |

) |

||||

Less: Net income allocated to unvested participating restricted stock |

(502 |

) |

(329 |

) |

(1,920 |

) |

(420 |

) |

||||||||

Net income (loss) available to common stockholders |

$ |

22,609 |

|

$ |

9,689 |

|

$ |

76,156 |

|

$ |

(102,853 |

) |

||||

Net income (loss) available to common stockholders per share: |

|

|

|

|

||||||||||||

Basic |

$ |

1.34 |

|

$ |

0.60 |

|

$ |

4.55 |

|

$ |

(6.34 |

) |

||||

Diluted |

$ |

1.33 |

|

$ |

0.60 |

|

$ |

4.52 |

|

$ |

(6.34 |

) |

||||

Weighted average shares outstanding: |

|

|

|

|

||||||||||||

Basic |

16,911 |

|

16,221 |

|

16,752 |

|

16,229 |

|

||||||||

Diluted |

16,971 |

|

16,283 |

|

16,858 |

|

16,229 |

|

||||||||

|

|

|

|

|

||||||||||||

Dividends declared per common share |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

0.76 |

|

||||

Dividends paid per common share |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

1.45 |

|

||||

|

|

|

|

|

||||||||||||

Consolidated Balance Sheets (In thousands, except share and per share amounts) |

||||||||

|

|

|

||||||

|

(Unaudited) |

|

||||||

Assets |

|

|

||||||

Current assets: |

|

|

||||||

Cash and cash equivalents |

$ |

304,159 |

|

$ |

383,369 |

|

||

Receivables, net of allowance of |

92,135 |

|

121,897 |

|

||||

Restricted cash |

64,685 |

|

39,884 |

|

||||

Prepaid gift card costs |

21,890 |

|

29,080 |

|

||||

Prepaid income taxes |

2,025 |

|

6,178 |

|

||||

Other current assets |

8,744 |

|

6,098 |

|

||||

Total current assets |

493,638 |

|

586,506 |

|

||||

Other intangible assets, net |

541,999 |

|

549,671 |

|

||||

Operating lease right-of-use assets |

334,624 |

|

346,086 |

|

||||

|

251,628 |

|

251,628 |

|

||||

Property and equipment, net |

175,318 |

|

187,977 |

|

||||

Long-term receivables, net of allowance of |

46,622 |

|

54,512 |

|

||||

Deferred rent receivable |

51,820 |

|

56,449 |

|

||||

Non-current restricted cash |

16,400 |

|

32,800 |

|

||||

Other non-current assets, net |

10,450 |

|

9,316 |

|

||||

Total assets |

$ |

1,922,499 |

|

$ |

2,074,945 |

|

||

Liabilities and Stockholders’ Deficit |

|

|

||||||

Current liabilities: |

|

|

||||||

Current maturities of long-term debt |

$ |

— |

|

$ |

13,000 |

|

||

Accounts payable |

42,586 |

|

37,424 |

|

||||

Gift card liability |

115,878 |

|

144,159 |

|

||||

Current maturities of operating lease obligations |

71,219 |

|

69,672 |

|

||||

Current maturities of finance lease and financing obligations |

10,608 |

|

11,293 |

|

||||

Accrued employee compensation and benefits |

30,752 |

|

21,237 |

|

||||

Accrued advertising |

53,873 |

|

21,641 |

|

||||

Deferred franchise revenue, short-term |

7,388 |

|

7,682 |

|

||||

Other accrued expenses |

12,678 |

|

22,460 |

|

||||

Total current liabilities |

344,982 |

|

348,568 |

|

||||

Long-term debt, net, less current maturities |

1,279,071 |

|

1,491,996 |

|

||||

Operating lease obligations, less current maturities |

323,855 |

|

345,163 |

|

||||

Finance lease obligations, less current maturities |

61,499 |

|

69,012 |

|

||||

Financing obligations, less current maturities |

32,183 |

|

32,797 |

|

||||

Deferred income taxes, net |

69,008 |

|

78,293 |

|

||||

Deferred franchise revenue, long-term |

46,723 |

|

52,237 |

|

||||

Other non-current liabilities |

19,495 |

|

11,530 |

|

||||

Total liabilities |

2,176,816 |

|

2,429,596 |

|

||||

Commitments and contingencies |

|

|

||||||

Stockholders’ deficit: |

|

|

||||||

Preferred stock, |

— |

|

— |

|

||||

Common stock, |

250 |

|

249 |

|

||||

Additional paid-in-capital |

253,751 |

|

257,625 |

|

||||

Retained earnings (accumulated deficit) |

22,523 |

|

(55,553 |

) |

||||

Accumulated other comprehensive loss |

(59 |

) |

(55 |

) |

||||

|

(530,782 |

) |

(556,917 |

) |

||||

Total stockholders’ deficit |

(254,317 |

) |

(354,651 |

) |

||||

Total liabilities and stockholders’ deficit |

$ |

1,922,499 |

|

$ |

2,074,945 |

|

||

Consolidated Statements of Cash Flows (In thousands) (Unaudited) |

||||||||

|

Nine Months Ended |

|||||||

|

|

|||||||

|

2021 |

2020 |

||||||

|

|

|

||||||

Cash flows from operating activities: |

|

|

||||||

Net income (loss) |

$ |

78,076 |

|

$ |

(102,433 |

) |

||

Adjustments to reconcile net income (loss) to cash flows provided by operating activities: |

|

|

||||||

Non-cash impairment and closure charges |

4,949 |

|

124,469 |

|

||||

Depreciation and amortization |

29,995 |

|

32,053 |

|

||||

Non-cash stock-based compensation expense |

8,572 |

|

9,193 |

|

||||

Non-cash interest expense |

2,146 |

|

1,990 |

|

||||

Deferred income taxes |

(9,156 |

) |

24,172 |

|

||||

Deferred revenue |

(5,808 |

) |

(5,067 |

) |

||||

Loss on disposition of assets |

1,436 |

|

2,630 |

|

||||

Other |

(8,418 |

) |

1,173 |

|

||||

Changes in operating assets and liabilities: |

|

|

||||||

Accounts receivable, net |

8,398 |

|

(27,849 |

) |

||||

Current income tax receivables and payables |

4,544 |

|

(41,426 |

) |

||||

Gift card receivables and payables |

(9,215 |

) |

(1,980 |

) |

||||

Other current assets |

(2,645 |

) |

(2,034 |

) |

||||

Accounts payable |

9,678 |

|

6,777 |

|

||||

Accrued employee compensation and benefits |

9,569 |

|

(6,406 |

) |

||||

Accrued advertising expenses |

32,232 |

|

19,579 |

|

||||

Other current liabilities |

(8,791 |

) |

1,887 |

|

||||

Cash flows provided by operating activities |

145,562 |

|

36,728 |

|

||||

Cash flows from investing activities: |

|

|

||||||

Principal receipts from notes, equipment contracts and other long-term receivables |

14,795 |

|

15,731 |

|

||||

Net additions to property and equipment |

(7,923 |

) |

(9,088 |

) |

||||

Proceeds from sale of property and equipment |

946 |

|

517 |

|

||||

Additions to long-term receivables |

— |

|

(1,475 |

) |

||||

Other |

(357 |

) |

(358 |

) |

||||

Cash flows provided by investing activities |

7,461 |

|

5,327 |

|

||||

Cash flows from financing activities: |

|

|

||||||

Repayment of long-term debt |

(9,750 |

) |

— |

|

||||

Borrowing from revolving credit facility |

— |

|

220,000 |

|

||||

Repayment of revolving credit facility |

(220,000 |

) |

— |

|

||||

Dividends paid on common stock |

— |

|

(23,934 |

) |

||||

Repurchase of common stock |

— |

|

(29,853 |

) |

||||

Principal payments on finance lease obligations |

(7,772 |

) |

(9,034 |

) |

||||

Proceeds from stock options exercised |

25,016 |

|

20,523 |

|

||||

Tax payments for restricted stock upon vesting |

(1,543 |

) |

(2,438 |

) |

||||

Tax payments for share settlement of restricted stock units |

(9,783 |

) |

(205 |

) |

||||

Cash flows (used in) provided by financing activities |

(223,832 |

) |

175,059 |

|

||||

Net change in cash, cash equivalents and restricted cash |

(70,809 |

) |

217,114 |

|

||||

Cash, cash equivalents and restricted cash at beginning of period |

456,053 |

|

172,475 |

|

||||

Cash, cash equivalents and restricted cash at end of period |

$ |

385,244 |

|

$ |

389,589 |

|

||

Non-GAAP Financial Measures

(In thousands, except per share amounts)

(Unaudited)

Reconciliation of net income (loss) available to common stockholders to net income (loss) available to common stockholders, as adjusted for the following items: Closure and impairment charges; amortization of intangible assets; non-cash interest expense; gain or loss on disposition of assets; and the combined tax effect of the preceding adjustments, as well as related per share data:

|

Three Months Ended |

Nine Months Ended |

||||||||||||||

|

|

|

||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||||

|

|

|

|

|

||||||||||||

Net income (loss) available to common stockholders, as reported |

$ |

22,609 |

|

$ |

9,689 |

|

$ |

76,156 |

|

$ |

(102,853 |

) |

||||

Closure and impairment charges |

443 |

|

168 |

|

5,024 |

|

124,521 |

|

||||||||

Amortization of intangible assets |

2,664 |

|

2,659 |

|

8,015 |

|

8,240 |

|

||||||||

Non-cash interest expense |

719 |

|

672 |

|

2,146 |

|

1,990 |

|

||||||||

Loss on disposition of assets |

1,299 |

|

1,087 |

|

1,436 |

|

2,630 |

|

||||||||

Net income tax provision for above adjustments |

(1,384 |

) |

(1,146 |

) |

(4,488 |

) |

(11,287 |

) |

||||||||

Net income allocated to unvested participating restricted stock |

(81 |

) |

(112 |

) |

(298 |

) |

(367 |

) |

||||||||

Net income (loss) available to common stockholders, as adjusted |

$ |

26,269 |

|

$ |

13,017 |

|

$ |

87,991 |

|

$ |

22,874 |

|

||||

|

|

|

|

|

||||||||||||

Diluted net income (loss) available to common stockholders per share: |

|

|

|

|

||||||||||||

Net income (loss) available to common stockholders per share, as reported |

$ |

1.33 |

|

$ |

0.60 |

|

$ |

4.52 |

|

$ |

(6.34 |

) |

||||

Closure and impairment charges |

0.02 |

|

0.01 |

|

0.22 |

|

7.15 |

|

||||||||

Amortization of intangible assets |

0.11 |

|

0.12 |

|

0.35 |

|

0.38 |

|

||||||||

Non-cash interest expense |

0.03 |

|

0.03 |

|

0.09 |

|

0.09 |

|

||||||||

Loss on disposition of assets |

0.06 |

|

0.05 |

|

0.06 |

|

0.12 |

|

||||||||

Net income allocated to unvested participating restricted stock |

(0.00 |

) |

(0.01 |

) |

(0.02 |

) |

(0.02 |

) |

||||||||

Rounding |

— |

|

— |

|

— |

|

0.02 |

|

||||||||

Diluted net income available to common stockholders per share, as adjusted |

$ |

1.55 |

|

$ |

0.80 |

|

$ |

5.22 |

|

$ |

1.40 |

|

||||

|

|

|

|

|

||||||||||||

Numerator for basic EPS - net income (loss) available to common stockholders, as adjusted |

$ |

26,269 |

|

$ |

13,017 |

|

$ |

87,991 |

|

$ |

22,874 |

|

||||

Effect of unvested participating restricted stock using the two-class method |

2 |

|

1 |

|

15 |

|

2 |

|

||||||||

Numerator for diluted EPS - net income available to common stockholders, as adjusted |

$ |

26,271 |

|

$ |

13,018 |

|

$ |

88,006 |

|

$ |

22,876 |

|

||||

|

|

|

|

|

||||||||||||

Denominator for basic EPS - weighted-average shares |

16,911 |

|

16,221 |

|

16,752 |

|

16,229 |

|

||||||||

Dilutive effect of stock options |

60 |

|

62 |

|

106 |

|

86 |

|

||||||||

Denominator for diluted EPS - weighted-average shares |

16,971 |

|

16,283 |

|

16,858 |

|

16,315 |

|

||||||||

Non-GAAP Financial Measures

(Unaudited)

Reconciliation of the Company's cash provided by operating activities to “adjusted free cash flow” (cash provided by operating activities, plus receipts from notes and equipment contracts receivable, less additions to property and equipment). Management uses this liquidity measure in its periodic assessments of, among other things, the amount of cash dividends per share of common stock and repurchases of common stock. We believe it is important for investors to have the same measure used by management for that purpose. Adjusted free cash flow does not represent residual cash flow available for discretionary purposes.

|

Nine Months Ended |

|||||||

|

|

|||||||

|

2021 |

2020 |

||||||

|

(In millions) |

|||||||

Cash flows provided by operating activities |

$ |

145.6 |

|

$ |

36.7 |

|

||

Receipts from notes and equipment contracts receivable |

8.4 |

|

8.0 |

|

||||

Net additions to property and equipment |

(7.9 |

) |

(9.1 |

) |

||||

Adjusted free cash flow |

146.1 |

|

35.6 |

|

||||

Dividends paid on common stock |

— |

|

(23.9 |

) |

||||

Repurchase of common stock |

— |

|

(29.9 |

) |

||||

|

$ |

146.1 |

|

$ |

(18.2 |

) |

||

Non-GAAP Financial Measures

(in thousands)

(Unaudited)

Reconciliation of the Company's net income (loss) to “adjusted EBITDA.” The Company defines adjusted EBITDA as net income or loss, adjusted for the effect of closure and impairment charges, interest charges, income tax provision or benefit, depreciation and amortization, non-cash stock-based compensation, gain or loss on disposition of assets, other non-income based taxes and other items deemed not reflective of current operations. Management may use certain non-GAAP measures along with the corresponding

|

Three Months Ended |

Nine Months Ended |

||||||||||||||

|

|

|

||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||||

|

|

|

|

|

||||||||||||

Net income (loss), as reported |

$ |

23,111 |

|

$ |

10,018 |

|

$ |

78,076 |

|

$ |

(102,433 |

) |

||||

Closure and impairment charges |

443 |

168 |

|

5,024 |

124,521 |

|

||||||||||

Interest charges on finance leases |

1,304 |

|

1,605 |

|

4,151 |

|

4,974 |

|

||||||||

All other interest charges |

16,419 |

|

17,437 |

|

50,109 |

|

51,336 |

|

||||||||

Income tax provision (benefit) |

7,661 |

|

(865 |

) |

15,368 |

|

(6,119 |

) |

||||||||

Depreciation and amortization |

10,010 |

|

10,685 |

|

29,969 |

|

32,030 |

|

||||||||

Non-cash stock-based compensation |

2,961 |

|

2,524 |

|

8,574 |

|

9,194 |

|

||||||||

Loss on disposition of assets |

1,299 |

|

1,087 |

|

1,436 |

|

2,630 |

|

||||||||

Other |

98 |

|

67 |

|

454 |

|

372 |

|

||||||||

Adjusted EBITDA |

$ |

63,306 |

|

$ |

42,726 |

|

$ |

193,161 |

|

$ |

116,505 |

|

||||

Restaurant Data

(Unaudited)

The following table sets forth, for the three and nine months ended

|

Three Months Ended |

Nine Months Ended |

||||||||||||||||||

|

|

|

||||||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||||||||||

|

|

|||||||||||||||||||

Applebee's |

|

|

|

|

||||||||||||||||

|

|

|

|

|

||||||||||||||||

Franchise |

1,619 |

|

1,636 |

|

|

1,623 |

|

1,620 |

|

|

||||||||||

Company |

69 |

|

69 |

|

|

69 |

|

68 |

|

|

||||||||||

Total |

1,688 |

|

1,705 |

|

|

1,692 |

|

1,688 |

|

|

||||||||||

|

|

|

|

|

||||||||||||||||

System-wide(b) |

|

|

|

|

||||||||||||||||

Domestic sales percentage change(c) |

30.2 |

% |

(16.7 |

) |

% |

38.6 |

% |

(27.6 |

) |

% |

||||||||||

Domestic same-restaurant sales percentage change(d) |

27.7 |

% |

(13.3 |

) |

% |

39.5 |

% |

(24.1 |

) |

% |

||||||||||

|

|

|

|

|

||||||||||||||||

Franchise(b) |

|

|

|

|

||||||||||||||||

Domestic sales percentage change(c) |

30.2 |

% |

(16.9 |

) |

% |

38.4 |

% |

(27.7 |

) |

% |

||||||||||

Domestic same-restaurant sales percentage change(d) |

27.8 |

% |

(13.4 |

) |

% |

39.3 |

% |

(24.1 |

) |

% |

||||||||||

Average weekly domestic unit sales (in thousands) |

$ |

51.4 |

|

$ |

39.2 |

|

|

$ |

50.6 |

|

$ |

36.6 |

|

|

||||||

IHOP |

|

|

|

|

||||||||||||||||

|

|

|

|

|

||||||||||||||||

Franchise |

1,573 |

|

1,530 |

|

|

1,568 |

|

1,517 |

|

|

||||||||||

Area license |

156 |

|

157 |

|

|

156 |

|

153 |

|

|

||||||||||

Total |

1,729 |

|

1,687 |

|

|

1,724 |

|

1,670 |

|

|

||||||||||

|

|

|

|

|

||||||||||||||||

System-wide(b) |

|

|

|

|

||||||||||||||||

Sales percentage change(c) |

46.1 |

% |

(34.4 |

) |

% |

41.6 |

% |

(37.6 |

) |

% |

||||||||||

Domestic same-restaurant sales percentage change, including area license restaurants(d) |

40.1 |

% |

(30.2 |

) |

% |

40.5 |

% |

(33.8 |

) |

% |

||||||||||

|

|

|

|

|

||||||||||||||||

Franchise(b) |

|

|

|

|

||||||||||||||||

Sales percentage change(c) |

45.7 |

% |

(34.3 |

) |

% |

40.9 |

% |

(37.6 |

) |

% |

||||||||||

Domestic same-restaurant sales percentage change(d) |

39.4 |

% |

(29.9 |

) |

% |

39.4 |

% |

(33.6 |

) |

% |

||||||||||

Average weekly unit sales (in thousands) |

$ |

36.2 |

|

$ |

25.6 |

|

|

$ |

34.0 |

|

$ |

24.9 |

|

|

||||||

|

|

|

|

|

||||||||||||||||

Area License (b) |

|

|

|

|

||||||||||||||||

Sales percentage change(c) |

50.9 |

% |

(35.0 |

) |

% |

48.1 |

% |

(37.1 |

) |

% |

||||||||||

Restaurant Data

(Unaudited)

(a) |

|

“Effective Restaurants” are the weighted average number of restaurants open in a given fiscal period, adjusted to account for restaurants open for only a portion of the period. Information is presented for all |

|

|

|

(b) |

|

“System-wide” sales are retail sales at domestic Applebee’s restaurants operated by franchisees and IHOP restaurants operated by franchisees and area licensees, as reported to the Company, in addition to retail sales at company-operated restaurants. System-wide sales do not include retail sales of ghost kitchens. Sales at restaurants that are owned by franchisees and area licensees are not attributable to the Company. An increase or decrease in franchisees' reported sales will result in a corresponding increase or decrease in our royalty revenue. Unaudited reported sales for Applebee's domestic franchise restaurants, Applebee's company-operated restaurants, IHOP franchise restaurants and IHOP area license restaurants for the three and nine months ended |

|

Three Months Ended |

|

Nine Months Ended |

|||||||||||||

|

|

|

|

|||||||||||||

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|||||||||

|

(In millions) |

|||||||||||||||

Reported sales |

|

|

|

|

|

|

|

|||||||||

Applebee's domestic franchise restaurant sales |

$ |

1,013.3 |

|

|

$ |

778.2 |

|

|

$ |

3,000.8 |

|

|

$ |

2,168.4 |

|

|

Applebee's company-operated restaurants |

35.2 |

|

|

27.4 |

|

|

109.4 |

|

|

75.4 |

|

|||||

IHOP franchise restaurant sales |

740.4 |

|

|

508.3 |

|

|

2,079.2 |

|

|

1,475.2 |

|

|||||

IHOP area license restaurant sales |

69.8 |

|

|

46.2 |

|

|

202.4 |

|

|

136.6 |

|

|||||

Total |

$ |

1,858.7 |

|

|

$ |

1,360.1 |

|

|

$ |

5,391.8 |

|

|

$ |

3,855.6 |

|

|

(c) |

|

“Sales percentage change” reflects, for each category of restaurants, the percentage change in sales in any given fiscal period compared to the prior fiscal period for all restaurants in that category. |

|

|

|

(d) |

|

“Domestic same-restaurant sales percentage change” reflects the percentage change in sales, in any given fiscal period, compared to the same weeks in the prior year for domestic restaurants that have been operated during both fiscal periods that are being compared and have been open for at least 18 months. Because of new unit openings and restaurant closures, the domestic restaurants open during both fiscal periods being compared may be different from period to period. |

Restaurant Data (Unaudited) |

||||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||

|

|

|

||||||||||

|

2021 |

2020 |

2021 |

2020 |

||||||||

Applebee's Restaurant Development Activity |

|

|

|

|||||||||

Summary - beginning of period: |

|

|

|

|

||||||||

Franchise |

1,627 |

|

1,680 |

|

1,640 |

|

1,718 |

|

||||

Company |

69 |

|

69 |

|

69 |

|

69 |

|

||||

Total Applebee's restaurants, beginning of period |

1,696 |

|

1,749 |

|

1,709 |

|

1,787 |

|

||||

Franchise restaurants opened: |

|

|

|

|

||||||||

Domestic |

2 |

|

1 |

|

4 |

|

1 |

|

||||

International |

— |

|

3 |

|

1 |

|

3 |

|

||||

Total franchise restaurants opened |

2 |

|

4 |

|

5 |

|

4 |

|

||||

Franchise restaurants permanently closed: |

|

|

|

|

||||||||

Domestic |

(5 |

) |

(20 |

) |

(15 |

) |

(52 |

) |

||||

International |

(4 |

) |

(5 |

) |

(10 |

) |

(11 |

) |

||||

Total franchise restaurants permanently closed |

(9 |

) |

(25 |

) |

(25 |

) |

(63 |

) |

||||

Net franchise restaurant reduction |

(7 |

) |

(21 |

) |

(20 |

) |

(59 |

) |

||||

Summary - end of period: |

|

|

|

|

||||||||

Franchise |

1,620 |

|

1,659 |

|

1,620 |

|

1,659 |

|

||||

Company |

69 |

|

69 |

|

69 |

|

69 |

|

||||

Total Applebee's restaurants, end of period |

1,689 |

|

1,728 |

|

1,689 |

|

1,728 |

|

||||

Domestic |

1,587 |

|

1,614 |

|

1,587 |

|

1,614 |

|

||||

International |

102 |

|

114 |

|

102 |

|

114 |

|

||||

IHOP Restaurant Development Activity |

|

|

|

|

||||||||

Summary - beginning of period: |

|

|

|

|

||||||||

Franchise |

1,588 |

|

1,666 |

|

1,611 |

|

1,680 |

|

||||

Area license |

156 |

|

157 |

|

158 |

|

161 |

|

||||

Company |

3 |

|

— |

|

3 |

|

— |

|

||||

Total IHOP restaurants, beginning of period |

1,747 |

|

1,823 |

|

1,772 |

|

1,841 |

|

||||

Franchise/area license restaurants opened: |

|

|

|

|

||||||||

Domestic franchise |

7 |

|

1 |

|

22 |

|

8 |

|

||||

Domestic area license |

1 |

|

2 |

|

2 |

|

3 |

|

||||

International franchise |

1 |

|

3 |

|

2 |

|

5 |

|

||||

Total franchise/area license restaurants opened |

9 |

|

6 |

|

26 |

|

16 |

|

||||

Franchise/area license restaurants permanently closed: |

|

|

|

|

||||||||

Domestic franchise |

(5 |

) |

(16 |

) |

(35 |

) |

(35 |

) |

||||

Domestic area license |

(1 |

) |

— |

|

(3 |

) |

(3 |

) |

||||

International franchise |

— |

|

(6 |

) |

(9 |

) |

(10 |

) |

||||

International area license |

— |

|

— |

|

(1 |

) |

(2 |

) |

||||

Total franchise/area license restaurants permanently closed |

(6 |

) |

(22 |

) |

(48 |

) |

(50 |

) |

||||

Net franchise/area license restaurant reduction |

3 |

|

(16 |

) |

(22 |

) |

(34 |

) |

||||

Franchise restaurants reacquired by the Company |

— |

|

— |

|

(1 |

) |

— |

|

||||

Net franchise/area license restaurant decrease |

3 |

|

(16 |

) |

(22 |

) |

(34 |

) |

||||

Summary - end of period |

|

|

|

|

||||||||

Franchise |

1,591 |

|

1,648 |

|

1,591 |

|

1,648 |

|

||||

Area license |

156 |

|

159 |

|

156 |

|

159 |

|

||||

Company |

3 |

|

— |

|

3 |

|

— |

|

||||

Total IHOP restaurants, end of period |

1,750 |

|

1,807 |

|

1,750 |

|

1,807 |

|

||||

Domestic |

1,656 |

|

1,683 |

|

1,656 |

|

1,683 |

|

||||

International |

94 |

|

124 |

|

94 |

|

124 |

|

||||

The restaurant counts and activity presented above do not include two domestic Applebee's ghost kitchens (small kitchens with no store-front presence, used to fill off-premise orders) and one Applebee's and six IHOP international ghost kitchens.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211104005457/en/

Investor Contact

Executive Director, Investor Relations

818-637-3632

Ken.Diptee@dinebrands.com

Media Contact

Vice President,

and Public Affairs

Susan.Nelson@dinebrands.com

Source: