Slowing Construction and Rising Capital Flows Set Stage for Life Sciences Market Rebound

Cushman & Wakefield (CWK) has released its 2025 Life Sciences Update, revealing significant shifts in the life sciences real estate market. The overall vacancy rate reached 20.5% in Q4 2024, increasing 250 basis points from Q2 2024. The U.S. market experienced negative net absorption for two consecutive years, though Boston, Chicago, and Los Angeles-Orange County showed positive absorption in 2024.

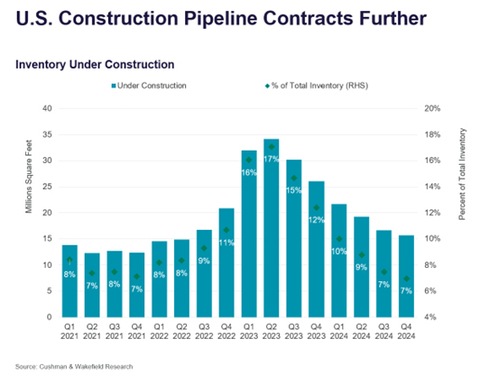

The construction pipeline has dramatically decreased to 2 million square feet expected beyond 2025, down from 16 msf currently under construction. While average asking rent growth slowed to 3% year-over-year, it remains 22% above 2022 levels. Notable market variations include Denver (+26%), Los Angeles-Orange County (+18%), and Chicago (+13%) showing strong growth, while New York City (-14%) and Boston (-11%) experienced declines.

Capital markets show increasing sales volume in 2025, though cap rates remain elevated as investors evaluate income potential and debt costs. Total returns have been negative for three consecutive years.

Cushman & Wakefield (CWK) ha pubblicato il suo aggiornamento sulle scienze della vita per il 2025, rivelando significativi cambiamenti nel mercato immobiliare delle scienze della vita. Il tasso di occupazione complessivo ha raggiunto il 20,5% nel quarto trimestre del 2024, aumentando di 250 punti base rispetto al secondo trimestre del 2024. Il mercato statunitense ha registrato un'assorbimento netto negativo per due anni consecutivi, sebbene Boston, Chicago e Los Angeles-Contea di Orange abbiano mostrato un'assorbimento positivo nel 2024.

Il pipeline di costruzione è drasticamente diminuito a 2 milioni di piedi quadrati previsti oltre il 2025, rispetto ai 16 msf attualmente in costruzione. Sebbene la crescita dei canoni di locazione medi sia rallentata al 3% anno su anno, rimane superiore del 22% rispetto ai livelli del 2022. Le variazioni di mercato notevoli includono Denver (+26%), Los Angeles-Contea di Orange (+18%) e Chicago (+13%), che mostrano una forte crescita, mentre New York City (-14%) e Boston (-11%) hanno registrato cali.

I mercati dei capitali mostrano un volume di vendite in aumento nel 2025, anche se i tassi di capitalizzazione rimangono elevati mentre gli investitori valutano il potenziale di reddito e i costi del debito. I rendimenti totali sono stati negativi per tre anni consecutivi.

Cushman & Wakefield (CWK) ha publicado su actualización de ciencias de la vida para 2025, revelando cambios significativos en el mercado inmobiliario de ciencias de la vida. La tasa de vacantes general alcanzó el 20.5% en el cuarto trimestre de 2024, aumentando 250 puntos básicos desde el segundo trimestre de 2024. El mercado estadounidense experimentó una absorción neta negativa durante dos años consecutivos, aunque Boston, Chicago y Los Ángeles-Contea de Orange mostraron una absorción positiva en 2024.

El pipeline de construcción ha disminuido drásticamente a 2 millones de pies cuadrados esperados más allá de 2025, en comparación con los 16 msf que actualmente están en construcción. Si bien el crecimiento del alquiler medio se desaceleró al 3% interanual, sigue siendo un 22% superior a los niveles de 2022. Las variaciones notables del mercado incluyen a Denver (+26%), Los Ángeles-Contea de Orange (+18%) y Chicago (+13%) mostrando un fuerte crecimiento, mientras que Nueva York (-14%) y Boston (-11%) experimentaron caídas.

Los mercados de capitales muestran un aumento en el volumen de ventas en 2025, aunque las tasas de capitalización siguen siendo elevadas mientras los inversores evalúan el potencial de ingresos y los costos de la deuda. Los retornos totales han sido negativos durante tres años consecutivos.

Cushman & Wakefield (CWK)는 2025년 생명과학 업데이트를 발표하며 생명과학 부동산 시장의 중요한 변화를 밝혔습니다. 전체 공실률은 2024년 4분기 20.5%에 도달했으며, 이는 2024년 2분기 대비 250 베이시스 포인트 증가한 수치입니다. 미국 시장은 두 해 연속으로 부정적인 순 흡수를 경험했지만, 보스턴, 시카고, 로스앤젤레스-오렌지 카운티는 2024년에 긍정적인 흡수를 보였습니다.

건설 파이프라인은 2025년 이후 예상되는 200만 평방피트로 급감했으며, 현재 건설 중인 16 msf에서 감소했습니다. 평균 임대료 성장률은 전년 대비 3%로 둔화되었지만, 여전히 2022년 수준보다 22% 높은 상태입니다. 주목할 만한 시장 변동으로는 덴버(+26%), 로스앤젤레스-오렌지 카운티(+18%), 시카고(+13%)가 강력한 성장을 보였고, 뉴욕시(-14%)와 보스턴(-11%)은 감소를 경험했습니다.

자본 시장은 2025년에 판매량이 증가하고 있지만, 투자자들이 수익 잠재력과 부채 비용을 평가하는 동안 자본화율은 여전히 높습니다. 총 수익률은 3년 연속으로 부정적이었습니다.

Cushman & Wakefield (CWK) a publié sa mise à jour sur les sciences de la vie pour 2025, révélant des changements significatifs sur le marché immobilier des sciences de la vie. Le taux d'inoccupation global a atteint 20,5% au quatrième trimestre 2024, augmentant de 250 points de base par rapport au deuxième trimestre 2024. Le marché américain a connu une absorption nette négative pendant deux années consécutives, bien que Boston, Chicago et Los Angeles-Comté d'Orange aient affiché une absorption positive en 2024.

Le pipeline de construction a considérablement diminué à 2 millions de pieds carrés prévus au-delà de 2025, contre 16 msf actuellement en construction. Bien que la croissance des loyers moyens ait ralenti à 3% d'une année sur l'autre, elle reste supérieure de 22% par rapport aux niveaux de 2022. Des variations notables du marché incluent Denver (+26%), Los Angeles-Comté d'Orange (+18%) et Chicago (+13%) affichant une forte croissance, tandis que New York (-14%) et Boston (-11%) ont connu des baisses.

Les marchés de capitaux montrent un volume de ventes en augmentation en 2025, bien que les taux de capitalisation restent élevés alors que les investisseurs évaluent le potentiel de revenu et les coûts de la dette. Les rendements totaux ont été négatifs pendant trois années consécutives.

Cushman & Wakefield (CWK) hat sein Update zu den Lebenswissenschaften für 2025 veröffentlicht und dabei bedeutende Veränderungen auf dem Immobilienmarkt für Lebenswissenschaften aufgezeigt. Die allgemeine Leerstandsquote erreichte im vierten Quartal 2024 20,5%, was einem Anstieg von 250 Basispunkten im Vergleich zum zweiten Quartal 2024 entspricht. Der US-Markt verzeichnete zwei aufeinanderfolgende Jahre mit negativer Nettoneuaufnahme, während Boston, Chicago und Los Angeles-Orang County 2024 eine positive Aufnahme zeigten.

Die Baupipeline ist drastisch auf 2 Millionen Quadratfuß gesunken, die über 2025 hinaus erwartet werden, im Vergleich zu den derzeit 16 msf, die sich im Bau befinden. Obwohl das durchschnittliche Mietwachstum auf 3% im Jahresvergleich zurückgegangen ist, liegt es weiterhin 22% über dem Niveau von 2022. Bemerkenswerte Marktvariationen sind Denver (+26%), Los Angeles-Orang County (+18%) und Chicago (+13%), die ein starkes Wachstum zeigen, während New York City (-14%) und Boston (-11%) Rückgänge verzeichneten.

Die Kapitalmärkte zeigen 2025 ein steigendes Verkaufsvolumen, obwohl die Kapitalisierungsraten hoch bleiben, da Investoren das Einkommenspotenzial und die Kosten der Verschuldung bewerten. Die Gesamtrenditen waren drei Jahre in Folge negativ.

- Sales volume increasing in 2025

- Some markets show strong rent growth: Denver +26%, LA-OC +18%, Chicago +13%

- Rents remain 22% higher than 2022 levels

- Positive absorption in key markets (Boston, Chicago, LA-OC)

- Vacancy rate increased to 20.5% in Q4 2024

- Negative net absorption for second consecutive year

- Negative total returns for three consecutive years

- Rent declines in major markets: NYC -14%, Boston -11%

- Construction pipeline dropped from 16M to 2M sq ft

Insights

Cushman & Wakefield's life sciences real estate market report reveals a sector in transition with mixed implications for the firm's business prospects. The current 20.5% vacancy rate and second consecutive year of negative net absorption indicate challenging near-term conditions for property owners and potentially lower transaction volumes for CWK's brokerage services.

However, the report strategically highlights several balancing factors: the dramatic construction pipeline contraction (from 16 msf to just 2 msf beyond 2025) suggests supply-demand equilibrium is approaching, while rising capital flows indicate investor confidence is returning. The regional rent variability—with Denver (

For CWK specifically, this report demonstrates their analytical capabilities while positioning them for the recovery phase. The softening rents and elevated vacancies may temporarily pressure leasing and property management revenues, but the increasing sales volume in 2025 should boost the firm's capital markets division. The report essentially telegraphs a market bottoming process where CWK can leverage its expertise to guide clients through the transition, potentially capturing market share as activity rebounds.

This market update represents a neutral indicator for Cushman & Wakefield's near-term financial performance. The life sciences sector's current challenges—20.5% vacancy rates and continued negative absorption—likely translate to reduced transaction and leasing commission volumes in this specific vertical, but the impact is by representing just one segment of CWK's diversified service portfolio.

The report's most significant financial implication lies in the rising capital markets sales volume noted for 2025, which could meaningfully contribute to CWK's brokerage revenue stream. However, the persistently elevated cap rates and three consecutive years of negative total returns suggest investment advisory services remain challenging, with cautious capital deployment still prevailing.

From a strategic perspective, CWK is leveraging this publication to position itself as a forward-looking adviser rather than merely reporting market difficulties. By highlighting the construction pipeline contraction and emerging investment opportunities, the firm demonstrates value-adding market intelligence that should strengthen client relationships through the cycle trough. The report effectively frames current market conditions as a potential inflection point, where CWK's advisory services become particularly valuable to clients navigating the complex balance of still-high vacancies against diminishing new supply.

Cushman & Wakefield releases its 2025 Life Sciences Update

(Photo: Business Wire)

The overall vacancy rate across major life sciences markets reached

The

“Despite short-term challenges, the sector is adjusting to market conditions as construction pipelines slow and capital investment gains momentum,” said Sandy Romero, Research Manager. “Occupiers seeking to expand or relocate in 2025 will benefit from an increased number of leasing options.”

Asking rent growth has softened, averaging

Sales volume is rising in 2025 as the broader commercial real estate market recovers. Capitalization (cap) rates remain elevated as investors weigh income potential and debt costs, while total returns have been negative for three consecutive years, mirroring broader property sector trends.

“While the market faces near-term challenges, long-term fundamentals remain strong. The demand for cutting-edge lab and research space, combined with strategic investment shifts, will continue to shape the life sciences real estate landscape through 2025 and beyond,” said Romero.

The full report can be downloaded here.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of

View source version on businesswire.com: https://www.businesswire.com/news/home/20250305640358/en/

Mike Boonshoft

michael.boonshoft@cushwake.com

Source: Cushman & Wakefield