Office Construction Costs Ease as Inflation Slows: Tariff and Labor Expenses Pose New Challenges and Uncertainties

Cushman & Wakefield releases 2025 General Contractor Sentiment Survey

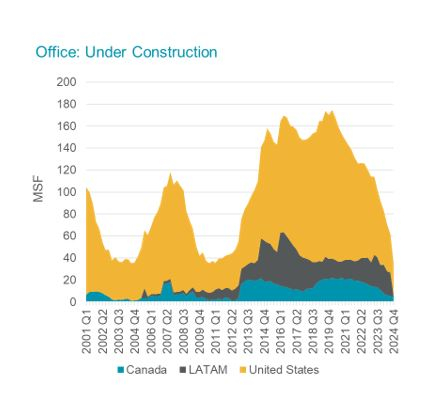

Office: Under Construction (Graphic: Business Wire)

“While we’re seeing the pace of inflation slow on construction costs, there remain serious headwinds and uncertainty about the impact of tariffs and labor shortages on the construction industry,” said Brian Ungles, President, Project & Development Services,

The new office construction pipeline has declined

“While new office construction pipeline has decreased, costs for all construction will continue to rise with more fit-out activity in existing offices and the strength of new construction in other property sectors, which increases competition for construction materials and labor,” said Richard Jantz, Tri-State Lead, Project & Development Services.

To facilitate fit outs by accommodating higher costs, office landlords increased Class A tenant improvement (TI) packages by

Cushman & Wakefield’s 2025 Americas Office Fit Out Cost Guide offers insights into 58 markets, providing occupiers with better support to refine their capital planning and relocation budgets. A comprehensive fit out cost section includes current costs for architectural trades; millwork; doors, frames and hardware; drywall, acoustic ceilings and carpentry; general finishes; mechanical, plumbing and fire protection; electrical and more. New in 2025, we’ve added a process to calculate all-in costs: Low Voltage Cabling, Audio Visual Equipment, Security, and Furniture, Fixtures & Equipment (FF&E), and soft costs. The report also explores key findings, an overview of general construction conditions, and a detailed analysis of the office sector.

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of

View source version on businesswire.com: https://www.businesswire.com/news/home/20250311793528/en/

Media Contact:

Mike Boonshoft

michael.boonshoft@cushwake.com

Source: Cushman & Wakefield