CreditRiskMonitor Announces 2021 Results

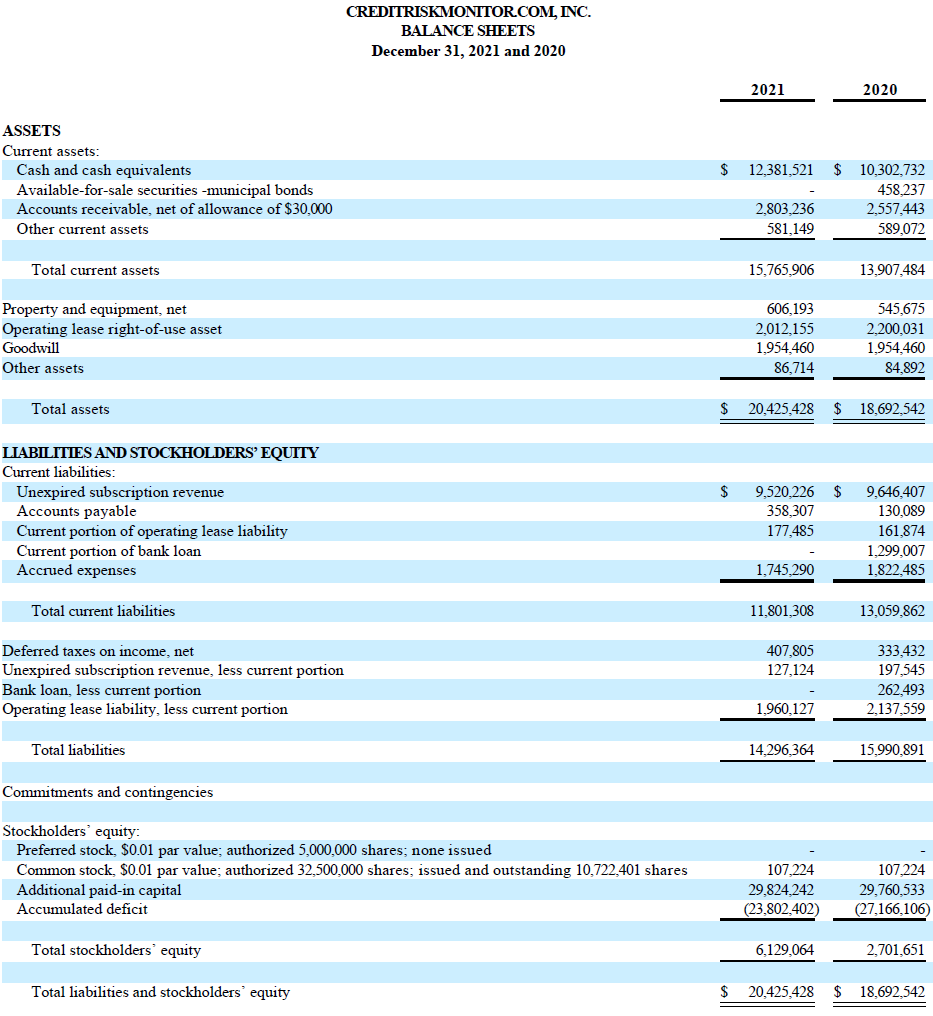

CreditRiskMonitor (OTCQX:CRMZ) reported a significant increase in operating revenues for 2021, reaching approximately $17 million, an 8.5% rise from $15.7 million in 2020. The company achieved a pre-tax operating income of about $2.3 million compared to a loss of $238 thousand in the previous year. Notably, it recognized $1.6 million in non-taxable income from a forgiven PPP loan, leading to a net income of approximately $3.4 million.

Future growth initiatives include the launch of SupplyChainMonitor and expansion of private company data coverage.

- Operating revenues increased by 8.5% to approximately $17 million in 2021.

- Achieved a pre-tax operating income of approximately $2.3 million in 2021, a turnaround from a loss in 2020.

- Recognized $1.6 million in non-taxable income from PPP loan forgiveness, contributing to a net income of approximately $3.4 million.

- None.

Insights

Analyzing...

VALLEY COTTAGE, NY / ACCESSWIRE / March 25, 2022 / CreditRiskMonitor (OTCQX:CRMZ) reported that operating revenues for the year ended December 31, 2021 increased to approximately

Mike Flum, President & COO, said, "2021's strong economic conditions coupled with robust liquidity afforded by security markets and trade credit has reduced the U.S. public company bankruptcy rate to approximately

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (https://www.creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

Our subscribers, including more than

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file exceeds

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, President & COO

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/694745/CreditRiskMonitor-Announces-2021-Results