Capella Provides Scandinavian Project Portfolio Update

Rhea-AI Summary

Capella Minerals (TSXV: CMIL, OTCQB: CMILF) has provided an update on its Scandinavian project portfolio, focusing on high-grade copper-cobalt-zinc projects in Norway and copper-gold projects in Finland. The company has:

1. Regained 100% interest in projects in the Løkken and Røros mining districts, Norway.

2. Streamlined its portfolio by divesting non-core assets in the Americas.

3. Planned a drone-based EM survey for the Killero targets in Finland, followed by drilling.

4. Identified 5 priority target areas near the former Løkken mine in Norway.

5. Obtained permits for a 4,000m drill program at the Hessjøgruva project in Norway.

The company aims to advance its Scandinavian projects and evaluate strategic alternatives for drilling at key targets.

Positive

- Regained 100% interest in high-grade copper-cobalt-zinc projects in Norway

- Streamlined project portfolio by divesting non-core assets

- Planned drone-based EM survey for Killero targets in Finland

- Identified 5 priority target areas near former Løkken mine in Norway

- Obtained permits for 4,000m drill program at Hessjøgruva project in Norway

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, CMILF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

The Company's project portfolio was also streamlined during H1, 2024, with the divestiture of two non-core assets in the

Northern Finland Copper-Gold Project (

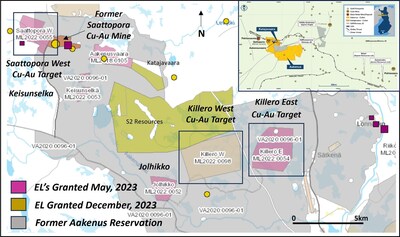

Capella's Northern Finland Copper-Gold Project consists of 5 exploration licenses ("EL's) with granted drill permits, and is located in the world-class metallogenic province of the Central Lapland Greenstone Belt ("CLGB") (Figure 1). The portfolio consists of the priority Killero E and Killero W targets (former Anglo American plc Base of Till – or "BoT" - copper-gold geochemical anomalies which were never drill tested), Saattopora W (the interpreted western extension of Outokumpu Oy's former Saattopora copper-gold mine), and two conceptual gold and copper targets (Keisunselka and Jolhikko)(see Company News Release dated December 5, 2023).

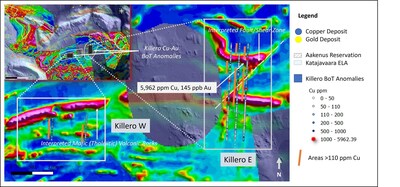

The Company's priority targets for drill testing are the Killero E and W targets, in addition to the Saattopora W target. At Killero E and W, the Company is planning to trial a drone-based electromagnetic ("EM") survey over the main BoT copper-gold anomalies in late summer with a view to better-defining sulfide-rich areas for priority drill testing (Figure 2). A maiden core drilling program is then expected to be undertaken when winter conditions again provide the frozen ground necessary for impact-free access to the project area.

At Saattopora W, relogging and resampling of available drill core from historical scout drilling was completed at the Finnish Geological Survey's ("GTK") core storage facility in Loppi, southern

Both Jolhikko (interpreted gold and copper targets within a complex deformation zone) and Keisunselka (interpreted gold targets hosted in faulted mafic volcanic rocks) are conceptual targets with little or no surface exposure. Accordingly, the Company expects to undertake reconnaissance BoT sampling over these areas during the 2024/2025 winter season.

Figure 1. Key targets in the Northern Finland Copper-Gold project.

Figure 2. Base of Till copper-gold anomalies at Killero overlain on drone magnetic survey data.

Norwegian Copper-Cobalt-Zinc VMS assets (

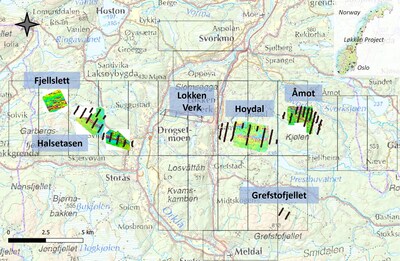

Capella's focus in central

Figure 3. Key targets at the Løkken copper-cobalt-zinc project. Areas of completed ground magnetic surveys and soil grids are also indicated.

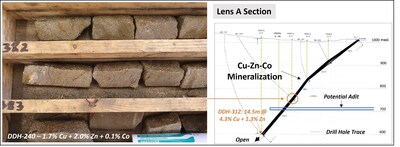

At the advanced exploration-stage Hessjøgruva copper-cobalt-zinc project, located in the northern Røros district, permits are currently in hand for a 4,000m / 8 hole drill program at the Hessjøgruva A Lens. This proposed drill program consists of both infill and step-out drilling and has been designed on the back of date derived from 12,035m of historical drilling plus new data acquired for the Canadian National Instrument 43-101 ("NI 43-101") technical report as filed by the Company on September 8, 2022 (Figure 4). The central Hessjøgruva project is also surrounded by additional Capella claims which cover the majority of the adjacent Nordgruve mining district, and which also includes a former copper concentrate processing facility at Kongensgruve.

Figure 4. High-grade copper-cobalt-zinc mineralization at Hessjøgruva and long section of main mineralized horizon.

1 Historic production values quoted for Løkken are from Grenne T, Ihlen PM, Vokes FM (1999) Scandinavian Caledonide metallogeny in a plate-tectonic perspective. Mineral Deposita 34:422–471. Capella has not performed sufficient work to verify the published data reported above, but the Company believes this information to be considered reliable and relevant. |

Eric Roth, Capella's President and CEO, commented: "Capella owns a compelling portfolio of copper-gold and copper-cobalt-zinc projects in the mining friendly jurisdictions of northern

In parallel, Capella's strategy of divesting its assets in the

On Behalf of the Board of Capella Minerals Ltd.

"Eric Roth"

___________________________

Eric Roth, Ph.D., FAusIMM

President & CEO

About Capella Minerals Ltd

Capella is a Canadian exploration and development company with a focus on copper-gold projects in the Central Lapland Greenstone Belt of northern

In northern

In the Trøndelag province of central

Capella holds equity positions in Teako Minerals (CSE: TMIN), Prospector Metals (TSXV: PPP), European Energy Metals (TSXV: FIN), and Unico Silver (ASX: USL) as a direct result of the recent divestiture of non-core assets. Capella also retains direct participation (

Cautionary Notes and Forward-looking Statements

This news release contains forward-looking information within the meaning of applicable securities legislation. Forward-looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Such statements include, without limitation, statements regarding the future results of operations, performance and achievements of Capella, including the timing, completion of and results from the exploration and drill programs described in this release. Although the Company believes that such statements are reasonable, it can give no assurances that such expectations will prove to be correct. All such forward-looking information is based on certain assumptions and analyses made by Capella in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. This information, however, is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Important factors that could cause actual results to differ from this forward-looking information include those described under the heading "Risks and Uncertainties" in Capella's most recently filed MD&A. Capella does not intend, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this news release, except as required by law. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/capella-provides-scandinavian-project-portfolio-update-302202383.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/capella-provides-scandinavian-project-portfolio-update-302202383.html

SOURCE Capella Minerals Limited