Calyxt Reports Fourth Quarter and Full Year 2020 Financial Results

Rhea-AI Summary

Calyxt (NASDAQ:CLXT) reported a revenue increase of 270% year-over-year, reaching $13.9 million in Q4 2020, attributed to grain sales. The net loss for Q4 was $13.4 million, slightly higher than Q4 2019. The company secured a commitment from ADM for its remaining 2020 grain production and executed a licensing agreement with S&W Seed Company for its alfalfa product. Calyxt's cash position improved to $30 million, including a $14 million capital raise. Its go-to-market strategies focus on seed sales, trait development, and licensing, positioning it for growth across multiple agricultural markets.

Positive

- Revenue grew 270% to $13.9 million in Q4 2020.

- Secured commitment from ADM for 2020 grain production.

- Completed a $14 million capital raise, enhancing cash runway.

Negative

- Net loss increased to $13.4 million in Q4 2020.

- Gross margin remained negative at $4.9 million in Q4 2020.

News Market Reaction 1 Alert

On the day this news was published, CLXT declined 17.81%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Continued to Progress Development of Winter Oats and Hemp, Both Targeted at Large Addressable Markets

Secured Commitment from ADM to Purchase Remaining 2019 Grain Inventory and All 2020 Grain Production - Have Completed Sale of 40 Percent of 2020 Grain Crop

Executed Commercial Agreement with S&W Seed Company on IQ™ Alfalfa Product, Marking Calyxt's First Trait License Agreement

Management to Host Conference Call Today at 4:30 p.m. ET

ROSEVILLE, MN / ACCESSWIRE / March 4, 2021 / Calyxt, Inc. (NASDAQ:CLXT), a plant-based technology company, has reported its financial results for the fourth quarter and full year ended December 31, 2020.

Commentary & Key Accomplishments

"I am excited to step in and lead Calyxt at this time," said Yves Ribeill, Ph.D., executive chairman. "On behalf of the Board, we want to thank Jim Blome for guiding Calyxt to a streamlined business model that can capitalize on delivering disruptive, plant-based innovations. He led Calyxt to a strong 2020, redirected Calyxt's innovation engine toward new and high-value opportunities and built a team with the right talent mix to drive Calyxt's go-to-market strategies, positioning Calyxt for growth - we wish Jim all the best in his future pursuits. This action represents a continuing step to focus Calyxt on significant innovation opportunities beyond commodity-based agriculture," concluded Dr. Ribeill.

"The fourth quarter of 2020 and early 2021 was marked by several major achievements that will drive Calyxt's performance and demand our focus over the next several quarters," said Bill Koschak, CFO of Calyxt.

The key 2020 accomplishments include:

- Continued development of our winter oat projects, which target the growing food and feed oat markets as well as for use as an alternate-season cover crop. We believe our oat projects could support climate resilience, making oats more competitive economically and able to be grown in new regions of the continent, and over the longer term, in additional regions of the world. Projects in oats are expected to deliver sustainability benefits once they become available for commercialization, expected as soon as 2026.

- Continued development of our projects in hemp, which target the protein, nutraceutical, fiber, and advanced materials markets. Our first efforts are focused on standardizing the crop for broad acre adoption and modernizing the breeding process. Projects in hemp are expected to provide benefits to growers and others in the crop's supply chain once they become available for commercialization, expected as soon as 2024.

- Securing a commitment from ADM to purchase our entire high oleic soybean 2020 grain production. As of today, we have sold 40 percent of the 2020 grain crop to ADM, with the remaining grain projected to be sold throughout 2021.

- An initial validation of Calyxt's product development and trait licensing go-to-market strategy with the execution of a trait license agreement for Calyxt's alfalfa product candidate to S&W Seed Company. This agreement represents an important milestone in the execution of Calyxt's go-to-market strategies, and it also demonstrates Calyxt's ability to work collaboratively, choose traits to enhance value, perform the research and development to ensure success, and support a large partner in bringing advanced plant science to market.

- The fortification of the balance sheet through the completion of a capital raise that netted Calyxt

$14.0 million of proceeds and extended the company's cash runway into the second half of 2022.

2021 subsequent events include:

- Entered into an agreement with Perdue AgriBusiness, an independent operating unit of Perdue Farms, ranked among the largest grain companies in the U.S., for the sale of soybean seed in 2021 that meets Perdue's growing region specifications.

- Appointed Yves Ribeill, Ph.D. as Executive Chair to serve in this role while Calyxt undertakes a search for a new CEO to replace Jim Blome.

- Completed appointments of world-renowned plant-biochemistry experts including Anne Osbourn, Ph.D., Group Leader at the John Innes Center; Elizabeth Sattely, Ph.D., HHMI Investigator and Associate Professor of Chemical Engineering at Stanford University; and Paul Bernasconi, Ph.D., Former Global Function Head for Molecular Biology at BASF Biosciences, to new Scientific Advisory Board chaired by Calyxt Co-Founder Dan Voytas, Ph.D. The Calyxt Scientific Advisory Board will focus on the identification of product candidates with the potential to be valuable disrupters to their target markets.

"In August, we announced our three go-to-market strategies that greatly reduced the investment required to bring product candidates to market," said Koschak. Those strategies are seed sales, trait development and technology licensing. Our trait license with S&W Seed Company and our seed sale agreement with Perdue AgriBusiness are two great examples of those go-to-market strategies at work."

Current Development Pipeline

We have nine projects at Phase 1 Stage or later in development across alfalfa, hemp, oats, soybeans, and wheat.

CROP | DEVELOPMENT PHASE | TRAIT1 | TARGET COMMERCIAL PLANTING YEAR | TARGET GO-TO-MARKET STRATEGY |

Alfalfa | Phase 3 | Improved Digestibility | 2021 | Trait |

Wheat | Phase 3 | High Fiber | 2023 | Trait |

Soybean | Phase 2 | High Oleic, Low Linolenic (HOLL) | 2023 | Seed |

Hemp | Phase 1 | Marketable Yield | 2023 | Seed or Trait |

Hemp | Phase 1 | Low THC for Food, Fiber, & Nutraceutical | 2024 | Seed or Trait |

Oat | Phase 1 | Winter (Cold Tolerant) | 2026 | Seed or Trait |

Soybean | Phase 2 | Improved HOLL | 2026 | Seed or Trait |

Soybean | Phase 1 | High Saturated Fat | 2026 | Seed or Trait |

Soybean | Phase 1 | Enhanced Protein Flavor | 2027 | Trait |

1The agronomic and functional quality of our product candidates and the timing of development are subject to a variety of factors and risks, which are described in our filings with the Securities and Exchange Commission.

Calyxt is also actively negotiating agreements with potential partners with respect to specific opportunities for which development activities would only commence upon reaching a definitive agreement. These projects are not included in the preceding table.

Other Full Year 2020 Operational Highlights

- Patent portfolio continued to grow with 10 new patents issued, including patents covering the use of TALEN and CRISPR gene editing technologies in plants, and multiple new patent applications were filed.

- Collaborated with NRGene® to advance product pipeline, including adoption of NRGene's cloud-based genomics platform to allow for more comprehensive evaluations to accelerate trait discovery and breeding across multiple crops.

- Appointed Sarah Reiter as Vice President of Business Development focusing on establishing world-class partnerships and value chains that lead to the successful commercialization of emerging technologies for companies of all sizes.

- Calyxt's HOLL soybean was deemed a non-regulated article under the "Am I Regulated?" process by the Biotechnology Regulatory Services of the Animal and Plant Health Inspection Service (APHIS), an agency of the United States Department of Agriculture (USDA). This product represents our second-generation high oleic soybean.

- Released our non-edited hemp germplasm by selling plants directly to a grower, driving several thousand dollars of revenue. This quick commercial success is an early step in making our hemp projects partner-ready, enabled the gathering of valuable insights and data, and is expected to serve as the base germplasm for the development of other hemp projects expected to launch as early as 2023.

- Licensed a new method to help increase product development efficiency from the University of Minnesota. The method has the potential to reduce the time needed to edit plants from approximately one year to several months.

- Appointed Bobby Williams, Ph.D. to the newly created role of Director of Gene Editing to further expand Calyxt's innovation, product pipeline, and trait discovery efforts and inform product advancement decisions.

Summary

"To enable us to retain our focus as a technology company with product concepts targeted at large addressable markets, we advanced the go-to-market strategy for our soybean product line and subsequently sold 40 percent of our 2020 grain production to ADM," said Dr. Ribeill. We believe this advancement will enable us to accelerate growth through partners for soybean products versus the pace of cash generation we could have achieved on our own. Today, we see immense opportunities across our portfolio, including in food, nutraceutical, energy, and agriculture. Our plan is to develop projects with partners that leverage our strengths in trait development and gene editing and our partners' product commercialization expertise. Discussions with potential partners have focused on our development of plant-based input solutions for specific downstream issues, including consumer preferences, sustainability, cost, quality, and regulatory compliance. We believe the necessary steps made in 2020 now strategically position Calyxt for growth and delivery of shareholder value in the years to come."

Fourth Quarter Financial Highlights

- Revenue was

$13.9 million in the fourth quarter of 2020, an increase of$10.2 million , or 270 percent, from$3.8 million in the fourth quarter of 2019. The revenue growth was driven by sales of grain in fourth quarter of 2020, as well as the liquidation of all soybean oil and meal inventories. The sales of grain in the fourth quarter of 2020 were$11.8 million and represent approximately 40 percent of the 2020 grain crop.

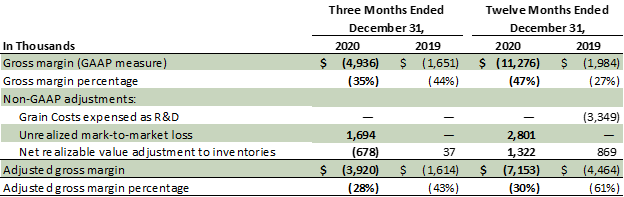

- Gross margin was a negative

$4.9 million , or a negative 35 percent, in the fourth quarter of 2020, a decrease of$3.3 million from$1.7 million , or a negative 44 percent, in the fourth quarter of 2019. Gross margin percentage improved by 900 basis points year-over-year. The improvement in gross margin percentage in the fourth quarter of 2020 reflects the impact of our change in go-to-market strategy for the soybean product line and a reduction in net realizable value adjustments to inventories of$0.5 million , partially offset by$1.7 million of unrealized losses on commodity derivatives from hedging contracts sold to convert our fixed price grain inventories and fixed price Forward Purchase Contracts to floating prices, consistent with how we expect to sell the grain.

- Adjusted gross margin was negative

$3.9 million , or negative 28 percent, in the fourth quarter of 2020, as compared to negative$1.6 million , or negative 43 percent, in the fourth quarter of 2019. The 1,500 basis point improvement was driven by the impact of our change in go-to-market strategy for the soybean product line.

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted gross margin and a reconciliation of gross margin, the most comparable GAAP measure, to adjusted gross margin.

- Total operating expenses were

$8.1 million in the fourth quarter of 2020, a decrease of$2.2 million , or 22 percent, from$10.3 million in the fourth quarter of 2019, driven by operating expense declines from the change in go-to-market strategy for our soybean product line and other operating expense reductions in General & Administrative expenses, partially offset by restructuring costs of$0.2 million . Restructuring costs include the impact of severance and other expenses resulting from the action we initiated in August 2020 to advance our soybean product line go-to-market strategy. We do not anticipate any further restructuring costs from this action.

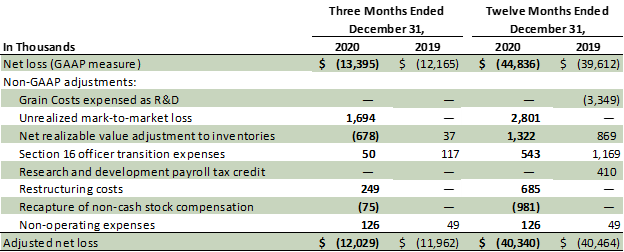

- Net loss was

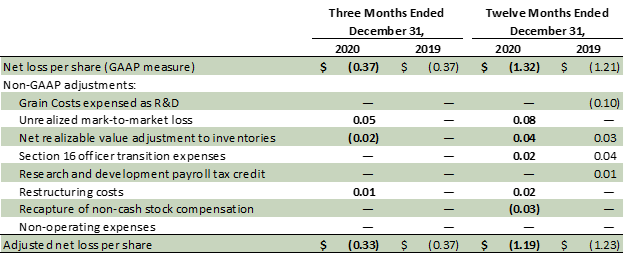

$13.4 million in the fourth quarter of 2020, an increase of$1.2 million , or 10 percent, from$12.2 million in the fourth quarter of 2019. The increase was driven by the increase in negative gross margin partially offset by the decline in operating expenses. Net loss per share was$0.37 in the fourth quarter of 2020, equal to the net loss per share in the fourth quarter of 2019, as the higher net loss was offset by higher weighted average shares from our successful capital raise in the fourth quarter of 2020.

Adjusted net loss was

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted net loss and adjusted net loss per share, and reconciliations of net loss and net loss per share, the most comparable GAAP measures, to adjusted net loss and adjusted net loss per share.

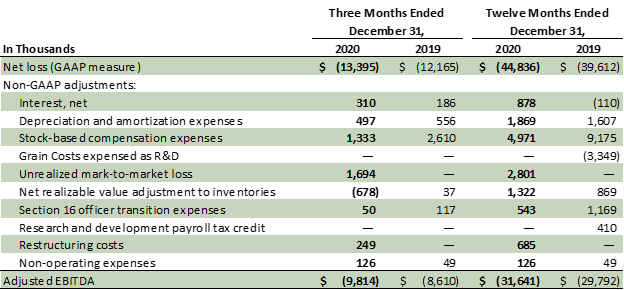

- Adjusted EBITDA loss was

$9.8 million in the fourth quarter of 2020, an increase of$1.2 million , or 14 percent, from$8.6 million in the fourth quarter of 2019. The increase was driven by the change in net loss.

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted EBITDA and a reconciliation of net loss, the most comparable GAAP measure, to adjusted EBITDA.

- Net cash provided was

$9.7 million in the fourth quarter of 2020, an increase of$17.6 million , from net cash used of$7.9 million in the fourth quarter of 2019. The increase was driven by$14.0 million of net proceeds from our capital raise in the fourth quarter of 2020 and$9.1 million of proceeds from the sale of short-term investments, partially offset by a$2.8 million net increase in cash flows used by operating assets and liabilities, primarily from activity related to our soybean product line, a$1.2 million increase in net loss, and a$1.3 million decrease in non-cash stock compensation expense. As of this date, we collected nearly all of our year-end accounts receivable.

- Cash, cash equivalents, short-term investments, and restricted cash totaled

$30.0 million as of December 31, 2020.

Fiscal Year 2020 Financial Highlights

- Revenue was

$23.9 million in 2020, an increase of$16.6 million , or 227 percent, from$7.3 million in 2019. The revenue growth was driven by the sale of a substantial portion of the 2020 grain crop and the completion of the sale of all soybean oil and meal during 2020. The sales of grain in 2020 were$13.0 million and included all remaining 2019 grain and seed and represent approximately 40 percent of the 2020 grain crop.

- Gross margin was a negative

$11.3 million , or negative 47 percent, in 2020, a decrease of$9.3 million from$2.0 million , or negative 27 percent, in 2019. Gross margin percentage declined by 2,008 basis points year-over-year. The decline in gross margin percentage in 2020 was driven by the higher volume of product sold, the impact of lower costs associated with products sold in 2019 because$3.3 million of Grain Costs were previously expensed as R&D,$2.8 million of unrealized commodity derivative losses from futures contracts sold to hedge our fixed price grain inventory and fixed price Forward Purchase Contracts, and a$1.3 million increase in our net realizable value adjustment to period-end inventories including write-downs of excess seed produced for 2020 plantings. These increases were partially offset by higher selling prices and benefits from the advancement of our soybean product line go-to-market strategy.

- Adjusted gross margin was negative

$7.2 million , or negative 30 percent, in 2020, compared to negative$4.5 million , or negative 61 percent, in 2019. The improvement on a percentage basis was driven by savings from the advancement of our soybean product line go-to-market strategy.

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted gross margin and a reconciliation of gross margin, the most comparable GAAP measure, to adjusted gross margin.

- Total operating expenses were

$32.6 million in 2020, a decrease of$5.1 million , or 14 percent, from$37.7 million in 2019, driven by operating expense declines from the change in go-to-market strategy for our soybean product line including$1.0 million from the recapture of non-cash stock compensation expense from the forfeiture and modification of unvested stock awards, lower stock compensation expense from fewer awards and lower award values, and other operating expense reductions in General & Administrative expenses, partially offset by restructuring costs of$0.7 million . Restructuring costs include the impact of severance and other expenses resulting from the action we initiated in August 2020 to advance our soybean product line go-to-market strategy. We do not anticipate any further restructuring costs from this action. The same period in 2019 also included$0.4 million of expense to write off R&D tax credits that were no longer realizable.

- Net loss was

$44.8 million in 2020, an increase of$5.2 million , or 13 percent, from$39.6 million in 2019. The increase was driven by the increase in negative gross margin partially offset by the decline in operating expenses. Net loss per share was$1.32 in 2020, an increase of$0.11 per share from a net loss per share of$1.21 in 2019, driven by the higher net loss.

- Adjusted net loss was

$40.3 million in 2020, essentially flat with$40.5 million in 2019. Adjusted net loss per share was$1.19 in 2020, an improvement of$0.04 per share from an adjusted net loss per share of$1.23 in 2019 driven by higher weighted average shares from our successful capital raise in the fourth quarter of 2020.

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted net loss and a reconciliation of net loss, the most comparable GAAP measure, to adjusted net loss.

- Adjusted EBITDA loss was

$31.6 million in 2020, an increase of$1.8 million , or 6 percent, from$29.8 million in 2019. The increase was driven by the change in net loss.

See below under the heading "Use of Non-GAAP Financial Information" for a discussion of adjusted EBITDA and a reconciliation of net loss, the most comparable GAAP measure, to adjusted EBITDA.

- Net cash used was

$41.7 million in 2020, an increase of$6.4 million from$35.3 million in 2019. The increase was driven by the purchase of$11.7 million of short-term investments, the increase in net loss, a$4.2 million decrease in non-cash stock compensation expense, and an increase in cash flows used by operating assets and liabilities of$4.2 million , primarily from activity related to our soybean product line. These drivers were partially offset by$14.0 million of net proceeds from our capital raise.

CFO Summary

"From a cash perspective the fourth quarter of 2020 was highlighted by the significant progress we made transitioning our soybean products to a seed go-to-market strategy, our capital raise, and achieving planned reductions in operating expenses," said Koschak.

"We completed the sale of all soybean oil and meal, exited nearly all soybean processing and transportation contracts, and sold approximately 40 percent of the 2020 grain crop. Our 2021 seed production is complete, and we are anticipating the sale of seed in 2021 based on what we have available that matches our potential customers' targeted growing regions."

"During the fourth quarter we completed a capital raise with net proceeds of

"Our operating expenses also declined in the fourth quarter, as a result of the benefits of the soybean transition and other actions we have taken to reduce costs to our targeted 2021 operating expense cash burn rate of

Fourth Quarter and Full Year 2020 Results Conference Call

Executive Chair Yves Ribeill, Ph.D. and Chief Financial Officer Bill Koschak will host the conference call, followed by a question-and-answer session. The conference call will be accompanied by a presentation, which can be viewed during the webcast or accessed via the investor relations section of Calyxt's website here.

To access the call, please use the following information:

Date: | Thursday, March 4, 2021 |

Time: | 4:30 p.m. EST, 1:30 p.m. PST |

Toll Free dial-in number: | 1-877-407-0789 |

Toll/International dial-in number: | 1-201-689-8562 |

Conference ID: | 13715392 |

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have difficulty connecting with the conference call, please contact MZ Group at +1 (949) 491-8235.

The conference call will be broadcast live and available for replay at http://public.viavid.com/index.php?id=143127 and via the investor relations section of Calyxt's website here.

A replay of the call will be available for one month following the conference.

Toll Free Replay Number: | 1-844-512-2921 |

International Replay Number: | 1-412-317-6671 |

Replay ID: | 13715392 |

About Calyxt:

Calyxt (NASDAQ: CLXT), based in Roseville, Minnesota, is a technology company with a mission to deliver plant-based innovations for a better world. Founded in 2010, Calyxt uses its proprietary TALEN® gene editing technology to work with world-class partners via technology licensing, product development, and seed sale arrangements to revolutionize the way the world uses plants to solve problems. For further information, please visit our website at www.calyxt.com.

Calyxt Media Contact:

Trina Lundblad, Director of Corporate Communications

(612) 790-0514

media@calyxt.com

Calyxt Investor Relations Contact:

Chris Tyson, Managing Director

MZ Group - MZ North America

(949) 491-8235

CLXT@mzgroup.us

www.mzgroup.us

USE OF NON-GAAP FINANCIAL INFORMATION

To supplement our audited financial results prepared in accordance with GAAP, we have prepared certain non-GAAP measures that include or exclude special items. These non-GAAP measures are not meant to be considered in isolation or as a substitute for financial information presented in accordance with GAAP and should be viewed as supplemental and in addition to our financial information presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures. In addition, other companies may report similarly titled measures, but calculate them differently, which reduces their usefulness as a comparative measure. Management utilizes these non-GAAP metrics as performance measures in evaluating and making operational decisions regarding our business.

We present adjusted gross margin, non-GAAP measure that includes the effects of Grain Costs expensed as R&D in a prior period, excludes the effects of commodity derivatives entered into to hedge the change in value of fixed price grain inventories and fixed price Forward Purchase Contracts as the expected impact from these contracts will be fully offset when the underlying grain is sold, and excludes the impact of any net realizable value adjustments to inventories occurring in the period, which would otherwise have been recorded as an adjustment to value in a prior period or would have been recorded in a future period as the underlying products are sold.

We provide in the table below a reconciliation of adjusted gross margin to gross margin, which is the most directly comparable GAAP financial measure. We provide adjusted gross margin because we believe that this non-GAAP financial metric provides investors with useful supplemental information at this stage of commercialization as the amounts being adjusted affect the period-to-period comparability of our gross margins and financial performance.

The table below presents a reconciliation of gross margin to adjusted gross margin:

We present adjusted net loss, a non-GAAP measure, and define it as net loss including the effects of Grain Costs expensed as R&D in a prior period, and excluding the effects of commodity derivatives entered into to hedge the change in value of fixed price grain inventories and fixed price Forward Purchase Contracts as the expected impact from these contracts will be fully offset when the underlying grain is sold, any net realizable value adjustments to inventories occurring in the period, which would otherwise have been recorded as an adjustment to value in a prior period or would have been recorded in a future period as the underlying products are sold, Section 16 officer transition expenses, R&D payroll tax credits that are no longer realizable, restructuring costs, the recapture of non-cash stock compensation expense from the forfeiture and modification of unvested stock awards associated with staffing adjustments made as part of the advancement of our soybean business model, and non-operating expenses, which are primarily gains and losses on foreign exchange transactions and losses on the disposals of land, building, and equipment.

We provide in the table below a reconciliation of adjusted net loss to net loss, which is the most directly comparable GAAP financial measure. We provide adjusted net loss because we believe that this non-GAAP financial metric provides investors with useful supplemental information at this stage of commercialization as the amounts being adjusted affect the period-to-period comparability of our net losses and financial performance.

The table below presents a reconciliation of net loss to adjusted net loss:

We present adjusted net loss per share, a non-GAAP measure, and define it as net loss per share including the effects of Grain Costs expensed as R&D in a prior period, and excluding the effects of commodity derivatives entered into to hedge the change in value of fixed price grain inventories and fixed price Forward Purchase Contracts as the expected impact from these contracts will be fully offset when the underlying grain is sold, any net realizable value adjustments to inventories occurring in the period, which would otherwise have been recorded as an adjustment to value in a prior period or would have been recorded in a future period as the underlying products are sold, Section 16 officer transition expenses, R&D payroll tax credits that are no longer realizable, restructuring costs, the recapture of non-cash stock compensation expense from the forfeiture and modification of unvested stock awards associated with staffing adjustments made as part of the advancement of our soybean business model, and non-operating expenses, which are primarily gains and losses on foreign exchange transactions and losses on the disposals of land, buildings, and equipment.

We provide in the table below a reconciliation of adjusted net loss per share to net loss per share, which is the most directly comparable GAAP financial measure. We provide adjusted net loss per share because we believe that this non-GAAP financial metric provides investors with useful supplemental information at this stage of commercialization as the amounts being adjusted affect the period-to-period comparability of our net losses per share and financial performance.

The table below presents a reconciliation of net loss per share to adjusted net loss per share:

We present adjusted EBITDA, a non-GAAP measure and define it as net loss excluding interest, net, income tax expense, depreciation and amortization expenses, stock-based compensation expenses, the effects of commodity derivatives entered into to hedge the change in value of fixed price grain inventories and fixed price Forward Purchase Contracts as the expected impact from these contracts will be fully offset when the underlying grain is sold, any net realizable value adjustments to inventories occurring in the period, which would otherwise have been recorded as an adjustment to value in a prior period or would have been recorded in a future period as the underlying products are sold, Section 16 officer transition expenses, R&D payroll tax credits that are no longer realizable, restructuring costs, and non-operating expenses, which are primarily gains and losses on foreign exchange transactions and losses on the disposals of land, buildings, and equipment; and including the effects of Grain Costs expensed as R&D in a prior period.

We provide in the table below a reconciliation of adjusted EBITDA to net loss, which is the most directly comparable GAAP financial measure. Because adjusted EBITDA excludes non-cash items and discrete or infrequently occurring items, we believe that adjusted EBITDA provides investors with useful supplemental information about the operational performance of our business and facilitates comparison of our financial results between periods where certain items may vary significantly independent of our business performance.

The table below presents a reconciliation of net loss to adjusted EBITDA:

Forward-Looking Statements

This communication contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as "anticipates," "believes," "continue," "estimates," "expects," "targets," "intends," "may," "might," "plans," "potential," "predicts," "projects," "should," or "will," the negative of these terms and other similar terminology. Forward-looking statements in this press release include statements about the potential impact of the COVID-19 pandemic on our business and operating results; our future financial performance; product pipeline and development; our business model and strategies for commercialization and sales of commercial products; regulatory progression; potential collaborations, partnerships and licensing arrangements and their contribution to our financial results, cash usage, and growth strategies, including with respect to potential revenue from royalties relating to our improved quality alfalfa; and anticipated trends in our business. These and other forward-looking statements are predictions and projections about future events and trends based on our current expectations, objectives and intentions and premised on current assumptions. Our actual results, level of activity, performance, or achievements could be materially different than those expressed, implied, or anticipated by forward-looking statements due to a variety of factors, including, but not limited to: the severity and duration of the evolving COVID-19 pandemic and the resulting impact on macro-economic conditions; the impact of increased competition, including with respect to enhanced quality alfalfa; disruptions at our or our collaborators' key facilities; changes in customer preferences and market acceptance of our or our partners' products, including our improved quality alfalfa; competition for collaboration partners and licensees and the successful execution of collaborations and licensing agreements; the impact of adverse events during development, including unsuccessful field trials or development trials or disruptions in seed production; the impact of improper handling of our product candidates by unaffiliated third parties during development, such as the improper aerial spraying of our high fiber wheat product candidate; failures by third-party contractors; inaccurate demand forecasting, including with respect to sales projections used by Calyxt management in determining potential license revenues; the effectiveness of commercialization efforts by commercial partners or licensees; our ability to make grain sales on terms acceptable to us; the timing of our grain sales; our ability to collect accounts receivable; disruptions to supply chains, including transportation and storage functions; commodity price conditions; the impact of changes or increases in oversight and regulation; disputes or challenges regarding intellectual property; proliferation and continuous evolution of new technologies; management changes; dislocations in the capital markets; and other important factors discussed under the caption entitled "Risk Factors" in our Annual Report on Form 10-K and subsequent filings on Form 10-Q or 8-K with the U.S. Securities and Exchange Commission. Any forward-looking statements made by us are based only on information currently available to us when, and speaks only as of the date, such statement is made. Except as otherwise required by securities and other applicable laws we do not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change.

CALYXT, INC.

CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Par Value and Share Amounts)

| December 31, 2020 | December 31, 2019 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 17,299 | $ | 58,610 | ||||

Short-term investments | 11,698 | - | ||||||

Restricted cash | 393 | 388 | ||||||

Accounts receivable | 4,887 | 1,122 | ||||||

Due from related parties | - | - | ||||||

Inventory | 1,383 | 2,594 | ||||||

Prepaid expenses and other current assets | 3,930 | 808 | ||||||

Total current assets | 39,590 | 63,522 | ||||||

Non-current restricted cash | 597 | 1,040 | ||||||

Land, buildings, and equipment | 22,860 | 23,212 | ||||||

Other non-current assets | 280 | 324 | ||||||

Total assets | $ | 63,327 | $ | 88,098 | ||||

Liabilities and stockholders' equity | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 929 | $ | 1,077 | ||||

Accrued expenses | 2,891 | 2,544 | ||||||

Accrued compensation | 1,950 | 2,181 | ||||||

Due to related parties | 766 | 977 | ||||||

Current portion of financing lease obligations | 364 | 356 | ||||||

Other current liabilities | 45 | 61 | ||||||

Total current liabilities | 6945 | 7,196 | ||||||

Financing lease obligations | 17,876 | 18,244 | ||||||

Long-term debt | 1,518 | - | ||||||

Other non-current liabilities | 113 | 150 | ||||||

Total liabilities | 26,452 | 25,590 | ||||||

Stockholders' equity: | ||||||||

Common stock, shares outstanding as of December 31, 2019 | 4 | 3 | ||||||

Additional paid-in capital | 204,807 | 185,588 | ||||||

Common stock in treasury, at cost, 100,152 shares as of December 31, 2020, and 82,360 as of December 31, 2019 | (1,043) | (1,043 | ) | |||||

Accumulated deficit | (166,893) | (122,057 | ) | |||||

Accumulated other comprehensive income (loss) | - | 17 | ||||||

Total stockholders' equity | 36,875 | 62,508 | ||||||

Total liabilities and stockholders' equity | $ | 63,327 | $ | 88,098 | ||||

CALYXT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Three Months Ended December 31 Unaudited)

(In Thousands Except Shares and Per Share Amounts)

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

Revenue | $ | 13,926 | $ | 3,764 | $ | 23,851 | $ | 7,296 | ||||||||

Cost of goods sold | 18,862 | 5,415 | 35,127 | 9,280 | ||||||||||||

Gross margin | (4,936) | (1.651 | ) | (11,276) | (1,984 | ) | ||||||||||

| Operating Expenses: | ||||||||||||||||

Research and development | 3,266 | 3,677 | 11,082 | 12,213 | ||||||||||||

Selling and supply chain | 1,012 | 1,752 | 4,380 | 5,172 | ||||||||||||

General and administrative | 3,444 | 4,664 | 16,157 | 18,966 | ||||||||||||

Management fees | 80 | 221 | 252 | 1,338 | ||||||||||||

| Restructuring costs | 249 | - | 685 | - | ||||||||||||

Total operating expenses | 8,051 | 10,314 | 32,556 | 37,689 | ||||||||||||

Loss from operations | (12,987) | (11,965 | ) | (43,832) | (39,673 | ) | ||||||||||

Interest, net | (310) | (186 | ) | (878) | 110 | |||||||||||

Non-operating expenses | (98) | (14 | ) | (126) | (49 | ) | ||||||||||

Loss before income taxes | (13,395) | (12,165 | ) | (44,836) | (39,612 | ) | ||||||||||

Income taxes | - | - | - | - | ||||||||||||

Net loss | $ | (13,395) | $ | (12,165 | ) | $ | (44,836) | $ | (39,612 | ) | ||||||

Basic and diluted loss per share | $ | (0.37) | $ | (0.37 | ) | $ | (1.32) | $ | (1.21 | ) | ||||||

Weighted average shares outstanding - basic and diluted | 36,282,974 | 32,943,636 | 33,882,406 | 32,805,684 | ||||||||||||

CALYXT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| Year Ended December 31, | ||||||||||||

| 2020 | 2019 | 2018 | ||||||||||

Operating activities | ||||||||||||

Net loss | $ | (44,836) | $ | (39,612 | ) | $ | (27,897 | ) | ||||

Adjustments to reconcile net loss to net cash used by operating activities: | ||||||||||||

Depreciation and amortization | 1,869 | 1,607 | 1,081 | |||||||||

Stock-based compensation | 4,971 | 9,175 | 4,385 | |||||||||

Changes in operating assets and liabilities: | ||||||||||||

Accounts receivable | (3,765) | (1,122 | ) | - | ||||||||

Due to/from related parties | (211) | (882 | ) | 676 | ||||||||

Inventory | 1,211 | (2,594 | ) | - | ||||||||

Prepaid expenses and other current assets | (3,122) | 493 | (726 | ) | ||||||||

Accounts payable | (148) | 259 | (118 | ) | ||||||||

Accrued expenses | 347 | 537 | 985 | |||||||||

Accrued compensation | (231) | 876 | 360 | |||||||||

Other current liabilities | (70) | (670 | ) | 940 | ||||||||

Other | 313 | (18 | ) | 112 | ||||||||

Net cash used by operating activities | (43,672) | (31,951 | ) | (20,202 | ) | |||||||

Investing activities | ||||||||||||

Purchases of land, buildings, and equipment | (1,786) | (2,969 | ) | (1,847 | ) | |||||||

Short-term investments | (11,698) | - | - | |||||||||

Net cash used by investing activities | (13,484) | (2,969 | ) | (1,847 | ) | |||||||

Financing activities | ||||||||||||

Proceeds from common stock issuance | 15,000 | - | 57,706 | |||||||||

Costs incurred related to the issuance of stock | (963) | - | (665 | ) | ||||||||

Proceeds from Payroll Protection Program loan | 1,518 | - | - | |||||||||

Repayments of financing lease obligations | (360) | (275 | ) | - | ||||||||

Proceeds from the exercise of stock options | 212 | 344 | 2,622 | |||||||||

Costs incurred related to shares withheld for net settlement | - | (813 | ) | (230 | ) | |||||||

Proceeds from sale and leaseback of land, buildings, and equipment | - | 414 | 1,240 | |||||||||

Net cash (used) provided by financing activities | 15,407 | (330 | ) | 60,673 | ||||||||

Net (decrease) increase in cash, cash equivalents and restricted cash | (41,749) | (35,250 | ) | 38,624 | ||||||||

Cash, cash equivalents and restricted cash - beginning of period | 60,038 | 95,288 | 56,664 | |||||||||

Cash, cash equivalents and restricted cash - end of period | $ | 18,289 | $ | 60,038 | $ | 95,288 | ||||||

SOURCE: Calyxt

View source version on accesswire.com:

https://www.accesswire.com/633543/Calyxt-Reports-Fourth-Quarter-and-Full-Year-2020-Financial-Results