Coeur Provides Exploration Update

Company’s largest exploration investment in its history delivering significant new results throughout its portfolio of North American precious metals assets

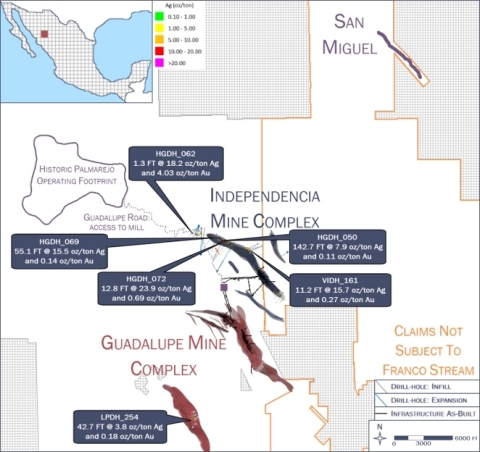

Palmarejo - Plan View (Graphic: Business Wire)

Key Highlights2,3

-

Ongoing drilling success at Palmarejo leading to new high-grade growth – Coeur has been successfully generating results from its infill and expansion drilling campaign within the Independencia and Guadalupe deposits. Specifically, assays across multiple target areas, including the

Hidalgo zone located at the northwest end of Independencia near existing infrastructure, have returned high-grade intercepts that demonstrate significant near-mine growth potential. Key highlights include:

- Hole HGDH_050 returned 142.7 feet (43.5 meters) of 0.11 ounces per ton (“oz/t”) (3.8 grams per tonne (“g/t”)) gold and 7.9 oz/t (270.9 g/t) silver

- Hole HGDH_069 returned 55.1 feet (16.8 meters) of 0.14 oz/t (4.8 g/t) gold and 15.5 oz/t (531.4 g/t) silver

- Hole HGDH_072 returned 12.8 feet (3.9 meters) of 0.69 oz/t (23.7 g/t) gold and 23.9 oz/t (819.4 g/t) silver

North Independencia (Independencia deposit) – Infill

- Hole VIDH_161 returned 11.2 feet (3.4 meters) of 0.27 oz/t (9.3 g/t) gold and 15.7 oz/t (538.3 g/t) silver

- Hole HGDH_062 returned 1.3 feet (0.4 meters) of 4.03 oz/t (138.2 g/t) gold and 18.2 oz/t (624.0 g/t) silver

La Patria zone (Guadalupe deposit) – Infill

- Hole LPDH_254 returned 42.7 feet (13.0 meters) of 0.18 oz/t (6.2 g/t) gold and 3.8 oz/t (130.3 g/t) silver

-

Drilling at

Kensington identifying additional high-grade growth opportunities – Building on late last year’s infill program, Coeur began 2021 by drilling on theElmira vein located approximately 2,700 feet (825 meters) east of the Kensington Main deposit while also testing expansion targets beyondElmira , including theJohnson vein. Coeur’s elevated level of exploration investment atKensington the past two years is intended to extend mine life and generate future potential growth opportunities beyond its existing reserves and resources. Notable assay results include:

- Hole EL21-0850-192-X30 returned 14.6 feet (4.5 meters) of 1.06 oz/t (36.3 g/t) gold

- Hole EL21-0850-192-X23 returned 19.7 feet (6.0 meters) of 0.48 oz/t (16.5 g/t) gold

- Hole EL21-0850-156-X11 returned 10.4 feet (3.2 meters) of 0.81 oz/t (27.8 g/t) gold, 0.8 feet (0.2 meters) of 6.43 oz/t (220.4 g/t) gold and 1.4 feet (0.4 meters) of 1.54 oz/t (53.7 g/t) gold

- Hole JN21-0900-181-X02 returned 1.2 feet (0.4 meters) of 1.31 oz/t (45.7 g/t) gold

- Hole JN21-0900-181-X04 returned 4.3 feet (1.3 meters) of 0.34 oz/t (11.7 g/t) gold

- Hole JN21-0900-181-X05 returned 3.6 feet (1.1 meters) of 0.72 oz/t (24.7 g/t) gold

-

New Southern Silver zone at Silvertip continues to demonstrate growth potential – New surface and underground drilling has discovered a flat-lying “manto” portion of the Southern Silver zone. As highlighted below, the manto appears to be thicker in places than the previously drilled vertical breccia zones interpreted as mineralized feeder structures. After further analysis, the Company believes several other manto-feeder relationships may be present at the Discovery,

Camp Creek and Central zones, and that underground drilling is the best approach to test these types of structures. Notable expansion drilling assay results from the Southern Silver zone manto mineralization include:

-

Hole 65Z21-485-007-005 returned 65.6 feet (20.0 meters) of 2.7 oz/t (92.5 g/t) silver,

16.9% zinc and0.5% lead -

Hole 65Z21-485-DDS1-015 returned 35.4 feet (10.8 meters) of 13.0 oz/t (445.7 g/t) silver,

19.4% zinc and7.5% lead and 17.1 feet (5.2 meters) of 18.0 oz/t (617.1 g/t) silver,7.7% zinc and12.0% lead

-

Positive results from largest drilling campaign at Wharf since acquisition – New significant oxide-gold assays were recently returned from the

Portland Ridge –Boston claim group and Flossie area. Key highlights from the 2021 infill drilling campaign include:

- Hole W21R-4781 returned 120 feet (36.6 meters) of 0.22 oz/t (7.5 g/t) gold

- Hole W21R-4826 returned 200 feet (61.0 meters) of 0.12 oz/t (4.1 g/t) gold

- Hole W21R-4812 returned 40 feet (12.2 meters) of 0.31 oz/t (10.6 g/t) gold

- Hole W21R-4827 returned 70 feet (21.3 meters) of 0.14 oz/t (4.8 g/t) gold

“Our 2021 exploration program accelerated during the summer months with 27 rigs active across six sites,” said Hans J. Rasmussen, Coeur’s Senior Vice President of Exploration. “We remain on-track to deliver the largest exploration campaign in Company history and are regularly setting new monthly drilling records. We expect to complete roughly 1.2 million feet (365,750 meters) of drilling by the end of the year, with the primary objective of further extending mine lives across our portfolio. These goals, along with our track record of consistently growing our reserve and resource base through the drill bit, are true differentiators for Coeur. Assays from both Palmarejo and Silvertip continue to demonstrate significant growth potential, further validating our commitment to a higher-level of exploration investment at each site. The

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/_resources/news/2021-09-09-Exploration-Update.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Palmarejo2,3

Coeur has drilled a total of approximately 149,200 feet (45,475 meters) from up to eight diamond core rigs across six different zones (three infill targets and three expansion targets) through the first seven months of 2021, compared to roughly 118,600 feet (36,150 meters) during the same period in 2020.

Key highlights from the 2021 exploration program include:

- Up to four active rigs (two infill and two expansion)

-

As previously discussed in Coeur’s

February 17, 2021 news release, mineralization typically consists of several vein intercepts creating wide, high-grade “clavos” where mine planning could incorporate larger transverse stopes that support higher production rates - Strategically located near existing mine infrastructure which has the potential to facilitate shorter development time to commence production

- Drill assay intervals have continued to produce the best grade-thickness at Palmarejo since drilling at the historic Clavo 76 prior to 2013

La Patria zone (Guadalupe deposit)

- Infill drilling with one drill rig has continued the exploration program that began in 2020, focusing on areas of historic drilling

- A second rig is currently being mobilized to test expansion targets to the southeast of the current resource area

North Independencia zone (Independencia deposit)

- Once the infill program is completed (currently estimated around mid-2022), Coeur plans to begin expansion drilling further northwest of the current resource limits

Guazapares district (greenfields exploration)

-

Field reconnaissance has identified areas of surface alteration and quartz veining east of Palmarejo in the Guazapares district, which was acquired in 2015 as part of the acquisition of

Paramount Gold and Silver Corp. , sits outside the gold stream area of interest and totals nearly 15,000 hectares. Drill permitting at an initial target area (Carmela) is currently underway with the objective of commencing drilling at this new target by the end of the year

Coeur plans to transition its focus on various resource expansion targets in the remainder of 2021, while also continuing the infill program at the Independencia North,

Palmarejo 2021 Production & Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Production4: 100,000 - 110,000 ounces of gold and 6.5 - 7.8 million ounces of silver

-

2021E

Exploration Investment 1: Approximately$14 million $9 million $5 million - 2020 Proven and Probable Reserves: 849,000 ounces of gold at an average grade of 0.06 oz/t (1.9 g/t) and 59.4 million ounces of silver at an average grade of 3.9 oz/t (132.8 g/t)

- 2020 Measured and Indicated Resources: 613,000 ounces of gold at an average grade of 0.05 oz/t (1.6 g/t) and 51.1 million ounces of silver at an average grade of 3.8 oz/t (130.6 g/t)

-

2020 Inferred Resources: 280,000 ounces of gold at an average grade of 0.06 oz/t (2.2 g/t) and 14.5 million ounces of silver at an average grade of 3.3 oz/t (114.6 g/t)

The 2021 Kensington exploration program started with two underground core rigs focused on infill drilling along the

Additionally, Coeur has drilled the

For the remainder of 2021, Coeur plans to (i) prioritize infill drilling at upper

- 2021E Production4: 115,000 - 130,000 ounces of gold

-

2021E

Exploration Investment 1: Approximately$13 million $9 million $4 million - 2020 Proven and Probable Reserves: 331,000 ounces of gold at an average grade of 0.20 oz/t (6.8 g/t)

- 2020 Measured and Indicated Resources: 830,000 ounces of gold at an average grade of 0.23 oz/t (7.9 g/t)

- 2020 Inferred Resources: 394,000 ounces of gold at an average grade of 0.25 oz/t (8.5 g/t)

Silvertip2,3

Coeur began the year drilling Silvertip with five surface rigs and one underground core rig focused on resource expansion, while also conducting infill drilling on select areas of the deposit to convert existing resources to reserves. Through first seven months of 2021, Coeur drilled approximately 199,900 feet (60,950 meters) at Silvertip compared to roughly 88,300 feet (26,925 meters) during the same period in 2020.

The Company’s news release on

Recent drilling has encountered flat-lying, manto-style mineralization with meaningful thicknesses, highlighting the potential to grow resource tonnage with additional drilling. These results suggest that the ore body in the zone consists of both vertical- and flat-lying manto-style mineralization. Notably, this new interpretation may apply to other zones at Silvertip that have not yet had the benefit of underground drilling to test for both vertical- and flat-lying mineralization which could lead to higher angle structures that support additional resource tonnage.

Furthermore, the latest drill core is beginning to demonstrate that the mineralization within the Southern Silver zone continues to the southwest, south and southeast, connecting with the

Silvertip 2021 Exploration Guidance and Year-End 2020 Reserves and Resources:

-

2021E

Exploration Investment 1: Approximately$18 million $15 million $3 million -

2020 Proven and Probable Reserves: 14.6 million ounces of silver at an average grade of 8.1 oz/t (278.2 g/t), 296.1 million pounds of zinc at an average grade of

8.2% and 193.2 million pounds of lead at an average grade of5.4% -

2020 Measured and Indicated Resources: 17.4 million ounces of silver at an average grade of 7.4 oz/t (255.0 g/t), 442.1 million pounds of zinc at an average grade of

9.4% and 216.5 million pounds of lead at an average grade of4.6% -

2020 Inferred Resources: 12.0 million ounces of silver at an average grade of 8.3 oz/t (283.3 g/t), 308.7 million pounds of zinc at an average grade of

10.6% and 143.9 million pounds of lead at an average grade of5.0%

Wharf2,3

In early 2021, Coeur initiated the largest drilling campaign at Wharf since it acquired the operation in 2015. The Company plans to invest approximately

The Company has essentially achieved its target drill footage for the year, efficiently reaching its goal approximately

Coeur is targeting oxide-gold hosted in the Deadwood Formation. The team has received about half the outstanding drill assays with roughly

Wharf 2021 Production & Exploration Guidance and Year-End 2020 Reserves and Resources:

- 2021E Production4: 85,000 - 95,000 ounces of gold

-

2021E

Exploration Investment 1: Approximately$5 million - 2020 Proven and Probable Reserves: 720,000 ounces of gold at an average grade of 0.03 oz/t (0.9 g/t)

- 2020 Measured and Indicated Resources: 605,000 ounces of gold at an average grade of 0.02 oz/t (0.8 g/t)

-

2020 Inferred Resources: 67,000 ounces of gold at an average grade of 0.02 oz/t (0.7 g/t)

About Coeur

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in

Notes

The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource.

-

Reflects midpoint of guidance as published by Coeur on

July 28, 2021 . - For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/_resources/news/2021-09-09-Exploration-Update.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

-

Guidance as published by Coeur on

July 28, 2021 . - Reflects cumulative investment in exploration at Wharf between 2015 and 2020.

2020 Year-End Proven and Probable Reserves

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| PROVEN RESERVES | |||||||||

| Palmarejo | 4,040,000 |

0.067 |

4.29 |

- |

- |

270,000 |

17,344,000 |

- |

- |

396,867,000 |

0.003 |

0.41 |

- |

- |

1,047,000 |

162,645,000 |

- |

- |

|

814,000 |

0.195 |

- |

- |

- |

159,000 |

- |

- |

- |

|

| Wharf | 19,181,000 |

0.024 |

- |

- |

- |

462,000 |

- |

- |

- |

| Silvertip | 186,000 |

- |

12.01 |

|

|

- |

2,233,000 |

37,647,000 |

31,656,000 |

| Total | 421,088,000 |

0.005 |

0.43 |

1,938,000 |

182,222,000 |

37,647,000 |

31,656,000 |

||

| PROBABLE RESERVES | |||||||||

| Palmarejo | 11,297,000 |

0.051 |

3.72 |

- |

- |

579,000 |

42,057,000 |

- |

- |

62,554,000 |

0.003 |

0.37 |

- |

- |

172,000 |

22,863,000 |

- |

- |

|

862,000 |

0.200 |

- |

- |

- |

172,000 |

- |

- |

- |

|

| Wharf | 9,186,000 |

0.028 |

- |

- |

- |

258,000 |

- |

- |

- |

| Silvertip | 1,618,000 |

- |

7.67 |

|

|

- |

12,403,000 |

258,418,000 |

161,569,000 |

| Total | 85,518,000 |

0.014 |

0.90 |

1,181,000 |

77,323,000 |

258,418,000 |

161,569,000 |

||

| PROVEN AND PROBABLE RESERVES | |||||||||

| Palmarejo | 15,337,000 |

0.055 |

3.87 |

- |

- |

849,000 |

59,400,000 |

- |

- |

459,421,000 |

0.003 |

0.40 |

- |

- |

1,219,000 |

185,508,000 |

- |

- |

|

1,676,000 |

0.197 |

- |

- |

- |

331,000 |

- |

- |

- |

|

| Wharf | 28,367,000 |

0.025 |

- |

- |

- |

720,000 |

- |

- |

- |

| Silvertip | 1,804,000 |

- |

8.11 |

|

|

- |

14,636,000 |

296,065,000 |

193,225,000 |

| Total | 506,606,000 |

0.006 |

0.51 |

3,119,000 |

259,545,000 |

296,065,000 |

193,225,000 |

||

2020 Year-End Measured and Indicated Resources

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| MEASURED RESOURCES | |||||||||

| Palmarejo | 1,840,000 |

0.052 |

3.67 |

- |

- |

95,000 |

6,746,000 |

- |

- |

240,568,000 |

0.002 |

0.24 |

- |

- |

388,000 |

57,160,000 |

- |

- |

|

2,390,000 |

0.233 |

- |

- |

- |

556,000 |

- |

- |

- |

|

| Wharf | 12,992,000 |

0.019 |

- |

- |

- |

245,000 |

- |

- |

- |

| Silvertip | 138,000 |

- |

11.17 |

|

|

- |

1,541,000 |

27,050,000 |

21,670,000 |

4,642,000 |

0.012 |

0.34 |

- |

- |

58,000 |

1,592,000 |

- |

- |

|

| La Preciosa | 9,536,000 |

0.005 |

3.04 |

- |

- |

45,000 |

29,001,000 |

- |

- |

| Total | 272,106,000 |

0.005 |

0.35 |

1,387,000 |

96,040,000 |

27,050,000 |

21,670,000 |

||

| INDICATED RESOURCES | |||||||||

| Palmarejo | 11,591,000 |

0.045 |

3.83 |

- |

- |

518,000 |

44,398,000 |

- |

- |

57,452,000 |

0.002 |

0.25 |

- |

- |

102,000 |

14,207,000 |

- |

- |

|

1,204,000 |

0.228 |

- |

- |

- |

274,000 |

- |

- |

- |

|

| Wharf | 12,717,000 |

0.028 |

- |

- |

- |

360,000 |

- |

- |

- |

| Silvertip | 2,206,000 |

- |

7.20 |

|

|

- |

15,892,000 |

415,000,000 |

194,780,000 |

27,668,000 |

0.011 |

0.31 |

- |

- |

306,000 |

8,655,000 |

- |

- |

|

| La Preciosa | 19,141,000 |

0.006 |

3.98 |

- |

- |

118,000 |

76,185,000 |

- |

- |

| Total | 131,979,000 |

0.013 |

1.21 |

1,678,000 |

159,337,000 |

415,000,000 |

194,780,000 |

||

| MEASURED AND INDICATED RESOURCES | |||||||||

| Palmarejo | 13,431,000 |

0.046 |

3.81 |

- |

- |

613,000 |

51,144,000 |

- |

- |

298,020,000 |

0.002 |

0.24 |

- |

- |

489,000 |

71,368,000 |

- |

- |

|

3,594,000 |

0.231 |

- |

- |

- |

830,000 |

- |

- |

- |

|

| Wharf | 25,710,000 |

0.024 |

- |

- |

- |

605,000 |

- |

- |

- |

| Silvertip | 2,344,000 |

- |

7.44 |

|

|

- |

17,433,000 |

442,050,000 |

216,450,000 |

32,310,000 |

0.011 |

0.32 |

- |

- |

364,000 |

10,247,000 |

- |

- |

|

| La Preciosa | 28,677,000 |

0.006 |

3.67 |

- |

- |

163,000 |

105,186,000 |

- |

- |

| Total | 404,086,000 |

0.008 |

0.63 |

3,064,000 |

255,377,000 |

442,050,000 |

216,450,000 |

||

2020 Year-End Inferred Resources

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| INFERRED RESOURCES | |||||||||

| Palmarejo | 4,345,000 |

0.064 |

3.34 |

- |

- |

280,000 |

14,525,000 |

- |

- |

226,049,000 |

0.002 |

0.27 |

- |

- |

409,000 |

61,671,000 |

- |

- |

|

1,597,000 |

0.247 |

- |

- |

- |

394,000 |

- |

- |

- |

|

| Wharf | 3,389,000 |

0.020 |

- |

- |

- |

67,000 |

- |

- |

- |

| Silvertip | 1,452,000 |

- |

8.26 |

|

|

- |

11,998,000 |

308,700,000 |

143,880,000 |

22,952,000 |

0.011 |

0.36 |

- |

- |

255,000 |

8,163,000 |

- |

- |

|

| Sterling | 31,903,000 |

0.028 |

- |

- |

- |

903,000 |

- |

- |

- |

| Wilco | 25,736,000 |

0.021 |

0.13 |

- |

- |

531,000 |

3,346,000 |

- |

- |

| La Preciosa | 1,761,000 |

0.003 |

3.31 |

- |

- |

6,000 |

5,835,000 |

- |

- |

| Total | 319,186,000 |

0.009 |

0.33 |

2,845,000 |

105,538,000 |

308,700,000 |

143,880,000 |

||

Notes to above Mineral Reserves and Resources:

-

The qualified person for Mineral Reserve and Mineral Resources estimates is

Christopher Pascoe , Coeur's Director, Technical Services. -

Mineral Reserve and Mineral Resource estimates are effective

December 31, 2020 . -

Assumed metal prices for estimated Mineral Reserves were

$1,400 $17.00 $1.15 $0.95 -

Assumed metal prices for estimated Mineral Resources were

$1,600 $20.00 $1.30 $1.00 Lincoln Hill and Wilco at$1,350 $22.00 $1,500 $20.00 - Mineral Resources are in addition to Mineral Reserves and do not have demonstrated economic viability. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be considered for estimation of Mineral Reserves, and there is no certainty that the Inferred Mineral Resources will be realized.

- Rounding of tons and ounces, as required by reporting guidelines, may result in apparent differences between tons, grade, and contained metal content.

- Excludes the impact of the gold stream agreement at Palmarejo.

- For details on the estimation of mineral resources and reserves, including the key assumptions, parameters and methods used to estimate the Mineral Resources and Mineral Reserves, Canadian investors should refer to the NI 43-101 Technical Reports for Coeur's properties on file at www.sedar.com.

Conversion Table

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20210909005142/en/

Attention:

Phone: (312) 489-5800

www.coeur.com

Source: