Welcome to our dedicated page for Cblt news (Ticker: CBBLF), a resource for investors and traders seeking the latest updates and insights on Cblt stock.

CBLT Inc (CBBLF) delivers focused mineral exploration updates from Ontario gold properties, including the flagship Falcon Gold Project. This resource aggregates official corporate announcements, geological findings, and strategic developments for stakeholders tracking Canadian mining opportunities.

Access verified updates on phased exploration programs, assay results from mechanized stripping campaigns, and property acquisitions. Our curated feed ensures transparency into the company’s methodical approach to validating historical mineralization through modern QA/QC protocols and accredited laboratory partnerships.

Key updates include progress reports from active exploration zones, strategic joint venture announcements, and technical insights from geological mapping initiatives. All content adheres to Canadian mining disclosure standards, providing reliable information for investment analysis.

Bookmark this page for streamlined access to CBLT’s latest developments in gold exploration across Ontario’s proven mineral belts. Monitor systematic value creation through consolidated property portfolios and data-driven exploration strategies.

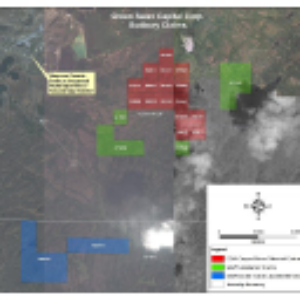

CBLT Inc. (TSXV: CBLT) has initiated Phase 2 of its work program at the Falcon Gold Property in Sudbury, Ontario, following a successful Phase 1. The property, which includes the past-producing Falcon Gold Mine, is located on 100% owned patented mining claims. Phase 2 involves a mechanized stripping program to follow up on previously reported grab samples with gold values up to 25.7 g/t.

The program aims to better understand the geological controls at the property. Phase 1 assay results, announced in July 2024, showed gold values ranging from <0.005 g/t to 25.7 g/t. Phase 2 will focus on locating and stripping historical features such as trenches and the dump for further sampling and mapping.

Historically, gold mineralization was discovered at the site in 1890, with various exploration phases conducted over the years. A 1988 drill program by Falconbridge calculated historical resources of 59,400 tons grading 0.226 oz/ton.

CBLT Inc. (TSXV: CBLT) has reported successful results from its Phase 1 reconnaissance prospecting program at the past-producing Falcon Gold Property in Sudbury, Ontario. The program confirmed high-grade gold mineralization, with grab samples yielding up to 25.7 g/t Au. The property, recently purchased from Kinross Gold Corp., has a history of gold discovery dating back to 1890.

Key findings include:

- 23 grab samples collected, with 7 samples returning grades over 2 g/t Au

- Gold mineralization associated with a pyrite-rich shear zone

- Historical resource estimate of 59,400 tons grading 0.226 oz/ton (not NI 43-101 compliant)

CBLT plans further work, including additional sampling and mapping, ahead of a mechanized stripping program to better understand the geological controls at Falcon Gold.