Citi Releases Latest Treasury Diagnostics Report

Survey Reveals Multiple Playbooks Emerging for Corporate Treasurers

Citi Releases Latest Treasury Diagnostics Report (Graphic: Business Wire)

As we emerge from the global pandemic, many corporate treasuries have established greater resilience across their operations with many now commencing the journey away from the manual processes of the past to adopting new techniques and digital solutions to make ready for the future.

For some, this means future proofing treasury through intelligent automation - initially based on rules and then extending to algorithmic techniques to augment human decision making. For most, however, the report shows that addressing the basic building blocks of data, processes and people to best measure and manage objectives remains the focus.

Digital Aspirations Exist but Infrastructural Challenges Remain

The report finds that there is broad client interest in “all things digital” in treasury and finance, including the utilization of emerging technologies for process automation and data-led insights.

-

57% of respondents are looking at transformative opportunities across both their core business and treasury function. - Driving efficiency within treasury and augmenting decision making are now the top two expectations for investing in emerging technologies.

However, many companies need to first focus on the treasury infrastructural fundamentals. The report finds low levels of automation and connectivity with bank systems highlighting the inability of some companies to effectively integrate their technology ecosystem.

-

64% report that their treasury management system (“TMS”) is either not integrated or only partially integrated with their enterprise resource planning (“ERP”), a likely root cause for the significant use of manual processes to support cash flow forecasting. -

79% report that they do not have a fully integrated TMS/ERP platform with their banks, again explaining the need for manual reconciliations. -

On the plus side, less than half (

49% ) report multiple e-banking platforms at each location which would indicate a shift to a better use of data provided by banking partners within company infrastructure.

“While

Playbooks for Treasury Emerging

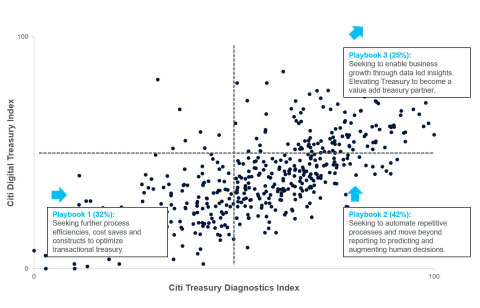

Depending on factors such as treasury maturity, legacy infrastructure, appetite to automate and aspirations for the role in which treasury will play, new playbooks for treasury are emerging.

This report introduces the Citi Digital Treasury Index, which assesses companies’ digital aspirations and preparedness expressed in their Citi treasury diagnostics responses. The Index provides tangible guidance to companies’ treasuries as to how to commence their journey to digitalization, the report offers playbooks for treasury. Each playbook is dependent on current levels of treasury maturity, digital effectiveness and future digital aspiration:

-

74% of those surveyed are not yet in a position to fully embrace the digital opportunity of which:

–

–

-

25% are in a position of treasury digital maturity to support business growth through data-led initiatives.

“New digital technologies and the evolution of financial services has prompted corporate treasury to rethink its future. Harvesting and utilizing data as a means to optimize and meet company risk management objectives is now a top priority amongst many of our clients”

Risk Management Fundamentals: Opportunities Remain

While the advent of new digital technologies and the evolution of financial services has prompted corporate treasury to rethink people, technology and processes deployed to manage risk, the fundamentals of treasury best practice remain. This study shows that effective treasury policies, delivered through processes and procedures, managed through key performance indicators is the foundation for achieving financial risk management objectives and a best-in-class treasury function.

-

Centralization of cash and risk remains the mantra with

63% of companies concentrating cash at global or regional level, with80% of companies concentrating cash on a daily basis. However, only61% have more than75% participation where allowable.

-

Despite the availability of advanced cash forecasting technologies, only

34% utilise statistical analysis of previous patterns to predict forward and80% remain reliant on Microsoft Excel as a component of the tech stack supporting the forecasting process.

-

77% of companies report more than75% daily visibility of their cash position. Yet despite the availability now for auto-matching technologies, only41% of survey participants report greater than75% auto reconciliation levels.

-

While

62% of companies reported reducing earnings volatility as a key risk management objective, the number of companies that actually directly hedge earnings translation exposures is quite low (12% ).

- Companies surveyed continue to follow a rolling, static, layered, or opportunistic approach to hedging forecasted exposures. However, short-dated hedging continues to be the preferred tenor with forecasting error a cause.

-

43% reported option-based strategies as being permissible with43% citing exposure uncertainty as the primary reason for their use.

-

While

79% of respondents reported having exposures to currencies outside the G-10, two-thirds (66% ) report either hedging emerging markets (“EM”) currency and G10 exposures the same, or essentially not hedging EM at all. Costs, market liquidity, and local regulatory considerations were cited as the primary challenges when managing EM currency risk.

“Corporates are now conducting comprehensive policy and ERP/TMS technology reviews with the main question being asked by seniors - where, when and how does currency risk emerge?”

About

###

About Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi| Blog: http://new.citi.com| Facebook: www.facebook.com/citi| LinkedIn: www.linkedin.com/company/citi

View source version on businesswire.com: https://www.businesswire.com/news/home/20210923005618/en/

Media Contacts:

Source: Citi