Anheuser-Busch InBev Reports Second Quarter 2022 Results

(Graphic: Business Wire)

Regulated and inside information1

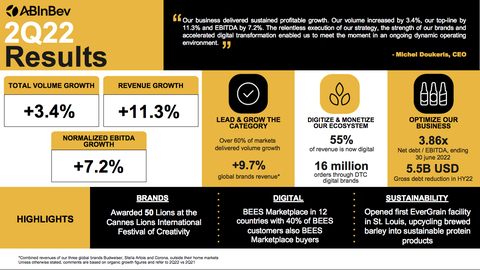

Continued momentum with double-digit top-line growth

“Our business delivered sustained profitable growth. Our volume increased by

Total Revenue

+

Revenue increased by

Approximately

Over

Total Volume

+

In 2Q22, total volumes grew by

Normalized EBITDA

+

In 2Q22 normalized EBITDA of 5

Underlying Profit

1

Underlying profit (normalized profit attributable to equity holders of

Underlying EPS

Underlying EPS was

Net Debt to EBITDA

3.86x

Net debt to normalized EBITDA ratio was 3.86x at

The 2022 Half Year Financial Report is available on our website at www.ab-inbev.com.

1The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the

Management comments

Continued momentum with double-digit top-line growth

We delivered top-line growth of

At the recent 2022 Cannes Lions International Festival of Creativity, we were awarded 50 Lions, a record high for our company.

Consistent execution of our strategy

We continue to execute on and invest in three key strategic pillars to deliver consistent growth and long-term value creation.

See Image 1.

1. Lead and grow the category:

This quarter we delivered volume growth in more than

2. Digitize and monetize our ecosystem:

BEES is now live in 18 markets and has reached 2.9 million monthly active users as of

3. Optimize our business:

We continued to deleverage with our net debt to normalized EBITDA ratio decreasing from 3.96x at

1. Lead and grow the category

We are executing on five proven and scalable levers to drive category expansion:

-

Inclusive Category: In 2Q22, participation of consumers with our portfolio increased in the majority of our key markets, according to our estimates, driven by brand, pack and liquid innovations. For example, in

Colombia we further scaled our local easy-drinking lager brand, Costeña Bacana, with growth driven primarily by legal drinking age consumers between 18-24 years old. InBrazil , the combination of our digital direct-to-consumer (DTC) platform, Zé Delivery, and 300ml returnable glass bottles are driving in-home consumption. -

Core Superiority: In 2Q22, our mainstream portfolio continued to outperform the industry across most of our key markets according to our estimates and delivered high-single digit revenue growth, led by particularly strong performances in

Brazil ,Mexico andColombia . -

Occasions Development : Our global brand Stella Artois grew revenue by7.7% outside of its home market, led by the focus on meal occasions in key markets such asBrazil andColombia . We continue to grow our non-alcoholic beer portfolio with the successful expansion of Corona Sunbrew inCanada . -

Premiumization: Our above core portfolio grew revenue by approximately

12% this quarter, led by continued double-digit growth of Michelob ULTRA in the US andMexico and expansion of Spaten inBrazil . Our global brands grew revenue by9.7% outside of their home markets, led by Corona with18.2% and Stella Artois with7.7% . Budweiser grew by6.1% , despite the impact of COVID-19 restrictions inChina , the brand’s largest market. -

Beyond Beer: Our global Beyond Beer business contributed over

425 million USD of revenue in the quarter. In the US, within the spirits-based-ready-to-drink segment, our portfolio continued to grow ahead of the industry led by Cutwater and NÜTRL vodka seltzer. InSouth Africa , Brutal Fruit and Flying Fish delivered continued double-digit volume growth.

2. Digitize and monetize our ecosystem

-

Digitizing our relationships with our more than 6 million customers globally: In 2Q22, the BEES platform captured approximately

7.4 billion USD in gross merchandise value (GMV) with over 24 million orders placed, growth of over60% and40% respectively versus 2Q21. Our e-commerce platform for sales of third party products,BEES Marketplace , is now live in 12 countries with40% of BEES customers now also Marketplace buyers. -

Leading the way in DTC solutions: Our omni-channel direct-to-consumer (DTC) ecosystem of digital and physical DTC products generated revenue of approximately

385 million USD in 2Q22. Our digital DTC brands generated over 16 million orders in the quarter, led by Zé Delivery inBrazil and the continued expansion of our on demand platform in 10 additional markets inLatin America .

3. Optimize our business

In HY22, we continued to efficiently allocate resources across our operations. This enabled further investment behind the organic growth of our business with over

Advancing our ESG priorities

We continue to advance our ESG agenda. In June, we commenced operations in our first EverGrain facility in

Creating a future with more cheers

Our business continues to build momentum and deliver consistent profitable growth even in the context of the ongoing dynamic operating environment. Our best-in-class portfolio of brands, accelerated digital transformation and global ecosystem provide a unique platform that positions us well to lead and grow the beer category and drive superior long-term value creation.

2022 Outlook

-

Overall Performance: We expect our EBITDA to grow in-line with our medium-term outlook of between 4

-8% and our revenue to grow ahead of EBITDA from a healthy combination of volume and price. The outlook for FY22 reflects our current assessment of the scale and magnitude of the COVID-19 pandemic, which is subject to change as we continue to monitor ongoing developments. -

Net Finance Costs: Net pension interest expenses and accretion expenses are expected to be in the range of 170 to

200 million USD per quarter, depending on currency and interest rate fluctuations. We expect the average gross debt coupon in FY22 to be approximately4.0% . Net finance costs will continue to be impacted by any gains and losses related to the hedging of our share-based payment programs. -

Effective Tax Rates (ETR): We expect the normalized ETR in FY22 to be in the range of

28% to30% , excluding any gains and losses relating to the hedging of our share-based payment programs. The ETR outlook does not consider the impact of potential future changes in legislation. -

Net Capital Expenditure: We expect net capital expenditure of between 4.5 and

5.0 billion USD in FY22.

Figure 1. Consolidated performance (million USD) |

||||||

2Q21 |

2Q22 |

Organic |

||||

|

|

growth |

||||

Total Volumes (thousand hls) |

144 845 |

149 729 |

|

|||

|

128 625 |

131 107 |

|

|||

Non-beer volumes |

15 299 |

17 544 |

|

|||

Third party products |

921 |

1 079 |

|

|||

Revenue |

13 539 |

14 793 |

|

|||

Gross profit |

7 819 |

7 997 |

|

|||

Gross margin |

|

|

-329 bps |

|||

Normalized EBITDA |

4 846 |

5 096 |

|

|||

Normalized EBITDA margin |

|

|

-127 bps |

|||

Normalized EBIT |

3 655 |

3 811 |

|

|||

Normalized EBIT margin |

|

|

-123 bps |

|||

|

|

|

|

|||

Profit attributable to equity holders of |

1 862 |

1 597 |

|

|||

Normalized profit attributable to equity holders of |

1 911 |

1 519 |

|

|||

Underlying profit attributable to equity holders of |

1 507 |

1 468 |

|

|||

|

|

|

|

|||

Earnings per share (USD) |

0.93 |

0.79 |

|

|||

Normalized earnings per share (USD) |

0.95 |

0.75 |

|

|||

Underlying earnings per share (USD) |

0.75 |

0.73 |

|

|||

|

|

|

||||

|

|

|

||||

HY21 |

HY22 |

Organic |

||||

|

|

growth |

||||

Total Volumes (thousand hls) |

280 398 |

289 074 |

|

|||

|

247 635 |

251 692 |

|

|||

Non-beer volumes |

31 243 |

35 488 |

|

|||

Third party products |

1 519 |

1 894 |

|

|||

Revenue |

25 832 |

28 027 |

|

|||

Gross profit |

14 869 |

15 243 |

|

|||

Gross margin |

|

|

-277 bps |

|||

Normalized EBITDA |

9 114 |

9 583 |

|

|||

Normalized EBITDA margin |

|

|

-122 bps |

|||

Normalized EBIT |

6 768 |

7 105 |

|

|||

Normalized EBIT margin |

|

|

-100 bps |

|||

|

|

|

|

|||

Profit attributable to equity holders of |

2 458 |

1 692 |

|

|||

Normalized profit attributable to equity holders of |

2 924 |

2 860 |

|

|||

Underlying profit attributable to equity holders of |

2 606 |

2 672 |

|

|||

|

|

|

|

|||

Earnings per share (USD) |

1.23 |

0.84 |

|

|||

Normalized earnings per share (USD) |

1.46 |

1.42 |

|

|||

Underlying earnings per share (USD) |

1.30 |

1.33 |

Figure 2. Volumes (thousand hls) |

||||||||||||

2Q21 |

Scope |

Organic |

2Q22 |

Organic growth |

||||||||

growth |

Total Volume |

Own beer volume |

||||||||||

|

28 115 |

- |

-754 |

27 361 |

- |

- |

||||||

Middle |

34 916 |

13 |

2 847 |

37 775 |

|

|

||||||

|

33 465 |

80 |

2 876 |

36 421 |

|

|

||||||

EMEA |

22 875 |

22 |

-59 |

22 838 |

- |

- |

||||||

|

25 205 |

1 |

-109 |

25 097 |

- |

- |

||||||

Global Export and Holding Companies |

269 |

-116 |

85 |

238 |

|

|

||||||

AB InBev Worldwide |

144 845 |

- |

4 885 |

149 729 |

|

|

||||||

. |

||||||||||||

HY21 |

Scope |

Organic |

HY22 |

Organic growth |

||||||||

growth |

Total Volume |

Own beer volume |

||||||||||

|

53 252 |

- |

-1 804 |

51 448 |

- |

- |

||||||

Middle |

67 980 |

22 |

4 022 |

72 024 |

|

|

||||||

|

71 929 |

151 |

4 735 |

76 815 |

|

|

||||||

EMEA |

40 540 |

29 |

2 392 |

42 962 |

|

|

||||||

|

46 081 |

1 |

-698 |

45 385 |

- |

- |

||||||

Global Export and Holding Companies |

615 |

-204 |

29 |

440 |

|

|

||||||

AB InBev Worldwide |

280 398 |

- |

8 676 |

289 074 |

|

|

||||||

Key Market Performances

-

Operating performance:

-

2Q22: Revenue grew by

2.7% with revenue per hl growing by5.5% driven by revenue management initiatives and continued premiumization. Sales-to-wholesalers (STWs) were down by2.7% . Sales-to-retailers (STRs) declined by3.4% , estimated to be below the industry. EBITDA declined by0.5% . -

HY22: Revenue grew by

2.4% . STWs declined by3.2% , with revenue per hl growth of5.8% . Our STR’s declined by3.9% . EBITDA declined by0.2% .

-

2Q22: Revenue grew by

- Commercial highlights: The beer industry remained resilient even in the context of a higher inflationary environment. Despite underperforming the industry, we remain confident in our commercial strategy to rebalance our portfolio toward faster growing segments. Our above core beer and spirits-based ready-to-drink portfolios outperformed the industry, led by Michelob ULTRA which grew by double-digits and Cutwater and NÜTRL vodka seltzer which grew strong double-digits.

-

Operating performance:

- 2Q22: Revenue grew by high-teens with revenue per hl growth of high-single digits driven primarily by revenue management initiatives. Our volumes grew by high-single digits, outperforming the industry, supported by ongoing channel and portfolio expansion and the phasing impact of a later Easter. EBITDA grew by mid-teens.

- HY22: Revenue grew by mid-teens with volumes growing by mid-single digits and revenue per hl growing by high-single digits. EBITDA grew by low-teens.

-

Commercial highlights: Our performance was driven by ongoing portfolio development, channel expansion, and digital transformation. Our core brands delivered high-single digit volume growth and our above core portfolio once again grew by double-digits, led by Modelo and Michelob ULTRA. We continue to expand our distribution footprint, with the opening of over 150 new Modelorama stores and the continuation of the OXXO rollout, expanding into approximately 800 additional stores. Over

60% of our BEES customers are now alsoBEES Marketplace buyers.

-

Operating performance:

- 2Q22: Revenue grew by high-twenties with low-teens revenue per hl growth, primarily driven by revenue management initiatives and premiumization. Our volumes grew by mid-teens, driven by the execution of our category expansion levers and supported by a favorable comparable. EBITDA grew by high-single digits, negatively impacted by a loss from the disposal of non-core assets.

-

HY22: Revenue grew by mid-twenties with volume increasing more than

10% and revenue per hl growth of low-teens. EBITDA grew by mid-teens.

-

Commercial highlights: We continue to grow the beer category, again delivering a new record high per capita consumption this quarter. Our premium and super premium portfolio reached an all-time high volume, delivering over

40% volume growth led by our global brands and local premium brand, Club Colombia. More than30% of our BEES customers are now alsoBEES Marketplace buyers.

-

Operating performance:

-

2Q22: Revenue grew by

26.8% , with volume growth of10.4% and revenue per hl growth of14.9% . Our beer volumes once again outperformed the industry according to our estimates, growing by8.5% . Non-beer volumes grew by16.2% . Our performance was driven by the consistent execution of our strategic priorities, continued recovery of out of home consumption occasions and channel expansion. EBITDA grew by34.3% . -

HY22: Total volume grew by

7.9% with beer volumes up by5.2% and non-beer volumes up by16.5% . Revenue increased by21.6% , with revenue per hl growth of12.7% . EBITDA grew by15.0% .

-

2Q22: Revenue grew by

-

Commercial highlights: Our premium and super premium brands delivered volume growth of more than

20% this quarter. Our core portfolio continued its momentum, increasing volumes low-teens, and we continued to invest behind developing our core plus brands. Over60% of our BEES customers are now alsoBEES Marketplace buyers. Our digital DTC platform, Zé Delivery, fulfilled almost 15 million orders in 2Q22, and has reached 4.2 million monthly active users.

-

Operating performance:

-

2Q22: Revenue grew by high-single digits, with low-single digit volume and high-single digit revenue per hl growth, supported by revenue management initiatives, ongoing premiumization and continued on-premise recovery. EBITDA grew by more than

10% . Versus 2Q19, top-line grew by mid-single digits despite on-premise volumes still not fully recovering to pre-pandemic levels. - HY22: Revenue grew by low-teens with high-single digit revenue per hl and low-single digit volume growth. EBITDA increased by mid-teens.

-

2Q22: Revenue grew by high-single digits, with low-single digit volume and high-single digit revenue per hl growth, supported by revenue management initiatives, ongoing premiumization and continued on-premise recovery. EBITDA grew by more than

-

Commercial highlights: Our growth this quarter was led by our global and super premium brands, which delivered high-single digit revenue growth. Our DTC product, PerfectDraft, expanded the active shopper base by more than

25% versus 2Q21.

-

Operating performance:

-

2Q22: Revenue grew by

7.6% , with7.5% revenue per hl growth and flat volumes, below the industry according to our estimates as our operations were impacted by significant production constraints in April and May due to floods impacting our Prospecton brewery. EBITDA grew by low double-digits. - HY22: Revenue grew by double-digits with high-single digit revenue per hl and low-teens increase in volume. EBITDA grew by mid-twenties.

-

2Q22: Revenue grew by

-

Commercial highlights: Underlying demand for our portfolio remains strong. The premium, super premium and Beyond Beer portfolios led our growth this quarter, all delivering a double-digit revenue increase. Our leading core brands delivered continued revenue growth. Driven by BEES, digital channels now represent

91% of our revenues.

-

Operating performance:

-

2Q22: The total industry declined mid-single digits due to COVID-19 restrictions. The restrictions disproportionately impacted our key regions and sales channels, resulting in a

6.5% total volume decline, underperforming the industry according to our estimates. The operating environment gradually improved throughout the quarter resulting in volume growth of high-single digits in June year-over-year. In 2Q22, revenue per hl grew by1.5% resulting in a total revenue decline of5.1% . EBITDA declined by11.8% . -

HY22: Volumes declined by

5.5% and revenue per hl grew by2.4% , leading to total revenue decline of3.3% . EBITDA declined by6.5% .

-

2Q22: The total industry declined mid-single digits due to COVID-19 restrictions. The restrictions disproportionately impacted our key regions and sales channels, resulting in a

- Commercial highlights: Underlying consumer demand for our brands remained strong. As restrictions eased in June, both our premium and super premium portfolios returned to volume growth increasing by double-digits.

Highlights from our other markets

-

Canada : Total revenue grew by low-single digits. Our beer volume outperformed a soft industry this quarter, led by our core portfolio which grew revenue by mid-single digits. -

Peru : We delivered double-digit top-line growth in 2Q22 with a balance of mid-twenties volume and over10% revenue per hl growth, driven by ongoing portfolio transformation, route to market expansion and supported by continued post COVID-19 recovery. Over50% of BEES customers are now alsoBEES Marketplace buyers. -

Ecuador : We delivered mid-thirties top-line growth with a volume increase of low-twenties this quarter, supported by continued expansion of the beer category and post COVID-19 recovery.60% of BEES customers are now alsoBEES Marketplace buyers. -

Argentina : Revenue grew by double-digits in 2Q22, driven primarily by revenue management initiatives in a highly inflationary environment, with flattish volumes. -

Africa excludingSouth Africa : InNigeria , our top-line grew by25% this quarter, driven by revenue management initiatives, though volumes were lower due to ongoing supply chain constraints. In other key markets, we continue to see strong consumer demand for our brands with double-digit volume and revenue growth in 2Q22 inTanzania ,Zambia andUganda . -

South Korea : Volumes grew by high-single digits in 2Q22, supported by further market share gains in both the on-premise and in-home channels and continued improvement in the operating environment. Revenue per hl increased by high-single digits resulting in double-digit revenue growth.

Consolidated Income Statement

Figure 3. Consolidated income statement (million USD) |

||||||

2Q21 |

2Q22 |

Organic |

||||

|

|

growth |

||||

Revenue |

13 539 |

14 793 |

|

|||

Cost of sales |

-5 720 |

-6 796 |

- |

|||

Gross profit |

7 819 |

7 997 |

|

|||

SG&A |

-4 511 |

-4 500 |

- |

|||

Other operating income/(expenses) |

347 |

314 |

|

|||

Normalized profit from operations (normalized EBIT) |

3 655 |

3 811 |

|

|||

Non-underlying items above EBIT |

-150 |

-9 |

|

|||

Net finance income/(cost) |

-755 |

-1 217 |

|

|||

Non-underlying net finance income/(cost) |

64 |

36 |

|

|||

Share of results of associates |

69 |

74 |

|

|||

Income tax expense |

-702 |

-721 |

|

|||

Profit |

2 182 |

1 975 |

|

|||

Profit attributable to non-controlling interest |

319 |

378 |

|

|||

Profit attributable to equity holders of |

1 862 |

1 597 |

|

|||

|

|

|

|

|||

Normalized EBITDA |

4 846 |

5 096 |

|

|||

Normalized profit attributable to equity holders of |

1 911 |

1 519 |

|

|||

|

|

|

||||

HY21 |

HY22 |

Organic |

||||

|

|

growth |

||||

Revenue |

25 832 |

28 027 |

|

|||

Cost of sales |

-10 963 |

-12 784 |

- |

|||

Gross profit |

14 869 |

15 243 |

|

|||

SG&A |

-8 571 |

-8 616 |

- |

|||

Other operating income/(expenses) |

470 |

478 |

|

|||

Normalized profit from operations (normalized EBIT) |

6 768 |

7 105 |

|

|||

Non-underlying items above EBIT |

-217 |

-105 |

|

|||

Net finance income/(cost) |

-2 047 |

-2 282 |

|

|||

Non-underlying net finance income/(cost) |

-299 |

14 |

|

|||

Share of results of associates |

100 |

129 |

|

|||

Non-underlying share of results of associates |

- |

-1 143 |

|

|||

Income tax expense |

-1 231 |

-1 244 |

|

|||

Profit |

3 074 |

2 474 |

|

|||

Profit attributable to non-controlling interest |

616 |

782 |

|

|||

Profit attributable to equity holders of |

2 458 |

1 692 |

|

|||

|

|

|

|

|||

Normalized EBITDA |

9 114 |

9 583 |

|

|||

Normalized profit attributable to equity holders of |

2 924 |

2 860 |

Consolidated other operating income/(expenses) in HY22 increased by

Non-underlying items above EBIT & Non-underlying share of results of associates

(million USD)

Figure 4. Non-underlying items above EBIT & Non-underlying share of results of associates (million USD) |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

COVID-19 costs |

-31 |

-4 |

-54 |

-13 |

||||

Restructuring |

-64 |

-14 |

-97 |

-51 |

||||

Business and asset disposal |

24 |

10 |

14 |

6 |

||||

Acquisition costs / Business combinations |

-6 |

- |

-6 |

- |

||||

AB InBev Efes related costs |

- |

-1 |

- |

-47 |

||||

Zenzele scheme |

-73 |

- |

-73 |

- |

||||

Non-underlying items in EBIT |

-150 |

-9 |

-217 |

-105 |

||||

Non-underlying share of results of associates |

- |

- |

- |

-1 143 |

||||

EBIT excludes negative non-underlying items of

Non-underlying share of results of associates includes the non-cash impairment of 1

Net finance income/(cost)

Figure 5. Net finance income/(cost) (million USD) |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Net interest expense |

-903 |

-838 |

-1 817 |

-1 683 |

||||

Net interest on net defined benefit liabilities |

-19 |

-19 |

-37 |

-37 |

||||

Accretion expense |

-142 |

-185 |

-265 |

-336 |

||||

Mark-to-market |

441 |

35 |

348 |

162 |

||||

Net interest income on Brazilian tax credits |

71 |

65 |

76 |

113 |

||||

Other financial results |

-204 |

-275 |

-353 |

-501 |

||||

Net finance income/(cost) |

-755 |

-1 217 |

-2 047 |

-2 282 |

||||

Net finance costs in HY22 and HY21 were positively impacted by the mark-to-market gain on the hedging of our share-based payment programs. The number of shares covered by the hedging of our share-based payment programs, and the opening and closing share prices, are shown in figure 6 below.

Figure 6. Share-based payment hedge |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Share price at the start of the period (Euro) |

53.75 |

54.26 |

57.01 |

53.17 |

||||

Share price at the end of the period (Euro) |

60.81 |

51.36 |

60.81 |

51.36 |

||||

Number of equity derivative instruments at the end of the period (millions) |

55.0 |

55.0 |

55.0 |

55.0 |

Non-underlying net finance income/(cost)

Figure 7. Non-underlying net finance income/(cost) (million USD) |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Mark-to-market |

360 |

29 |

283 |

134 |

||||

Early termination fee of Bonds and Other |

-295 |

7 |

-582 |

-120 |

||||

Non-underlying net finance income/(cost) |

64 |

36 |

-299 |

14 |

||||

Non-underlying net finance cost in HY22 and HY21 includes mark-to-market gains on derivative instruments entered into to hedge the shares issued in relation to the Grupo Modelo and

The number of shares covered by the hedging of the deferred share instrument and the restricted shares are shown in figure 8, together with the opening and closing share prices.

Figure 8. Non-underlying equity derivative instruments |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Share price at the start of the period (Euro) |

53.75 |

54.26 |

57.01 |

53.17 |

||||

Share price at the end of the period (Euro) |

60.81 |

51.36 |

60.81 |

51.36 |

||||

Number of equity derivative instruments at the end of the period (millions) |

45.5 |

45.5 |

45.5 |

45.5 |

||||

Income tax expense

Figure 9. Income tax expense (million USD) |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Income tax expense |

702 |

721 |

1 231 |

1 244 |

||||

Effective tax rate |

|

|

|

|

||||

Normalized effective tax rate |

|

|

|

|

||||

Normalized effective tax rate before MTM |

|

|

|

|

||||

The increase in normalized ETR excluding mark-to-market gains and losses linked to the hedging of our share-based payment programs in 2Q22 compared to 2Q21 and the decrease in HY22 compared to HY21 is driven by country mix.

Figure 10. Normalized Profit attributable to equity holders of |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Profit attributable to equity holders of |

1 862 |

1 597 |

2 458 |

1 692 |

||||

Net impact of non-underlying items on profit |

50 |

-78 |

466 |

1 168 |

||||

Normalized profit attributable to equity holders of |

1 911 |

1 519 |

2 924 |

2 860 |

||||

Underlying profit attributable to equity holders of |

1 507 |

1 468 |

2 606 |

2 672 |

||||

Both normalized and underlying profit attributable to equity holders in 2Q21 and HY21 were positively impacted by

Basic, normalized and underlying EPS

Figure 11. Earnings per share (USD) |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Basic earnings per share |

0.93 |

0.79 |

1.23 |

0.84 |

||||

Net impact of non-underlying items on profit |

0.02 |

-0.05 |

0.24 |

0.58 |

||||

Normalized earnings per share |

0.95 |

0.75 |

1.46 |

1.42 |

||||

Underlying earnings per share |

0.75 |

0.73 |

1.30 |

1.33 |

||||

Weighted average number of ordinary and restricted shares (million) |

2 004 |

2 012 |

2 004 |

2 012 |

Normalized EPS in 2Q22 and 2Q21 included a mark-to-market gain on the hedging of our share-based payment programs of

Figure 12. Key components - Normalized Earnings per share in USD |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Normalized EBIT before hyperinflation |

1.82 |

1.90 |

3.39 |

3.55 |

||||

Hyperinflation impacts in normalized EBIT |

- |

-0.01 |

-0.01 |

-0.02 |

||||

Normalized EBIT |

1.82 |

1.90 |

3.38 |

3.53 |

||||

Mark-to-market (share-based payment programs) |

0.22 |

0.02 |

0.17 |

0.08 |

||||

Net finance cost |

-0.60 |

-0.62 |

-1.20 |

-1.21 |

||||

Income tax expense |

-0.37 |

-0.39 |

-0.64 |

-0.65 |

||||

Associates & non-controlling interest |

-0.13 |

-0.15 |

-0.26 |

-0.32 |

||||

Normalized EPS |

0.95 |

0.75 |

1.46 |

1.42 |

||||

Mark-to-market (share-based payment programs) |

-0.22 |

-0.02 |

-0.17 |

-0.08 |

||||

Hyperinflation impacts in EPS |

0.02 |

-0.01 |

0.02 |

-0.01 |

||||

Underlying EPS |

0.75 |

0.73 |

1.30 |

1.33 |

||||

Weighted average number of ordinary and restricted shares (million) |

2 004 |

2 012 |

2 004 |

2 012 |

||||

Reconciliation between profit attributable to equity holders and normalized EBITDA

Figure 13. Reconciliation of normalized EBITDA to profit attributable to equity holders of |

||||||||

2Q21 |

2Q22 |

HY21 |

HY22 |

|||||

Profit attributable to equity holders of |

1 862 |

1 597 |

2 458 |

1 692 |

||||

Non-controlling interests |

319 |

378 |

616 |

782 |

||||

Profit |

2 182 |

1 975 |

3 074 |

2 474 |

||||

Income tax expense |

702 |

721 |

1 231 |

1 244 |

||||

Share of result of associates |

-69 |

-74 |

-100 |

-129 |

||||

Non-underlying share of results of associates |

- |

- |

- |

1 143 |

||||

Net finance (income)/cost |

755 |

1 217 |

2 047 |

2 282 |

||||

Non-underlying net finance (income)/cost |

-64 |

-36 |

299 |

-14 |

||||

Non-underlying items above EBIT |

150 |

9 |

217 |

105 |

||||

Normalized EBIT |

3 655 |

3 811 |

6 768 |

7 105 |

||||

Depreciation, amortization and impairment |

1 191 |

1 286 |

2 345 |

2 477 |

||||

Normalized EBITDA |

4 846 |

5 096 |

9 114 |

9 583 |

||||

Normalized EBITDA and normalized EBIT are measures utilized by

Normalized EBITDA is calculated excluding the following effects from profit attributable to equity holders of

Normalized EBITDA and normalized EBIT are not accounting measures under IFRS accounting and should not be considered as an alternative to profit attributable to equity holders as a measure of operational performance, or an alternative to cash flow as a measure of liquidity. Normalized EBITDA and normalized EBIT do not have a standard calculation method and AB InBev’s definition of normalized EBITDA and normalized EBIT may not be comparable to that of other companies.

Financial position

Figure 14. Cash Flow Statement (million USD) |

||||

HY21 |

HY22 |

|||

Operating activities |

||||

Profit of the period |

3 074 |

2 474 |

||

Interest, taxes and non-cash items included in profit |

6 062 |

7 015 |

||

Cash flow from operating activities before changes in working capital and use of provisions |

9 134 |

9 489 |

||

|

||||

Change in working capital |

-1 327 |

-3 339 |

||

Pension contributions and use of provisions |

-258 |

-195 |

||

Interest and taxes (paid)/received |

-3 696 |

-3 823 |

||

Dividends received |

86 |

50 |

||

Cash flow from operating activities |

3 939 |

2 182 |

||

|

||||

Investing activities |

||||

Net capex |

-2 104 |

-1 939 |

||

Acquisition and sale of subsidiaries, net of cash acquired/disposed of |

-203 |

-44 |

||

Net proceeds from sale/(acquisition) of other assets |

98 |

66 |

||

Cash flow from investing activities |

-2 209 |

-1 917 |

||

|

||||

Financing activities |

||||

Dividends paid |

-1 382 |

-1 276 |

||

Net (payments on)/proceeds from borrowings |

-7 999 |

-3 452 |

||

Payment of lease liabilities |

-256 |

-286 |

||

Sale/(purchase) of non-controlling interests and other |

-470 |

-378 |

||

Cash flow from financing activities |

-10 107 |

-5 392 |

||

Net increase/(decrease) in cash and cash equivalents |

-8 377 |

-5 128 |

HY22 recorded a decrease in cash and cash equivalents of 5

-

Our cash flow from operating activities reached 2

182 million USD in HY22 compared to 3939 million USD in HY21. The decrease was primarily driven by changes in working capital for HY22 compared to HY21 as 2021 figures were impacted by lower capital expenditure and bonus accruals in 2020. In addition, changes in working capital in the first half of 2022 and 2021 reflect higher working capital levels at the end of June than at year-end as a result of seasonality. -

Our cash outflow from investing activities was 1

917 million USD in HY22 compared to a cash outflow of 2209 million USD in HY21. The decrease in the cash flow from investing activities was mainly due to lower net capital expenditures and lower outflows from acquisition of subsidiaries in HY22 compared to HY21. Out of the total HY22 capital expenditures, approximately32% was used to improve the company’s production facilities while49% was used for logistics and commercial investments and19% was used for improving administrative capabilities and for the purchase of hardware and software. -

Our cash outflow from financing activities amounted to 5

392 million USD in HY22, as compared to a cash outflow of 10107 million USD in HY21. The decrease is primarily driven by lower debt redemption in HY22 compared to HY21.

Our net debt decreased to

Our net debt to normalized EBITDA ratio was 3.86x as of

We continue to proactively manage our debt portfolio. After redemptions in

In addition to a very comfortable debt maturity profile and strong cash flow generation, as of

Figure 15. Terms and debt repayment schedule as of

Notes

To facilitate the understanding of AB InBev’s underlying performance, the analyses of growth, including all comments in this press release, unless otherwise indicated, are based on organic growth and normalized numbers. In other words, financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scope changes. Scope changes represent the impact of acquisitions and divestitures, the start or termination of activities or the transfer of activities between segments, curtailment gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of the underlying performance of the business. All references per hectoliter (per hl) exclude US non-beer activities. References to the

Legal disclaimer

This release contains “forward-looking statements”. These statements are based on the current expectations and views of future events and developments of the management of

Conference call and webcast

Investor Conference call and webcast on Thursday,

Registration details:

Webcast (listen-only mode):

To join by phone, please use one of the following two phone numbers:

Toll-Free: 877-407-8029

Toll: 201-689-8029

About

Annex 1

AB InBev Worldwide |

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

144 845 |

- |

- |

- |

4 885 |

149 729 |

|

|||||||

of which |

128 625 |

-914 |

- |

- |

3 395 |

131 107 |

|

|||||||

Revenue |

13 539 |

-126 |

-210 |

72 |

1 517 |

14 793 |

|

|||||||

Cost of sales |

-5 720 |

1 |

91 |

-31 |

-1 138 |

-6 796 |

- |

|||||||

Gross profit |

7 819 |

-124 |

-118 |

41 |

380 |

7 997 |

|

|||||||

SG&A |

-4 511 |

117 |

89 |

-17 |

-179 |

-4 500 |

- |

|||||||

Other operating income/(expenses) |

347 |

-38 |

6 |

-5 |

4 |

314 |

|

|||||||

Normalized EBIT |

3 655 |

-46 |

-23 |

20 |

204 |

3 811 |

|

|||||||

Normalized EBITDA |

4 846 |

-52 |

-52 |

21 |

333 |

5 096 |

|

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

-127 bps |

|||||||

|

|

|

|

|

|

|

|

|||||||

|

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

28 115 |

- |

- |

- |

-754 |

27 361 |

- |

|||||||

Revenue |

4 289 |

- |

-17 |

- |

118 |

4 390 |

|

|||||||

Cost of sales |

-1 628 |

-3 |

6 |

- |

-161 |

-1 785 |

- |

|||||||

Gross profit |

2 661 |

-3 |

-11 |

- |

-43 |

2 604 |

- |

|||||||

SG&A |

-1 257 |

-1 |

7 |

- |

42 |

-1 209 |

|

|||||||

Other operating income/(expenses) |

9 |

3 |

- |

- |

-4 |

7 |

- |

|||||||

Normalized EBIT |

1 413 |

-1 |

-4 |

- |

-5 |

1 402 |

- |

|||||||

Normalized EBITDA |

1 611 |

- |

-6 |

- |

-9 |

1 597 |

- |

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

-121 bps |

|||||||

|

|

|

|

|

|

|

|

|||||||

Middle |

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

34 916 |

13 |

- |

- |

2 847 |

37 775 |

|

|||||||

Revenue |

3 053 |

-13 |

-4 |

- |

558 |

3 594 |

|

|||||||

Cost of sales |

-1 074 |

4 |

2 |

- |

-368 |

-1 435 |

- |

|||||||

Gross profit |

1 979 |

-8 |

-1 |

- |

190 |

2 159 |

|

|||||||

SG&A |

-809 |

6 |

2 |

- |

-74 |

-874 |

- |

|||||||

Other operating income/(expenses) |

1 |

- |

2 |

- |

-17 |

-14 |

- |

|||||||

Normalized EBIT |

1 171 |

-3 |

3 |

- |

100 |

1 271 |

|

|||||||

Normalized EBITDA |

1 454 |

-2 |

3 |

- |

155 |

1 610 |

|

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

-311 bps |

|||||||

|

|

|

|

|

|

|

|

|||||||

|

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

33 465 |

80 |

- |

- |

2 876 |

36 421 |

|

|||||||

Revenue |

1 898 |

26 |

59 |

72 |

570 |

2 626 |

|

|||||||

Cost of sales |

-1 013 |

-6 |

-43 |

-31 |

-326 |

-1 419 |

- |

|||||||

Gross profit |

885 |

20 |

16 |

41 |

245 |

1 207 |

|

|||||||

SG&A |

-638 |

-33 |

-22 |

-17 |

-145 |

-855 |

- |

|||||||

Other operating income/(expenses) |

254 |

-42 |

6 |

-5 |

30 |

243 |

|

|||||||

Normalized EBIT |

501 |

-54 |

- |

20 |

129 |

595 |

|

|||||||

Normalized EBITDA |

684 |

-54 |

5 |

21 |

165 |

820 |

|

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

132 bps |

EMEA |

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

22 875 |

22 |

- |

- |

-59 |

22 838 |

- |

|||||||

Revenue |

2 196 |

-71 |

-168 |

- |

184 |

2 140 |

|

|||||||

Cost of sales |

-1 007 |

-3 |

85 |

- |

-162 |

-1 087 |

- |

|||||||

Gross profit |

1 188 |

-74 |

-83 |

- |

22 |

1 054 |

|

|||||||

SG&A |

-838 |

74 |

62 |

- |

21 |

-680 |

|

|||||||

Other operating income/(expenses) |

44 |

1 |

-4 |

- |

8 |

49 |

|

|||||||

Normalized EBIT |

395 |

1 |

-24 |

- |

52 |

423 |

|

|||||||

Normalized EBITDA |

658 |

-7 |

-45 |

- |

87 |

692 |

|

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

132 bps |

|||||||

|

|

|

|

|

|

|

|

|||||||

|

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

25 205 |

1 |

- |

- |

-109 |

25 097 |

- |

|||||||

Revenue |

1 864 |

-29 |

-70 |

- |

69 |

1 835 |

|

|||||||

Cost of sales |

-810 |

- |

31 |

- |

-101 |

-881 |

- |

|||||||

Gross profit |

1 055 |

-29 |

-39 |

- |

-32 |

954 |

- |

|||||||

SG&A |

-591 |

28 |

22 |

- |

10 |

-531 |

|

|||||||

Other operating income/(expenses) |

35 |

- |

- |

- |

-8 |

26 |

- |

|||||||

Normalized EBIT |

498 |

-1 |

-18 |

- |

-30 |

449 |

- |

|||||||

Normalized EBITDA |

672 |

-1 |

-23 |

- |

-27 |

620 |

- |

|||||||

Normalized EBITDA margin |

|

|

|

|

|

|

-274 bps |

|||||||

|

|

|

|

|

|

|

|

|||||||

Global Export and Holding Companies |

2Q21 |

Scope |

Currency

|

Hyperinflation

|

Organic

|

2Q22 |

Organic

|

|||||||

Total volumes (thousand hls) |

269 |

-116 |

- |

- |

85 |

238 |

|

|||||||

Revenue |

238 |

-39 |

-10 |

- |

19 |

208 |

|

|||||||

Cost of sales |

-187 |

9 |

10 |

- |

-20 |

-189 |

- |

|||||||

Gross profit |

51 |

-31 |

- |

- |

-2 |

19 |

- |

|||||||

SG&A |

-377 |

43 |

18 |

- |

-34 |

-350 |

- |

|||||||

Other operating income/(expenses) |

4 |

- |

3 |

- |

-5 |

2 |

- |

|||||||

Normalized EBIT |

-322 |

12 |

21 |

- |

-41 |

-330 |

- |

|||||||

Normalized EBITDA |

-232 |

13 |

14 |

- |

-37 |

-242 |

- |

Annex 2

AB InBev Worldwide |

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

280 398 |

- |

- |

8 676 |

289 074 |

|

||||||

of which |

247 635 |

-1 892 |

- |

5 949 |

251 692 |

|

||||||

Revenue |

25 832 |

-229 |

-514 |

2 938 |

28 027 |

|

||||||

Cost of sales |

-10 963 |

3 |

224 |

-2 049 |

-12 784 |

- |

||||||

Gross profit |

14 869 |

-225 |

-290 |

889 |

15 243 |

|

||||||

SG&A |

-8 571 |

213 |

188 |

-447 |

-8 616 |

- |

||||||

Other operating income/(expenses) |

470 |

-18 |

3 |

24 |

478 |

|

||||||

Normalized EBIT |

6 768 |

-30 |

-99 |

466 |

7 105 |

|

||||||

Normalized EBITDA |

9 114 |

-44 |

-156 |

670 |

9 583 |

|

||||||

Normalized EBITDA margin |

|

|

|

|

|

-122 bps |

||||||

|

|

|

|

|

|

|

||||||

|

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

53 252 |

- |

- |

-1 804 |

51 448 |

- |

||||||

Revenue |

8 040 |

- |

-18 |

170 |

8 192 |

|

||||||

Cost of sales |

-3 080 |

-5 |

6 |

-270 |

-3 349 |

- |

||||||

Gross profit |

4 960 |

-5 |

-11 |

-100 |

4 844 |

- |

||||||

SG&A |

-2 350 |

-2 |

7 |

66 |

-2 279 |

|

||||||

Other operating income/(expenses) |

15 |

6 |

- |

7 |

28 |

|

||||||

Normalized EBIT |

2 625 |

-1 |

-4 |

-27 |

2 592 |

- |

||||||

Normalized EBITDA |

3 014 |

- |

-6 |

-33 |

2 975 |

- |

||||||

Normalized EBITDA margin |

|

|

|

|

|

-118 bps |

||||||

|

|

|

|

|

|

|||||||

Middle |

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

67 980 |

22 |

- |

4 022 |

72 024 |

|

||||||

Revenue |

5 893 |

-27 |

-107 |

934 |

6 693 |

|

||||||

Cost of sales |

-2 055 |

9 |

39 |

-619 |

-2 625 |

- |

||||||

Gross profit |

3 838 |

-18 |

-68 |

315 |

4 068 |

|

||||||

SG&A |

-1 577 |

15 |

26 |

-95 |

-1 631 |

- |

||||||

Other operating income/(expenses) |

5 |

- |

2 |

-18 |

-12 |

- |

||||||

Normalized EBIT |

2 266 |

-3 |

-40 |

202 |

2 425 |

|

||||||

Normalized EBITDA |

2 824 |

-3 |

-48 |

286 |

3 060 |

|

||||||

Normalized EBITDA margin |

|

|

|

|

|

-239 bps |

||||||

|

|

|

|

|

|

|

||||||

|

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

71 929 |

151 |

- |

4 735 |

76 815 |

|

||||||

Revenue |

4 146 |

52 |

-65 |

1 200 |

5 333 |

|

||||||

Cost of sales |

-2 091 |

-12 |

17 |

-706 |

-2 792 |

- |

||||||

Gross profit |

2 055 |

40 |

-49 |

494 |

2 541 |

|

||||||

SG&A |

-1 254 |

-60 |

7 |

-302 |

-1 609 |

- |

||||||

Other operating income/(expenses) |

287 |

-25 |

5 |

45 |

312 |

|

||||||

Normalized EBIT |

1 088 |

-45 |

-37 |

237 |

1 244 |

|

||||||

Normalized EBITDA |

1 447 |

-45 |

-39 |

302 |

1 666 |

|

||||||

Normalized EBITDA margin |

|

|

|

|

|

-77 bps |

EMEA |

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

40 540 |

29 |

- |

2 392 |

42 962 |

|

||||||

Revenue |

3 763 |

-125 |

-246 |

549 |

3 940 |

|

||||||

Cost of sales |

-1 796 |

-5 |

124 |

-323 |

-2 000 |

- |

||||||

Gross profit |

1 966 |

-130 |

-123 |

226 |

1 939 |

|

||||||

SG&A |

-1 496 |

128 |

97 |

-70 |

-1 341 |

- |

||||||

Other operating income/(expenses) |

92 |

1 |

-6 |

- |

88 |

|

||||||

Normalized EBIT |

563 |

-1 |

-32 |

156 |

685 |

|

||||||

Normalized EBITDA |

1 060 |

-17 |

-65 |

214 |

1 192 |

|

||||||

Normalized EBITDA margin |

|

|

|

|

|

134 bps |

||||||

|

|

|

|

|

|

|

||||||

|

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

46 081 |

1 |

- |

-698 |

45 385 |

- |

||||||

Revenue |

3 500 |

-54 |

-63 |

88 |

3 471 |

|

||||||

Cost of sales |

-1 555 |

- |

27 |

-126 |

-1 655 |

- |

||||||

Gross profit |

1 944 |

-55 |

-36 |

-38 |

1 816 |

- |

||||||

SG&A |

-1 126 |

53 |

22 |

52 |

-999 |

|

||||||

Other operating income/(expenses) |

64 |

- |

- |

3 |

67 |

|

||||||

Normalized EBIT |

882 |

-2 |

-14 |

17 |

884 |

|

||||||

Normalized EBITDA |

1 242 |

-2 |

-17 |

9 |

1 232 |

|

||||||

Normalized EBITDA margin |

|

|

|

|

|

-64 bps |

||||||

|

|

|

|

|

|

|

||||||

Global Export and Holding Companies |

HY21 |

Scope |

Currency

|

Organic

|

HY22 |

Organic

|

||||||

Total volumes (thousand hls) |

615 |

-204 |

- |

29 |

440 |

|

||||||

Revenue |

491 |

-74 |

-15 |

-3 |

399 |

- |

||||||

Cost of sales |

-385 |

17 |

11 |

-4 |

-362 |

- |

||||||

Gross profit |

106 |

-58 |

-4 |

-8 |

36 |

- |

||||||

SG&A |

-769 |

80 |

31 |

-98 |

-756 |

- |

||||||

Other operating income/(expenses) |

7 |

- |

2 |

-14 |

-5 |

- |

||||||

Normalized EBIT |

-656 |

22 |

29 |

-120 |

-725 |

- |

||||||

Normalized EBITDA |

-473 |

23 |

18 |

-108 |

-541 |

- |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220727006135/en/

Investors

+1 212 573 9287

shaun.fullalove@ab-inbev.com

+32 16 276 888

maria.glukhova@ab-inbev.com

+1 646 746 9673

cyrus.nentin@ab-inbev.com

Media

+1 917 940 7421

kate.laverge@ab-inbev.com

Ana Zenatti

+1 646 249 5440

ana.zenatti@ab-inbev.com

+1 310 592 6319

fallon.buckelew@ab-inbev.com

Source: