BT Brands Reports Results for the First Quarter Ended April 3, 2022

Rhea-AI Summary

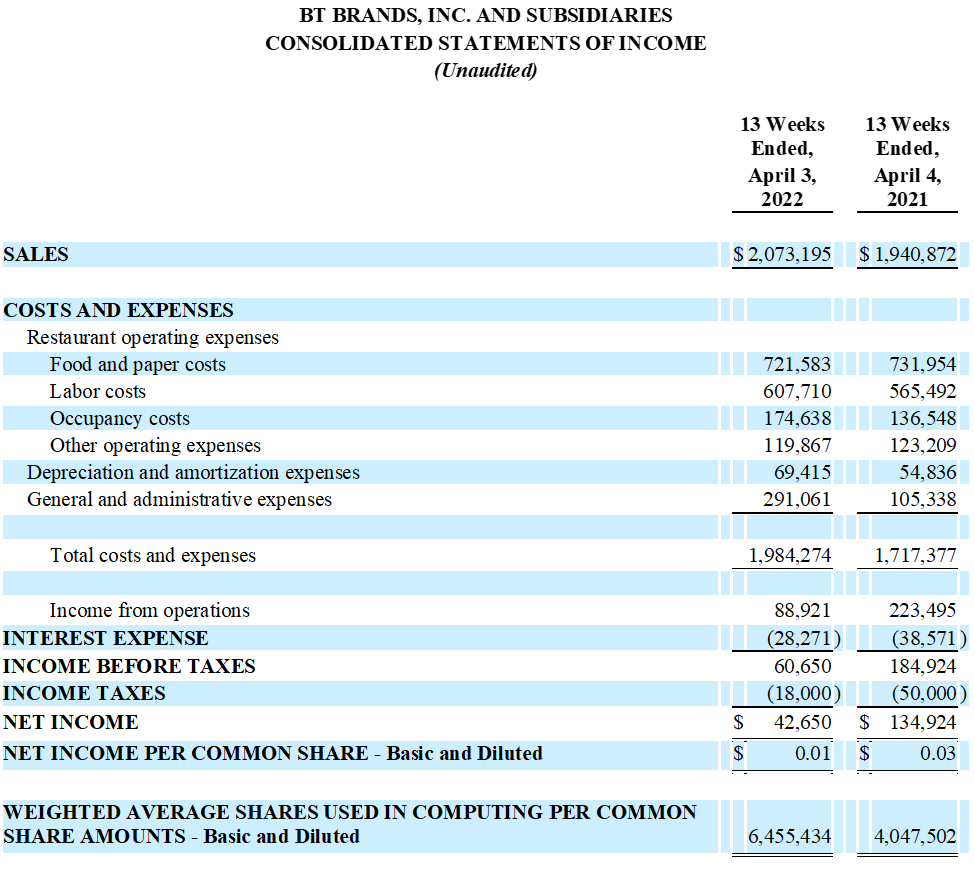

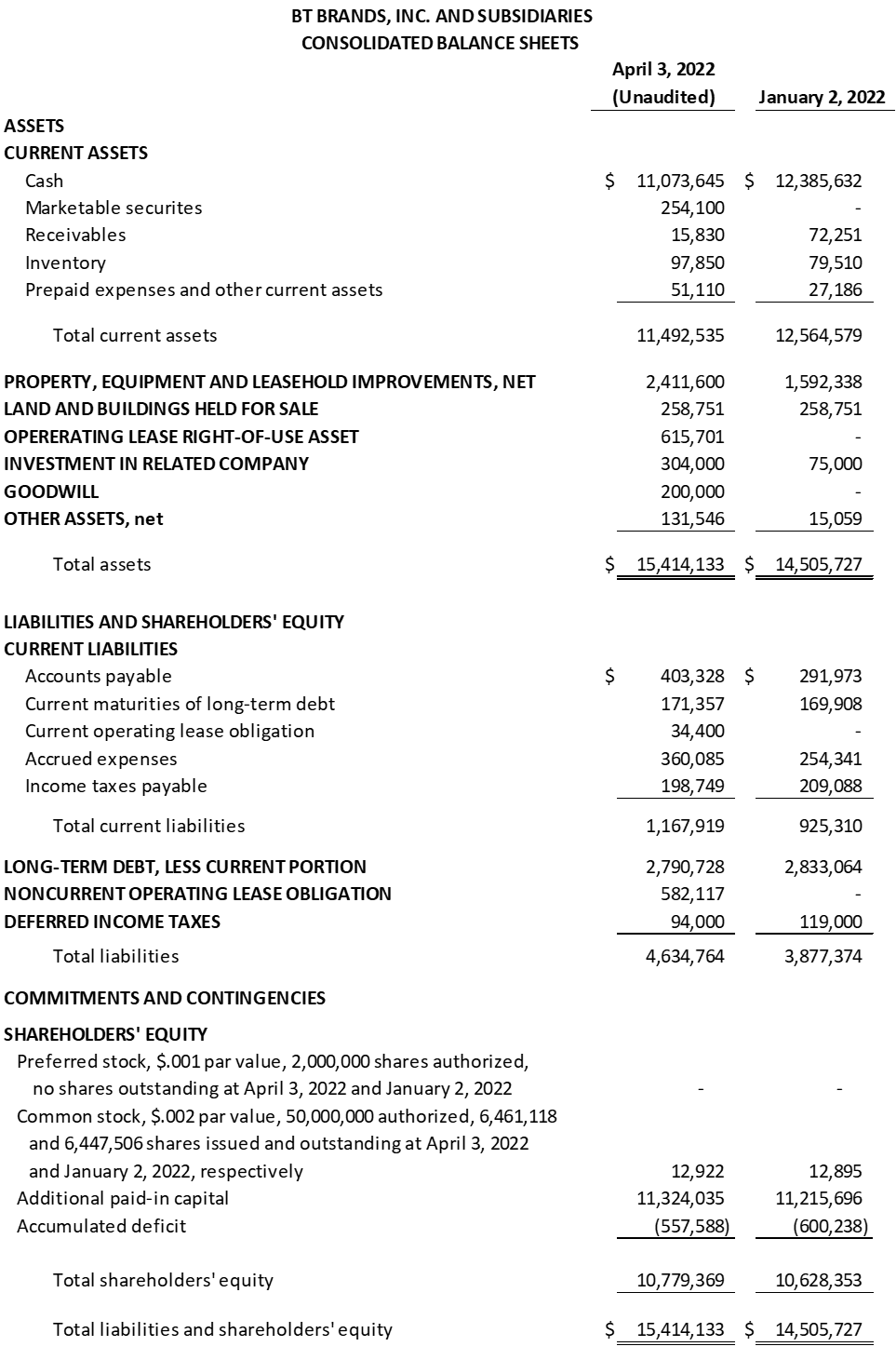

BT Brands, Inc. (NASDAQ:BTBD, BTBDW) reported a 6.8% increase in total revenues to $2.1 million for the 13 weeks ended April 3, 2022. Restaurant operating income rose 17.1% to $379,982, with a net income of $42,650 or $0.01 per share. The quarter ended with $11.1 million in cash, aided by the recent acquisitions of Keegan's Seafood Grille and Pie in the Sky Bakery. CEO Gary Copperud acknowledged challenges from staffing and inflationary pressures, leading to no financial forecast being provided for fiscal 2022.

Positive

- Total revenues increased 6.8% to $2.1 million.

- Restaurant operating income rose 17.1% to $379,982.

- Acquisition of Keegan's Seafood Grille contributed to sales and earnings.

- Cash balance at the end of the quarter was $11.1 million.

Negative

- Staffing challenges experienced in Burger Time.

- Inflationary pressure and supply chain constraints expected to impact performance.

- No financial forecast provided for fiscal 2022 due to uncertainties.

News Market Reaction 1 Alert

On the day this news was published, BTBDW declined 11.88%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

WEST FARGO, ND / ACCESSWIRE / May 18, 2022 / BT Brands, Inc. (NASDAQ:BTBD)(NASDAQ:BTBDW), operator of quick-service Burger Time restaurants and its recently acquired Keegan's Seafood Grille and Pie in the Sky Bakery and Coffee businesses, reported financial results for the 13 weeks ended April 3, 2022.

Highlights of the Company's financial results include:

- Total revenues for 2022 increased

6.8% to$2.1 million for the 13 weeks compared to the fiscal 2021period - Restaurant operating income increased

17.1% to$379,982 - Net income attributable to common shareholders was

$42,650 or $.01 per share for the period - The Company ended the quarter with

$11.1 million in cash - The recent Keegan's Seafood Grille acquisition added to sales and earnings for the quarter

Gary Copperud, the Company's Chief Executive Officer, said, "We faced challenges during the quarter at Burger Time in terms of staffing and winter weather that was less friendly than one year ago. We have made significant progress on our business plan, completing two accretive acquisitions since our IPO. The recent purchases should nearly double our current revenue run-rate." Mr. Copperud added, "we continue to face inflationary pressure, supply chain constraints, and a tight staffing market, which are expected to impact performance for the balance of 2022."

Fiscal 2022 Outlook:

Given the ongoing uncertainty surrounding possible acquisitions in 2022 and the performance of the recent acquisitions, together with the impacts of labor markets and supply chain constraints and the current inflationary environment, the Company is not providing a financial forecast for fiscal 2022.

About BT Brands, Inc.: BT Brands, Inc. (BTBD and BTBDW) owns and operates a fast-food restaurant chain called Burger Time with locations in North and South Dakota and Minnesota. The Company recently acquired Keegan Seafood Grille near Clearwater, Florida area and Pie In the Sky Coffee and Bakery in Woods Hole, Massachusetts. BT Brands is seeking acquisitions within the restaurant industry.

Forward-Looking Statements Disclaimer:

This press release contains forward-looking statements within the meaning of federal securities laws. The words "intend," "may," "believe," "will," "should," "anticipate," "expect," "seek," and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, which may cause the Company's actual results to differ materially from results expressed or implied by the forward-looking statements. These risks include such factors as the disruption to our business from the recent pandemic and the impact on our results of operations, financial condition, and the impact of federal, state, and local government actions and customer behavior in response to the pandemic and its aftermath, the impact and duration of staffing constraints at our restaurants, increased competition, cost increases or shortages in raw food products, and other matters discussed under the Risk Factors section of the BT Brands' Annual Report on Form 10-K for the fiscal year ended January 2, 2022, filed with the SEC, and other filings with the SEC. BT Brands disclaims any obligation or duty to update or modify these forward-looking statements.

CONTACT FOR FURTHER INFORMATION:

KENNETH BRIMMER 612-229-8811

SOURCE: BT Brands, Inc.

View source version on accesswire.com:

https://www.accesswire.com/701764/BT-Brands-Reports-Results-for-the-First-Quarter-Ended-April-3-2022