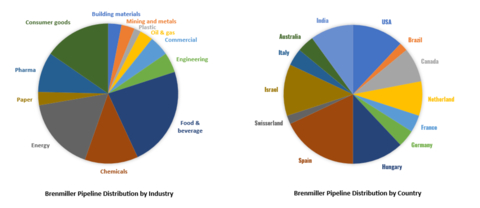

Brenmiller’s Project Pipeline Expands to 49 Projects Representing Over $500 Million in Potential Value in 12 Industries Across 13 Countries

- Contract proposals and negotiations with some of the world’s largest companies, including Fortune 100s, demonstrate Brenmiller’s robust capability to provide thermal energy storage solutions for energy-intensive and power-producing industries

- Need for on-demand access to around-the-clock renewable heat, combined with global climate policies are driving industry interest in Brenmiller’s bGen™ ZERO thermal energy storage technology

-

U.S. ,Spain ,Hungary ,Israel , andIndia represent largest geographic share of pipeline projects

ROSH HA’AYIN,

Brenmiller is advancing potential projects in 12 industries. Food and beverage, consumer goods, energy, chemicals, and pharmaceuticals represent the largest share across 13 countries including the

Brenmiller is advancing potential projects in 12 industries. Food and beverage, consumer goods, energy, chemicals, and pharmaceuticals represent the largest share across 13 countries including the

Approximately two-thirds of the pipeline projects are equipment sales and one-third will be delivered through an Energy-as-a-Service model. Nearly all Brenmiller’s pipeline projects convert renewable electricity into process heat.

Brenmiller’s bGen™ TES technology replaces the need for fossil fuel boilers at industrial and power plants, which contribute to nearly one-quarter of all global emissions. It uses crushed rocks to store low-cost electricity from renewable or other sustainable sources and dispatches steam, hot water or hot air according to customers’ needs. Brenmiller’s TES technology is modular and highly configurable and provides heavy-emitting and mission-critical customers with scalable access to zero-emission heat while ensuring 24/7 operational reliability.

“The nearly fifty active project proposals, offers and negotiations our team has going with some of the largest and most innovative industrials and energy companies is great for business, but it’s even better for the planet: It reflects both our customers’ confidence in our ability to deliver and shifting attitudes toward decarbonization market-wide,” stated Brenmiller’s Chairman and CEO, Avi Brenmiller. “Several of these projects are in advanced stages of negotiations and we anticipate that two to four of them may advance into binding, revenue-generating contracts in the coming quarters.”

About bGen™

bGen™, Brenmiller’s TES system, converts electricity into heat to power sustainable industrial processes at a price that is competitive with natural gas. The bGen™ charges by capturing low-cost electricity from renewables or the grid and stores it in crushed rocks. It then discharges steam, hot water or hot air on demand according to customer requirements. The bGen™ also supports the development of utility-scale renewables by providing critical flexibility and grid-balancing capabilities. bGen™ was named among TIME’s Best Inventions of 2023 in the Green Energy category.

About Brenmiller Energy Ltd.

Brenmiller Energy helps energy-intensive industries and power producers end their reliance on fossil fuel boilers. Brenmiller’s patented bGen™ thermal battery is a modular and scalable energy storage system that turns renewable electricity into zero-emission heat. It charges using low-cost renewable electricity and discharges a continuous supply of heat on demand and according to its customers’ needs. The most experienced thermal battery developer on the market, Brenmiller operates the world’s only gigafactory for thermal battery production and is trusted by leading multinational energy companies. For more information visit the company’s website at https://bren-energy.com/ and follow the company on X (formerly Twitter) and LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, the Company is using forward-looking statements in this press release when it discusses: the Company’s project pipeline of 49 potential contracts in various stages of development for its bGen™ ZERO TES systems; such potential projects can potentially be valued at over

View source version on businesswire.com: https://www.businesswire.com/news/home/20240517659552/en/

Media:

Tori Bentkover

brenmillerenergy@antennagroup.com

Source: Brenmiller Energy Ltd.