$4.25 Million Gold Sale

Barton Gold Holdings announced the sale of approximately 1,400 ounces of gold, recovered from its December 2022 mill cleanout and preservation program. The sale was executed under a treatment and refining contract, with an initial provisional payment of USD $2.82 million (AUD $4.25 million) received, representing 90% of the gold’s estimated value. Final payment will depend on further weighing, sampling, and assay results, expected by July 2024. The company highlights this sale as a significant achievement, contributing to over AUD $10 million in non-dilutive cash generated since its IPO in June 2021. These funds have covered all corporate costs and strengthened Barton's financial position.

- Sale of approximately 1,400 ounces of gold.

- Received a provisional payment of USD $2.82 million (AUD $4.25 million).

- Generated over AUD $10 million in non-dilutive cash since June 2021 IPO.

- Funds have covered 100% of corporate costs and reinforced treasury position.

- Final payment subject to variability in weighing, sampling, and assay results.

- Potential financial obligation if final payment is less than provisional payment.

HIGHLIGHTS

- Sale of ~1,400oz gold produced from December 2022 mill cleanout and preservation program [1]

- Provisional payment of

90% received, totalling USD$2.82 million (AUD$4.25 million ) [2]

ADELAIDE, AUSTRALIA / ACCESSWIRE / June 18, 2024 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or the Company) is pleased to confirm the sale of gold recovered from its December 2022 mill cleanout and preservation program. 1

Approximately 1,400 ounces gold have been sold via a treatment and refining contract for the Company's gold concentrate materials, the general terms of which include the following:

- 11 dry metric tonnes of concentrates (+/-

10% ); - Market competitive treatment ( TC ) and refining charges ( RC ) and Au / Ag payability (Payability);

90% initial payment against current assays, average 10 day gold price (Provisional Payment);- independent third party weighing, sampling and moisture determination (WSMD);

- independent third party sampling and assay of all concentrate materials (Assays);

- final payment based upon WSMD, Assays, and average July gold price (Final Payment); and

- other terms and conditions standard for a gold refining and sale contract of this type.

The USD

The Final Payment will be a ‘balancing payment' based upon final WSMD, Assays, Payability and other cost factor calculations, and average July 2024 gold / silver prices. If the Final Payment value is greater than the Provisional Payment received, the difference will be payable from the buyer to Barton. If the Final Payment value is less than the Provisional Payment, the difference will be payable by Barton to the buyer.

Barton notes that the weights and assays on which the Provisional Payment are based are indicative only and final recoveries may vary significantly based upon metallurgical and other factors. The materials are highly variable in nature and these figures are not a forecast of final gold recoveries or sale proceeds.

Commenting on Barton's gold sale, Barton Managing Director Alex Scanlon said:

"We are very excited to announce this gold sale, which has been achieved on extremely competitive terms. This outcome reflects both a great deal of hard work by our management team, and its broader commercial skill.

"This is also an excellent result for our shareholders. Barton continues to differentiate itself not only via the cost-efficient advancement of its development projects, but also a growing track record of asset monetisation. Since our June 2021 IPO, these efforts have generated over A

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

| Alexander Scanlon Managing Director a.scanlon@bartongold.com.au +61 425 226 649 | Shannon Coates Company Secretary cosec@bartongold.com.au +61 8 9322 1587 |

About Barton Gold

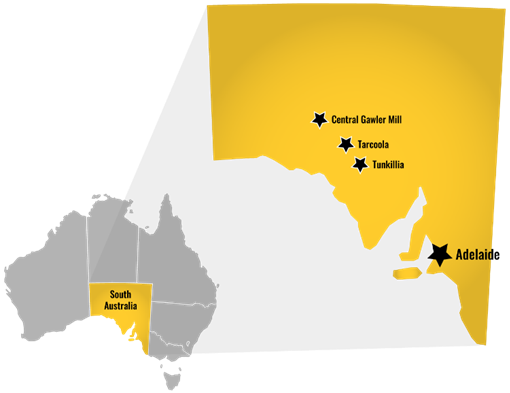

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.2Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

- Existing brownfield open pit mine within trucking distance of Barton's processing plant

- Under-explored asset with untapped scale potential

Tunkillia Gold Project

- 1.5Moz Au Mineral Resources (51.3Mt @ 0.91 g/t Au)*

- District-scale structures with advanced satellite targets

Infrastructure

- 650ktpa CIP process plant, mine village, and airstrip

- Tarcoola ~40 person lodging to support mine operations

- Tunkillia camp to support dedicated project team

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

| Tarcoola Mineral Resource | Dr Andrew Fowler (Consultant) | AusIMM | Member |

| Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

| Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

| Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

| Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

| Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

| Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates in the Prospectus continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

[1] Refer to ASX announcements dated 20 December 2022, 21 August 2023, 27 March and 29 April 2024

[2] Assuming AUD / USD foreign exchange rate of approximately 1.50 AUD per USD as at 18 June 2024

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcement 4 March 2024. Total Barton attributable JORC (2012) Mineral Resources include 824koz Au (26.8Mt @ 0.96 g/t Au) in Indicated and 750koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com

FAQ

What is the significance of Barton Gold's recent gold sale?

How much provisional payment did Barton Gold receive for its recent gold sale?

What does the final payment for Barton's gold sale depend on?

How has Barton Gold's financial position benefited from its gold sales since the IPO?