Asure Releases Third Quarter 2023 Results Showing 34% y/y Revenue Growth, Issues Preliminary FY 2024 Guidance

AUSTIN, TX / ACCESSWIRE / December 5, 2023 / Asure Software, Inc. (NASDAQ:ASUR) ("Asure" or "the Company"), a provider of cloud-based Human Capital Management (HCM) software solutions and services, recently released its third quarter 2023 financial results for the period ended September 30, 2023.

"We are excited to have delivered another strong performance for our Company in the third quarter with

"We are building on our strong momentum by advancing our technology through leading partnerships as well as launching strategic sales initiatives. As an example, we recently launched an offering that bundles our 401k product with payroll services to help drive new client additions and we have seen good reception in the brief time since this effort was launched. Our focus on areas of differentiation, such as HR Compliance, our best-in-class tax platform, and our Asure Marketplace™, is anticipated to account for an increasing share of our revenue moving forward and is expected to generate high-margin revenue streams during the remainder of 2023 and into 2024."

Revenue: Asure reported total revenue of

EBITDA, Adjusted EBITDA, and Net Loss: The company reported EBITDA of

Gross Profit and Non-GAAP Gross Profit: Gross profits were reported at

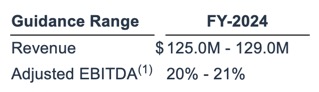

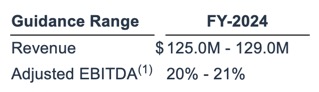

"We expect that the growth of our business will continue and today we are issuing guidance for the fourth quarter of 2023 as well as introducing preliminary guidance for 2024 revenues. Regarding the fourth quarter of 2023, we expect revenues in the range of

Asure has also recently announced new products and integrations into its suite of HCM services:

401k Product: In collaboration with Vestwell, Asure announced a new 401k product bundled with Secure Act 2.0. This offering is aimed at helping SMB clients compete against larger companies to attract and retain labor talent, as well as ensure compliance with an increasing number of state mandates that require employers to offer retirement benefits.

Lendio Integration Into Asure Marketplace: Asure has teamed up with Lendio to integrate the funding platform right into the Asure Marketplace. This will allow Asure's SMB clients to gain access to Lendio's one-stop-shop business financing platform, which can be used to compare and contrast different funding options for client SMBs.

Treasury Compliance Service: Powered by JP Morgan, the new service is designed to help regional and niche payroll providers ensure compliance is met about money movements. Regulatory requirements set under the Money Transmission Modernization Act (MTMA), the Bank Secrecy Act (BSA), and the National Automated Clearing House Association (NACHA) have notably increased and have placed stringent requirements on payroll providers. Asure's service aims to streamline the process to ensure consistent compliance with these regulations.

For more information about the company's services, latest news, and ongoing initiatives, visit https://www.asuresoftware.com and https://spotlightgrowth.com/asures-nasdaq-asur-q3-2023-financial-results-demonstrate-continued-exceptional-growth-and-improvements-to-operational-efficiency/.

About Asure Software

Asure Software (NASDAQ:ASUR) provides cloud-based Human Capital Management (HCM) software solutions that assist organizations of all sizes in streamlining their HCM processes. Asure's suite of HCM solutions includes HR, payroll, time and attendance, benefits administration, and talent management. The company's approach to HR compliance services incorporates AI technology to enhance scalability and efficiency while prioritizing client interactions. For more information, please visit www.asuresoftware.com.

About Spotlight Growth

SpotlightGrowth.com is a digital hub for micro-caps, small-caps, venture capital, private equity, crowdfunding, cryptocurrency, and other emerging growth investors. SpotlightGrowth.com serves as our media subsidiary and provides insights on small-cap companies. Follow us on social media: Twitter; Facebook; Instagram; Reddit; and YouTube.

Disclaimer

This communication was produced by Spotlight Growth (SG), an IR advisor to small and micro-cap companies. SG is not a registered or licensed broker-dealer or investment adviser. No information contained in this communication constitutes an offer to sell, a solicitation of an offer to buy, or a recommendation of any security. SG may be compensated by respective clients for publicizing information relating to its client's securities. See https://spotlightgrowth.com/disclosures for more information.

Contact:

Asure Software

patrick.mckillop@asuresoftware.com

Spotlight Growth

info@spotlightgrowth.com

SOURCE: Asure Software

View source version on accesswire.com:

https://www.accesswire.com/813182/asure-releases-third-quarter-2023-results-showing-34-yy-revenue-growth-issues-preliminary-fy-2024-guidance