Avino Commences Underground Development at La Preciosa

Rhea-AI Summary

Avino Silver & Gold Mines has commenced underground development at its wholly-owned La Preciosa Property in Mexico after receiving all required mining permits. The company is advancing a 350-metre mine access and haulage decline to intercept the high-grade La Gloria and Abundancia veins. The first phase of development is budgeted at under $5M, funded from cash reserves.

The company reports approximately $26 million in cash at the end of 2024 and remains debt-free except for operating equipment leases. La Preciosa, one of Mexico's largest undeveloped silver deposits, features higher silver grades than currently being mined at Avino. The project is expected to generate local economic growth through direct and indirect employment opportunities.

Positive

- Received all required permits for La Preciosa mining operations

- Strong cash position of $26M at end of 2024

- Debt-free status (excluding equipment leases)

- Higher silver grades at La Preciosa compared to current operations

- Initial development cost under $5M, fully funded from cash reserves

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, ASM gained 9.77%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / January 15, 2025 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6) a long-standing silver producer in Mexico, reports that underground development at its

"This milestone achievement is a testament to the dedication and vision of the entire Avino team," said David Wolfin, President and CEO of Avino. "It underscores our firm commitment to responsible development and transformational growth. The receipt of all required permits marks the culmination of lengthy collaboration with Federal and State regulators, as well as meaningful engagement with community leaders. This step marks a significant milestone for Avino, as we move one of Mexico's largest undeveloped silver deposits forward. La Preciosa represents higher silver grades than currently being mined and processed at Avino. This, coupled with robust metal prices, is setting Avino up for a strong 2025 and beyond. We would like to thank our experienced and devoted team who completed the rigorous permit process culminating in this successful approval. Furthermore, we commend everyone involved for their role in advancing La Preciosa and all those who share our vision for a better future for local communities and stakeholders."

With many of the necessary outbuildings completed, Avino has proactively prepared its mining fleet and is now advancing the development of a 350-metre mine access and haulage decline. This is designed to intercept the high-grade La Gloria and Abundancia veins, aligning with the Company's mine development plan.

Beyond direct job creation, activities at La Preciosa are expected to drive local economic growth, including the generation of both direct and indirect employment opportunities among local suppliers, subcontractors, and community groups. Avino is committed to operating La Preciosa with a small environmental footprint and in an economically sustainable manner.

Development for the first phase at La Preciosa is expected to be under

About La Preciosa

La Preciosa hosts one of the largest undeveloped primary silver resources in Mexico and is located approximately 19 kilometres from our Avino Mine operations, which has an operating 2,500 tpd mill processing facility and all the necessary infrastructure to allow for mineral processing from La Preciosa.

La Preciosa's mineral resource inventory significantly increased Avino's consolidated National Instrument 43-101 mineral resources, which is currently 371 million silver equivalent ounces.

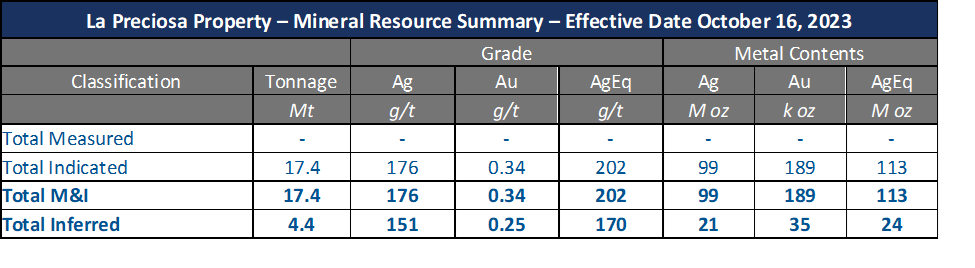

The current Mineral Resources for La Preciosa are summarized below. These resources were previously disclosed and are reported in the most recent Technical Report effective February 5, 2024 and it is available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov, and as well, the report can be viewed on the Avino website here.

Table 1 - Mineral Resource Statement

* Notes for Table 1 are summarized on the final page of this news release.

Terms of the Acquisition of the La Preciosa property by Avino, which was completed on March 21, 2022, can be found here.

Qualified Person

Peter Latta, P. Eng, MBA, Avino's VP Technical Services, is a qualified person within the context of National Instrument 43-101 who has reviewed and approved the technical data in this news release.

About Avino Silver & Gold Mines Ltd.

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company intends to maintain long term sustainable and profitable mining operations to reward shareholders and the community alike through our growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Avino currently controls mineral resources, as per NI 43-101, with a total mineral content of 371 million silver equivalent ounces, within our district-scale land package. Early in 2024, the pre-feasibility Study on the Oxide Tailings Project was completed. This study is a key milestone in our growth trajectory. As part of Avino's commitment to adopting sustainable practices, we have been operating a dry-stack tailings facility for more than one year now with excellent results. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: IR@avino.com

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company's Avino Property, including La Preciosa, located near Durango in west-central Mexico (the "Avino Property") with an effective date of October 16, 2023, and references to Measured, Indicated, and Inferred Resources, referred to in this press release. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the estimated amount and grade of mineral reserves and mineral resources, including the cut-off grade; (ii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of operating the mine, of sustaining capital, of strip ratios and the duration of financing payback periods; (iii) the estimated amount of future production, both ore processed and metal recovered and recovery rates; (iv) estimates of operating costs, life of mine costs, net cash flow, net present value (NPV) and economic returns from an operating mine; and (v) the completion of the full Technical Report, including a Preliminary Economic Assessment, and its timing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy", "goals", "objectives" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events as at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," or "inferred mineral resources" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Footnotes - Table 1:

The stated mineral resources comply with the disclosure requirements of NI 43-101 and are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards - For Mineral Resources and Mineral Reserves".

Mineral resources for La Preciosa are estimated at a cut-off grade of 120 g/t AgEq.

Mineral resources for La Preciosa are estimated using a long-term silver price of US

$19.00 /oz and a long-term gold price of US$1,750 /oz.Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Tonnage and metal content figures are expressed in thousands and may not add up due to rounding.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original press release on accesswire.com