Argo Group Highlights Comprehensive Ongoing Strategic Review Process in Letter to Shareholders

Details Exhaustive Outreach to More Than 80 Parties in Pursuit of Sale or Other Strategic Transaction

Urges Shareholders to Vote “FOR” All Argo’s Highly Qualified Director Nominees on the BLUE Proxy Card

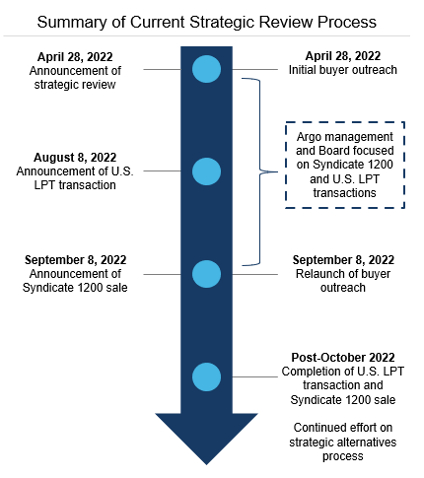

In the letter Argo details the comprehensive ongoing strategic review process the Argo Board of Directors (the “Board”) is undertaking to evaluate a range of alternatives, including a potential sale of the whole Company. With assistance from Argo’s financial advisor,

The process is being led by the Strategic Review Committee of the Board, which comprises directors who have significant experience executing M&A transactions and maximizing shareholder value. Argo is confident the strategic review process is best overseen by the Argo Board of Directors and its Strategic Review Committee, not by Capital Returns’ nominees.

The full text of the letter follows and can be found at the investor relations section of the Company’s website.

Dear Fellow Shareholders,

Your Board of Directors is focused on maximizing the value of Argo’s shares. That is why the Board launched a strategic review process to evaluate a range of alternatives, including a potential sale of the whole Company. As part of this process:

-

Argo’s financial advisor,

Goldman Sachs & Co. LLC , has conducted exhaustive outreach to more than 80 parties, including a balanced mix of potential strategic buyers and financial sponsors. - The ongoing process is being overseen by the Strategic Review Committee of the Board, which comprises directors who have significant experience successfully executing M&A transactions and maximizing shareholder value.

-

To ensure shareholder alignment, the Board appointed

J. Daniel Plants , Chief Investment Officer ofVoce Capital Management LLC , Argo’s largest active shareholder with approximately9.5% of the Company’s shares, to the Board and as Chair of the Strategic Review Committee. -

Your Board has acted decisively to transform our business and make Argo a more streamlined and attractive company. As a result, Argo is a

U.S. focused specialty insurance business and is now best positioned to drive our business strategies and evaluate strategic opportunities.

Your Board’s nominees are all essential in overseeing our progress as we continue the strategic review process. The Board believes that the nominees put forth by

We urge you to vote the BLUE card to ensure that shareholders receive the maximum value for their shares by allowing your Board to complete this comprehensive review process.

ARGO BOARD IS TAKING DECISIVE ACTIONS TO MAXIMIZE SHAREHOLDER VALUE

Your Board has taken a series of decisive actions to enhance and unlock the value of the business for shareholders. For example, over the last two years Argo has announced significant divestitures to exit international businesses and focus on its most profitable business lines. The Company has also re-underwritten its core

Argo has also announced two major risk transfer transactions, which together will significantly strengthen the Company’s financial position and result in the transfer of approximately

Following the recent completion of the LPT transaction and the pending sale of our Syndicate 1200 business to Westfield, your Board remains committed to continuing the review of strategic alternatives, better positioning Argo on a path to greater success.

THE STRATEGIC REVIEW PROCESS IS COMPREHENSIVE –

ARGO REACHED OUT TO MORE THAN 80 PARTIES

Your Board is conducting a thorough, disciplined strategic review process and is committed to leaving no stone unturned. The Board has been transparent throughout the pendency of the strategic review process and has provided frequent updates to shareholders regarding the status and potential outcomes of this process.

The Board is open to considering any and all credible offers, and as previously noted, Argo’s financial advisor has conducted exhaustive outreach to more than 80 parties, including a balanced mix of potential strategic buyers and financial sponsors. The group of prospective acquirors has also included select international companies with an interest in expanding their

Through these discussions, it is evident that the parties have found the latest developments and progress of transformation initiatives impressive, acknowledging that Argo is a healthier, streamlined business. The next step is for interested bidders to put forward proposals with any financing commitments and binding documentation.

The Board’s dedicated Strategic Review Committee is composed solely of seasoned directors to drive the process, including

The current Board has been conducting a robust and thorough process, and keeping this Board in place will ensure the process is not disrupted or hindered. Your Board’s focus throughout this process is choosing the right path that maximizes value for all shareholders.

ARGO HAS THE RIGHT BOARD TO OVERSEE THE COMPANY’S STRATEGY AND FUTURE

As of the 2022 annual general meeting, the Board will be made up of seven experienced directors, six of whom are independent. The Board’s current composition reflects its proactive refreshment program and its commitment to selecting diverse directors with relevant expertise. Six of our current nine directors joined the Board since the Company undertook its repositioning, and 10 directors have rotated off the Board in the last three years, including two at this year’s upcoming annual general meeting. Our average director tenure is now only three years. As a result of this significant level of change, the Board’s deliberations and actions reflect independent and fresh perspectives.

Further, the seven Argo directors up for election at the annual general meeting –

In sharp contrast, we believe that unlike all of Argo’s current Board members:

-

Mr. Bobman does not deal in facts. He has failed to acknowledge that the two major risk transfer transactions have made Argo a more attractive company for interested parties. His lack of public company board experience is evident in his apparent inability to recognize Argo is conducting a thorough, disciplined strategic alternatives process. -

Mr. Michelson serves as an advisor or director of at least six other companies. During his tenure as a director atFedNat Insurance , the company has suffered a ~98% stock price decline, been delisted from Nasdaq, triggered a default on over$120 million Florida Department of Financial Services .

In addition, over the past year of interactions between Argo and Capital Returns, Capital Returns has only proposed that Argo commence a strategic review process and appoint its nominees to the Board. The Board is already undertaking a strategic review – which has yielded two major risk transfer transactions, including the LPT with Enstar, as well as the pending sale of the Company’s Lloyd’s Syndicate 1200 – and continues to explore other value maximizing alternatives, including a sale of the whole Company. Capital Returns has given no indication that its nominees have any other perspectives or ideas to contribute.

PROTECT THE VALUE OF YOUR INVESTMENT

VOTE THE BLUE PROXY CARD TODAY “FOR” ALL OF ARGO’S NOMINEES

We believe the strategic review process is best overseen by the Argo Board of Directors and its Strategic Review Committee, not Capital Returns’ nominees.

The Argo Board formally interviewed Capital Returns’ candidates –

Whether or not you plan to attend the annual meeting, you have an opportunity to protect your investment in Argo by voting the BLUE proxy card. Your vote is extremely important, no matter how many shares you own. We urge you to vote today by telephone, by internet or by signing, dating and returning the BLUE proxy card in the postage-paid envelope provided. Please disregard any white proxy card you receive from Capital Returns.

The Argo Board has been unwavering in its commitment to maximize value for Argo shareholders and we thank you for your continued support.

Sincerely,

The Board of Directors of

YOUR VOTE IS IMPORTANT!

If you have any questions, or need assistance in voting your shares on the BLUE proxy card, please call our proxy solicitor:

INNISFREE M&A INCORPORATED

Shareholders in the Banks and Brokers Call Collect at +1 (212) 750-5833

|

ABOUT

FORWARD-LOOKING STATEMENTS

This press release and any related oral statements may include forward-looking statements that reflect our current views with respect to future events and financial and operational performance. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “positioning,” “expect,” “intend,” “plan,” “believe,” “do not believe,” “aim,” “project,” “anticipate,” “confident,” “seek,” “will,” “likely,” “assume,” “estimate,” “may,” “continue,” “create,” “maximize,” “guidance,” “objective,” “outcome,” remain optimistic,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “on track,” “simplifies” and similar expressions of a future or forward-looking nature. Such statements are subject to certain risks and uncertainties that could cause actual events or results to differ materially. For a more detailed discussion of such risks and uncertainties, see Item 1A, “Risk Factors” in Argo’s Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended

View source version on businesswire.com: https://www.businesswire.com/news/home/20221115006605/en/

Investors:

Head of Investor Relations

860-970-5845

andrew.hersom@argogroupus.com

AVP, Investor Relations and Corporate Finance

978-387-4150

gregory.charpentier@argogroupus.com

Media:

Senior Vice President, Group Communications

210-321-2104

david.snowden@argogroupus.com

Source: