AGNICO EAGLE PROVIDES AN UPDATE ON 2023 EXPLORATION RESULTS AND 2024 EXPLORATION PLANS - MINERAL RESERVES UP 10.5% YEAR-OVER-YEAR TO 54 MOZ; INITIAL MINERAL RESERVES OF 5.2 MOZ DECLARED AT EAST GOULDIE; INITIAL UNDERGROUND MINERAL RESOURCES DECLARED AT DETOUR LAKE OF 1.6 MOZ

Stock Symbol: AEM (NYSE and TSX)

(All amounts expressed in

"The Company's ambitious exploration program in 2023 and continuing into 2024 is yielding exciting results. At Detour Lake, step-out drilling suggests potential for an underground operation and, together with optimization of the current open pits and mill, bringing the Detour Lake mine to a production rate of one million ounces per year. At Odyssey, step-out drilling continues to significantly extend the East Gouldie deposit to the west and east. At Hope Bay, drill results confirm the expansion of the

Highlights from 2023 include:

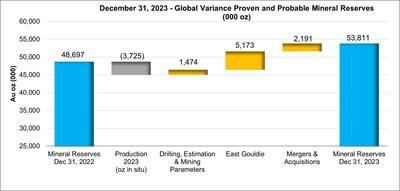

- Gold mineral reserves increase to record level – Year-end 2023 gold mineral reserves increased by

10.5% to 53.8 million ounces of gold (1,287 million tonnes grading 1.30 grams per tonne ("g/t") gold). The year-over-year increase in mineral reserves is largely due to the declaration of initial mineral reserves at East Gouldie, the acquisition of the remaining50% interest in the Canadian Malartic complex and mineral reserve replacement at Macassa andFosterville . At year-end 2023, measured and indicated mineral resources were 44.0 million ounces (1,189 million tonnes grading 1.15 g/t gold) and inferred mineral resources were 33.1 million ounces (411 million tonnes grading 2.50 g/t gold), including initial underground inferred mineral resources at Detour Lake - Detour Lake – The Company's exploration success outside of the mineral resource open pit continued, with results of up to 24.8 g/t gold over 7.4 metres at 420 metres depth approximately 860 metres west of the mineral resource open pit. An initial underground inferred mineral resource was declared below and to the west of the existing pit, totalling 1.56 million ounces of gold (21.8 million tonnes grading 2.23 g/t gold). Exploration in 2024 is expected to continue to test and extend the west plunge of the main deposit. The Company expects to provide an update on the Detour underground project and ongoing exploration results in the first half of 2024

- Odyssey mine at the Canadian Malartic complex – Initial mineral reserves of 5.17 million ounces of gold (47.0 million tonnes grading 3.42 g/t gold) were declared in the central portion of the East Gouldie deposit at year-end 2023. Successful exploration over the past year has extended the limits of the East Gouldie inferred mineral resource laterally to the west by 870 metres, with results of up to 6.2 g/t gold over 6.7 metres at 1,299 metres depth. Recent drilling continues to return good results towards the east with results of up to 6.7 g/t gold over 13.5 metres at 1,467 metres depth and 140 metres to the east of the current mineral resources outline. Inferred mineral resources at the East Gouldie deposit were 3.3 million ounces of gold (45.2 million tonnes grading 2.29 g/t gold)

- Hope Bay – Exploration drilling in 2023 totalled more than 125,000 metres, with work focused on the

Madrid and Doris deposits. At theMadrid deposit, the target area in the gap between the Suluk and Patch 7 zones delivered strong drill results in the quarter, including 16.3 g/t gold over 28.6 metres at 385 metres depth and 12.7 g/t gold over 4.6 metres at 677 metres depth. Results confirm the potential to expand gold mineralization in theMadrid deposit at depth and along strike to the south. Based on recent exploration success, the Company is evaluating a larger potential production scenario for Hope Bay. The Company expects to report results from this internal technical evaluation in 2025 Fosterville – Continued exploration success in the Robbins Hill and Lower Phoenix areas and improved mining parameters led to full replacement of 2023 production. Mineral reserves are stable year-over-year at 1.7 million ounces of gold (8.6 million tonnes grading 6.10 g/t gold). The lower average grade of the mineral reserves compared to year-end 2022 is the result of the depletion of the high grade Swan Zone that has been replaced mostly by lower grade mineral reserves from the Robbins Hill area- Amaruq – Positive grade reconciliation led to adjustments in the ore zone model and mineral reserve estimation parameters, resulting in a new proven and probable mineral reserve estimate of 1.8 million ounces of gold (15.4 million tonnes grading 3.72 g/t gold). Based on these results, the Company has approved an extension to the IVR open pit, which is expected to contribute approximately 70,000 ounces of gold to the 2026 production profile and extend the mine life to 2028 (previous mine life was 2026). Exploration also continued to return significant mineralization at depth, with results up to 11.3 g/t gold over 6.4 metres at 979 metres depth

- Macassa – Continued exploration success in the Main Break and the South Mine Complex ("SMC") zones contributed to growth in proven and probable mineral reserves at Macassa to 2.0 million ounces gold (4.2 million tonnes grading 14.45 g/t gold), and in the Amalgamated Kirkland ("AK") deposit to 160,000 ounces of gold (742,000 tonnes grading 6.69 g/t gold), with drill results in AK of up to 25.0 g/t gold over 5.0 metres at 365 metres depth

- Kittila – Exploration in 2023 identified an underexplored, parallel mineralized structure named the East Zone located in the Suuri area at shallow depth, approximately 140 metres east of the mine's producing Main Zone and outside current mineral resources. Recent drilling in the East Zone returned an intersection of 11.5 g/t gold over 7.8 metres at 204 metres depth

- Exploration budget – The Company has budgeted

$259.0 million $77.7 million

GOLD MINERAL RESERVES

At December 31, 2023, the Company's proven and probable mineral reserve estimate totalled 53.8 million ounces of gold (1,287 million tonnes grading 1.30 g/t gold). This represents a

The year-over-year increase in mineral reserves at December 31, 2023 is largely due to a substantial new mineral reserve addition of 5.2 million ounces of gold at the East Gouldie deposit at the Odyssey mine. The acquisition of the remaining

In Zacatecas State in central

Mineral reserves were calculated using a gold price of

The ore extracted from the Company's mines in 2023 contained 3.72 million ounces of gold in-situ (61.8 million tonnes grading 1.88 g/t gold). This includes the Company's

The variance in the Company's proven and probable mineral reserves from December 31, 2022 to December 31, 2023 is set out in the chart below.

The Company's gold mineral reserves as at December 31, 2023 are set out in the table below, and are compared with the gold mineral reserves as at December 31, 2022. Data in this table and certain other data in this news release have been rounded to the nearest thousand and discrepancies in total amounts are due to rounding.

Gold Mineral Reserves By Mine / Project* | Proven & Probable Gold Mineral | Average Mineral Reserve Gold Grade | |||||||

2023 | 2022 | Change | 2023 | 2022 | Change | ||||

LaRonde mine | 2,244 | 2,515 | -271 | 6.4 | 6.36 | 0.04 | |||

LaRonde Zone 5 | 636 | 710 | -74 | 2.2 | 2.12 | 0.08 | |||

LaRonde complex | 2,880 | 3,225 | -345 | 4.51 | 4.42 | 0.09 | |||

Canadian | 2,436 | 1,505 | 931 | 0.83 | 0.9 | -0.07 | |||

Odyssey deposits** | 310 | 98 | 211 | 2.17 | 2.22 | -0.05 | |||

East Gouldie deposit** | 5,173 | 0 | 5,173 | 3.42 | |||||

Canadian | 7,919 | 1,603 | 6,315 | 1.73 | 0.93 | 0.8 | |||

Goldex | 901 | 962 | -61 | 1.59 | 1.62 | -0.03 | |||

Akasaba West | 143 | 147 | -4 | 0.89 | 0.84 | 0.05 | |||

Detour Lake (at or above 0.5 g/t) | 16,594 | 17,253 | -659 | 0.93 | 0.93 | 0 | |||

Detour Lake (below 0.5 g/t) | 3,335 | 3,431 | -96 | 0.39 | 0.39 | 0 | |||

Detour Lake total | 19,928 | 20,683 | -755 | 0.76 | 0.76 | 0 | |||

Macassa | 1,954 | 1,797 | 157 | 14.45 | 17.2 | -2.75 | |||

Macassa Near Surface | 23 | 16 | 7 | 5.93 | 5.31 | 0.62 | |||

AK deposit | 160 | 100 | 60 | 6.69 | 5.2 | 1.49 | |||

Macassa total | 2,136 | 1,913 | 224 | 13.11 | 15.11 | -2.00 | |||

Upper Beaver | 1,395 | 1,395 | — | 5.43 | 5.43 | 0 | |||

Hammond Reef | 3,323 | 3,323 | — | 0.84 | 0.84 | 0 | |||

Amaruq | 1,837 | 2,164 | -327 | 3.72 | 4.05 | -0.33 | |||

Meadowbank complex | 1,837 | 2,164 | -327 | 3.72 | 4.05 | -0.33 | |||

Meliadine | 3,467 | 3,766 | -299 | 5.91 | 6.02 | -0.11 | |||

Hope Bay | 3,397 | 3,409 | -12 | 6.52 | 6.5 | 0.02 | |||

1,682 | 1,677 | 4 | 6.1 | 7.95 | -1.85 | ||||

Kittila | 3,584 | 3,683 | -100 | 4.14 | 4.2 | -0.06 | |||

546 | 665 | -118 | 1.9 | 2.01 | -0.11 | ||||

San Nicolás ( | 672 | 0 | 672 | 0.4 | |||||

La | 0 | 81 | -81 | 0.76 | |||||

Total Mineral Reserves | 53,811 | 48,697 | 5,114 | 1.3 | 1.28 | 0.02 | |||

* Ownership of mines and projects is |

** Agnico Eagle's ownership of the Canadian Malartic complex increased to |

† Agnico Eagle has agreed to subscribe for a |

The Company estimates that at a gold price

GOLD MINERAL RESOURCES

At December 31, 2023, the Company's measured and indicated mineral resource estimate totalled 44.0 million ounces of gold (1,189 million tonnes grading 1.15 g/t gold). This represents a

The year-over-year decrease in measured and indicated mineral resources is primarily due to the upgrade of mineral resources at East Gouldie to mineral reserves, largely offset by the successful conversion of inferred mineral resources into measured and indicated mineral resources and the acquisition of the remaining

At December 31, 2023, the Company's inferred mineral resource estimate totalled 33.1 million ounces of gold (411 million tonnes grading 2.50 g/t gold). This represents a

The year-over-year increase in inferred mineral resources is primarily due to the acquisition of the remaining

The Company's gold mineral resources as at December 31, 2023 are set out in the table below.

Operation / Project* | Measured & Indicated | Inferred | ||

Gold Mineral Resources | Gold Mineral Resources | |||

Contained Gold | Gold Grade | Contained Gold | Gold Grade | |

(000 oz.) | (g/t) | (000 oz.) | (g/t) | |

LaRonde mine | 632 | 3.06 | 286 | 5.67 |

LaRonde Zone 5 | 774 | 2.27 | 1,134 | 3.38 |

LaRonde complex | 1,407 | 2.57 | 1,420 | 3.68 |

Canadian | — | — | 214 | 0.81 |

Odyssey | 75 | 1.71 | 1,453 | 2.29 |

731 | 2.04 | 4,480 | 2.12 | |

East Gouldie | 244 | 1.56 | 3,331 | 2.29 |

Canadian | 1,050 | 1.88 | 9,477 | 2.12 |

Goldex | 1,646 | 1.64 | 871 | 1.68 |

Akasaba West | 91 | 0.7 | — | — |

Wasamac | 2,173 | 2.43 | 789 | 2.66 |

Detour Lake | 17,955 | 0.77 | 2,717 | 1.05 |

Detour Lake Zone 58N | 534 | 5.8 | 136 | 4.35 |

Detour Lake total | 18,489 | 0.79 | 2,853 | 1.09 |

Macassa | 598 | 8.58 | 1,094 | 9.21 |

Macassa Near Surface | 13 | 6.14 | 28 | 6.62 |

AK deposit | 37 | 6.95 | 52 | 5.69 |

Macassa total | 647 | 8.4 | 1,173 | 8.89 |

Anoki-McBean | 349 | 2.77 | 107 | 3.84 |

Upper Beaver | 403 | 3.45 | 1,416 | 5.07 |

722 | 2.15 | 1,863 | 3.11 | |

Hammond Reef | 2,298 | 0.54 | — | — |

Aquarius | 1,106 | 1.49 | 14 | 0.87 |

Holt complex | 1,699 | 4.52 | 1,310 | 4.48 |

Amaruq | 1,600 | 3.74 | 623 | 4.65 |

Meliadine | 1,629 | 4 | 2,222 | 6.22 |

Hope Bay | 1,255 | 3.64 | 2,108 | 5.41 |

1,512 | 4.05 | 1,461 | 4.54 | |

1,668 | 2.38 | 1,376 | 2.4 | |

Kittila | 1,687 | 2.93 | 1.067 | 5.06 |

Barsele ( | 176 | 1.27 | 1,005 | 1.98 |

685 | 1.83 | 104 | 1.73 | |

La | 88 | 0.52 | 1 | 0.4 |

Tarachi | 361 | 0.58 | 4 | 0.52 |

Chipriona | 326 | 0.92 | 21 | 0.66 |

El Barqueño Gold | 331 | 1.16 | 351 | 1.13 |

San Nicolás ( | 20 | 0.19 | 10 | 0.13 |

563 | 0.91 | 1,433 | 2.36 | |

Total Mineral Resources | 43,981 | 1.15 | 33,080 | 2.5 |

* Ownership of mines and projects is |

† Agnico Eagle has agreed to subscribe for a |

The economic parameters used to estimate mineral reserves and mineral resources for all properties are set out below.

Assumptions used for the December 31, 2023 mineral reserve and mineral resource estimates reported by the Company

Metal Price for Mineral Reserve Estimation* | |||

Gold (US$/oz) | Silver (US$/oz) | Copper (US$/lb) | Zinc (US$/lb) |

* Exceptions: |

Metal Price for Mineral Resource Estimation* | |||

Gold (US$/oz) | Silver (US$/oz) | Copper (US$/lb) | Zinc (US$/lb) |

* Exceptions: |

Exchange rates* | |||

C$ per | Mexican peso per | AUD per | US$ per |

AUD1.36 | |||

* Exceptions: exchange rate of |

The above metal price assumptions are below the three-year historic average (from January 1, 2021 to December 31, 2023) of approximately

2024 EXPLORATION BUDGET

The Company has budgeted

The Company's exploration focus remains on extending mine life at existing operations, testing near-mine opportunities and advancing key value driver projects. Exploration priorities for 2024 include drilling the western and deep extension of the Detour Lake deposit to assist in the optimization of the open pit operations and to further advance a potential underground mining scenario, growing the underground mineral reserve and mineral resource at the Odyssey mine and continuing large exploration programs at other operating assets and Hope Bay.

The Company's exploration and corporate development budget for 2024 is set out below. The exploration plans and more detailed budgets for individual mines and projects are set out further below, organized by region.

2024 Exploration Program and Corporate Development Budget

Expensed Exploration | Capitalized Exploration | ||||

Sustaining | Non-Sustaining | ||||

(000s $) | (000s m) | (000s $) | (000s $) | (000s m) | |

LaRonde complex | $ 8,100 | 35.4 | $ 2,300 | $ — | 14.8 |

Canadian | 13,300 | 70.6 | — | 7,100 | 66.4 |

Goldex | 2,200 | 18.4 | 2,900 | — | 22.0 |

7,100 | 39.7 | — | — | — | |

Detour Lake | 7,400 | 40.0 | — | 20,300 | 120.0 |

Macassa | — | — | 2,000 | 32,900 | 161.9 |

13,500 | 19.4 | — | 1,600 | — | |

Meliadine | — | — | 5,400 | 13,200 | 77.7 |

Meadowbank complex | 1,900 | 6.8 | — | — | — |

Hope Bay | 22,000 | 50.0 | — | — | — |

12,700 | 22.0 | — | — | — | |

11,700 | 36.5 | — | 10,900 | 38.7 | |

4,600 | 10.8 | — | — | — | |

Kittila | 4,700 | 18.5 | 1,800 | 5,300 | 51.5 |

7,100 | 12.6 | — | — | — | |

2,500 | 10.0 | 1,800 | 400 | 10.7 | |

13,400 | 6.0 | — | — | — | |

7,000 | 5.4 | — | — | — | |

Joint Ventures & Other | 5,600 | 8.4 | — | — | — |

G&A | 6,100 | — | — | — | — |

Total Exploration | $ 151,100 | 410.5 | $ 16,200 | $ 91,700 | 563.7 |

Hope Bay - Other Expenditures | 12,200 | ||||

Other Project Studies | 20,900 | — | — | ||

Total Corporate Development and Technical Services | 44,600 | — | — | ||

Total Exploration and Project Expenses | $ 228,800 | $ 16,200 | $ 91,700 | ||

ABITIBI REGION –

CANADIAN

MRMR Highlights

The strong growth in mineral reserves at the Odyssey mine at year-end 2023 is largely due to successful conversion drilling in the East Gouldie deposit, the completion of an internal study and infill drilling which increased the proven and probable mineral reserves by 5.2 million ounces of gold (47 million tonnes grading 3.42 g/t gold) as at December 31, 2023. An additional 150,000 ounces of gold in the mineral reserves are attributed to the Odyssey South deposit and the Odyssey internal zones as the understanding of these two mineralized areas continues to improve with ongoing drilling and mine development.

The Canadian Malartic open pit mine saw an increase of approximately 122,000 ounces of gold in proven and probable mineral reserves (reflecting the Company's

The acquisition of the remaining

At East Gouldie, new inferred mineral resources of 1.7 million ounces of gold were added through exploration drilling, offset by 1 million ounces of gold converted to measured and indicated mineral resources and the alignment of gold prices with the Company's assumptions. At year-end 2023, inferred mineral resources at East Gouldie totalled 3.3 million ounces of gold (45.2 million tonnes grading 2.29 g/t gold).

2023 Exploration Highlights

At the Odyssey mine in 2023, exploration drilling totalled 131,565 metres, which exceeded the budget of 101,500 metres after the program was augmented mid-year by a supplemental budget for 25,000 metres of additional drilling.

Exploration drilling at the Odyssey mine in 2023 continued to focus on three objectives: infill drilling of the Odyssey South deposit and the adjacent Odyssey internal zones; investigating lateral extensions to the west and to the east along the favourable East Gouldie mineralized corridor to grow the inferred mineral resources at East Gouldie; and adding holes in the planned upper mining levels in the East Gouldie deposit to further de-risk the project.

Selected recent drill intercepts from the Odyssey mine are set out in the composite longitudinal section below and in a table in the Appendix.

[Odyssey mine – Composite Longitudinal Section]

[Odyssey mine – Composite Cross Section and Composite Longitudinal Section of Odyssey Deposits]

Recent drilling highlights from Odyssey South and the internal zones include: 4.2 g/t gold over 6.8 metres at 383 metres depth in hole MEV23-293 in the shallow, western portion of Odyssey South; 6.8 g/t gold over 12.6 metres (core length) at 478 metres depth in hole UGOD-016-176 in the Odyssey internal zones; and 3.0 g/t gold over 14.3 metres (core length) at 374 metres depth in hole UGOD-016-199.

The continued positive results from the Odyssey internal zones show the potential with further drilling to add mineral resources at shallow depth near existing underground mine infrastructure.

Hole MEX22-251RWZ intersected 2.2 g/t gold over 50 metres at 1,659 metres depth, demonstrating the thickness of mineralization encountered in the lower portion of the East Gouldie mineral reserves.

In the program to extend the East Gouldie deposit laterally, drilling highlights include 5.0 g/t gold over 15.9 metres at 1,355 metres depth in hole MEX23-304 and 6.2 g/t gold over 6.7 metres at 1,299 metres depth in hole MEX23-304Z, with the intersections located approximately 300 metres and 200 metres laterally to the west, respectively, of the western limit of the current inferred mineral resources at East Gouldie. Drilling in the eastern portion of the East Gouldie corridor intersected 6.7 g/t gold over 13.5 metres at 1,467 metres depth in hole MEX23-305Z, approximately 140 metres east of the inferred mineral resources at East Gouldie. The holes demonstrate the potential to add inferred mineral resources laterally at East Gouldie with further drilling into these extensions of mineralization.

2024 Exploration Plan and Budget

The Company expects to spend approximately

The remaining

Following the consolidation of

WASAMAC

The Wasamac gold project was acquired on March 31, 2023, as part of the Yamana Transaction. The Wasamac deposit is characterized by shear hosted disseminated pyrite mineralization within an albite-sericite-carbonate alteration zone that ranges in thickness from a few metres up to 30 metres within the 50 to 55 degree, north-dipping Wasa Shear.

MRMR Highlights

The measured and indicated mineral resource estimate at year-end 2023 for the Wasamac project totalled 2.2 million ounces of gold (27.8 million tonnes grading 2.43 g/t) and inferred mineral resources were 0.8 million ounces of gold (9.2 million tonnes grading 2.66 g/t).

This is the first estimate of mineral resources at Wasamac published by Agnico Eagle. The Company continues to assess various scenarios regarding optimal mining rates and milling strategies for possible mine construction at the project. While these evaluations continue, the Company has decided to not include the historical mineral reserve estimate at Wasamac into the Company's mineral reserve estimate. Rather, the Company has classified the Wasamac project entirely as mineral resources.

2023 Exploration Highlights

At the Wasamac project in 2023, exploration drilling of 16,600 metres was completed by Agnico Eagle after the closing of the Yamana Transaction. The full-year program, including drilling by the previous owner, was comprised of infill and conversion drilling of the main Wasamac deposit (19,000 metres for 27 holes) and exploration drilling at the Francoeur area (6,400 metres for 15 holes) and the Wildcat area (5,800 metres for 13 holes), for a total of 31,200 metres in 55 holes drilled during the full year.

Selected recent drill intercepts from the Wasamac project are set out in the composite longitudinal section below and in a table in the Appendix.

[Wasamac Project – Plan Map and Composite Longitudinal Section of Wasamac deposit]

Recent highlights from the exploration program at the Wasamac deposit include 4.9 g/t gold over 13.4 metres (core length) at 590 metres depth in hole WS23-666; 2.8 g/t gold over 18.8 metres at 565 metres depth in hole WS23-663 in the Main Zone; and 4.4 g/t gold over 3.9 metres at 484 metres depth in hole WS23-634 in zones 3 and 4.

At Francoeur, hole FS23-129 targeted the eastern extension of the Francoeur shear related to the Horne-Creek fault and returned 4.5 g/t gold over 5.3 metres (core length) at 324 metres depth.

At Wildcat, highlight hole WS23-661 returned 3.6 g/t gold over 20.6 metres (core length) at 44 metres depth and 5.6 g/t gold over 4.1 metres (core length) at 123 metres depth; and hole WS23-653 returned 3.4 g/t gold over 5.4 metres (core length) at 267 metres depth.

2024 Exploration Plan and Budget

The Company expects to spend approximately

As part of the Company's Abitibi platform optimization program, the Company continues to assess various scenarios regarding the mining rates and milling strategies for the project.

LARONDE COMPLEX

2023 Exploration Highlights

At the LaRonde Zone 5 ("LZ5") and LaRonde mines at the LaRonde complex in 2023, exploration drilling totalled 41,300 metres, with eight drill rigs operating underground and two operating from surface.

Selected recent drill intercepts from the LaRonde complex are set out in the composite longitudinal section below and in a table in the Appendix.

[LaRonde Complex – Composite Longitudinal Section]

Exploration drilling in the western depth extension of the LZ5 deposit on the Ellison property returned highlights of 1.8 g/t gold over 24.8 metres at 686 metres depth in hole BZ-2023-007; 3.0 g/t gold over 26.4 metres at 627 metres depth in hole BZ-2023-007A; and 2.1 g/t gold over 16.8 metres at 857 metres depth in hole BZ-2023-026. These results demonstrate the continuity of mineralization at depth and to the west of the current mineral reserves and mine workings at the LZ5 mine.

Further progress was made in 2023 in rehabilitating Level 9 and extending the exploration drift at Level 215 to provide additional drill platforms to test the vertical extensions of known zones on the Bousquet property and below the LZ5 deposit.

2024 Exploration Plan and Budget

The Company expects to spend approximately

The planned work program above includes

GOLDEX

MRMR Highlights

At the Goldex mine, positive results from drilling in the Deep 2, South zones and western part of the Main Zone during 2023 have added 99,000 ounces of gold in mineral reserves, replacing in part the mining of 161,000 ounces of in-situ gold for 2023.

2023 Exploration Highlights

At the Goldex mine in 2023, exploration drilling targeted mainly the W Zone, which is the extension of the Goldex diorite host rock and is located approximately 200 metres west of the main deposit at relatively shallow depths compared to the current mine workings. A total of 13,408 metres were drilled into the W Zone in 2023 with highlights including: 1.2 g/t gold over 35.0 metres at 476 metres depth in hole GD27-053; 1.5 g/t gold over 45.0 metres at 591 metres depth in hole GD27-056; and 1.1 g/t gold over 42.0 metres at 607 metres depth in hole GD27-063.

Exploration at the W Zone could lead to the addition of mineral resources in the near future should exploration drilling continue to be successful.

2024 Exploration Plan and Budget

The Company expects to spend approximately

ABITIBI REGION –

DETOUR LAKE

MRMR Highlights

An initial underground inferred mineral resource was declared below and to the west of the existing pit, totalling 1.56 million ounces of gold (21.8 million tonnes grading 2.23 g/t gold). The Company believes that these inferred mineral resources represent only a portion of the mineralized potential located below the mineral resources pit shell.

2023 Exploration Highlights

At the Detour Lake mine in 2023, exploration drilling totalled 213,000 metres in 306 holes for the full year. The program successfully defined continuity of mineralization below and west of the mineral resources pit, resulting in the initial underground inferred mineral resource estimate described above.

Selected recent drill intercepts from the Detour Lake mine are set out in the plan map and composite longitudinal section below and in a table in the Appendix.

[Detour Lake – Plan Map and Composite Longitudinal Section]

The results below and west of the mineral reserves pit include the following highlights: 11.4 g/t gold over 5.6 metres at 319 metres depth in hole DLM23-730W; 2.7 g/t gold over 47.2 metres at 233 metres depth, including 6.5 g/t gold over 13.3 metres at 220 metres depth, hole DLM23-757; and 5.5 g/t gold over 16.6 metres at 307 metres depth in hole DLM23-775.

The drilling program also demonstrated the continuity of the mineralization outside of the mineral resource footprint over a 2.5 kilometre strike length in the western plunge of the known orebody. Highlight intercepts include: 18.3 g/t gold over 12.6 metres at 545 metres depth in hole DLM23-733A; 7.8 g/t gold over 2.7 metres at 1,030 metres depth in hole DLM23-747; 6.0 g/t gold over 22.4 metres at 236 metres depth in hole DLM23-735; 24.8 g/t gold over 7.4 metres at 420 metres depth in hole DLM23-767; and 19.3 g/t gold over 2.7 metres at 845 metres depth in hole DLM23-773.

Exploration Plan and Budget for 2024

The Company expects to spend approximately

In addition, the Company expects to spend approximately

The Company continues to evaluate the potential for underground mining. The Company expects to provide an update the Detour underground project and ongoing exploration results in the first half of 2024.

MACASSA

MRMR Highlights

The Macassa mine achieved a

The realized synergies between Macassa and the nearby AK and Near Surface ("NSUR") deposits continued to benefit the Macassa mine, with the addition of 67,000 ounces of gold in mineral reserves at the AK and NSUR deposits, net of production. Total mineral reserves at AK now stand at 160,000 ounces of gold (741,500 tonnes grading 6.69 g/t gold) at year-end 2023 and production is expected to start in 2024, demonstrating the achievement of operational synergies from the Merger.

2023 Exploration Highlights

At the Macassa mine in 2023, exploration drilling totalled metres, including 86,221 metres in the SMC and Main Break zones and 26,946 metres in the NSUR and AK deposits.

Selected recent drill intercepts from the Macassa mine are set out in the composite longitudinal section below and in a table in the Appendix.

[Macassa – Isometric View and Composite Longitudinal Section]

Drilling intersected significant results east of the current mineral resource, further supporting a lateral extension to SMC East, with highlight hole 53-4782 returning 43.0 g/t gold over 1.9 metres at 1,664 metres depth and hole 53-4813A returned 40.4 g/t gold over 1.9 metres at 1,698 metres depth.

In the Lower/West SMC, the drill program was successful in identifying multiple mineralized zones and visible gold, which suggests potential for lateral extensions and localized hanging wall splays. Recent significant results from the program include: 78.9 g/t gold over 1.9 metres at 1,827 metres depth in hole 57-1394; 67.6 g/t over 1.9 metres at 1,846 metres depth in hole 57-1442; and 69.6 g/t gold over 1.5 metres at 1,879 metres depth and 110.4 g/t gold over 1.5 metres at 1,884 metres depth in hole 57-1445.

In the Main Break, results to the east and up-trend of known mineral resources support the extension of mineral resources and confirm the potential for further mineralization to the east. Highlights include: 16.7 g/t gold over 1.3 metres at 2,122 metres depth in hole 58-892; 25.1 g/t gold over 1.3 metres at 2,086 metres depth in hole 58-894; and 39.6 g/t gold over 3.2 metres at 2,000 metres depth and 50.1 g/t gold over 3.3 metres at 2,007 metres depth in hole 58-920.

In the AK and NSUR deposits, drilling also expanded the mineral reserve base by

2024 Exploration Plan and Budget

The Company expects to spend approximately

As a part of an

MELIADINE

2023 Exploration Highlights

At the Meliadine mine in 2023, exploration drilling totalled 91,579 metres, with work focused on three areas: deep exploration and conversion drilling at the Pump deposit; infill drilling of inferred mineral resources at depth in the Wesmeg and Tiriganiaq deposits; and exploration drilling at the F-Zone deposit. The ongoing development of an exploration drift is providing improved access for new underground drilling platforms to investigate the lateral and depth extensions of the main Tiriganiaq deposit.

Selected recent drill intercepts from the Tiriganiaq deposit at the Meliadine property are set out in the plan map and composite longitudinal section below and in a table in the Appendix.

[Meliadine Mine – Plan Map & Composite Longitudinal Section]

The positive results from exploration drilling at shallow depth into the Pump North Zone include: hole M23-3596 intersecting 10.8 g/t gold over 4.9 metres at 210 metres depth and 4.5 g/t gold over 6.7 metres, at 220 metres depth including 8.3 g/t gold over 3.3 metres at 220 metres depth; hole M23-3577A, drilled on the same section, which returned 16.1 g/t gold over 3.6 metres at 361 metres depth and 10.8 g/t gold over 4.3 metres at 383 metres depth; hole M23-3595, drilled 115 metres to the west of hole M23-3577A, which intersected 10.7 g/t gold over 3.9 metres at 305 metres depth; and hole M23-3580, drilled 25 metres west of hole M23-3595, which returned 5.0 g/t gold over 5.8 metres at 437 metres depth and 4.7 g/t gold over 5.1 metres at 455 metres depth, indicating that the mineralized folded iron formation is still open at depth.

At Tiriganiaq, drilling is converting sectors to the west and exploring outside of the mineral resource limits in the east, and returned results such as hole M23-3760 intersecting 6.0 g/t gold over 3.0 metres at 299 metres depth. This interval is approximatively 200 metres deeper and 100 metres east of the current inferred mineral resource and mineral reserve limits, demonstrating their continuity at depth toward one of the major known Tiriganiaq ore shoots.

At Wesmeg North, recent highlights include hole ML300-10340-D4, which intersected 6.1 g/t gold over 11.7 metres at 467 metres depth, as well as hole ML300-10340-D1, which intersected 7.5 g/t gold over 7.9 metres at 519 metres depth. These intervals are located down plunge of one of the deposit's high-grade ore shoots and demonstrate its continuity. Additionally, hole ML300-10340-D6 returned 11.1 g/t gold over 5.3 metres at 303 metres depth, demonstrating the potential to develop a new ore shoot outside of the mineral resource.

At Wesmeg, hole M23-3659 intersected 9.4 g/t gold over 3.7 metres at 351 metres depth, and on the same section, hole ML400-10200-F1 intersected 15.4 g/t gold over 3.7 metres at 396 metres depth and 12.6 g/t gold over 3.3 metres depth at 402 metres depth. Approximately 100 metres further east, hole ML300-10340-D2 intersected 11.4 g/t over 3.9 metres at 494 metres depth.

2024 Exploration Plan and Budget

The Company expects to spend approximately

AMARUQ AT MEADOWBANK

MRMR Highlights

The Amaruq mine at the Meadowbank complex saw continued positive reconciliation performance during 2023 and, as a result, the estimation parameters and mining assumptions were adjusted which resulted in an increase of 150,000 ounces of gold in mineral reserves that were offset by production depletion.

2023 Exploration Highlights

At Amaruq in 2023, exploration drilling totalled 29,133 metres, including conversion drilling. The main objectives of this exploration program were: to infill Whale Tail underground mineral resources; to confirm IVR open pit mineral resources for an eventual pit pushback; and to extend underground mineral resources at depth in the Whale Tail and IVR deposits.

Selected recent drill intercepts from Amaruq are set out in the composite longitudinal section below and in a table in the Appendix.

[Amaruq – Composite Longitudinal Section]

Exploration drilling in proximity to the underground mineral resources of the Whale Tail deposit intersected significant mineralization from Zone QZ03 and Zone IC with the following highlights: 3.8 g/t gold over 6.8 metres at 503 metres depth in hole AMQ23-3034; 4.9 g/t gold over 6.7 metres at 595 metres depth in hole AMQ23-3043B; and 7.4 g/t gold over 2.4 metres at 554 metres depth in hole AMQ23-3046.

The drilling at depth at the IVR deposit intercepted significant mineralized zones including the following highlights: 5.1 g/t gold over 17.4 metres at 901 metres depth hole AMQ23-3062; and hole AMQ23-3064A intercepting three intersections from a folded zone, including 6.3 g/t gold over 5.2 metres at 967 metres depth, 11.3 g/t gold over 6.4 metres at 979 metres depth and 4.4 g/t gold over 9.2 metres at 1,013 metres depth. These results demonstrate that the IVR deposit remains open at depth and further demonstrate the potential to grow underground mineral resources at Amaruq.

2024 Exploration Plan and Budget

The Company expects to spend approximately

HOPE BAY

MRMR Highlights

Exploration drilling at Hope Bay added 336,000 ounces of inferred mineral resources at year-end 2023, mostly from the Patch 7 zone, which was partially offset by a reduction of 177,000 ounces of gold in inferred mineral resources due to project-wide conversion to indicated mineral resources and improvement of mining parameters.

2023 Exploration Highlights

At the Hope Bay project in 2023, exploration drilling totalled 125,150 metres in 224 holes, focused on the

Based on the positive results at

Exploration at

Recent results have extended this area of mineralization to a minimum of 2,200 metres in lateral distance and 500 metres in vertical distance, and demonstrated that gold mineralization extends approximately 200 metres south of the Patch 7 deposit.

Selected recent drill intercepts from the

[Madrid Deposit at Hope Bay – Composite Longitudinal Section]

Hole HBM23-143 returned 16.3 g/t gold over 28.6 metres at 385 metres depth in Patch 7 and represents one the best holes drilled to date in the

In the northern extension of the gap target, hole HBM23-140 returned 12.7 g/t gold over 4.6 metres at 677 metres depth in the Suluk zone. This intercept is located 580 metres north of previously reported hole HBM23-105 (10 g/t gold over 14.0 metres at 677 metres depth, see the Company's news release dated July 26, 2023) and 1,100 metres north of hole HBM23-143, further demonstrating the lateral extent of the Suluk-Patch 7 mineralized trend.

Drilling that targeted the southern extension of the Patch 7 zone was highlighted by hole HBM23-132, which returned 5.0 g/t gold over 4.4 metres at 460 metres depth and 5.9 g/t gold over 2.3 metres at 530 metres depth, approximately 200 metres south of the mineral resources at Patch 7. This hole demonstrates the southern extension of the known favourable gold mineralization at Patch 7, and the trend remains open in the 1-kilometre-long underexplored area to the south between the Patch 7 and Patch 14 zones.

At Doris, the planned exploration drilling program for 2023 was completed early in the third quarter and results continued to confirm and expand the known mineralized zones. Drilling at Doris and nearby targets will resume in early 2024.

In regional exploration during 2023, one drill rig tested early-stage targets in the northern part of the Hope Bay greenstone belt and a regional lake sediment survey was completed in the Elu belt. A significant follow-up regional exploration program is planned for 2024.

2024 Exploration Plan and Budget

After a pause in drilling during the transition to winter, the Hope Bay project is ramping back up to full capacity with seven surface drill rigs. The Company expects to spend approximately

MRMR Highlights

The

2023 Exploration Highlights

At the

At the

Selected recent drill intercepts from the

[

Recent highlight holes at

In the

Also in the

At Robbins Hill, hole UDR047 intersected 5.0 g/t gold over 6.0 metres at 574 metres depth in the Hoffman Zone in a sulphide intercept located 900 metres south of the current Hoffman mineral reserves.

In the Curie Zone at Robbins Hill, hole UDH4834 intersected 149.6 g/t over 5.6 metres at 566 metres depth within the lower portion of the Curie mineral reserves.

Highlight hole UDH4580A intersected 301.4 g/t gold over 2.0 metres at 636 metres depth in the underexplored Wu Zone, which extends for more than 700 metres in length within the Robbins Hill system.

2024 Exploration Plan and Budget

The Company expects to spend approximately

Regionally at

KITTILA

MRMR Highlights

At the Kittila mine, improved modelling of the deposit and conversion drilling in the Suuri and Roura Deep areas resulted in the addition of 182,000 ounces of gold in mineral reserves, replacing

2023 Exploration Highlights

At the Kittila mine in 2023, exploration and conversion drilling totalled 58,000 metres, mainly targeted at the Main and Sisar zones in the northern and southern portions of the deposit at approximately 1.0 to 1.4 kilometres depth.

Selected recent drill intercepts from the Kittila mine are set out in the composite longitudinal section below and in a table in the Appendix.

[Kittila Mine – Composite Longitudinal Section]

To the north in the Rimpi area, highlight hole RIE23-630 intersected 5.1 g/t gold over 4.7 metres at 1,059 metres depth in the Main Zone, representing a 200-metre extension of the Main Zone to the north at moderate depths. Drilling is ongoing in this area.

The exploration and conversion drilling program in the central Roura area near the bottom of the shaft was highlighted by hole RUG23-515, which intersected 7.0 g/t gold over 19.8 metres at 1,133 metres depth in the Sisar Zone, including 18.8 g/t gold over 4.1 metres at 1,129 metres depth; and hole ROD23-7000D, which intersected 7.8 g/t gold over 4.2 metres at 1,154 metres depth in the Main Zone. These intersections are northern extensions of the gold mineralization in the Suuri zone, and they demonstrate the potential to add mineral reserves in this area, which remains open at depth.

In step-out drilling towards the south in the Suuri area, hole SUU23-700C intersected 3.4 g/t gold over 3.8 metres at 935 metres depth in the Main Zone, extending gold mineralization by 250 metres to the south. Approximately 400 metres above hole SUU237-00C, hole SUU23-606 intersected 10.0 g/t gold over 5.9 metres at 506 metres depth in the Main Zone, demonstrating the wide exploration target for continued exploration drilling to the south.

During the second half of 2023, exploration drilling from surface began targeting an underexplored, parallel mineralized structure named the East Zone located in the Suuri area approximately 140 metres east of the mine's producing Main Zone and outside current mineral resources. Following up on the previously announced hole SUU23004 in the East Zone, which intersected 11.8 g/t gold over 9.9 metres at 208 metres depth, including 18.2 g/t gold over 4.8 metres at 206 metres depth (see the Company's news release dated October 25, 2023), two recent holes returned further significant gold mineralization at shallow depths in the East Zone: hole SSU23-008 intersected 11.5 g/t gold over 7.8 metres at 204 metres depth, including 20.5 g/t gold over 3.7 metres at 205 metres depth, with the intersection located 73 metres south of hole SUU23-004; and hole SUU23-001 intersected 4.3 g/t gold over 2.7 metres at 158 metres depth, approximately 200 metres north of hole SUU23-004.

The newly identified East Zone is an attractive, high-grade parallel zone at shallow depth that has the potential to provide an additional source of ore proximal to existing mine infrastructure.

2024 Exploration Plan and Budget

The Company expects to spend approximately

2023 Exploration Highlights

At the Pinos Altos mine in 2023, exploration drilling totalled 21,264 metres in 81 holes, focused on the Pinos Altos Deep project beneath the mine, the advanced Cubiro underground project in the northwest of the property and the

At Pinos Altos Deep, drilling beneath the Oberon de Weber mining zone was highlighted by hole US23-299, which intersected 4.9 g/t gold and 193 g/t silver over 6.9 metres at 254 metres depth, including 10.5 g/t gold and 186 g/t silver over 2.3 metres at 254 metres depth, demonstrating the potential to add mineral resources and mineral reserves approximately 100 metres below current underground mine workings.

The positive results from recent exploration show the potential to continue to add and convert remaining mineral resources into mineral reserves and to extend the life of mine at

Exploration Plan and Budget for 2024

The Company expects to spend approximately

About Agnico Eagle

Agnico Eagle is a Canadian based and led senior gold mining company and the third largest gold producer in the world, producing precious metals from operations in

Further Information

For further information regarding Agnico Eagle, please contact Investor Relations at the email address investor.relations@agnicoeagle.com or call (416) 947-1212.

Forward-Looking Statements

The information in this news release has been prepared as at February 15, 2024. Certain statements contained in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under the provisions of Canadian provincial securities laws and are referred to herein as "forward-looking statements". All statements, other than statements of historical fact, that address circumstances, events, activities or developments that could, or may or will occur are forward looking statements. When used in this news release, the words "achieve", "aim", "anticipate", "could", "estimate", "expect", "forecast", "future", "plan", "possible", "potential", "schedule", "target", "tracking", "will", and similar expressions are intended to identify forward-looking statements. Such statements include, without limitation: the Company's forward-looking guidance, including project timelines, drilling targets or results, life of mine estimates; the estimated timing and conclusions of the Company's studies and evaluations; the Company's plans at the Hope Bay project; the Company's plans at the Wasamac project; statements concerning other expansion projects, optimization efforts, projected exploration, including costs and other estimates upon which such projections are based; timing and amounts of exploration expenditures and other cash needs; estimates of future mineral reserves, mineral resources, the projected development of certain ore deposits, including estimates of exploration, development and production and other capital costs and estimates of the timing of such exploration, development and production or decisions with respect to such exploration, development and production; estimates of mineral reserves and mineral resources and the effect of drill results on future mineral reserves and mineral resources; the Company's ability to obtain the necessary permits and authorizations in connection with its proposed or current exploration, development and mining operations and the anticipated timing thereof; future exploration; the anticipated timing of events with respect to the Company's mine sites; and anticipated trends with respect to the Company's operations, exploration and the funding thereof. Such statements reflect the Company's views as at the date of this news release and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by Agnico Eagle as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The material factors and assumptions used in the preparation of the forward looking statements contained herein, which may prove to be incorrect, include, but are not limited to, the assumptions set forth herein and in management's discussion and analysis ("MD&A") and the Company's Annual Information Form ("AIF") for the year ended December 31, 2022 filed with Canadian securities regulators and that are included in its Annual Report on Form 40-F for the year ended December 31, 2022 ("Form 40-F") filed with the

Notes to Investors Regarding the Use of Mineral Resources

The mineral reserve and mineral resource estimates contained in this news release have been prepared in accordance with the Canadian securities administrators' (the "CSA") National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

Effective February 25, 2019, the SEC's disclosure requirements and policies for mining properties were amended to more closely align with current industry and global regulatory practices and standards, including NI 43-101. However, Canadian issuers that report in

Investors are cautioned that while the SEC now recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Under Canadian regulations, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in limited circumstances. Investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports in this news release are or will be economically or legally mineable.

Further, "inferred mineral resources" have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that any part or all of an inferred mineral resource will ever be upgraded to a higher category.

The mineral reserve and mineral resource data set out in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. The Company does not include equivalent gold ounces for by-product metals contained in mineral reserves in its calculation of contained ounces and mineral reserves are not reported as a subset of mineral resources.

Scientific and Technical Information

The scientific and technical information contained in this news release relating to exploration activities has been approved by Guy Gosselin, Eng. and P.Geo., Executive Vice-President, Exploration and Olivier Grondin, P.Geo., Vice-President, Exploration; and relating to mineral reserves and mineral resources has been approved by Dyane Duquette, P.Geo., Vice-President, Mineral Resources Management, each of whom is a "Qualified Person" for the purposes of NI 43-101.

Detailed Mineral Reserve and Mineral Resource Data

MINERAL RESERVES | |||||||||||

As at December 31, 2023 | |||||||||||

OPERATION / PROJECT | PROVEN | PROBABLE | PROVEN & PROBABLE | ||||||||

GOLD | Mining | 000 Tonnes | g/t | 000 Oz | 000 | g/t | 000 Oz | 000 | g/t | 000 Oz | Recovery |

LaRonde mine1 | U/G | 2,342 | 4.98 | 375 | 8,568 | 6.79 | 1,870 | 10,910 | 6.40 | 2,244 | 94.7 |

LaRonde Zone 52 | U/G | 4,450 | 2.11 | 301 | 4,523 | 2.30 | 334 | 8,972 | 2.20 | 636 | 94.7 |

LaRonde complex Total | 6,791 | 3.10 | 676 | 13,091 | 5.24 | 2,204 | 19,882 | 4.51 | 2,880 | ||

Canadian | O/P | 45,474 | 0.58 | 852 | 45,332 | 1.09 | 1,584 | 90,806 | 0.83 | 2,436 | 89.0 |

East Gouldie4 | U/G | — | — | — | 47,005 | 3.42 | 5,173 | 47,005 | 3.42 | 5,173 | 94.6 |

Odyssey deposits5 | U/G | 17 | 2.25 | 1 | 4,422 | 2.17 | 308 | 4,440 | 2.17 | 310 | 95.3 |

Canadian | 45,491 | 0.58 | 853 | 96,760 | 2.27 | 7,065 | 142,251 | 1.73 | 7,919 | ||

Goldex6 | U/G | 797 | 2.60 | 66 | 16,873 | 1.54 | 834 | 17,669 | 1.59 | 901 | 85.8 |

Akasaba West7 | O/P | 203 | 0.84 | 5 | 4,823 | 0.89 | 138 | 5,025 | 0.89 | 143 | 77.1 |

Quebec Total | 53,282 | 0.93 | 1,601 | 131,546 | 2.42 | 10,242 | 184,828 | 1.99 | 11,843 | ||

Detour Lake (Above 0.5 g/t) | O/P | 70,048 | 1.14 | 2,565 | 484,633 | 0.90 | 14,029 | 554,681 | 0.93 | 16,594 | 91.9 |

Detour Lake (Below 0.5 g/t) | O/P | 48,656 | 0.43 | 666 | 215,712 | 0.38 | 2,669 | 264,368 | 0.39 | 3,335 | 90.0 |

Detour Lake Total8 | 118,703 | 0.85 | 3,230 | 700,346 | 0.74 | 16,698 | 819,049 | 0.76 | 19,928 | ||

Macassa mine9 | U/G | 248 | 16.17 | 129 | 3,959 | 14.34 | 1,825 | 4,207 | 14.45 | 1,954 | 97.4 |

Macassa Near Surface10 | U/G | 2 | 4.23 | — | 117 | 5.96 | 22 | 119 | 5.93 | 23 | 95.0 |

AK deposit11 | U/G | — | — | — | 742 | 6.69 | 160 | 742 | 6.69 | 160 | 95.0 |

Macassa Total | 249 | 16.10 | 129 | 4,818 | 12.96 | 2,007 | 5,067 | 13.11 | 2,136 | ||

Upper Beaver12 | U/G | — | — | — | 7,992 | 5.43 | 1,395 | 7,992 | 5.43 | 1,395 | 95.0 |

Hammond Reef13 | O/P | — | — | — | 123,473 | 0.84 | 3,323 | 123,473 | 0.84 | 3,323 | 89.2 |

Ontario Total | 118,952 | 0.88 | 3,359 | 836,629 | 0.87 | 23,424 | 955,581 | 0.87 | 26,783 | ||

Amaruq | O/P | 3,010 | 1.58 | 153 | 9,469 | 3.76 | 1,146 | 12,479 | 3.24 | 1,299 | 91.7 |

Amaruq | U/G | 49 | 5.96 | 9 | 2,829 | 5.81 | 528 | 2,878 | 5.81 | 538 | 91.7 |

Meadowbank complex Total14 | 3,059 | 1.65 | 162 | 12,298 | 4.23 | 1,674 | 15,357 | 3.72 | 1,837 | ||

Meliadine | O/P | 266 | 4.27 | 37 | 4,632 | 4.46 | 664 | 4,898 | 4.45 | 700 | 94.7 |

Meliadine | U/G | 1,514 | 7.57 | 369 | 11,846 | 6.30 | 2,398 | 13,360 | 6.44 | 2,767 | 96.3 |

Meliadine Total15 | 1,780 | 7.08 | 405 | 16,478 | 5.78 | 3,062 | 18,258 | 5.91 | 3,467 | ||

Hope Bay16 | U/G | 93 | 6.77 | 20 | 16,123 | 6.51 | 3,377 | 16,216 | 6.52 | 3,397 | 87.5 |

Nunavut Total | 4,932 | 3.71 | 588 | 44,899 | 5.62 | 8,113 | 49,831 | 5.43 | 8,701 | ||

U/G | 679 | 12.52 | 273 | 7,897 | 5.55 | 1,409 | 8,576 | 6.10 | 1,682 | 95.0 | |

Australia Total | 679 | 12.52 | 273 | 7,897 | 5.55 | 1,409 | 8,576 | 6.10 | 1,682 | ||

Kittila18 | U/G | 984 | 4.11 | 130 | 25,943 | 4.14 | 3,454 | 26,926 | 4.14 | 3,584 | 86.9 |

Europe Total | 984 | 4.11 | 130 | 25,943 | 4.14 | 3,454 | 26,926 | 4.14 | 3,584 | ||

O/P | 24 | 1.21 | 1 | 2,363 | 1.21 | 92 | 2,387 | 1.21 | 93 | 94.4 | |

U/G | 2,386 | 2.14 | 164 | 4,150 | 2.17 | 290 | 6,536 | 2.16 | 454 | 94.2 | |

Pinos Altos Total19 | 2,410 | 2.13 | 165 | 6,514 | 1.82 | 381 | 8,924 | 1.90 | 546 | ||

San Nicolás ( | O/P | 23,858 | 0.41 | 314 | 28,761 | 0.39 | 358 | 52,619 | 0.40 | 672 | 17.6 |

Mexico Total | 26,268 | 0.57 | 479 | 35,275 | 0.65 | 739 | 61,543 | 0.62 | 1,219 | ||

Total Gold | 205,096 | 0.98 | 6,430 | 1,082,188 | 1.36 | 47,380 | 1,287,284 | 1.30 | 53,811 | ||

SILVER | Mining | 000 Tonnes | g/t | 000 Oz | 000 | g/t | 000 Oz | 000 | g/t | 000 Oz | Recovery |

LaRonde | U/G | 2,342 | 14.32 | 1,078 | 8,568 | 21.60 | 5,950 | 10,910 | 20.04 | 7,028 | 74.9 |

O/P | 24 | 43.30 | 33 | 2,363 | 36.35 | 2,762 | 2,387 | 36.42 | 2,796 | 44.5 | |

U/G | 2,386 | 40.03 | 3,070 | 4,150 | 47.41 | 6,326 | 6,536 | 44.71 | 9,396 | 49.3 | |

Pinos Altos Total | 2,410 | 40.06 | 3,104 | 6,514 | 43.40 | 9,088 | 8,924 | 42.50 | 12,192 | ||

San Nicolás ( | O/P | 23,858 | 23.93 | 18,356 | 28,761 | 20.91 | 19,333 | 52,619 | 22.28 | 37,689 | 38.2 |

Total Silver | 28,609 | 24.50 | 22,538 | 43,843 | 24.38 | 34,371 | 72,453 | 24.43 | 56,909 | ||

COPPER | Mining | 000 Tonnes | % | tonnes | 000 | % | tonnes | 000 | % | tonnes | Recovery |

LaRonde | U/G | 2,342 | 0.19 | 4,558 | 8,568 | 0.30 | 25,341 | 10,910 | 0.27 | 29,899 | 83.6 |

Akasaba West | O/P | 203 | 0.44 | 890 | 4,823 | 0.50 | 24,262 | 5,025 | 0.50 | 25,153 | 83.6 |

Upper Beaver | U/G | — | — | — | 7,992 | 0.25 | 19,980 | 7,992 | 0.25 | 19,980 | 90.0 |

San Nicolás ( | O/P | 23,858 | 1.26 | 299,809 | 28,761 | 1.01 | 291,721 | 52,619 | 1.12 | 591,530 | 75.7 |

Total Copper | 26,402 | 1.16 | 305,258 | 50,144 | 0.72 | 361,305 | 76,546 | 0.87 | 666,562 | ||

ZINC | Mining | 000 Tonnes | % | tonnes | 000 | % | tonnes | 000 | % | tonnes | Recovery |

LaRonde | U/G | 2,342 | 0.62 | 14,424 | 8,568 | 1.08 | 92,164 | 10,910 | 0.98 | 106,588 | 69.2 |

San Nicolás ( | O/P | 23,858 | 1.61 | 383,313 | 28,761 | 1.37 | 394,115 | 52,619 | 1.48 | 777,428 | 65.5 |

Total Zinc | 26,199 | 1.52 | 397,736 | 37,330 | 1.30 | 486,280 | 63,529 | 1.39 | 884,016 | ||

*Underground ("U/G"), Open Pit ("O/P") |

** Represents metallurgical recovery percentage |

1 LaRonde mine: Net smelter value cut-off varies according to mining type and depth, not less than |

2 LaRonde Zone 5: Gold cut-off grade varies according to stope size and depth, not less than 1.56 g/t. |

3 Canadian Malartic: Gold cut-off grade not less than 0.34 g/t for Barnat pit. |

4 East Gouldie: Gold cut-off grade not less than 1.67 g/t. |

5 Odyssey deposits: Gold cut-off grade varies according to mining zone and depth, not less than 1.53 g/t. |

6 Goldex: Gold cut-off grade varies according to mining type and depth, not less than 1.00 g/t. |

7 Akasaba West: Net smelter value cut-off varies, not less than |

8 Detour Lake: Gold cut-off grade not less than 0.30 g/t. |

9 Macassa mine: Gold cut-off grade varies according to mining type, not less than 3.71 g/t for long hole method and 4.41 g/t for cut and fill method. |

10 Macassa Near Surface: Gold cut-off grade not less than 4.33 g/t. |

11 Amalgamated |

12 Upper Beaver: Net smelter value cut-off not less than |

13 Hammond Reef: Gold cut-off grade not less than 0.41 g/t. |

14 Amaruq: Gold cut-off grade varies according to mining type, not less than 1.14 g/t for open pit mineral reserves and 3.42 g/t for underground mineral reserves (gold cut-off grade for marginal underground mineral reserves from development is 1.14 g/t). |

15 Meliadine: Gold cut-off grade varies according to mining type, not less than 1.80 g/t for open pit mineral reserves and 4.40 g/t for underground mineral reserves (gold cut-off grade for marginal underground mineral reserves from development is 1.80 g/t). |

16 Hope Bay: Gold cut-off grade not less than 4.00 g/t. |

17 |

18 Kittila: Gold cut-off grade varies according to haulage distance, not less than 2.59 g/t. |

19 |

20San Nicolás ( |

MINERAL RESOURCES | |||||||||||||

As at December 31, 2023 | |||||||||||||

OPERATION / PROJECT | MEASURED | INDICATED | MEASURED & INDICATED | INFERRED | |||||||||

GOLD | Mining | 000 Tonnes | g/t | 000 Oz | 000 | g/t | 000 | 000 | g/t | 000 | 000 | g/t | 000 |

LaRonde | U/G | — | — | — | 6,424 | 3.06 | 632 | 6,424 | 3.06 | 632 | 1,569 | 5.67 | 286 |

LaRonde Zone 5 | U/G | — | — | — | 10,594 | 2.27 | 774 | 10,594 | 2.27 | 774 | 10,437 | 3.38 | 1,134 |

LaRonde complex Total | — | — | — | 17,018 | 2.57 | 1,407 | 17,018 | 2.57 | 1,407 | 12,006 | 3.68 | 1,420 | |

Canadian | O/P | — | — | — | — | — | — | — | — | — | 8,171 | 0.81 | 214 |

Odyssey | U/G | — | — | — | 1,372 | 1.71 | 75 | 1,372 | 1.71 | 75 | 19,700 | 2.29 | 1,453 |

U/G | — | — | — | 11,134 | 2.04 | 731 | 11,134 | 2.04 | 731 | 65,748 | 2.12 | 4,480 | |

East Gouldie | U/G | — | — | — | 4,853 | 1.56 | 244 | 4,853 | 1.56 | 244 | 45,239 | 2.29 | 3,331 |

Odyssey Project Total | — | — | — | 17,358 | 1.88 | 1,050 | 17,358 | 1.88 | 1,050 | 130,687 | 2.20 | 9,263 | |

Canadian Malartic Total | — | — | — | 17,358 | 1.88 | 1,050 | 17,358 | 1.88 | 1,050 | 138,858 | 2.12 | 9,477 | |

Goldex | U/G | 12,360 | 1.86 | 739 | 18,837 | 1.50 | 907 | 31,197 | 1.64 | 1,646 | 16,154 | 1.68 | 871 |

Akasaba West | O/P | — | — | — | 4,044 | 0.70 | 91 | 4,044 | 0.70 | 91 | — | — | — |

Wasamac | U/G | — | — | — | 27,850 | 2.43 | 2,173 | 27,850 | 2.43 | 2,173 | 9,232 | 2.66 | 789 |

Quebec Total | 12,360 | 1.86 | 739 | 85,109 | 2.06 | 5,628 | 97,468 | 2.03 | 6,367 | 176,249 | 2.22 | 12,558 | |

Detour Lake | O/P | 30,861 | 1.45 | 1,434 | 697,821 | 0.74 | 16,520 | 728,681 | 0.77 | 17,955 | 58,317 | 0.62 | 1,156 |

Detour Lake | U/G | — | — | — | — | — | — | — | — | — | 21,811 | 2.23 | 1,561 |

Detour Lake Zone 58N | U/G | — | — | — | 2,868 | 5.80 | 534 | 2,868 | 5.80 | 534 | 973 | 4.35 | 136 |

Detour Lake Total | 30,861 | 1.45 | 1,434 | 700,688 | 0.76 | 17,055 | 731,549 | 0.79 | 18,489 | 81,101 | 1.09 | 2,853 | |

Macassa | U/G | 258 | 10.32 | 86 | 1,910 | 8.35 | 512 | 2,168 | 8.58 | 598 | 3,692 | 9.21 | 1,094 |

Macassa Near Surface | U/G | — | — | — | 65 | 6.14 | 13 | 65 | 6.14 | 13 | 133 | 6.62 | 28 |

AK Project | U/G | — | — | — | 163 | 6.95 | 37 | 163 | 6.95 | 37 | 282 | 5.69 | 52 |

Macassa Total | 258 | 10.32 | 86 | 2,138 | 8.17 | 562 | 2,396 | 8.40 | 647 | 4,106 | 8.89 | 1,173 | |

Aquarius | O/P | — | — | — | 23,112 | 1.49 | 1,106 | 23,112 | 1.49 | 1,106 | 502 | 0.87 | 14 |

Holt complex | U/G | 5,806 | 4.29 | 800 | 5,884 | 4.75 | 898 | 11,690 | 4.52 | 1,699 | 9,097 | 4.48 | 1,310 |

Anoki-McBean | U/G | — | — | — | 3,919 | 2.77 | 349 | 3,919 | 2.77 | 349 | 867 | 3.84 | 107 |

Upper Beaver | U/G | — | — | — | 3,636 | 3.45 | 403 | 3,636 | 3.45 | 403 | 8,688 | 5.07 | 1,416 |

O/P | — | — | — | 2,006 | 1.62 | 104 | 2,006 | 1.62 | 104 | 1,020 | 1.44 | 47 | |

U/G | — | — | — | 8,433 | 2.28 | 618 | 8,433 | 2.28 | 618 | 17,588 | 3.21 | 1,816 | |

Upper Canada Total | — | — | — | 10,439 | 2.15 | 722 | 10,439 | 2.15 | 722 | 18,608 | 3.11 | 1,863 | |

Hammond Reef | O/P | 47,063 | 0.54 | 819 | 86,304 | 0.53 | 1,478 | 133,367 | 0.54 | 2,298 | — | — | — |

Ontario Total | 83,988 | 1.16 | 3,140 | 836,119 | 0.84 | 22,574 | 920,107 | 0.87 | 25,713 | 122,968 | 2.21 | 8,736 | |

Amaruq | O/P | — | — | — | 4,758 | 2.62 | 401 | 4,758 | 2.62 | 401 | 236 | 2.87 | 22 |

Amaruq | U/G | — | — | — | 8,544 | 4.37 | 1,199 | 8,544 | 4.37 | 1,199 | 3,938 | 4.75 | 602 |

Amaruq Total | — | — | — | 13,302 | 3.74 | 1,600 | 13,302 | 3.74 | 1,600 | 4,173 | 4.65 | 623 | |

Meadowbank complex Total | — | — | — | 13,302 | 3.74 | 1,600 | 13,302 | 3.74 | 1,600 | 4,173 | 4.65 | 623 | |

Meliadine | O/P | 3 | 3.17 | — | 4,613 | 3.14 | 466 | 4,615 | 3.14 | 466 | 1,135 | 4.45 | 162 |

Meliadine | U/G | 422 | 4.64 | 63 | 7,626 | 4.49 | 1,100 | 8,047 | 4.49 | 1,163 | 9,986 | 6.42 | 2,060 |

Meliadine Total | 424 | 4.63 | 63 | 12,238 | 3.98 | 1,566 | 12,663 | 4.00 | 1,629 | 11,120 | 6.22 | 2,222 | |

Hope Bay | U/G | — | — | — | 10,734 | 3.64 | 1,255 | 10,734 | 3.64 | 1,255 | 12,110 | 5.41 | 2,108 |

Nunavut Total | 424 | 4.63 | 63 | 36,274 | 3.79 | 4,421 | 36,699 | 3.80 | 4,485 | 27,404 | 5.62 | 4,953 | |

O/P | 820 | 2.81 | 74 | 1,771 | 3.87 | 220 | 2,591 | 3.53 | 294 | 326 | 2.72 | 29 | |

U/G | 262 | 3.99 | 34 | 8,758 | 4.20 | 1,184 | 9,019 | 4.20 | 1,218 | 9,693 | 4.60 | 1,433 | |

Fosterville Total | 1,082 | 3.10 | 108 | 10,528 | 4.15 | 1,404 | 11,610 | 4.05 | 1,512 | 10,019 | 4.54 | 1,461 | |

O/P | 269 | 3.65 | 32 | 16,416 | 1.42 | 749 | 16,685 | 1.46 | 781 | 13,536 | 1.75 | 762 | |

U/G | — | — | — | 5,115 | 5.39 | 887 | 5,115 | 5.39 | 887 | 4,284 | 4.45 | 613 | |

Northern Territory Total | 269 | 3.65 | 32 | 21,531 | 2.36 | 1,636 | 21,800 | 2.38 | 1,668 | 17,820 | 2.40 | 1,376 | |

Australia Total | 1,351 | 3.21 | 139 | 32,059 | 2.95 | 3,040 | 33,410 | 2.96 | 3,180 | 27,839 | 3.17 | 2,837 | |

Kittilä | O/P | — | — | — | — | — | — | — | — | — | 373 | 3.89 | 47 |

Kittilä | U/G | 4,299 | 2.91 | 402 | 13,632 | 2.93 | 1,285 | 17,931 | 2.93 | 1,687 | 6,192 | 5.13 | 1,020 |

Kittilä Total | 4,299 | 2.91 | 402 | 13,632 | 2.93 | 1,285 | 17,931 | 2.93 | 1,687 | 6,565 | 5.06 | 1,067 | |

Barsele | O/P | — | — | — | 3,178 | 1.08 | 111 | 3,178 | 1.08 | 111 | 2,260 | 1.25 | 91 |

Barsele | U/G | — | — | — | 1,158 | 1.77 | 66 | 1,158 | 1.77 | 66 | 13,552 | 2.10 | 914 |

Barsele Total | — | — | — | 4,335 | 1.27 | 176 | 4,335 | 1.27 | 176 | 15,811 | 1.98 | 1,005 | |

Europe Total | 4,299 | 2.91 | 402 | 17,967 | 2.53 | 1,461 | 22,266 | 2.60 | 1,863 | 22,376 | 2.88 | 2,072 | |

O/P | — | — | — | 1,266 | 1.03 | 42 | 1,266 | 1.03 | 42 | 445 | 1.27 | 18 | |

U/G | — | — | — | 10,394 | 1.92 | 643 | 10,394 | 1.92 | 643 | 1,431 | 1.87 | 86 | |

Pinos Altos Total | — | — | — | 11,659 | 1.83 | 685 | 11,659 | 1.83 | 685 | 1,876 | 1.73 | 104 | |

La | O/P | 4,478 | 0.52 | 74 | 814 | 0.54 | 14 | 5,292 | 0.52 | 88 | 66 | 0.40 | 1 |

San Nicolás ( | O/P | 261 | 0.08 | 1 | 3,037 | 0.20 | 19 | 3,297 | 0.19 | 20 | 2,468 | 0.13 | 10 |

Tarachi | O/P | — | — | — | 19,290 | 0.58 | 361 | 19,290 | 0.58 | 361 | 242 | 0.52 | 4 |

Chipriona | O/P | — | — | — | 10,983 | 0.92 | 326 | 10,983 | 0.92 | 326 | 976 | 0.66 | 21 |

El Barqueño Gold | O/P | — | — | — | 8,834 | 1.16 | 331 | 8,834 | 1.16 | 331 | 9,628 | 1.13 | 351 |

O/P | — | — | — | 19,267 | 0.91 | 563 | 19,267 | 0.91 | 563 | 9,819 | 1.36 | 429 | |

U/G | — | — | — | — | — | — | — | — | — | 9,079 | 3.44 | 1,004 | |

Santa Gertrudis Total | — | — | — | 19,267 | 0.91 | 563 | 19,267 | 0.91 | 563 | 18,898 | 2.36 | 1,433 | |

Total | 4,739 | 0.49 | 75 | 73,884 | 0.97 | 2,299 | 78,623 | 0.94 | 2,373 | 34,154 | 1.75 | 1,923 | |

Total Gold | 107,161 | 1.32 | 4,558 | 1,081,412 | 1.13 | 39,423 | 1,188,573 | 1.15 | 43,981 | 410,990 | 2.50 | 33,080 | |

OPERATION / PROJECT | MEASURED | INDICATED | MEASURED & INDICATED | INFERRED | |||||||||

SILVER | Mining | 000 Tonnes | g/t | 000 Oz | 000 Tonnes | g/t | 000 Oz | 000 Tonnes | g/t | 000 Oz | 000 Tonnes | g/t | 000 Oz |

LaRonde | U/G | — | — | — | 6,424 | 11.98 | 2,474 | 6,424 | 11.98 | 2,474 | 1,569 | 12.25 | 618 |

O/P | — | — | — | 1,266 | 21.60 | 879 | 1,266 | 21.6 | 879 | 445 | 31.74 | 454 | |

U/G | — | — | — | 10,394 | 50.99 | 17,040 | 10,394 | 50.99 | 17,040 | 1,431 | 36.19 | 1,665 | |

Pinos Altos Total | — | — | — | 11,659 | 47.80 | 17,919 | 11,659 | 47.8 | 17,919 | 1,876 | 35.13 | 2,120 | |

La | O/P | 4,478 | 2.72 | 391 | 814 | 2.61 | 68 | 5,292 | 2.7 | 460 | 66 | 2.18 | 5 |

San Nicolás ( | O/P | 261 | 6.40 | 54 | 3,037 | 11.86 | 1,158 | 3,297 | 11.43 | 1,211 | 2,468 | 9.26 | 735 |

Chipriona | O/P | — | — | — | 10,983 | 100.72 | 35,566 | 10,983 | 100.72 | 35,566 | 976 | 86.77 | 2,722 |

El Barqueño Silver | O/P | — | — | — | — | — | — | — | — | — | 4,393 | 124.06 | 17,523 |

El Barqueño Gold | O/P | — | — | — | 8,834 | 4.73 | 1,343 | 8,834 | 4.73 | 1,343 | 9,628 | 16.86 | 5,218 |

O/P | — | — | — | 19,267 | 3.66 | 2,269 | 19,267 | 3.66 | 2,269 | 9,819 | 1.85 | 585 | |

U/G | — | — | — | — | — | — | — | — | — | 9,079 | 23.31 | 6,803 | |

Santa Gertrudis Total | — | — | — | 19,267 | 3.66 | 2,269 | 19,267 | 3.66 | 2,269 | 18,898 | 12.16 | 7,389 | |

Total Silver | 4,739 | 2.92 | 445 | 61,018 | 30.99 | 60,796 | 65,757 | 28.97 | 61,240 | 39,874 | 28.34 | 36,328 | |

COPPER | Mining | 000 Tonnes | % | Tonnes Cu | 000 Tonnes | % | Tonnes Cu | 000 Tonnes | % | Tonnes Cu | 000 Tonnes | % | Tonnes Cu |

LaRonde | U/G | — | — | — | 6,424 | 0.13 | 8,613 | 6,424 | 0.13 | 8,613 | 1,569 | 0.28 | 4,371 |

Akasaba West | O/P | — | — | — | 4,044 | 0.43 | 17,270 | 4,044 | 0.43 | 17,270 | — | — | — |

Upper Beaver | U/G | — | — | — | 3,636 | 0.14 | 5,135 | 3,636 | 0.14 | 5,135 | 8,688 | 0.20 | 17,284 |

San Nicolás ( | O/P | 261 | 1.35 | 3,526 | 3,037 | 1.17 | 35,489 | 3,297 | 1.18 | 39,015 | 2,468 | 0.94 | 23,144 |

Chipriona | O/P | — | — | — | 10,983 | 0.16 | 17,291 | 10,983 | 0.16 | 17,291 | 976 | 0.12 | 1,174 |

El Barqueño Gold | O/P | — | — | — | 8,834 | 0.19 | 16,400 | 8,834 | 0.19 | 16,400 | 9,628 | 0.22 | 21,152 |

El Barqueño Silver | O/P | — | — | — | — | — | — | — | — | — | 4,393 | 0.04 | 1,854 |

Total Copper | 261 | 1.35 | 3,526 | 36,958 | 0.27 | 100,198 | 37,218 | 0.28 | 103,724 | 27,721 | 0.25 | 68,980 | |

ZINC | Mining | 000 Tonnes | % | Tonnes | 000 | % | Tonnes | 000 | % | Tonnes | 000 | % | Tonnes |

LaRonde | U/G | — | — | — | 6,424 | 0.74 | 47,404 | 6,424 | 0.74 | 47,404 | 1,569 | 0.36 | 5,600 |

San Nicolás ( | O/P | 261 | 0.39 | 1,012 | 3,037 | 0.71 | 21,618 | 3,297 | 0.69 | 22,630 | 2,468 | 0.62 | 15,355 |

Chipriona | O/P | — | — | — | 10,983 | 0.83 | 91,637 | 10,983 | 0.83 | 91,637 | 976 | 0.73 | 7,073 |

Total Zinc | 261 | 0.39 | 1,012 | 20,444 | 0.79 | 160,659 | 20,704 | 0.78 | 161,671 | 5,012 | 0.56 | 28,029 | |

*Underground ("U/G"), Open Pit ("O/P") |

Assumptions used for the December 31, 2023 mineral reserve and mineral resource estimates reported by the Company

Metal Price for Mineral Reserve Estimation* | |||

Gold (US$/oz) | Silver (US$/oz) | Copper (US$/lb) | Zinc (US$/lb) |

* Exceptions: |

Mines / Projects | Metal Price for Mineral Resource Estimation* | |||

Gold (US$/oz) | Silver (US$/oz) | Copper (US$/lb) | Zinc (US$/lb) | |

Operating mines and pipeline projects | ||||

* Exceptions: |

Exchange rates* | |||

C$ per | Mexican peso per | AUD per | US$ per |

AUD1.36 | |||

* Exceptions: exchange rate of |

The above metal price assumptions are below the three-year historic average (from January 1, 2021 to December 31, 2023) of approximately

Mineral reserves are reported exclusive of mineral resources. Tonnage amounts and contained metal amounts set out in this table have been rounded to the nearest thousand, so may not aggregate to equal column totals. Mineral reserves are in-situ, taking into account all mining recoveries, before mill or heap leach recoveries. Underground mineral reserves and measured and indicated mineral resources are reported within mineable shapes and include internal and external dilution. Inferred mineral resources are reported within mineable shapes and include internal dilution. Mineable shape optimization parameters may differ for mineral reserves and mineral resources.

The mineral reserves and mineral resources tonnages reported for silver, copper and zinc are a subset of the mineral reserves and mineral resources tonnages for gold. The Company's economic parameters set the maximum price allowed to be no more than the lesser of the three‐year moving average and current spot price, which is a common industry standard. Given the current commodity price environment, Agnico Eagle continues to use more conservative gold and silver prices.

NI 43-101 requires mining companies to disclose mineral reserves and mineral resources using the subcategories of "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A mineral reserve is the economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The mineral reserves presented in this news release are separate from and not a portion of the mineral resources.

Modifying factors are considerations used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

A proven mineral reserve is the economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in the modifying factors. A probable mineral reserve is the economically mineable part of an indicated and, in some circumstances, a measured mineral resource. The confidence in the modifying factors applied to a probable mineral reserve is lower than that applied to a proven mineral reserve.

A mineral resource is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling.

A measured mineral resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. An indicated mineral resource is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An inferred mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity.

Investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable.

A feasibility study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors, together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study.

Additional Information

Additional information about each of the Company's material mineral projects as at December 31, 2023, including information regarding data verification, key assumptions, parameters and methods used to estimate mineral reserves and mineral resources and the risks that could materially affect the development of the mineral reserves and mineral resources required by sections 3.2 and 3.3 and paragraphs 3.4(a), (c) and (d) of NI 43-101 can be found in the Company's AIF and MD&A filed on SEDAR each of which forms a part of the Company's Form 40-F filed with the SEC on EDGAR and in the following technical reports filed on SEDAR in respect of the Company's material mineral properties: NI 43-101 Technical Report of the LaRonde complex in

APPENDIX

Recent Selected Exploration Drill Results

LZ5 mine at LaRonde complex

Drill hole | Mine / zone | From | To (metres) | Depth of | Estimated | Gold | Gold |

BZ-2023-007 | LZ5 | 865.4 | 898.0 | 686 | 24.8 | 1.8 | 1.8 |

BZ-2023-007A | LZ5 | 834.0 | 866.0 | 627 | 26.4 | 3.0 | 3.0 |

BZ-2022-026 | LZ5 | 982.9 | 1009.1 | 857 | 16.8 | 2.1 | 2.1 |

*Results from LZ5 mine use a capping factor of 30 g/t gold. |

W Zone at Goldex

Drill hole | From | To | Depth of | Estimated true | Gold grade (g/t) | Gold grade |

GD27-053 | 387.0 | 475.5 | 476 | 35.0 | 1.2 | 1.2 |

GD27-056 | 676.5 | 777.0 | 591 | 45.0 | 1.5 | 1.5 |

GD27-063 | 516.0 | 618.0 | 607 | 42.0 | 1.1 | 1.1 |

*Results from W Zone at Goldex use a capping factor of 50 g/t gold. |

East Gouldie deposit, Odyssey South deposit and Odyssey internal zones at Odyssey mine

Drill hole | Deposit / Zone | From | To | Depth of | Estimated | Gold grade | Gold grade |

MEV23-269 | East Gouldie | 489.8 | 492.8 | 351 | 3.0** | 5.1 | 5.1 |

MEV23-275RR | East Gouldie | 578.0 | 582.5 | 497 | 4.5** | 5.4 | 5.4 |

MEV23-281 | East Gouldie | 444.0 | 452.0 | 396 | 8.0** | 13.7 | 6.1 |

MEV23-293 | Odyssey South | 714.5 | 722.1 | 383 | 6.8 | 4.2 | 4.2 |

MEX22-251RWZ | East Gouldie | 1,774.3 | 1,835.3 | 1,659 | 50.0 | 2.3 | 2.2 |

MEX23-285 | East Gouldie | 973.4 | 978.8 | 853 | 5.4** | 4.7 | 4.7 |

MEX23-289 | East Gouldie | 666.7 | 679.6 | 420 | 12.8** | 5.2 | 5.2 |

MEX23-300 | East Gouldie | 1,138.0 | 1,146.5 | 1,067 | 6.4 | 4.2 | 4.2 |

MEX23-304 | East Gouldie | 1,564.5 | 1,581.1 | 1,355 | 15.9 | 5.0 | 5.0 |

MEX23-304Z | East Gouldie | 1,565.0 | 1,572.1 | 1,299 | 6.7 | 6.2 | 6.2 |

MEX23-305Z | East Gouldie | 1,824.7 | 1,839.0 | 1,467 | 13.5 | 6.7 | 6.7 |

MEX23-306 | East Gouldie | 692.5 | 696.3 | 578 | 3.3 | 6.1 | 6.1 |

and | East Gouldie | 724.0 | 729.0 | 605 | 4.5 | 7.0 | 6.7 |

and | East Gouldie | 871.3 | 876.3 | 725 | 4.5 | 12.8 | 11.7 |

UGOD-016-176 | Odyssey internal | 346.5 | 359.1 | 478 | 12.6** | 6.8 | 6.8 |

UGOD-016-188 | Odyssey S, Odyssey int, EG | 271.0 | 310.6 | 344 | 39.6** | 3.4 | 3.2 |

UGOD-016-190 | Odyssey South | 264.0 | 277.5 | 307 | 13.5** | 3.2 | 3.2 |

and | East Gouldie | 287.5 | 298.5 | 315 | 11.0** | 10.3 | 7.6 |

and | Odyssey internal | 326.8 | 331.6 | 328 | 4.8** | 5.9 | 5.9 |

UGOD-016-198 | East Gouldie | 325.0 | 330.5 | 330 | 5.4** | 3.9 | 3.9 |

UGOD-016-199 | Odyssey internal | 361.5 | 375.8 | 374 | 14.3** | 3.0 | 3.0 |

UGOD-036-002 | East Gouldie | 101.0 | 105.4 | 395 | 4.3** | 3.1 | 3.1 |

and | Odyssey internal | 143.0 | 149.5 | 410 | 6.5** | 14.0 | 4.9 |

UGOD-036-003 | East Gouldie | 174.5 | 200.0 | 466 | 25.5** | 3.7 | 2.9 |

and | East Gouldie | 309.5 | 328.0 | 544 | 18.5** | 2.7 | 2.7 |

*Results from East Gouldie, Odyssey internal zones and Odyssey South use a capping factor of 20 g/t gold. |

**Core length |

Wasamac, Francoeur and Wildcat deposits at Wasamac project

Drill hole | Deposit / Zone | From | To | Depth of | Estimated true | Gold grade | Gold grade |

FS23-129 | Francoeur | 374.6 | 379.9 | 324 | 5.3** | 4.5 | 4.5 |

WS23-634 | Wasamac | 526.1 | 530.1 | 484 | 3.9 | 4.4 | 4.4 |

WS23-653 | Wildcat | 387.6 | 393.0 | 267 | 5.4** | 3.4 | 3.4 |

WS23-661 | Wildcat | 44.9 | 65.5 | 44 | 20.6** | 3.6 | 3.6 |

and | Wildcat | 157.8 | 162.0 | 123 | 4.1** | 5.6 | 5.6 |

WS23-663 | Wasamac | 599.0 | 620.1 | 565 | 18.8 | 2.8 | 2.8 |

WS23-666 | Wasamac | 620.5 | 636.0 | 590 | 13.4** | 4.9 | 4.9 |

*Results from Wasamac project use a capping factor of 30 g/t gold. |

**Core length |

West Pit and West Pit Extension zones at Detour Lake

Drill hole | Zone | From (metres) | To (metres) | Depth of | Estimated (metres) | Gold grade |

DLM23-727W | West Pit Extension | 980.0 | 983.0 | 896 | 2.7 | 5.4 |

DLM-23-730W | West Pit | 393.0 | 399.1 | 319 | 5.6 | 11.4 |

DLM-23-733A | West Pit Extension | 602.0 | 617.1 | 545 | 12.6 | 18.3 |

DLM-23-735 | West Pit Extension | 260.7 | 287.0 | 236 | 22.4 | 6.0 |

and | West Pit Extension | 305.5 | 314.0 | 265 | 7.3 | 6.4 |

and | West Pit Extension | 331.0 | 334.0 | 284 | 2.7 | 11.7 |

DLM-23-745 | West Pit Extension | 317.0 | 320.0 | 285 | 2.7 | 10.0 |

and | West Pit Extension | 370.0 | 373.0 | 332 | 2.7 | 32.2 |

DLM-23-747 | West Pit Extension | 1,157.0 | 1,160.0 | 1,030 | 2.7 | 7.8 |

DLM-23-757 | West Pit | 283.3 | 334.2 | 233 | 47.2 | 2.7 |

including | 283.3 | 297.7 | 220 | 13.3 | 6.5 | |

DLM-23-763A | West Pit Extension | 631.0 | 634.0 | 559 | 2.7 | 21.9 |

and | West Pit Extension | 824.0 | 835.0 | 723 | 9.4 | 3.7 |

DLM-23-767 | West Pit Extension | 464.9 | 474.0 | 420 | 7.4 | 24.8 |

DLM-23-773 | West Pit Extension | 1,010.2 | 1,013.2 | 845 | 2.7 | 19.3 |

DLM-23-774A | West Pit Extension | 1,188.5 | 1,192.0 | 999 | 3.3 | 8.7 |

DLM-23-775 | West Pit Extension | 343.0 | 361.0 | 307 | 16.6 | 5.4 |

DLM-23-779 | West Pit Extension | 959.0 | 962.0 | 855 | 2.7 | 5.9 |

DLM-23-783 | West Pit Extension | 912.0 | 915.2 | 795 | 2.8 | 13.2 |

*Results from Detour Lake are uncapped. |

SMC, Main Break and AK zones at Macassa complex