Adobe Digital Price Index: Online Inflation Slowing; Consumers Pull Back On Spending

-

Online prices in

April 2022 up2.9% on annual basis, dropping0.5% month-over-month - Over half of the 18 product categories tracked by Adobe saw price decreases

-

$77.8 billion $5.28 billion

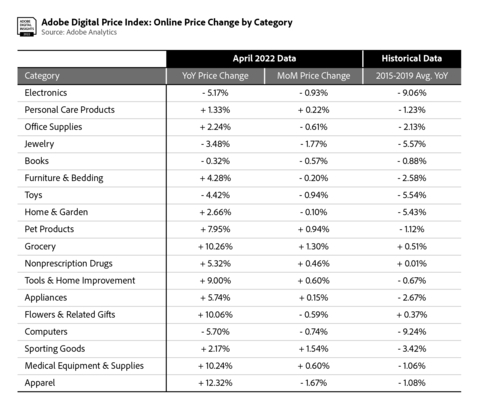

Price Table (Graphic: Business Wire)

Prices for electronics were down

In April, consumers spent

“As the cost of borrowing and economic uncertainty rises for consumers, we are beginning to see the early impact on both online inflation and spend,” said

The DPI provides the most comprehensive view into how much consumers pay for goods online. Powered by Adobe Analytics, it analyzes one trillion visits to retail sites and over 100 million SKUs across 18 product categories: electronics, apparel, appliances, books, toys, computers, groceries, furniture/bedding, tools/home improvement, home/garden, pet products, jewelry, medical equipment/supplies, sporting goods, personal care products, flowers/related gifts, non-prescription drug and office supplies.

In April, 13 of the 18 categories tracked by the DPI saw YoY price increases, with apparel rising the most. Price drops were observed in five categories: electronics, jewelry, books, toys and computers.

Eight of the 18 categories in the DPI saw price increases MoM. Price drops were observed across 10 categories including electronics, office supplies, jewelry, books, furniture/bedding, toys, home/garden, flowers/related gifts, computers and apparel.

Notable categories in the Adobe Digital Price Index for April:

-

Electronics: Prices were down

5.2% YoY (down0.9% MoM). This is the largest YoY drop for the category sinceNovember 2020 (InOctober 2020 , prices were down6.2% YoY). As the biggest category in e-commerce by share of spend, price movements have an outsized impact on overall inflation online. -

Computers: Prices were down

5.7% YoY (down0.7% MoM). This is the 16th consecutive month of deflation for the category, after rising2.9% YoY inDecember 2020 . The price decrease is still below historical levels, however, with computer prices dropping9.2% YoY on average (from 2015 to 2019). -

Apparel: Prices were up

12.3% YoY (down1.7% MoM). While the category has now seen over a year of online inflation (13 months), there are signs that prices are beginning to ease. FromNovember 2021 toMarch 2022 , prices increased by more than15.7% YoY each month, well above the12.3% YoY in April. -

Groceries: Prices continued to surge and rose

10.3% YoY (up1.3% MoM), setting another new record on an annual basis. This follows a9.0% YoY increase in March, a7.6% YoY increase in February and a5.8% YoY increase in January—all record highs. Groceries remains the only category to move in lockstep with the CPI on a long-term basis, with online prices rising now for 27 consecutive months. -

Pet Products: Prices were up

8.0% YoY (up0.9% MoM), the highest increase for the category YoY. Online inflation for pet products has now been observed for two full years, with the previous high point inSeptember 2020 (up7.8% YoY).

Methodology

The DPI is modeled after the Consumer Price Index (CPI), published by the

Powered by Adobe Analytics, Adobe uses a combination of Adobe Sensei, Adobe’s AI and machine learning framework, and manual effort to segment the products into the categories defined by the CPI manual. The methodology was first developed alongside renowned economists

About Adobe

Adobe is changing the world through digital experiences. For more information, visit www.adobe.com.

© 2022 Adobe. All rights reserved. Adobe and the Adobe logo are either registered trademarks or trademarks of Adobe in

View source version on businesswire.com: https://www.businesswire.com/news/home/20220511005378/en/

Public relations contacts

Adobe

kfu@adobe.com

Adobe

belkadi@adobe.com

Source: Adobe