Global Holiday Season Spending Expected to Grow by 16% in 2024, BNPL Surges While Synthetic Identity Fraud Emerges as Top Threat

-

ACI’s Unwrapping Checkout Trends report anticipates a

16% increase in global eCommerce transaction value during the 2024 holiday season, with the travel sector leading the growth. - Synthetic identity fraud is the top threat this holiday season, with average transaction value at nine times more than other common types of payments fraud.

-

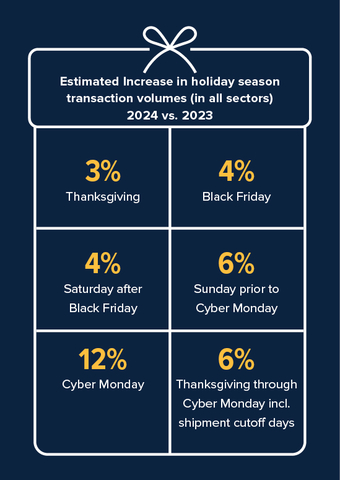

Sales transaction volume is expected to increase

6% across all Cyber Weekends.

Holidays_Prediction_Infographics_ACI (Graphic: Business Wire)

Buy now, pay later (BNPL) booms as shoppers turn to flexible payments

BNPL payments experienced a remarkable surge as shoppers turned to more flexible payment methods to spread their spending and manage their budgets. In H1 2024, global BNPL transactions skyrocketed by an astounding

Synthetic identity fraud is threatening to disrupt holiday season sales

According to ACI data, fraud values increased by more than

Fraudsters are turning to AI to fuel fraud

AI technology, such as AI-driven bots and scripts, has given fraudsters unprecedented speed to automate the process of generating synthetic identities on a massive scale. Fraudsters have also finessed the use of deep fake technology to create images, voice and video to bypass existing fraud detection systems.

"The rapid proliferation of AI-driven fraud tactics and stolen data on the Dark Web is escalating threats, making it harder than ever for merchants to distinguish real customers," said Cleber Martins, head of payments intelligence and risk solutions at ACI Worldwide. "Merchants should tighten their defenses by harnessing AI predictive modeling to detect threats and using payment intelligence signals to eliminate false positives without disrupting genuine transactions."

Key report insights at a glance

Payment trends (H1 2024 vs. H1 2023 transactional data)

-

Global eCommerce transaction volumes experienced

7% growth, led by an8% increase in travel volumes and a3% increase in ticketing. -

Alternative payment methods are shaking up the payments mix, with payment methods via BNPL and digital wallets growing

237% and209% , respectively. -

Digital eCommerce transactions saw solid year-over-year (YoY) growth, with travel sector transactions via mobile surging

22% versus5% for desktop in H1 2024 vs. 2023. -

Omnichannel retailers hold a competitive advantage, as convenience-oriented consumers spend

70% more when choosing Click and Collect or Buy Online, Pickup in-Store.

Holiday season predictions

-

Global eCommerce transaction volume is anticipated to increase by

12% during the holiday season, with the travel sector leading the expected transaction growth. -

2024 will see a

6% increase in sales volume across all Cyber Weekend days, with Cyber Monday expected to achieve the biggest YoY growth at12% . - Fraudsters will intensify their use of advanced AI tools to exploit vulnerabilities and mask activities with fake accounts and IDs to scale attacks.

Actions for merchants to capitalize on holiday sales spike

- Leverage AI to automate fraud protection, mitigate data siloes, and deliver real-time intelligence across commerce and marketing.

- Implement advanced machine learning algorithms and predictive modeling to understand the fraud landscape and predict future risks.

- Utilize data-rich analytics to gain deep insights into consumer journeys and behavior that can help optimize interactions, reduce friction and boost acceptance rates.

"Consumers' shopping journeys are evolving with more channels, hybrid services, and diverse payment options. Payments play a pivotal role in the shopping experience, reshaping how customers engage and shop," said Bobby Koscheski, head of merchant, ACI Worldwide. "By harnessing precise and real-time data and insights, merchants can better understand customers, verify digital identities, and craft hyper-personalized journeys that build trust while maximizing sales."

For more information, click here to download the ACI’s Unwrapping Checkout Trends report

*Holiday season/Q4 refers to the period of October through December.

About ACI Worldwide

ACI Worldwide, an original innovator in global payments technology, delivers transformative software solutions that power intelligent payments orchestration in real time so banks, billers, and merchants can drive growth, while continuously modernizing their payment infrastructures, simply and securely. With nearly 50 years of trusted payments expertise, we combine our global footprint with a local presence to offer enhanced payment experiences to stay ahead of constantly changing payment challenges and opportunities.

© Copyright ACI Worldwide, Inc. 2024

ACI, ACI Worldwide, ACI Payments, Inc., ACI Pay, Speedpay, and all ACI product/solution names are trademarks or registered trademarks of ACI Worldwide, Inc., or one of its subsidiaries, in

View source version on businesswire.com: https://www.businesswire.com/news/home/20241008686290/en/

Media

Nick Karoglou | Head of Communications and Corporate Affairs | nick.karoglou@aciworldwide.com

Lyn Kwek | Communications and Corporate Affairs Director, APAC/

Source: ACI Worldwide