ACI Worldwide Scamscope Report Finds APP Scam Losses Expected To Hit $6.8 Billion by 2027

- APP scam losses projected to reach $6.8 billion by 2027

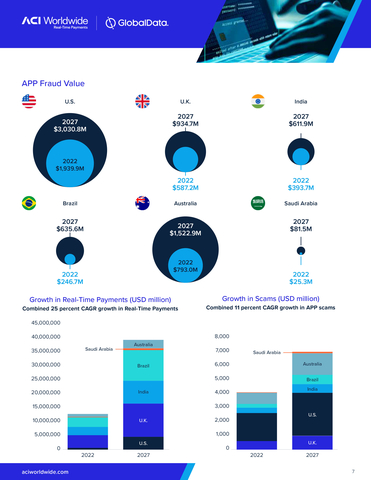

- Real-time transaction value to grow at a 25% CAGR

- Report emphasizes strategies to combat APP scams

- Concerning correlation between scam increase and real-time payments volume

- Pressure on regulators to define accountability and liability for APP scams

Insights

Analyzing...

-

Losses to APP scams are expected to record an average CAGR of

11% from 2022-2027 across analyzed markets. -

APP scam losses are expected to grow at almost

50% of the CAGR of real-time transaction value. - Report outlines scam defense strategies, which include creating an intelligence-sharing network, embracing responsible AI and boosting consumer education.

(Graphic: Business Wire)

APP fraud scams involve fraudsters tricking their victims into willingly making large bank transfers to them – in many cases, this happens via social engineering across social media networks or via telephone. “As real-time payments surge forward, the slower yet disconcerting rise of APP scams puts regulators under pressure to define accountability and assign liability,” commented Cleber Martins, head of payments intelligence and risk solutions at ACI Worldwide. “A cross-industry payments intelligence model for sharing anonymized fraud intelligence signals can strengthen the insights for automated AI systems and facilitate collaboration in real time to profile transaction risk without compromising IP, data privacy or compliance obligations.”

Fraud prevention key to unlocking sustainable growth in real-time payments

Among the markets covered in the report,

In

Real-time payments leap ahead of APP scams, yet caution prevails

APP scam losses in the

Regulatory mandates put banks on the hook for scam victim reimbursement

According to the Scamscope report, APP scam losses in the

With APP scam losses expected to reach

The report outlines four key recommendations for financial institutions to tackle the issue

- According to the Scamscope report, approximately 3 out of 10 fraud victims close their accounts, posing financial consequences for banks. There is also increasing pressure on regulators to hold banks accountable for fraud. Banks must get ahead of regulatory mandates to fortify control and build trust.

- APP scams are a cross-industry problem that requires solutions, techniques and intelligence shared among financial institutions, the government, telcos and social media tech companies. Seamless collaboration is needed to combat social engineering, liability disputes and mule account scams.

- By closely monitoring both incoming and outgoing transactions and analyzing account behavior, banks can break the mule account chain and detect mule accounts associated with synthetic or stolen identities and instances of account takeover.

- In the AI-driven era, a proactive approach is paramount to combat scammers. Leveraging diverse data signals and advanced technologies like voice biometrics enables institutions to understand customer intent, prevent emerging AI threats and safeguard customer relations.

Scamscope key findings at a glance:

-

APP fraud losses by country 2022-2027

-

Australia :$793 -$1,522.9 million -

Brazil :$246.7 -$635.6 million -

India :$393.7 -$611.9 million -

Saudi Arabia :$25.3 -$81.5 million -

U.K. :$587.2 -$934.7 million -

U.S. :$1,939.9 -$3,030.8 million

-

-

CAGR of APP scams value vs. CAGR of real-time transactions value (2022-2027)

-

Australia :14% vs.24% -

Brazil :21% vs.26% -

India :9% vs.22% -

Saudi Arabia :26% vs.34% -

U.K. :10% vs.22% -

U.S. :9% vs.41%

-

-

Top 3 APP fraud scams by country

-

Australia : Outstanding Balance (33% ), Product (22% ) and Investment (22% ) -

Brazil : Advance Payment (27% ), Product (20% ) and Investment (17% ) -

India : Product (42% ), Investment (21% ) and Advance Payment (16% ) -

Saudi Arabia : Product (33% ), Investment (16% ) and Advance Payment (14% ) -

U.S. : Product (23% ), Investment (23% ) and Advance Payment (17% ) -

U.K. : Advance Payment (25% ), Product (24% ) and Investment (19.5% )

-

Note to editors:

*Authorized push payment (APP) scams: The term describes a method of fraud in which criminals coerce legitimate users to initiate a payment to a destination account under their control. Funds leaving legitimate customers’ accounts will travel through one or several mule accounts before being collected by the fraudsters or converted by them into hard-to-trace digital assets, such as crypto or NFTs. Other terms for APP scams include “PIX fraud” in

About ACI Worldwide

ACI Worldwide is a global leader in mission-critical, real-time payments software. Our proven, secure and scalable software solutions enable leading corporations, fintechs and financial disruptors to process and manage digital payments, power omni-commerce payments, present and process bill payments, and manage fraud and risk. We combine our global footprint with a local presence to drive the real-time digital transformation of payments and commerce.

© Copyright ACI Worldwide, Inc. 2023

ACI, ACI Worldwide, ACI Payments, Inc., ACI Pay, Speedpay and all ACI product/solution names are trademarks or registered trademarks of ACI Worldwide, Inc., or one of its subsidiaries, in

View source version on businesswire.com: https://www.businesswire.com/news/home/20231204840417/en/

Media

Nick Karoglou | Head of Communications and Corporate Affairs | nick.karoglou@aciworldwide.com

Lyn Kwek | Communications and Corporate Affairs Director, APAC/

Source: ACI Worldwide