AB Explains ESG-Labeled Bonds: Quality Over Quantity

Rhea-AI Summary

AllianceBernstein (AB) has analyzed over 11,000 ESG-labeled bonds, revealing that while issuance has declined, the overall quality of the market has improved. AB's proprietary strength score, based on disclosure, ambition, and credibility of targets, shows a surge in quality across issuers and vintage years.

Key findings include:

- Weaker issues are less frequent in the market

- Greenwashing appears to be less of an issue

- Active investors are guiding issuers towards stronger ESG-labeled bond structures

AB's engagements with companies have shown positive results, such as supporting ambitious sustainability-linked bonds (SLBs) and encouraging substantial scope 3 emissions reduction targets. This analysis demonstrates the evolving landscape of ESG-labeled bonds, emphasizing quality over quantity in the market.

Positive

- None.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, AB gained 2.13%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

NORTHAMPTON, MA / ACCESSWIRE / August 21, 2024 / AllianceBernstein

ESG-Labeled Bond Issuance Has Declined, but Quality Has Improved

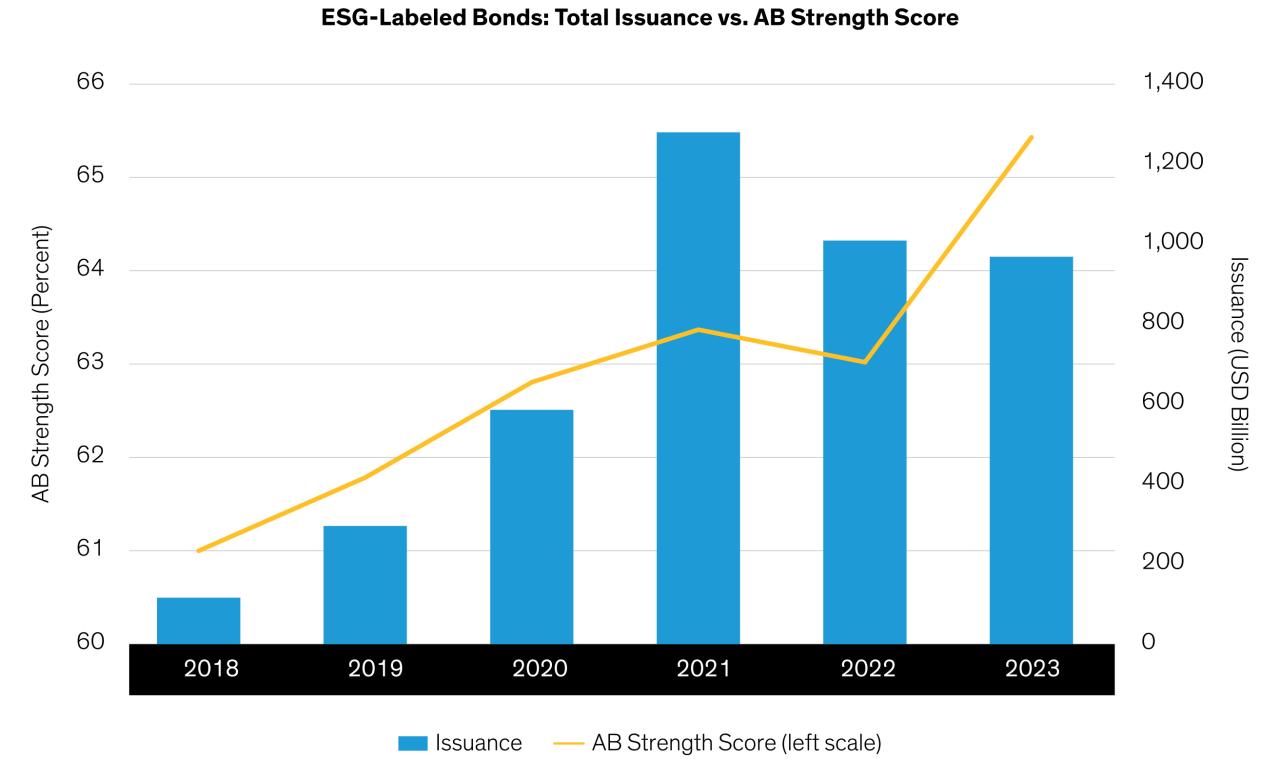

After a rapid ascent, issuance of ESG-labeled bonds has fallen back recently, even as we've observed that the overall quality of the market has improved (Display). That's an intriguing combination-with an explanation.

We've analyzed over 11,000 ESG-labeled bonds, comparing each bond's stated intentions at the time of issue with actual performance 12 months later (for example, how the bond's proceeds were allocated across different projects, and the ESG impact of those projects).

Using three criteria-disclosure, plus ambition of and credibility versus targets-and employing more than 20 underlying factors with different weightings, we calculated a quality (or strength) score for each bond, enabling us to compare them across issuers, universes and vintage years.

The surge in strength scores aligns with our experience: weaker issues are coming to market less frequently, so the overall quality of the new-issue market is rising and greenwashing seems less of an issue. We also believe that much of the improved strength is a result of diligent active investors guiding issuers to develop stronger ESG-labeled bond structures.

Our own engagements* offer examples. A global utility company issued sustainability-linked bonds (SLBs) with ambitious targets, which it missed. Our discussions with management revealed the reasons were both temporary and outside their control. We commended their ambition and supported further SLB issuance. Also, a European consumer company's SLB targeted substantial scope 3 emissions reductions-even though many peers only disclose scopes 1 and 2.

*AB engages companies where it believes the engagement is in the best interest of its clients.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.

Learn more about AB's approach to responsibility here.

Past performance does not guarantee future results. AB ESG-labeled bond strength score represents a proprietary analysis of ESG-labeled bonds 12 months after they were issued. The rating is based on the bonds' stated targets and progress towards those targets. A higher score reflects a stronger ESG-labeled bond. Scores shown above are the market average for each vintage year. Through December 31, 2023 Source: Bloomberg, LGX Datahub and AB

View additional multimedia and more ESG storytelling from AllianceBernstein on 3blmedia.com.

Contact Info:

Spokesperson: AllianceBernstein

Website: https://www.3blmedia.com/profiles/alliancebernstein

Email: info@3blmedia.com

SOURCE: AllianceBernstein

View the original press release on accesswire.com