Redlining's legacy: New Zillow maps show the continuing barriers to homeownership in Black neighborhoods

- Lack of credit access is a significant barrier to homeownership, particularly for Black families.

- Renters in credit-insecure areas often pay more for rent than they would for a mortgage.

- Credit insecurity is prevalent in Black neighborhoods, limiting credit building opportunities.

- New Orleans has the widest income-adjusted gap between rent and mortgage payments in credit-insecure areas.

- Policymakers can address the issue by encouraging reporting of positive rent payments, improving awareness of down payment assistance, and supporting policies that build more affordable homes.

- None.

Insights

Analyzing...

Black families unable to buy homes due to a lack of credit are often stuck paying more in rent

- Lack of access to credit is keeping many renters from homeownership, despite those renters living in areas where a monthly mortgage payment is less than rent.

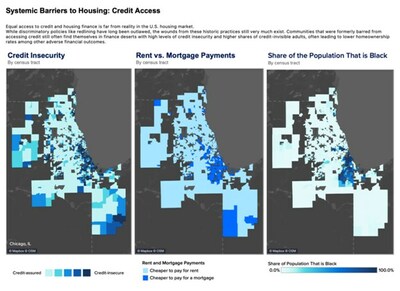

- Areas with higher levels of credit insecurity tend to have higher populations of color, especially Black households — a legacy of redlining practices that were outlawed decades ago.

- Improving credit access is essential to closing the racial wealth gap and improving access to homeownership across the board.

"Lack of credit access keeps people in a cycle of paying more in rent than they would pay each month for a mortgage on that same home," said Nicole Bachaud, senior economist at Zillow. "Communities of color, particularly Black families, see this play out, keeping a path to economic stability and wealth generation locked. Policymakers should take action to reasonably improve access to credit for millions of families."

Credit insecurity refers to the challenges individuals and households face in qualifying for credit, and is particularly prevalent in Black neighborhoods, where access to traditional and safe credit building is limited. As a result, many Black households are forced to remain renters in their communities, despite being able to afford a monthly mortgage payment. This is especially concerning considering that tenants nationwide spend

In areas with more credit insecurity, homeownership rates are lower. Even so, a monthly mortgage payment would cost less than rent in these areas, even with mortgage rates at 22-year highs. This shows that a lack of credit access is as much a barrier to homeownership as affordability, and highlights the urgent need to address disparities in credit access.

This new Zillow analysis includes maps that show how credit-insecure census tracts are directly linked to the share of the population that is Black, and to the areas where rent is more expensive than mortgage payments.

In

Zillow has also published a table that displays homeownership rate, the share of census tracts where it is cheaper to buy than rent and the share of a typical homeowner or renter's income needed to pay for a typical mortgage or rental, sorted by the level of credit security.

The disparities in credit access are particularly impactful for communities with higher rates of credit insecurity, which tend to have larger populations of color, in particular, Black households. The legacy of redlining practices, though prohibited by law, continue to impact communities today, perpetuating racial disparities in homeownership and financial opportunities.

Policymakers could explore a number of solutions to help address this issue. Encouraging more financial institutions and landlords to report positive rent payments -- and for government sponsored agencies to consider this data -- would help renters build credit, especially in areas where building a credit profile is so difficult. Improving awareness of down payment assistance can help more renters overcome the cash barriers they face when trying to purchase a home. And supporting policies that build more homes can help open more doors to homes that are affordable and accessible.

The table below shines a line on census tracts that are considered credit insecure, showing where people could afford to buy but are locked out of homeownership due to a lack of credit profile.

Credit Insecure Census Tracts | |||||

Metro Area | Homeownership Rate | Share of Population That is Black | Share of Census Tracts Where it is Cheaper to Buy Than Rent | Share of Median Homeowner Income Spent on a New Mortgage | Share of Median Renter Income Spent on a New Rental |

39.2 % | 57.6 % | 25.6 % | 37.0 % | 65.3 % | |

36.0 % | 10.2 % | 0.0 % | 45.0 % | 62.2 % | |

47.4 % | 63.8 % | 81.8 % | 25.8 % | 61.6 % | |

54.3 % | 63.6 % | 71.7 % | 25.9 % | 51.3 % | |

33.2 % | 17.9 % | 0.0 % | 46.5 % | 80.7 % | |

46.5 % | 35.1 % | 6.3 % | 39.4 % | 56.4 % | |

45.7 % | 35.9 % | 50.9 % | 29.7 % | 61.8 % | |

46.3 % | 27.7 % | 73.2 % | 26.9 % | 63.6 % | |

42.0 % | 33.5 % | 89.0 % | 22.1 % | 58.6 % | |

41.0 % | 35.0 % | 38.9 % | 29.0 % | 55.6 % | |

46.7 % | 21.6 % | 41.6 % | 37.2 % | 61.4 % | |

46.9 % | 9.5 % | 0.0 % | 47.0 % | 63.8 % | |

50.3 % | 60.1 % | 84.8 % | 21.9 % | 54.8 % | |

30.4 % | 20.0 % | 68.6 % | 30.5 % | 75.8 % | |

50.1 % | 22.8 % | 70.9 % | 31.9 % | 56.3 % | |

43.2 % | 36.1 % | 64.8 % | 25.8 % | 46.5 % | |

44.8 % | 48.8 % | 33.3 % | 39.8 % | 57.2 % | |

45.9 % | 30.4 % | 48.6 % | 26.6 % | 50.9 % | |

35.7 % | 14.0 % | 2.2 % | 43.5 % | 56.8 % | |

29.0 % | 9.2 % | 0.0 % | 68.4 % | 88.1 % | |

50.2 % | 32.1 % | 48.9 % | 26.5 % | 51.4 % | |

45.3 % | 68.2 % | 82.4 % | 22.6 % | 50.5 % | |

37.6 % | 39.9 % | 20.5 % | 55.1 % | 86.3 % | |

38.4 % | 39.7 % | 63.8 % | 26.7 % | 51.5 % | |

41.8 % | 22.4 % | 24.5 % | 30.0 % | 66.3 % | |

47.2 % | 26.7 % | 0.0 % | 42.4 % | 63.8 % | |

46.4 % | 56.7 % | 67.1 % | 28.6 % | 77.5 % | |

29.6 % | 32.2 % | 0.8 % | 57.9 % | 75.9 % | |

52.8 % | 13.4 % | 56.8 % | 24.9 % | 44.7 % | |

45.0 % | 37.4 % | 19.6 % | 46.3 % | 59.6 % | |

47.4 % | 47.7 % | 71.3 % | 30.4 % | 64.8 % | |

47.0 % | 6.7 % | 0.0 % | 46.9 % | 53.0 % | |

50.8 % | 19.8 % | 86.2 % | 19.5 % | 56.6 % | |

48.0 % | 3.5 % | 0.0 % | 42.0 % | 71.5 % | |

40.5 % | 10.6 % | 24.0 % | 42.8 % | 78.1 % | |

40.9 % | 42.9 % | 0.0 % | 38.9 % | 61.5 % | |

52.3 % | 46.7 % | 0.0 % | 34.3 % | 54.8 % | |

49.1 % | 6.0 % | 3.7 % | 58.7 % | 70.8 % | |

37.3 % | 7.5 % | 0.0 % | 45.9 % | 69.0 % | |

46.2 % | 4.0 % | 0.0 % | 47.7 % | 66.9 % | |

49.3 % | 6.1 % | 49.6 % | 33.2 % | 56.4 % | |

30.6 % | 6.4 % | 0.0 % | 72.2 % | 84.7 % | |

33.5 % | 16.3 % | 0.0 % | 61.2 % | 78.8 % | |

39.1 % | 3.1 % | 0.0 % | 59.7 % | 61.4 % | |

41.7 % | 11.3 % | 0.0 % | 48.2 % | 68.8 % | |

46.8 % | 50.5 % | 74.6 % | 20.3 % | 53.2 % | |

47.7 % | 28.4 % | 30.8 % | 51.1 % | 74.8 % | |

42.3 % | 49.6 % | 42.9 % | 32.9 % | 63.6 % | |

36.6 % | 51.1 % | 10.8 % | 36.1 % | 66.4 % | |

About Zillow Group:

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in

Zillow Group's affiliates, subsidiaries and brands include Zillow®; Zillow Premier Agent®; Zillow Home Loans℠; Trulia®; Out East®; StreetEasy®; HotPads®; ShowingTime+℠; and Spruce®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2023 MFTB Holdco, Inc., a Zillow affiliate.

i Source: Federal Reserve Bank of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/redlinings-legacy-new-zillow-maps-show-the-continuing-barriers-to-homeownership-in-black-neighborhoods-301977809.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/redlinings-legacy-new-zillow-maps-show-the-continuing-barriers-to-homeownership-in-black-neighborhoods-301977809.html

SOURCE Zillow