New Homeowners Can Spend Nearly $30K on Unexpected But Common Projects

Zillow's recent research reveals that first-time homebuyers may face unexpected costs averaging nearly $30,000 for home projects, a shock for 65% of home shoppers not seeking fixer-uppers. Millennials anticipate expenses between $10,000 and $15,000, but actual costs can reach $26,900. Major repairs include HVAC systems averaging $3,615. Zillow Offers assists homebuyers in acquiring move-in ready homes, while Thumbtack connects them with local professionals for necessary repairs. This insight underscores the importance of budgeting for homeownership beyond the purchase price.

- Zillow Offers allows buyers to purchase move-in ready homes, reducing the hassle of repairs and open houses.

- Partnership with Thumbtack connects homeowners with local professionals, enhancing service accessibility.

- First-time homebuyers significantly underestimate the costs of necessary home projects, leading to potential financial strain.

- The average expected cost for home projects is over $10,000 higher than millennials anticipate.

Insights

Analyzing...

SAN FRANCISCO and SEATTLE, July 13, 2021 /PRNewswire/ -- With millennial first-time buyers taking advantage of record low mortgage rates and jumping into homeownership, many are likely unaware of the projects they may have to undertake to get their new home move-in ready. New research1 and survey data from Thumbtack and Zillow find a typical for-sale home could need nearly

To help first-time buyers feel prepared for the home-buying journey, Zillow compiled a list of the most common projects its teams tackle after purchasing homes through Zillow Offers, a service that allows sellers to skip prep, open houses and showings by selling directly to the company. Zillow handles the prep work, including repairs, so buyers can feel confident they're purchasing a move-in ready home that is clean, safe and functional. Using that list of common repairs, Thumbtack, the modern home management platform, calculated the national average costs to complete each project.

According to the new survey of 1,000 homebuyers, the average millennial expects to pay between

"This research suggests first-time homebuyers typically underestimate the costs of the unsexy projects they may have to tackle before they even move in," says Amanda Pendleton, Zillow home trends expert. "That sticker shock may be increasingly common in a competitive market where buyers are dropping inspection contingencies as a strategy to win a bidding war. Make sure to factor in these unexpected costs when making an offer to make sure you can afford them, or nail down the tradeoffs you're willing to make for a move-in ready home. That way, you can focus on the fun, personalized projects that make a new house feel like home."

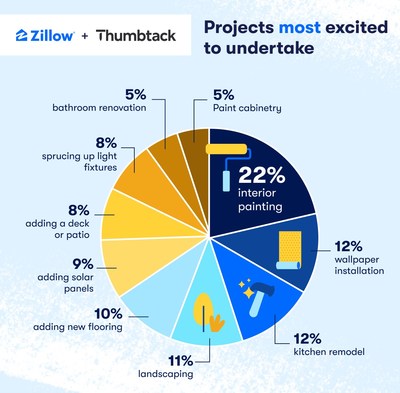

Homebuyers say they're most excited about improvement projects that allow them to express their personal style and make a home feel like their own. Millennial homebuyers are most excited to tackle interior painting (

"We know homebuyers are most concerned about the hassle of home maintenance and repairs. It feels overwhelming to know where to begin, but also, who to entrust with your most valuable possession," says David Steckel, Thumbtack's home expert. "Thumbtack makes it easy to care for your home from top to bottom. We help bring to life the joy of homeownership by connecting homeowners with skilled local professionals who can make their homes a haven, fit for relaxing, working, entertaining and more."

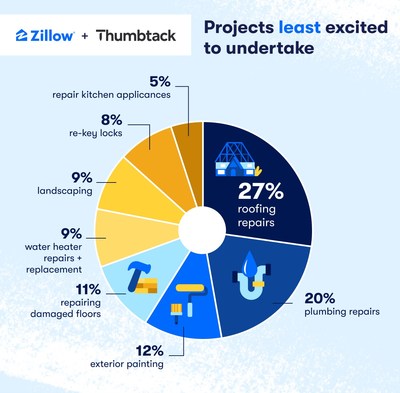

Homebuyers are least excited about making roofing repairs, which cost an average of

One way to manage costs when purchasing a home is to work with the seller's agent to negotiate compensation for repairs and updates in the offer terms. By working with a trusted agent who can help identify unforeseen issues, and springing for a pre-inspection, buyers may get a better idea of the necessary projects a for-sale home could need before submitting an offer. Thumbtack can then help estimate the costs of these projects and connect homeowners with the right skilled professionals in their area to get each project done and done well. For those seeking a move-in ready home, shoppers in 25 markets can also filter their search on Zillow for "Zillow-owned homes."

Methodology

- First, mapped the Zillow list of projects against Thumbtack categories based on keywords

- Filtered out projects that were too specific and that did not have a sufficient number of matching data points with Thumbtack

- Cleansed the job values by removing outliers or amounts that were far too high compared to normal

- Averaged the amounts per Zillow Category and Thumbtack's top designated market area (DMA)

- Top DMAs were chosen according to the availability of data points across all Zillow projects

- All prices shown reflect the national average across the U.S. Prices may vary by city depending on supply and demand, price of materials, etc. For data on specific regions, please go to www.thumbtack.com/prices.

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter.

As the most-visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting or financing with transparency and nearly seamless end-to-end service. Zillow Offers® buys and sells homes directly in dozens of markets across the country, allowing sellers control over their timeline. Zillow Home Loans™, our affiliate lender, provides our customers with an easy option to get pre-approved and secure financing for their next home purchase. Zillow recently launched Zillow Homes, Inc., a licensed brokerage entity, to streamline Zillow Offers transactions.

Zillow Group's brands, affiliates and subsidiaries include Zillow®, Zillow Offers®, Zillow Premier Agent®, Zillow Home Loans™, Zillow Closing Services™, Zillow Homes, Inc., Trulia®, Out East®, StreetEasy® and HotPads®. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).

About Thumbtack

Thumbtack is a technology leader building the modern home management platform. Through the Thumbtack app, homeowners can effortlessly manage their homes — confidently knowing what to do, when to do it and who to hire. Bringing the

1 Source: Thumbtack Home Project Data

2 Source: Thumbtack and Zillow Millennial Home Buying Survey. A sample of 1,000 U.S. adults was surveyed between June 11, 2021 and June 14, 2021. DKC Analytics conducted and analyzed this survey with a sample procured using the Pollfish survey delivery platform, which delivers online surveys globally through mobile apps, the mobile web and the desktop web. No post-stratification has been applied to the results.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-homeowners-can-spend-nearly-30k-on-unexpected-but-common-projects-301332170.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-homeowners-can-spend-nearly-30k-on-unexpected-but-common-projects-301332170.html

SOURCE Zillow