VIZSLA SILVER PROVIDES EXPLORATION UPDATE ON PANUCO PROJECT: OUTLINES 10KM DRILL PROGRAM TO TEST NEW TARGETS IN THE EAST AREA

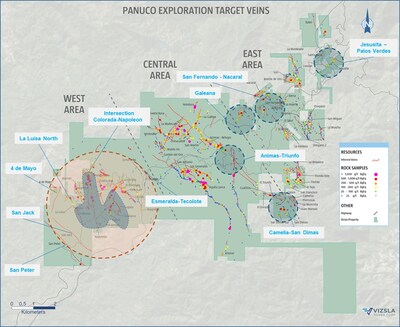

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA) has announced an updated exploration plan for its Panuco Project in Sinaloa, Mexico. The company plans to conduct 10,000 metres of new exploration drilling targeting high-priority zones in the central and east areas of the district, with a focus on identifying the next epicenter of high-grade mineralization. Additionally, 5,000 meters of resource infill/expansion drilling will be completed in the Copala central area.

This comprehensive plan also includes geophysical surveys over 950 line-km and aims to update the mineral resource estimate by Q4 2024. The previous drilling efforts have resulted in multiple new discoveries and a robust resource base that will serve as the foundation for Panuco Project 1.

Recent acquisitions of La Garra and San Enrique properties have extended Vizsla's land package, promising further exploration upside. The company is leveraging advanced technologies like AI and machine learning to enhance targeting, alongside traditional methods.

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA) ha annunciato un piano di esplorazione aggiornato per il suo Progetto Panuco a Sinaloa, Messico. L'azienda prevede di effettuare 10.000 metri di nuovi perforazioni esplorative mirando a zone ad alta priorità nelle aree centrali e orientali del distretto, con l'obiettivo di identificare il prossimo epicentro di mineralizzazione ad alto tenore. Inoltre, saranno completati 5.000 metri di perforazioni per l'infill/espansione delle risorse nell'area centrale di Copala.

Questo piano completo include anche sondaggi geofisici su 950 km di linea e mira ad aggiornare la stima delle risorse minerali entro il quarto trimestre del 2024. I precedenti sforzi di perforazione hanno portato a numerose nuove scoperte e a una base di risorse robusta che servirà da fondamento per il Progetto Panuco 1.

Recenti acquisizioni delle proprietà La Garra e San Enrique hanno ampliato il pacchetto fondiario di Vizsla, promettendo ulteriori opportunità di esplorazione. L'azienda sta sfruttando tecnologie avanzate come l'IA e il machine learning per migliorare il targeting, insieme a metodi tradizionali.

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA) ha anunciado un plan de exploración actualizado para su Proyecto Panuco en Sinaloa, México. La empresa planea realizar 10,000 metros de nuevas perforaciones exploratorias enfocadas en zonas de alta prioridad en las áreas central y este del distrito, con el objetivo de identificar el próximo epicentro de mineralización de alta ley. Además, se completarán 5,000 metros de perforaciones de llenado/expansión de recursos en el área central de Copala.

Este plan integral también incluye encuestas geofísicas sobre 950 km de línea y tiene como objetivo actualizar la estimación de recursos minerales para el cuarto trimestre de 2024. Los esfuerzos de perforación previos han resultado en múltiples nuevos descubrimientos y en una base de recursos sólida que servirá de base para el Proyecto Panuco 1.

Las recientes adquisiciones de las propiedades La Garra y San Enrique han ampliado el paquete land de Vizsla, prometiendo un mayor potencial de exploración. La empresa está aprovechando tecnologías avanzadas como IA y aprendizaje automático para mejorar el enfoque, junto con métodos tradicionales.

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA)는 멕시코 시날로아에 위치한 파누코 프로젝트에 대한 업데이트된 탐사 계획을 발표했습니다. 회사는 10,000미터의 신규 탐사 드릴링을 실시할 계획이며, 중앙 및 동쪽 지역의 고우선 구역을 대상으로 하고, 고품위 광물화의 다음 중심지를 찾는 데 중점을 둘 것입니다. 또한, 5,000미터의 자원 내충전/확장 드릴링이 코팔라 중앙 지역에서 완료될 예정입니다.

이 종합 계획에는 950km의 선형 요소에 대한 지구물리학적 조사도 포함되어 있으며, 2024년 4분기까지 광물 자원 추정치를 업데이트하는 것을 목표로 하고 있습니다. 이전의 드릴링 노력은 여러 개의 새로운 발견과 견고한 자원 기반을 낳았는데, 이는 파누코 프로젝트 1의 기초가 될 것입니다.

최근 라 가르라와 산 엔리케 자산의 인수로 비즐라의 토지 패키지가 확장되어 추가 탐사 잠재력이 약속되고 있습니다. 회사는 전통적인 방법과 함께 인공지능 및 기계학습과 같은 첨단 기술을 활용하여 타겟팅을 향상시키고 있습니다.

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA) a annoncé un plan d'exploration mis à jour pour son Projet Panuco à Sinaloa, au Mexique. La société prévoit de réaliser 10 000 mètres de nouveaux forages d'exploration visant des zones de haute priorité dans les secteurs central et est du district, en se concentrant sur l'identification du prochain épicentre de minéralisation de haute qualité. De plus, 5 000 mètres de forages d'infill/expansion des ressources seront effectués dans la zone centrale de Copala.

Ce plan complet comprend également des enquêtes géophysiques sur 950 km de lignes et vise à mettre à jour l'estimation des ressources minérales d'ici le quatrième trimestre 2024. Les efforts de forage précédents ont abouti à de multiples nouvelles découvertes et à une base de ressources solide qui servira de fondation pour le Projet Panuco 1.

Les récentes acquisitions des propriétés La Garra et San Enrique ont élargi le portefeuille foncier de Vizsla, promettant des opportunités d'exploration supplémentaires. L'entreprise exploite des technologies avancées telles que l'IA et l'apprentissage automatique pour améliorer le ciblage, en complément des méthodes traditionnelles.

Vizsla Silver Corp. (NYSE: VZLA, TSX-V: VZLA) hat einen aktualisierten Explorationsplan für sein Panuco-Projekt in Sinaloa, Mexiko, angekündigt. Das Unternehmen plant, 10.000 Meter neue Explorationsbohrungen in hochpriorisierten Zonen der zentralen und östlichen Bereiche des Bezirks durchzuführen, um das nächste Epizentrum der hochgradigen Mineralisierung zu identifizieren. Darüber hinaus werden 5.000 Meter an Bohrungen zur Ressourcenauffüllung/-erweiterung im zentralen Bereich von Copala abgeschlossen.

Dieser umfassende Plan schließt auch geophysikalische Erhebungen über 950 Linienkilometer ein und zielt darauf ab, die Schätzung der Mineralressourcen bis zum vierten Quartal 2024 zu aktualisieren. Die bisherigen Bohrungen haben zahlreiche neue Entdeckungen und eine robuste Ressourcenbasis hervorgebracht, die als Grundlage für das Panuco Projekt 1 dienen wird.

Die jüngsten Akquisitionen der Grundstücke La Garra und San Enrique haben Vizslas Landpaket erweitert, was vielversprechenden weiteren Erkundungsspielraum eröffnet. Das Unternehmen nutzt moderne Technologien wie KI und maschinelles Lernen zur Verbesserung der Zielgenauigkeit, zusätzlich zu traditionellen Methoden.

- 10,000 metres of new exploration drilling to identify high-grade mineralization.

- 5,000 meters of resource infill/expansion drilling in Copala central area.

- Geophysical surveys over 950 line-km.

- Updated mineral resource estimate planned for Q4 2024.

- Significant resource base from previous drilling.

- Recent acquisitions of La Garra and San Enrique properties expand land package.

- None.

Insights

This exploration update from Vizsla Silver provides valuable insights into the company's plans to expand its resource base at the Panuco project. Key points include:

- A 10,000 meter drill program planned to test new targets in the central and eastern areas of the property, aiming to identify additional high-grade mineralization centers.

- An additional 5,000 meters of infill drilling at Copala to upgrade resources for the first few years of potential production.

- Geophysical surveys and expanded mapping efforts to refine targeting.

- A mineral resource update planned for Q4 2024.

The company's methodical approach to exploration, combining geological mapping, sampling, geophysics and targeted drilling, increases the chances of making new discoveries. The focus on both near-term resource expansion and longer-term district-scale potential is a balanced strategy. However, investors should note that exploration success is not guaranteed and additional discoveries will take time to develop into resources.

From a financial perspective, Vizsla Silver's exploration plans demonstrate a well-funded and aggressive approach to growing the Panuco project's value. Key financial implications include:

- Significant ongoing investment in exploration, indicating the company's confidence in the project's potential.

- Focus on both near-term resource growth (infill drilling) and long-term potential (new target areas), balancing short and long-term value creation.

- The planned Q4 2024 resource update could be a potential catalyst for the stock if it shows meaningful resource expansion.

- Acquisition of new properties (La Garra and San Enrique) adds exploration upside but will require additional future investment.

While the exploration program is promising, investors should be aware that it represents ongoing cash outflow with no immediate revenue. The company's ability to fund these activities and the timeline to potential production remain important considerations.

Vizsla's geological approach at Panuco is comprehensive and scientifically sound. Key geological aspects include:

- Use of multiple exploration techniques including mapping, geochemistry, geophysics and structural analysis to refine targets.

- Recognition of district-scale potential with multiple mineralized centers, supported by varied intrusion ages and extensive alteration.

- Identification of Copala-like targets (e.g., San Dimas Vein) which could lead to significant new discoveries.

- Focus on depth potential in areas showing surface expressions near the paleosurface (e.g., Galeana target).

The company's geological model, suggesting multiple mineralization events over time, is well-supported by the data presented. The planned geophysical surveys should further refine this model. The exploration strategy demonstrates a strong understanding of epithermal systems and increases the probability of new discoveries. However, the complexity of the district means that patience and persistent exploration will be required to fully unlock its potential.

NYSE: VZLA TSX-V: VZLA

"With Panuco Project 1 now having been defined, the hunt for Project 2 begins," commented Michael Konnert, President and CEO. "Since our initial discovery at Napoleon, we have completed over 350,000 metres of diamond drilling, made several new discoveries and outlined a robust, high-grade resource base which serves as the foundation for Panuco Project 1, located in the southwest corner of the district. We are now determined to identify the next epicenter of high-grade mineralization in the central and/or east area of the district with the potential to host similar resources to that outlined in Project 1. To support this objective, we have budgeted 10,000 metres of new exploration drilling for the remainder of the year designed to test highly prospective targets. These select targets are based on an improved geologic understanding of the structural controls to mineralization as well as ongoing mapping, sampling, observations of metal ratios and alteration and other exploration methods. Additionally, we will continue to enhance the resource base that informs the Project 1 PEA through an expanded infill program targeting the first few years of production from

Key Exploration Objectives for 2024

- Complete +10,000 metres of exploration drilling in the central-east area of the district.

- Complete +5,000 meters of resource infill/expansion drilling in

Copala central. - Complete VTEM, airborne mag and radiometric surveys on 950 l-km.

- Advance mapping of the district to

70% coverage. - Provide updated resource estimate in Q4 2024.

Webcast

Vizsla Silver will be hosting a webcast at 9:30 am PT (12:30 pm ET) on Thursday, August 22, 2024, to present and discuss the geology of the

Exploration Approach and Organic Growth

The foundation of Vizsla's exploration approach for organic growth consists of detailed mapping, rock chip sampling aided by a LiDAR DTM model of the district and diamond drilling. Other initiatives such as alteration mapping with the use of Terraspec ASD® and 3D modelling of alteration minerals and metal ratios support prioritizing prospective targets. Additionally, ground Electro-Magnetics ("EM"), airborne magnetics, high-resolution multispectral satellite imagery, age dating and more recently AI and machine learning-based targeting done by VRIFY have been key for targeting. Furthermore, in 2023, the Company established a technical committee with Dr. Peter Megaw and Dr. Craig Gibson (Prismo Metals Inc.) to further enhance the knowledge of the district and to augment the probability of finding new mineralized centers (see Press Release dated April 26, 2023).

Vizsla's exploration approach and programs completed to date have resulted in a significantly improved geologic understanding of the district and have successfully defined multiple layers of exploration upside radiating out from the current center of mass in the west. This center of mass, referred to as Project 1, hosts ~

Beyond expanding resources and testing targets which support Project 1 in the west, Vizsla is committed to finding additional mineralized centers in the central and east areas of the district. Through the application of Vizsla´s exploration approach and initiatives across the district, the Company has defined several district-wide targets it plans to test in H2 2024, which have the potential to host similar resources to that of Project 1.

Additionally, the recent acquisitions of the La Garra and

Enhancing Project 1:

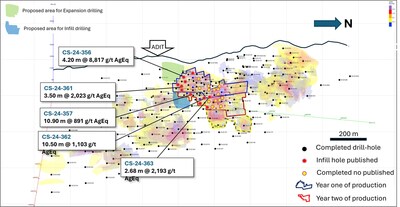

Since data cut-off for drill results to be included in the current MRE (September 1, 2023), Vizsla has completed over 65,000 metres of drilling designed to upgrade and expand mineral resources in the western portion of the district, particularly on the

To date, exploration and resource drilling at

Our most recently completed

Infill drilling completed at the southern extent of the Napoleon area has also demonstrated mineral continuity along the main Napoleon structure and splay veins, particularly the high-grade, shallow dipping Hanging Wall 4 ("HW4") splay vein. Drilling results and observations based on metal zonation and alteration continue to support the interpretation that the corridor is tilted, where the southern extent of drilling is at the top of the mineralized horizon, near surface. Ongoing analysis of core samples and 3D modelling of metal ratios and alteration minerals have further enhanced our understanding of the local controls on mineralization and have defined vectors to three potential feeder zones along the main Napoleon Vein.

At HW4, recent infill drilling has returned higher than average grade silver and gold values. The HW4 vein dips to the east at a shallow angle (35° to 55°) and is situated within the hanging wall side of the main Napoleon vein. HW4 remains open to the east, particularly in its southern extent where the vein shows higher silver and gold grades.

Other notable targets included the Cruz Negra and La Luisa Veins. At La Luisa, recent exploration has not only expanded the zones mineralized footprint well beyond the 2024 MRE boundary, but new alteration mapping with the aid of Terraspec®, has validated Vizsla's local exploration model. At La Luisa, the Company has identified a 400-metre gap between the current mineral resource boundary and seven exploratory holes in the north. Furthermore, two potential feeder zones within a target depth horizon have been interpreted through geologic modelling and observed metal ratios. Cruz Negra, located between La Luisa and Napoleon main, remains open along strike to the north, and the more recent discovery,

Resource Extension Targets:

- The

Copala structure remains open down-dip in the south and along strike to the north. Additionally, with the recent discovery of the historicCopala adit, potential for high-grade mineralization closer to surface in the central portion of the vein has been confirmed. - Napoleon HW4 is a shallow dipping vein that splays off to the east from main Napoleon. Drilling targeting main Napoleon has reported multiple high-grade intercepts along HW4 that warrant future resource expansion down dip to the east.

- La Luisa remains open at depth and along strike to the southeast and to the north in the 400 metre gap zone. Additionally, geologic modelling and observed metal ratios suggest two potential feeder zones at depth that warrant future drill-testing.

- Cruz Negra is a relatively narrow (average thickness), gold-rich vein trending northwest that splays off from the Josephine Vein (situated parallel to Napoleon). Open-ended intercepts completed in 2022 suggest that mineralization continues to the northwest in the direction of the Alacran Vein in the northwest. The 500 metre gap between Cruz Negra drilling in the southeast and

Alacran in the northwest warrant future exploration drilling.

Proximal Targets:

- 4 de Mayo is a set of subvertical narrow veins trending northwest located west of La Luisa. Scout drilling in the area has reported some high-grade silver intercepts close to surface. The 4 de Mayo vein shows strong pinch and swell characteristics but remains open to the south and at depth.

- Colorada-Napoleon intersection is a conceptual target located at the projected intersection of the Colorada Vein and the northern extent of Napoleon, where indications of good structural preparation exist. This target has been validated by preliminary AI and Machine Learning analysis done by VRIFY.

- Esmeralda-Tecolote is a set of two epithermal veins discovered through mapping. Sampling on the veins and vein textures suggest a high level in the epithermal profile and warrants drill testing in the future.

- San Jack and San Peter are two parallel structures that show subtle quartz veining and strong hydrothermal alteration on surface. These structures are located west of Napoleon and La Luisa, in the southwest dipping, western block of the district. Extrapolation of our working exploration model applied at Napoleon and La Luisa suggests that vein mineralization could occur below the rhyolite tuffs exposing veining and alteration.

Table of Top 20 Drill Composites drilled post September 1, 2023, cut-off date.

Drillhole | From | To | Downhole | Estimated | Ag | Au | Pb | Zn | AgEq | Vein | ||

(m) | (m) | (m) | (m) | (g/t) | (g/t) | % | % | (g/t) | ||||

CS-24-356 | 219.00 | 223.90 | 4.90 | 4.20 | 1,694 | 103.20 | - | - | 8,817 | Copala | ||

Includes | 219.85 | 220.60 | 0.75 | 0.64 | 9,920 | 663.00 | - | - | 55,769 | |||

NP-24-429 | 433.75 | 435.10 | 1.35 | 1.30 | 2390 | 28.10 | 2.19 | 9.61 | 4,533 | HW4 | ||

CS-24-352 | 211.80 | 217.25 | 5.45 | 5.00 | 1,378 | 22.95 | - | - | 2,872 | |||

Includes | 213.00 | 216.00 | 3.00 | 2.75 | 2,115 | 39.10 | - | - | 4,681 | |||

NP-24-431 | 428.55 | 431.15 | 2.60 | 2.40 | 1,551 | 14.08 | 0.97 | 3.84 | 2,561 | HW4 | ||

Includes | 428.55 | 429.90 | 1.35 | 1.24 | 2460 | 23.20 | 1.57 | 6.10 | 4,121 | |||

CS-24-347 | 287.85 | 294.00 | 6.15 | 6.00 | 1,882 | 10.31 | - | - | 2,440 | |||

Includes | 289.00 | 291.45 | 2.45 | 2.39 | 3,859 | 20.51 | - | - | 4,957 | |||

CS-24-366 | 348.85 | 357.00 | 8.15 | 7.00 | 1,898 | 9.51 | - | - | 2,398 | |||

Includes | 348.85 | 349.50 | 0.65 | 0.56 | 3,950 | 25.40 | - | - | 5,385 | |||

Includes | 351.00 | 352.50 | 1.50 | 1.29 | 3,430 | 18.95 | - | - | 4,457 | |||

Includes | 352.80 | 354.00 | 1.20 | 1.03 | 3,200 | 13.00 | - | - | 3,829 | |||

NP-23-359 | 80.00 | 82.05 | 2.05 | 1.65 | 1,552 | 8.37 | 0.47 | 1.22 | 2,066 | |||

Includes | 80.90 | 82.05 | 1.15 | 0.93 | 2,630 | 14.20 | 0.62 | 1.57 | 3,480 | |||

CS-23-304 | 468.00 | 471.30 | 3.30 | 2.80 | 1,366 | 6.80 | - | - | 1,722 | |||

Includes | 468.85 | 469.50 | 0.65 | 0.55 | 5,320 | 25.20 | - | - | 6,618 | |||

CS-24-354 | 153.50 | 168.30 | 14.80 | 13.00 | 1,017 | 8.19 | - | - | 1,503 | |||

Includes | 153.50 | 155.10 | 1.60 | 1.40 | 4,124 | 35.11 | - | - | 6,229 | |||

Includes | 157.55 | 159.05 | 1.50 | 1.31 | 2,540 | 21.30 | - | - | 3,813 | |||

CS-24-344 | 561.95 | 573.90 | 11.95 | 8.70 | 1,096 | 5.18 | - | - | 1,363 | Copala | ||

Includes | 563.10 | 564.00 | 0.90 | 0.66 | 8,720 | 36.60 | - | - | 10,516 | |||

CS-24-362 | 344.60 | 346.10 | 16.10 | 10.50 | 804 | 5.27 | - | - | 1,103 | |||

Includes | 337.50 | 339.75 | 2.25 | 1.47 | 3,437 | 24.87 | - | - | 4,881 | |||

CS-24-359 | 332.15 | 341.65 | 9.50 | 7.80 | 788 | 4.40 | - | - | 1,027 | Copala 3 | ||

Includes | 336.25 | 337.30 | 1.05 | 0.86 | 5,010 | 25.30 | - | - | 6,343 | |||

Includes | 341.00 | 341.65 | 0.65 | 0.53 | 1,360 | 7.26 | - | - | 1,749 | |||

CS-24-357 | 347.00 | 347.45 | 14.45 | 10.90 | 762 | 2.80 | - | - | 891 | |||

Includes | 345.50 | 347.45 | 1.95 | 1.47 | 3,805 | 13.58 | - | - | 4,419 | |||

CS-24-342 | 627.60 | 634.25 | 6.65 | 6.00 | 487 | 3.69 | - | - | 703 | |||

NAP-2023-004 | 108.45 | 119.35 | 10.90 | 6.50 | 328 | 4.32 | 0.79 | 2.11 | 696 | Napoleon | ||

Includes | 109.12 | 115.25 | 6.13 | 3.65 | 505 | 6.33 | 2.89 | 0.10 | 1,038 | |||

COP-2023-004 | 195.75 | 202.10 | 6.35 | 5.10 | 318 | 5.23 | - | - | 658 | Copala | ||

Includes | 197.65 | 198.00 | 0.35 | 0.28 | 338 | 16.00 | - | - | 1,436 | |||

Includes | 200.90 | 202.10 | 1.20 | 0.96 | 1,270 | 13.45 | - | - | 2,104 | |||

NP-23-419 | 564.00 | 572.45 | 8.45 | 3.25 | 58 | 7.74 | 0.73 | 1.44 | 650 | La Luisa Main | ||

Includes | 567.00 | 568.60 | 1.60 | 0.62 | 50 | 16.74 | 0.27 | 0.99 | 1,220 | |||

NP-23-420 | 414.60 | 418.25 | 3.65 | 2.80 | 95 | 6.97 | 0.11 | 0.17 | 568 | La Luisa Main | ||

Includes | 415.60 | 417.50 | 1.90 | 1.46 | 116 | 11.50 | 0.05 | 0.07 | 888 | |||

COP-2023-001 | 145.30 | 158.90 | 13.60 | 13.60 | 240 | 1.61 | - | - | 332 | |||

Includes | 146.00 | 147.10 | 1.10 | 1.10 | 1,075 | 11.55 | - | - | 1,793 | |||

NP-23-397 | 670.15 | 679.85 | 9.70 | 8.70 | 32 | 1.44 | 0.17 | 2.45 | 221 | La Luisa Main | ||

Includes | 670.15 | 671.55 | 1.40 | 1.26 | 77 | 6.55 | 0.54 | 1.32 | 577 |

Note: AgEq = Ag g/t x Ag rec. + ((Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t))/Ag price/gram. Metal price assumptions are |

The Hunt for Project 2:

Since consolidation of the

Other important initiatives planned for Q4 2024 include a geophysical survey consisting of VTEM, airborne mag and radiometrics on ~950-line km at 100 metres at 100 metres spacing. Information derived from these surveys will be applied in combination with other tools on hand such as, geology, geochemistry, alteration and multi-spectral World View III satellite imagery to define new exploration targets and locate additional mineralized centers. Geologic evidence that supports the presence of multiple mineralized centers include: intrusions with different age and composition, ubiquitous presence of dikes and domes, extensive hydrothermal alteration across the district, many vein prospects and a vast amount of veins with variable orientations, geochemistry and recently determined 40Ar/39Ar age dates that resolved mineralization at

District Targets:

Notable targets to be tested in Q4 2024 located in the central and east areas of the district with potential to host similar mineral resources to that outlined in Project 1 in the west include:

- Camelia-

San Dimas , which consists of two almost vertical subparallel veins in the Camelia trend and the high-grade, flat lying and east dipping, San Dimas Vein. The San Dimas Vein is the highest ranked target due to its features that make it similar toCopala . - Animas-Triunfo is a target designed to test recent interpretations based on mapping, that indicates that the Animas Vein extends to the southeast, in the direction of the Camelia-San Dimas target veins.

- The

Galeana target is a northeast trending vein with significant silver anomalies observed on surface. More importantly, geologic mapping suggests that exposed outcrops of the Galeana Vein occur proximal to the paleosurface, thus providing great potential for deep drilling. - San Fernando-Nacaral are two parallel veins, that similar to the

Galeana target, show indications of great exploration potential at depth. - Jesusita-Palos Verdes is a northeast trending vein target in the east area of the district. Positive drill results and alteration-based interpretations done by Prismo, combined with significant silver anomalies on surface and spectacular vein outcrops warrant additional deep drilling.

Greenfields Projects:

La Garra

The La Garra-Metates District, comprised of 16 claims covering 16,962 Ha, is located approximately 32 km north-northwest of the Panuco Project and 32 km south-southwest of First Majestic's flagship

In December 2023, Vizsla Silver conducted a five-day site visit and collected 37 samples on vein outcrops and underground pillars on La Garra and

The

Key Exploration Objectives for 2024

- Complete +10,000 metres of exploration drilling in the central-east area of the district.

- Complete +5,000 meters of resource infill/expansion drilling in

Copala central. - Complete VTEM, airborne mag and radiometric surveys on 950 l-km.

- Advance mapping of the district to

70% coverage. - Provide updated resource estimate in Q4 2024.

About the Panuco Project

The newly consolidated

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

On January 8, 2024, the Company announced an updated mineral resource estimate for

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in

Quality Assurance / Quality Control

Drill core samples were shipped to ALS Limited in

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Jesus Velador, Ph.D. MMSA QP., Vice President of Exploration, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources" are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to

Website: www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration, development, and production at

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla Silver's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company's mining activities in

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-provides-exploration-update-on-panuco-project-outlines-10km-drill-program-to-test-new-targets-in-the-east-area-302227183.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/vizsla-silver-provides-exploration-update-on-panuco-project-outlines-10km-drill-program-to-test-new-targets-in-the-east-area-302227183.html

SOURCE Vizsla Silver Corp.