Vox Royalty Provides Development Updates and Approval of 2025 Share Repurchase Program

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) has announced significant developments in its gold royalty portfolio and renewed its share repurchase program. The company reported three key updates:

1. Black Cat Syndicate acquired the 1.2Mtpa Lakewood Processing Plant for A$85M, potentially accelerating production at the Kal East Gold Project by up to 15 months, representing a 50% expansion compared to previous studies.

2. Orla Mining provided updates on the South Railroad gold project in Nevada, including positive drilling results and permitting progress, targeting construction in 2026 and first production in 2027.

3. Galway Metals announced a 17% increase in Indicated Resource and 22% in Inferred category at the Estrades project, along with improved gold recoveries.

The company's Board approved a new share repurchase program for up to US$1,500,000 of common shares, to be executed through an independent broker in compliance with Rule 10b-18.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha annunciato sviluppi significativi nel suo portafoglio di royalty sull'oro e ha rinnovato il programma di riacquisto delle azioni. L'azienda ha riportato tre aggiornamenti chiave:

1. Black Cat Syndicate ha acquisito l'impianto di lavorazione Lakewood da 1,2Mtpa per 85 milioni di dollari australiani, potenzialmente accelerando la produzione al Kal East Gold Project fino a 15 mesi, rappresentando un'espansione del 50% rispetto agli studi precedenti.

2. Orla Mining ha fornito aggiornamenti sul progetto oro South Railroad in Nevada, inclusi risultati di perforazione positivi e progressi nelle autorizzazioni, puntando alla costruzione nel 2026 e alla prima produzione nel 2027.

3. Galway Metals ha annunciato un aumento del 17% nelle risorse indicate e del 22% nella categoria inferita al progetto Estrades, insieme a un miglioramento nei recuperi dell'oro.

Il Consiglio dell'azienda ha approvato un nuovo programma di riacquisto di azioni per un massimo di 1.500.000 dollari statunitensi di azioni ordinarie, da eseguire tramite un broker indipendente in conformità con la Regola 10b-18.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha anunciado desarrollos significativos en su cartera de regalías de oro y ha renovado su programa de recompra de acciones. La compañía informó tres actualizaciones clave:

1. Black Cat Syndicate adquirió la planta de procesamiento Lakewood de 1,2Mtpa por 85 millones de dólares australianos, lo que podría acelerar la producción en el proyecto de oro Kal East hasta 15 meses, representando una expansión del 50% en comparación con estudios anteriores.

2. Orla Mining proporcionó actualizaciones sobre el proyecto de oro South Railroad en Nevada, incluidos resultados de perforación positivos y avances en permisos, con el objetivo de iniciar la construcción en 2026 y la primera producción en 2027.

3. Galway Metals anunció un aumento del 17% en los recursos indicados y del 22% en la categoría inferida en el proyecto Estrades, junto con una mejora en las recuperaciones de oro.

La Junta de la compañía aprobó un nuevo programa de recompra de acciones por un máximo de 1.500.000 dólares estadounidenses de acciones comunes, que se ejecutará a través de un corredor independiente en cumplimiento con la Regla 10b-18.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR)는 금 로열티 포트폴리오의 중요한 발전을 발표하고 자사주 매입 프로그램을 갱신했습니다. 회사는 세 가지 주요 업데이트를 보고했습니다:

1. Black Cat Syndicate가 1.2Mtpa Lakewood 가공 공장을 8,500만 호주 달러에 인수하여 Kal East Gold Project의 생산을 최대 15개월 앞당길 수 있으며, 이는 이전 연구에 비해 50% 확장을 나타냅니다.

2. Orla Mining은 네바다의 South Railroad 금 프로젝트에 대한 업데이트를 제공했으며, 긍정적인 시추 결과와 허가 진행 상황을 포함하여 2026년에 건설을 목표로 하고 2027년에 첫 생산을 목표로 하고 있습니다.

3. Galway Metals는 Estrades 프로젝트에서 지표 자원이 17% 증가하고 추정 자원이 22% 증가했으며, 금 회수율이 개선되었다고 발표했습니다.

회사의 이사회는 최대 1,500,000 미국 달러의 보통주에 대한 새로운 자사주 매입 프로그램을 승인했으며, 이는 Rule 10b-18을 준수하여 독립 중개인을 통해 실행될 것입니다.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) a annoncé des développements significatifs dans son portefeuille de redevances aurifères et a renouvelé son programme de rachat d'actions. La société a rapporté trois mises à jour clés :

1. Black Cat Syndicate a acquis l'usine de traitement de Lakewood de 1,2Mtpa pour 85 millions AUD, ce qui pourrait accélérer la production au projet aurifère Kal East de jusqu'à 15 mois, représentant une expansion de 50 % par rapport aux études précédentes.

2. Orla Mining a fourni des mises à jour sur le projet aurifère South Railroad au Nevada, y compris des résultats de forage positifs et des progrès dans l'obtention de permis, visant à commencer la construction en 2026 et à produire pour la première fois en 2027.

3. Galway Metals a annoncé une augmentation de 17 % des ressources indiquées et de 22 % dans la catégorie inférée au projet Estrades, ainsi qu'une amélioration des récupérations d'or.

Le conseil d'administration de la société a approuvé un nouveau programme de rachat d'actions pour un maximum de 1 500 000 USD d'actions ordinaires, qui sera exécuté par l'intermédiaire d'un courtier indépendant conformément à la règle 10b-18.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) hat bedeutende Entwicklungen in seinem Gold-Royalty-Portfolio angekündigt und sein Aktienrückkaufprogramm erneuert. Das Unternehmen berichtete über drei wichtige Updates:

1. Black Cat Syndicate hat die Lakewood-Verarbeitungsanlage mit einer Kapazität von 1,2Mtpa für 85 Millionen AUD erworben, was die Produktion im Kal East Gold Project um bis zu 15 Monate beschleunigen könnte, was eine 50%ige Erweiterung im Vergleich zu früheren Studien darstellt.

2. Orla Mining hat Updates zum South Railroad Goldprojekt in Nevada bereitgestellt, einschließlich positiver Bohrergebnisse und Fortschritte bei Genehmigungen, mit dem Ziel, 2026 mit dem Bau zu beginnen und 2027 die erste Produktion zu erreichen.

3. Galway Metals hat einen Anstieg der angegebenen Ressourcen um 17% und der abgeleiteten Kategorie um 22% im Estrades-Projekt bekannt gegeben, zusammen mit verbesserten Goldgewinnen.

Der Vorstand des Unternehmens genehmigte ein neues Aktienrückkaufprogramm für bis zu 1.500.000 US-Dollar an Stammaktien, das über einen unabhängigen Broker gemäß Regel 10b-18 durchgeführt werden soll.

- Acquisition of Lakewood Processing Plant accelerates production timeline by 15 months at royalty-linked Kal East project

- 50% expansion in processing capacity at Kal East (from 0.8Mtpa to 1.2Mtpa)

- Three new gold royalties started generating revenue in late 2024

- South Railroad project advancing with positive drill results and secured water rights

- Estrades project showed significant resource increases and improved gold recoveries

- No shares were repurchased under the previous share repurchase program

- South Railroad production timeline extends to 2027, indicating delayed revenue generation

Insights

Vox Royalty's development updates reveal substantive advancements in multiple gold projects within their royalty portfolio that materially accelerate potential revenue timelines. The acquisition of the Lakewood Processing Plant by Black Cat (where Vox holds a 1% NSR royalty) represents a critical inflection point, potentially accelerating production by 15 months and expanding throughput capacity by 50% from previous studies. This acceleration directly impacts Vox's near-term revenue profile.

Notably, progress at Orla's South Railroad project (where Vox holds a 0.633% NSR) shows meaningful advancement toward construction in 2026 and production in 2027, with key permitting milestones being achieved. The announcement of Galway's resource increase and metallurgical improvements at Estrades (where Vox holds a 2% NSR) further strengthens the company's growth pipeline.

The renewal of a $1.5 million share repurchase program signals management's conviction in Vox's undervaluation at current levels. With three royalties recently beginning to generate revenue in late 2024 and additional assets potentially entering production in 2026-2027, Vox is positioned for sequential revenue growth over the next several years. The company's royalty model provides operational leverage to rising gold prices without direct exposure to mining cost inflation.

The developments across Vox's royalty portfolio demonstrate particularly favorable project advancements. Black Cat's A$85M acquisition of the fully-permitted Lakewood Processing Plant transforms their production timeline significantly. This 1.2Mtpa facility not only accelerates production by up to 15 months but also provides expanded capacity versus previous plans. Most critical for Vox shareholders is that this acceleration directly impacts multiple gold deposits covered by their uncapped 1% NSR royalty.

At South Railroad, Orla's permitting achievements represent genuine progress, with water rights secured and environmental impact statements nearing finalization. The appointment of an EPCM contractor signals serious construction intent. The exploration results featuring intercepts like 1.04 g/t Au over 55.2m demonstrate resource expansion potential beyond the current feasibility study parameters.

Galway's 17% increase in Indicated Resources and 31% improvement in potential gold recoveries at Estrades materially enhances project economics. The initiation of a scoping study moves this past-producing polymetallic project closer to a restart decision.

These developments collectively strengthen Vox's medium-term growth trajectory with minimal capital requirements from Vox itself—the true advantage of the royalty business model.

DENVER, CO / ACCESS Newswire / March 13, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent developments from royalty operating partners, Black Cat Syndicate Limited ("Black Cat"), Orla Mining Ltd. ("Orla") and Galway Metals Inc. ("Galway"), along with announcing that its Board of Directors has approved the renewal of a share repurchase program ("SRP").

Spencer Cole, Chief Investment Officer stated: "Vox is seeing strong momentum in its gold royalty portfolio, with multiple projects seeking to expand production or moving closer to first production in Western Australia, Nevada and Quebec. Three new gold royalties started generating revenue for Vox in late 2024, and based on these development updates, additional royalty-linked deposits could be fast-tracked into production in 2026 and 2027. Key developments include Black Cat's A

Key Updates

Black Cat announced the acquisition of the operating 1.2Mtpa Lakewood Processing Plant, which is expected to bring forward production plans by up to 15 months at the royalty-linked Kal East Gold Project in Western Australia.

Orla provided an exploration and permitting update on their South Railroad gold project in Nevada, targeting construction in 2026 and first production in 2027.

Galway announced a resource update, positive metallurgical testwork results and the initiation of a scoping study at the past-producing Estrades polymetallic project in Quebec.

Bulong (Production - Western Australia) - Acquisition of nearby Lakewood Processing Plant and Project Acceleration(1)

Vox holds an uncapped

1% NSR over the Myhree, Boundary, Queen Margaret, Melbourne United, Strathfield and Trump gold deposits at the Kal East project. Initial production and toll-treatment via the nearby Paddington mill commenced at the Myhree gold deposit in Q3 2024.On February 25, 2025, Black Cat announced the acquisition of the operating 1.2Mtpa Lakewood Gold Processing Plant, located near Kalgoorlie, Western Australia for A

$85M .Lakewood is located within 40km of the Kal East Gold Operation, and has the potential to bring forward production at Kal East by up to 15 months.

Black Cat's new production capacity represents a

50% expansion compared to the May 2024 study (0.8Mtpa).Black Cat also stated that throughput could be increased beyond the current 1.2Mtpa by commissioning the existing secondary mill.

Kal East mining activities are now being fast-tracked, with re-optimisation of open-pit and underground deposits already underway, including at Myhree/Boundary.

On March 12, 2025, Black Cat went into an ASX trading halt "pending the release of an announcement regarding a proposed capital raising to fund an acceleration of mining activities at the Kal East Gold Project".

Vox Management Summary: Acquisition of the fully permitted and operating Lakewood processing facility allows Black Cat to accelerate gold production, with expanded throughput capacity compared to prior studies of +

50% (from 0.8Mtpa to 1.2Mtpa) and has potential to bring forward gold production by up to 15-months to take advantage of the current gold price environment. Vox management expects this development to reduce the amount of time for additional gold deposits covered by the Bulong1% NSR royalty to be brought into production from 2026 onwards.

Figure 1: Lakewood Processing Plant

Source: https://api.investi.com.au/api/announcements/bc8/bd3fbbf3-fc2.pdf

South Railroad (Development - Nevada, USA) - 2024 Exploration Results, 2025 Budget and Permitting Progressing(2)

Vox holds an uncapped

0.633% NSR over parts of the South Railroad gold project in Nevada, with advance royalty payments payable on an ongoing, periodic basis prior to production.On February 25, 2025, Orla provided exploration results and permitting progress updates from the South Railroad Project:

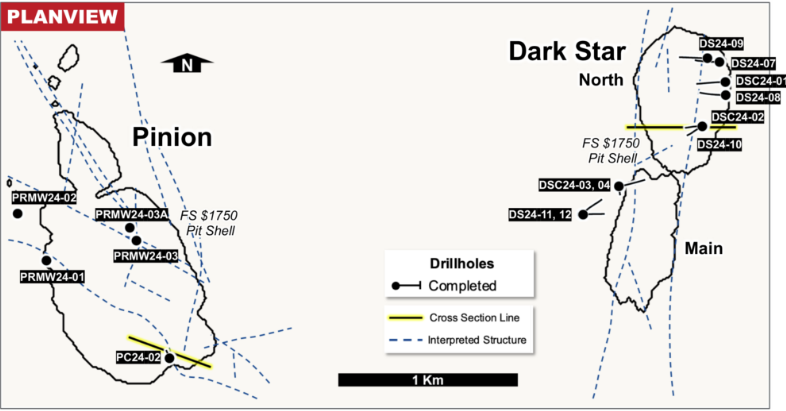

Multiple broad intersections within and beyond the feasibility study open pits at Dark Star and Pinion targets, including 1.04 g/t Au over 55.2m including 2.86 g/t Au over 11.1m (drillhole PC24-02).

Orla also announced a

$15M exploration program targeting resource growth, comprised of 10,000m of drilling focused on near-deposit targets (Dark Star and Pinion) and 8,000m across the northern and southern areas.Orla also announced that water rights have been secured for the project, as well as other major permitting advances such as near-finalization of the Environmental Impact Statement and Supplemental Environmental Reports (SERs) required by the US Bureau of Land Management. Orla expects all SER's to be finalized in Q1-2025.

Orla has also received Class I and II Air Operating Permits, to be followed by a Notice of Intent and subsequent discharge permits.

The South Railroad project has advanced as well, with Orla awarding the EPCM contract, commencing basic engineering.

Vox Management Summary: Vox management believes that the positive drilling results from the 2024 exploration campaign underscore the quality and expansion potential of the South Railroad Project. Orla's award of the EPCM contract for South Railroad is a strong endorsement of expectations to advance final permitting toward a Record of Decision in 2026. Based on Orla's March 2025 investor presentation, Vox management expects construction commencement at South Railroad in 2026 and first production in 2027.

Figure 2: Pinion and Dark Star 2024 drill holes

Source: https://orlamining.com/news/orla-mining-intersects-high-grade-oxide-gold-at-south-carlin-complex-and-advances-permitting-for-south-railroad-project-in-nevada/

Estrades (Exploration - Quebec, Canada) - Galway Metals Announces Initiation of Scoping Study(3)

Vox holds a

2% NSR over certain eastern portions of the past-producing Estrades volcanogenic massive sulfide (VMS) polymetallic project (gold-zinc-copper-silver) in Quebec, Canada.On January 27, 2025, Galway released an updated mineral resource estimate, which included:

A

17% increase in the Indicated Resource and a22% in the Inferred category compared to the 2018 study.Galway also released updated metallurgical testing results, displaying a

31% increase in potential gold recoveries, with potentially significant impacts on project economics.Galway also expects to initiate a scoping study for the Estrades project in 2025, which would materially advance the project.

Vox Management Summary: This latest activity at the Estrades VMS project, underpinned by positive metallurgical testing results and an increased mineral resource, are encouraging steps towards a future restart decision on this high-grade past producing mine. We look forward to additional newsflow from Galway as the Estrades project is expected to advance from advanced exploration into full development.

Share Repurchase Program

The Board of Directors of the Company has approved the renewal of an SRP for the repurchase of up to US

Repurchases under the SRP will be made at times and in amounts as the Company deems appropriate and may be made through open market transactions at prevailing market prices, privately negotiated transactions or by other means in accordance with securities laws in the United States. The actual timing, number and value of repurchases under the SRP will be determined by management in its discretion and will depend on a number of factors, including market conditions, stock price and other factors. The SRP may be suspended or discontinued at any time. Open market repurchases will only be made outside of Canada through the facilities of the Nasdaq or any alternative open market in the United States, as applicable.

Under the Company's previous SRP during the period of March 19, 2024 through the date hereof, no Vox common shares were repurchased.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, requirements for and operator ability to receive regulatory approvals, and statements relating the potential repurchase of shares by the Company or its broker in the open market.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, including international trade and tariffs; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine and the middle east, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2023 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Black Cat Syndicate Limited - Lakewood Acquisition Drives Gold Acceleration Strategy - Dated February 25, 2025:

https://api.investi.com.au/api/announcements/bc8/bd3fbbf3-fc2.pdfOrla Mining Ltd. - Orla Mining Intersects High Grade Oxide Gold at South Carlin Complex and Advances Permitting for South Railroad Project in Nevada- dated February 25, 2025

https://orlamining.com/news/orla-mining-intersects-high-grade-oxide-gold-at-south-carlin-complex-and-advances-permitting-for-south-railroad-project-in-nevada/Galway Metals Inc. - Dramatic Increase in Gold Recovery Significantly Improves the Business Options for Past-Producing High-Grade Gold Zinc Estrades Mine - Scoping Study to be Initiated - dated January 27, 2025:

https://galwaymetalsinc.com/2025/01/dramatic-increase-in-gold-recovery-significantly-improves-the-business-options-for-past-producing-high-grade-gold-zinc-estrades-mine-scoping-study-to-be-initiated/

SOURCE: Vox Royalty Corp.

View the original press release on ACCESS Newswire