Vox Royalty Provides Development Updates on Gold and Silver Royalty Assets

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) has announced significant updates on three key royalty assets. Minerals 260 is acquiring the Bullabulling gold project (2.3Moz) in Western Australia for A$166.5M, planning an 80,000m drilling program. Vox holds an uncapped A$10/oz gold royalty on key areas of this project.

Silver Mines completed an optimization study for the Bowdens silver project, showing a 10% increase in mineral reserves over a 16-year mine life. Vox maintains an uncapped 0.85% Gross Revenue Royalty on resource areas. The project estimates pre-tax NPV5 of A$528M and IRR of 27% at spot pricing.

Alamos Gold announced construction commencement at the Lynn Lake gold project in Manitoba, committing ~$600M in capex from 2025-2027. The project targets 2.2Moz Au production over 17 years, with first production expected in 2028. Vox holds a 2% gross proceeds royalty on part of the MacLellan deposit.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha annunciato aggiornamenti significativi su tre importanti asset di royalty. Minerals 260 sta acquisendo il progetto aurifero Bullabulling (2,3Moz) in Australia Occidentale per 166,5 milioni di dollari australiani, pianificando un programma di perforazione di 80.000 metri. Vox detiene una royalty non limitata di 10 A$/oz d'oro su aree chiave di questo progetto.

Silver Mines ha completato uno studio di ottimizzazione per il progetto argento Bowdens, mostrando un aumento del 10% nelle riserve minerarie su una vita mineraria di 16 anni. Vox mantiene una royalty sul fatturato lorda non limitata dello 0,85% sulle aree di risorsa. Il progetto prevede un valore attuale netto (NPV) pre-tasse di 528 milioni di dollari australiani e un tasso di rendimento interno (IRR) del 27% ai prezzi attuali.

Alamos Gold ha annunciato l'inizio della costruzione del progetto aurifero Lynn Lake in Manitoba, impegnando circa 600 milioni di dollari in spese di capitale dal 2025 al 2027. Il progetto mira a una produzione di 2,2Moz d'oro in 17 anni, con la prima produzione prevista per il 2028. Vox detiene una royalty su proventi lordi del 2% su parte del deposito di MacLellan.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha anunciado actualizaciones significativas sobre tres activos clave de regalías. Minerals 260 está adquiriendo el proyecto de oro Bullabulling (2.3Moz) en Australia Occidental por A$166.5M, planeando un programa de perforación de 80,000 metros. Vox posee una regalía de oro de A$10/oz sin límite en áreas clave de este proyecto.

Silver Mines completó un estudio de optimización para el proyecto de plata Bowdens, mostrando un aumento del 10% en las reservas minerales a lo largo de 16 años de vida minera. Vox mantiene una regalía del 0,85% sobre los ingresos brutos sin límite en áreas de recursos. El proyecto estima un VPN5 antes de impuestos de A$528M y una TIR del 27% a precios actuales.

Alamos Gold anunció el inicio de la construcción en el proyecto de oro Lynn Lake en Manitoba, comprometiendo aproximadamente A$600M en gastos de capital desde 2025 hasta 2027. El proyecto busca una producción de 2.2Moz de Au durante 17 años, con la primera producción esperada para 2028. Vox mantiene una regalía del 2% sobre los ingresos brutos de parte del depósito de MacLellan.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR)는 세 가지 주요 로열티 자산에 대한 중요한 업데이트를 발표했습니다. Minerals 260은 호주 서부에 있는 Bullabulling 금 프로젝트(2.3Moz)를 A$166.5M에 인수하며, 80,000m의 시추 프로그램을 계획하고 있습니다. Vox는 이 프로젝트의 주요 지역에서 uncapped A$10/oz 금 로열티를 보유하고 있습니다.

Silver Mines는 Bowdens 은 프로젝트에 대한 최적화 연구를 완료하였고, 16년의 광산 수명 동안 광물 매장량이 10% 증가한 것으로 나타났습니다. Vox는 자원 지역에 대해 uncapped 0.85%의 총 수익 로열티를 유지합니다. 이 프로젝트는 현재 가격 기준으로 세전 NPV5가 A$528M이며 IRR이 27%로 추정됩니다.

Alamos Gold는 매니토바의 Lynn Lake 금 프로젝트에서 건설이 시작되었다고 발표하며, 2025년에서 2027년까지 약 A$600M의 자본 지출을 약속했습니다. 이 프로젝트는 17년 동안 2.2Moz Au 생산을 목표로 하며, 첫 생산은 2028년으로 예상됩니다. Vox는 MacLellan 매장지의 일부에 대해 2%의 총 수익 로열티를 보유하고 있습니다.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) a annoncé d'importantes mises à jour concernant trois actifs de redevances clés. Minerals 260 acquiert le projet d'or Bullabulling (2,3Moz) en Australie-Occidentale pour 166,5 millions de dollars australiens, prévoyant un programme de forage de 80 000 mètres. Vox détient une redevance non plafonnée de 10 A$/oz sur des zones clés de ce projet.

Silver Mines a achevé une étude d'optimisation pour le projet d'argent Bowdens, montrant une augmentation de 10 % des réserves minérales sur une durée de vie de mine de 16 ans. Vox maintient une redevance de 0,85 % sur le revenu brut sans plafond sur les zones de ressources. Le projet estime un VAN5 avant impôts de 528 millions de dollars australiens et un TRI de 27 % aux prix du marché.

Alamos Gold a annoncé le début de la construction du projet d'or Lynn Lake au Manitoba, s'engageant à investir environ 600 millions de dollars canadiens entre 2025 et 2027. Le projet vise à produire 2,2Moz d'Au sur 17 ans, avec la première production prévue pour 2028. Vox détient une redevance de 2 % sur les produits bruts d'une partie du gisement de MacLellan.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) hat bedeutende Updates zu drei wichtigen Royalties bekannt gegeben. Minerals 260 erwirbt das Bullabulling-Goldprojekt (2,3Moz) in Western Australia für 166,5 Millionen AUD und plant ein Bohrprogramm von 80.000 Metern. Vox hält eine unlimitierte Goldroyalty von 10 AUD/oz in Schlüsselbereichen dieses Projekts.

Silver Mines hat eine Optimierungsstudie für das Bowdens-Silberprojekt abgeschlossen, die eine Steigerung der Mineralreserven um 10% über eine Lebensdauer von 16 Jahren zeigt. Vox behält eine unlimitierte Umsatzroyalty von 0,85% auf Ressourcenbereiche. Das Projekt schätzt den vorsteuerlichen NPV5 auf 528 Millionen AUD und eine IRR von 27% bei aktuellen Preisen.

Alamos Gold hat den Baubeginn des Lynn Lake-Goldprojekts in Manitoba angekündigt und verpflichtet sich zu Investitionen von etwa 600 Millionen AUD in den Jahren 2025-2027. Das Projekt zielt auf eine Produktion von 2,2Moz Au über 17 Jahre, mit einer ersten Produktion, die für 2028 erwartet wird. Vox hält eine 2%ige Bruttoerlösroyalty auf einen Teil des MacLellan-Vorkommens.

- Bullabulling gold project acquired for A$166.5M with planned 80,000m drilling program

- Bowdens silver project shows 10% increase in mineral reserves

- Bowdens optimization study reveals pre-tax NPV5 of A$528M and 27% IRR

- Lynn Lake construction commenced with ~$600M capital commitment

- Lynn Lake projected to produce 2.2Moz gold over 17-year mine life

- None.

Insights

The acquisition of Bullabulling for

The Bowdens optimization study reveals compelling economics with a pre-tax NPV5 of

Alamos Gold's

This triple-header of development updates materially enhances Vox's medium-term royalty revenue potential. The Bullabulling acquisition price implies a valuation of approximately

The combined effect of these updates strengthens Vox's development pipeline, with potential royalty revenue streams from 2028 onwards. The company's strategic focus on development-stage assets is being validated by operator commitments totaling over

TORONTO, ON / ACCESS Newswire / January 21, 2025 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent developments from royalty operating partners, Norton Gold Fields Pty Ltd, a wholly owned subsidiary of Zijin Mining Group Co., Ltd. ("Norton"), Silver Mines Limited ("Silver Mines") and Alamos Gold Inc. ("Alamos").

Spencer Cole, Chief Investment Officer, stated: "We're excited to start the new year with key royalty development newsflow, including a significant ownership change for the Bullabulling gold project, the completion of an optimization study for Australia's largest silver project at Bowdens, and a construction decision for Alamos' Lynn Lake gold project. There has been limited disclosure on Bullabulling since Norton acquired the project in 2014, and as Minerals 260's new flagship asset, we expect significant project activity and newsflow in 2025, starting with a planned 80,000m drilling program. The Bowdens optimization study resulted in improved economics and an increase to overall reserves, enabling Silver Mines to engage in detailed funding discussions and advance final permitting. Likewise, the Lynn Lake construction decision and ~

Key Updates

The Bullabulling 2.3Moz gold project (1.4Moz Indicated, 0.9Moz Inferred) in Western Australia, to be acquired by Minerals 260 Limited ("Minerals 260") for A

$166.5 million , with an 80,000m drilling program planned post-acquisition of Bullabulling.Silver Mines has released an optimization study for the Bowdens silver project in New South Wales, Australia, including a

10% increase in mineral reserves over a proposed 16-year mine life.Alamos announced the start of construction on the Lynn Lake gold project in Manitoba, Canada, budgeting approximately

$600M of capex from 2025 - 2027 and targeting production of 2.2Moz Au over a proposed 17-year mine life.

Bullabulling (Development - Western Australia) - Minerals 260 to acquire project for A

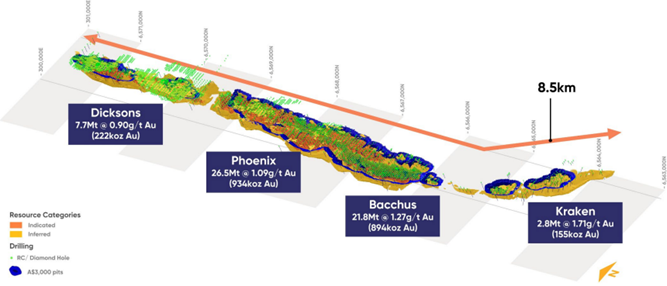

Vox holds an uncapped A

$10 /oz gold royalty (>100Koz production) over key areas of the Phoenix and Dicksons deposits at the Bullabulling gold project in Western Australia.On January 14, 2025, Minerals 260 announced that the company entered into a binding agreement to purchase Bullabulling from Norton:

The transaction includes cash consideration of A

$156.5M plus A$10M of Minerals 260 shares.Bullabulling is one of the largest undeveloped, open pit gold projects in Australia, with a resource consisting of 1.4Moz Indicated and 0.9Moz Inferred.

The project is located on granted mining leases and benefits from existing on-site infrastructure, such as a camp, offices, refuelling tanks and other buildings.

Minerals 260 is expected to kick off a 80,000m drilling campaign at Bullabulling immediately after closing the acquisition in Q2 2025, focused on numerous known exploration targets throughout the property.

Vox Management Summary: This A

$166M transaction is a material catalyst for the large-scale Bullabulling gold project, which will become Minerals 260's flagship asset post-acquisition. We are expecting significant 2025 activity and newsflow post-completion (expected in Q2 2025), with a significant 80,000m drilling program planned and a resource update expected in Q4 2025.

Source: https://api.investi.com.au/api/announcements/mi6/d7eda791-4d1.pdf

Bowdens (Development - New South Wales, Australia) - Optimization study results announced, detailed funding discussions underway(2)

Vox holds an uncapped

0.85% Gross Revenue Royalty ("GRR") on the resource areas at Bowdens, and a1.00% GRR on related regional exploration tenure in New South Wales, Australia.On December 20, 2024, Silver Mines announced the results of an optimization study at Bowdens, which improved upon several metrics from the 2018 feasibility study, including:

Increased ore reserves by

10% .Potential projected production of 53Moz Ag, 92kt Zn and 67kt Pb over a 16-year mine life at a strip ratio of 1.5:1.

Estimated pre-tax NPV5 of A

$528M and an IRR of27% at spot commodity pricing, with an initial capex estimate of A$303M .Next steps include commencing detailed project funding discussions with potential partners, and the parallel completion of the work required to convert the latest optimisation study into a Definitive Feasibility Study.

Silver Mines will provide more detailed development and permitting timelines once the Development Consent from the NSW government is granted.

Vox Management Summary: The results of the optimization study are a positive development for Bowdens, outlining a robust silver project and enabling the operator to advance funding discussions with potential financing partners. We look forward to final permitting outcomes in the near-term as well as further updates on potential funding sources to progress Australia's largest undeveloped silver project to a final investment decision.

Lynn Lake (Construction - Canada) - Positive construction decision announced, ~

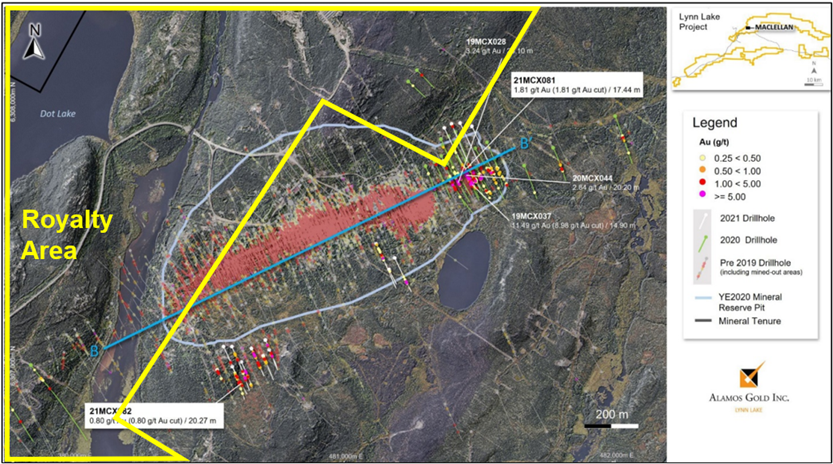

Vox holds an uncapped

2% gross proceeds (post initial capex recovery) royalty on part of the MacLellan deposit.On January 13, 2025, Alamos announced a positive construction decision on the Lynn Lake project in Manitoba, Canada:

Lynn Lake will drive additional growth for Alamos, with a projected production date of 2028. The project is expected to produce 2.2Moz over a 17-year mine life, including average production of 176koz per year for its first ten years at first quartile mine-site AISC.

Alamos has updated its 3-year capex guidance to include Lynn Lake growth capital of

$100 -120M in 2025,$250 -275M in 2026 and$235 -260M in 2027.The 2025 capital is expected to be allocated to access road upgrades, camp construction, bulk earthworks, and orders for long lead-time items.

Development activities are expected to ramp up significantly through 2025, including near-mine and regional exploration throughout the 58,000ha land package, with targets identified near the planned MacLellan mill.

Vox Management Summary: We congratulate operating partner Alamos Gold on their positive decision to start construction at Lynn Lake in Manitoba, with strong operating metrics as outlined in the 2023 Updated Feasibility Study.

Source: (Figure 10-3) https://s24.q4cdn.com/779615370/files/doc_downloads/lyn_reports/2023/LL-FS-Update-NI-43-101-Technical-Report-Final.pdf

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Spencer Cole | Kyle Floyd |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflicts in Ukraine and Israel, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2023 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Minerals 260 - Transformational acquisition of the 2.3Moz Bullabulling Gold Project in Western Australia, one of Australia's largest undeveloped gold projects - dated 15 January 2025:

https://api.investi.com.au/api/announcements/mi6/d7eda791-4d1.pdf

Silver Mines Ltd - Bowdens Optimisation Study Outlines Robust, High-Margin Silver Project - dated 20 December 2024

https://www.silvermines.com.au/wp-content/uploads/2024/12/06cwphk5h841hx.pdf

Alamos Gold Inc - Alamos Gold Achieves Increased 2024 Guidance with Record Annual Production; Three-Year Operating Guidance Outlines

24% Production Growth by 2027 at Significantly Lower Costs - Dated 13 January 2025:

https://s24.q4cdn.com/779615370/files/doc_news/2025/Jan/20250113_Alamos-Q424-Production-Three-Year-Guidance_Final.pdf

SOURCE: Vox Royalty Corp.

View the original press release on ACCESS Newswire