Vox Royalty Announces Agreement to Acquire Transformational Global Gold Portfolio, Overnight Marketed Offering of Common Shares and Expanded Revolving Credit Facility

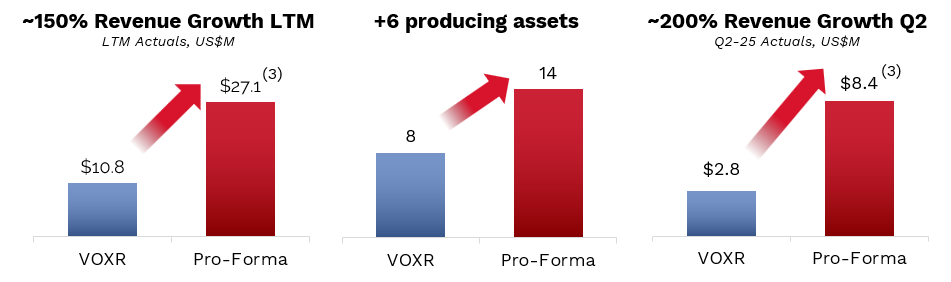

Vox Royalty (NASDAQ: VOXR) has announced a transformational acquisition of a global gold portfolio worth $60 million, comprising ten gold offtake and royalty assets across eight jurisdictions. The portfolio, acquired from Deterra Royalties, generated $16.3 million in revenue over the trailing four quarters ending June 2025, with a Q2-2025 gold cash flow of $5.6 million.

The transaction will be funded through a $55 million overnight marketed offering of common shares at $3.70 per share and an expanded $40 million revolving credit facility with BMO. The acquisition is expected to increase revenue per share by approximately 115% and expand Vox's producing asset count to 14.

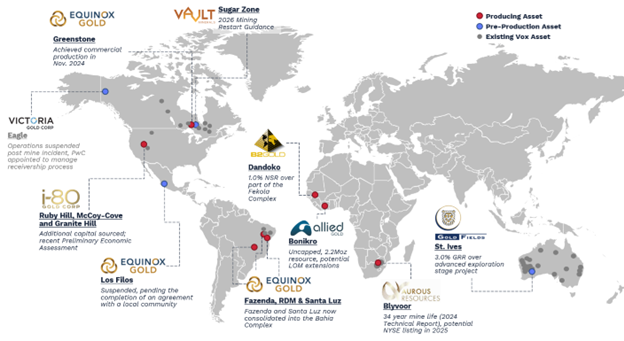

The portfolio includes assets operated by major mining companies such as Equinox Gold, Allied Gold, Gold Fields, and B2Gold, providing access to over 300,000 ounces of physical gold annually. The transaction is expected to close around September 26, 2025, subject to regulatory approvals.

Vox Royalty (NASDAQ: VOXR) ha annunciato un'acquisizione trasformativa di un portafoglio globale di oro del valore di $60 milioni, comprendente dieci asset di offtake e royalty in otto giurisdizioni. Il portafoglio, acquistato da Deterra Royalties, ha generato $16,3 milioni di ricavi negli ultimi quattro trimestri terminati a giugno 2025, con un flusso di cassa relativo all'oro nel Q2-2025 di $5,6 milioni.

L'operazione sarà finanziata tramite un'offerta di mercato overnight di azioni ordinarie per $55 milioni a 3,70 dollari per azione e una linea di credito revolving espansa da $40 milioni con BMO. L'acquisizione dovrebbe aumentare l'utile per azione di circa 115% e ampliare il numero di asset produttivi di Vox a 14.

Il portafoglio include asset gestiti da grandi aziende minerarie quali Equinox Gold, Allied Gold, Gold Fields e B2Gold, offrendo accesso a oltre 300.000 once di oro fisico all'anno. Si prevede che la transazione si chiuda verso il 26 settembre 2025, soggetta alle approvazioni regolatorie.

Vox Royalty (NASDAQ: VOXR) ha anunciado una adquisición transformadora de una cartera global de oro por valor de $60 millones, que comprende diez activos de offtake y regalías en ocho jurisdicciones. La cartera, adquirida a Deterra Royalties, generó $16,3 millones en ingresos en los últimos cuatro trimestres que finalizan en junio de 2025, con un flujo de caja de oro para el segundo trimestre de 2025 de $5,6 millones.

La transacción se financiará mediante una oferta anunciada en el mercado nocturno de acciones comunes por $55 millones a $3,70 por acción y una ampliación de una línea de crédito revolvente de $40 millones con BMO. Se espera que la adquisición aumente las ganancias por acción en aproximadamente un 115% y expanda el número de activos productores de Vox a 14.

El portafolio incluye activos operados por grandes compañías mineras como Equinox Gold, Allied Gold, Gold Fields y B2Gold, proporcionando acceso a más de 300,000 onzas de oro físico al año. Se espera que la transacción se cierre alrededor del 26 de septiembre de 2025, sujeto a aprobaciones regulatorias.

Vox Royalty (NASDAQ: VOXR)가 $60백만의 가치가 있는 글로벌 금 포트폴리오의 변혁적 인수를 발표했습니다. 이는 8개 관할 구역에 걸친 열 가지 금 수익 창출 및 로열티 자산으로 구성됩니다. Deterra Royalties로부터 인수된 이 포트폴리오는 2025년 6월까지의 최근 4개 분기에 걸쳐 $16.3백만의 매출을 창출했으며, 2025년 2분기 금 현금 흐름은 $5.6백만입니다.

거래는 주식의 $3.70당 55백만 달러의 야간 시장 공모를 통해 자금을 조달하고, BMO와의 확장된 $40백만 회전크레딧 facility으로 자금을 조달합니다. 인수로 주당 순이익이 약 115% 증가하고 Vox의 생산 자산 수가 14개로 늘어날 것으로 예상됩니다.

포트폴리오에는 Equinox Gold, Allied Gold, Gold Fields, B2Gold와 같은 대형 광산기업이 운영하는 자산이 포함되어 있으며, 연간 30만 온스 이상의 물리적 금에 접근할 수 있습니다. 거래는 2025년 9월 26일경에 마무리될 예정이며 규제 승인을 조건으로 합니다.

Vox Royalty (NASDAQ: VOXR) a annoncé une acquisition transformationnelle d’un portefeuille mondial d’or d’une valeur de 60 millions de dollars, comprenant dix actifs d’achat et de redevances répartis sur huit juridictions. Le portefeuille, acquis à Deterra Royalties, a généré 16,3 millions de dollars de revenus au titre des quatre derniers trimestres se terminant en juin 2025, avec un flux de trésorerie en or pour le T2-2025 de 5,6 millions de dollars.

La transaction sera financée par une offre éclair sur le marché nocturne d’actions ordinaires de 55 millions de dollars à 3,70 dollars» et une ligne de crédit revolving étendue de 40 millions de dollars avec BMO. L’acquisition devrait augmenter le bénéfice par action d’environ 115% et porter le nombre d’actifs productifs de Vox à 14.

Le portefeuille comprend des actifs exploités par des majors tels que Equinox Gold, Allied Gold, Gold Fields et B2Gold, offrant un accès à plus de 300 000 onces d’or physique par an. La transaction devrait être clôturée vers le 26 septembre 2025, sous réserve des approbations réglementaires.

Vox Royalty (NASDAQ: VOXR) hat eine transformative Akquisition eines globalen Goldportfolios im Wert von 60 Millionen USD angekündigt, das zehn Gold-Fromthek- und Royalties-Assets in acht Rechtsordnungen umfasst. Das Portfolio, das von Deterra Royalties erworben wurde, erzielte in den letzten vier Quartalen bis Juni 2025 16,3 Millionen USD Umsatz, mit einem Gold-Cashflow im Q2-2025 von 5,6 Millionen USD.

Die Transaktion wird durch ein over-night marketed offering von Stammaktien in Höhe von 55 Millionen USD zu 3,70 USD pro Aktie sowie durch eine erweiterte revolvierende Kreditfazilität von 40 Millionen USD mit BMO finanziert. Die Akquisition soll den Gewinn je Aktie um ungefähr 115% erhöhen und Vox' Produktionsaktiva auf 14 steigern.

Das Portfolio umfasst Assets, die von großen Bergbauunternehmen wie Equinox Gold, Allied Gold, Gold Fields und B2Gold betrieben werden, und bietet Zugang zu über 300.000 Unzen physischen Gold pro Jahr. Der Abschluss der Transaktion wird voraussichtlich um den 26. September 2025 erfolgen, vorbehaltlich regulatorischer Genehmigungen.

Vox Royalty (NASDAQ: VOXR) أعلنت عن استحواذ تحولي على محفظة ذهب عالمية قيمتها $60 مليون، تتكون من عشرة أصول تخص Offtake وحقوق امتياز عبر ثماني ولايات قضائية. المحفظة، التي اشتراها من Deterra Royalties، حققت $16.3 مليون في الإيرادات على مدى الأرباع الأربعة الأخيرة حتى يونيو 2025، وبالتدفق النقدي من الذهب للربع الثاني من 2025 قدره $5.6 مليون.

سيتم تمويل الصفقة عبر عرض سوق ليلي سوقي للأسهم العادية بقيمة $55 مليون عند سعر $3.70 للسهم وخط ائتمان دوَّران موسع بقيمة $40 مليون مع BMO. من المتوقع أن تزيد الصفقة الإيرادات للسهم بنحو 115% وتزيد عدد الأصول المنتجة لـ Vox إلى 14.

تشمل المحفظة أصولاً تشغِّلها شركات تعدين كبرى مثل Equinox Gold و Allied Gold و Gold Fields و B2Gold، وتوفر وصولاً إلى أكثر من 300,000 أونصة من الذهب الفعلي سنوياً. من المتوقع إتمام الصفقة نحو 26 سبتمبر 2025، رهناً بالموافقات التنظيمية.

Vox Royalty (纳斯达克: VOXR) 宣布以 $6000万美元收购全球黄金组合,涵盖八个司法辖区的十项金采出和特许权资产。该组合由 Deterra Royalties 转让所得,截至2025年6月的最近四个季度实现 $1630万的收入,2025年第二季度黄金现金流为 $560万。

交易将通过一轮 55百万美元的隔夜公开发行普通股,发行价3.70美元/股以及与 BMO 扩大的 4000万美元循环信贷额度来融资。此次收购预计每股收益将提升约 115% , Vox 的在产资产数量将增至14项。

组合包含由 Equinox Gold、Alored Gold、Gold Fields、B2Gold 等大型矿业公司运营的资产,可实现年产 30万盎司以上的实物黄金。预计交易将在 2025 年 9 月 26 日左右完成,需经监管机构批准。

- Portfolio generated $16.3 million in revenue over trailing four quarters with strong Q2-2025 performance of $5.6 million

- Expected 115% increase in revenue per share post-acquisition

- Margins outperformed gold price with 170% growth from $23.10/oz to $63.10/oz

- Expansion to 14 producing assets with exposure to large-cap operators

- Access to over 300,000 ounces of physical gold annually

- Portfolio's gold focus may enable GDXJ index inclusion in 2026

- Significant dilution through $55 million equity offering at $3.70 per share

- Increased debt exposure through $40 million revolving credit facility

- Several assets in portfolio face operational challenges (Los Filos suspended, Eagle in receivership)

- Multiple assets subject to production caps and delivery limitations

Insights

Vox's $60M gold portfolio acquisition is transformational, increasing revenue per share by 115% with significant margin expansion potential.

Vox Royalty is executing a highly accretive acquisition of ten gold offtake and royalty assets spanning 12 mines across eight countries for

This deal is transformational for Vox's scale and shareholder returns. The company expects

The acquired portfolio has demonstrated superior financial performance beyond gold price appreciation. While gold prices increased

To fund the transaction, Vox is conducting an overnight marketed offering targeting

One strategic benefit is the portfolio's contribution to Vox's potential inclusion in the GDXJ index in 2026, as pro-forma revenue will be

All figures expressed in USD unless noted otherwise.

DENVER, Sept. 23, 2025 (GLOBE NEWSWIRE) -- Vox Royalty Corp. (NASDAQ: VOXR) (TSX: VOXR) (“Vox” or the “Company”), a returns focused mining royalty and streaming company, is pleased to announce that it has entered into definitive agreements to acquire a global gold portfolio of ten gold offtake and royalty assets, covering twelve mines and projects across eight jurisdictions, including Australia, Brazil, Canada, Côte d’Ivoire, Mali, Mexico, South Africa and the United States (the “Portfolio”), from certain subsidiaries of Deterra Royalties Limited (“Deterra”), for total upfront cash consideration of

Kyle Floyd, Chief Executive Officer stated: “We are excited to announce this highly accretive gold portfolio transaction that is expected to grow revenue per share by over

Pro Forma Growth from Global Gold Portfolio

Notes:

1. Based on Q2 -25 Vox revenues of

2. Based on LTM Vox revenues of

3. Pro-Forma represents actuals reported by Vox Royalty Corp and as disclosed by Deterra June 2025 quarter portfolio update dated July 31, 2025 - https://www.deterraroyalties.com/wp-content/uploads/2025/07/2922636.pdf

Past results of the acquired portfolio may not be representative of future results.

Transaction Rationale

- This Transaction is expected to have an immediately accretive financial impact, including: i) revenue per share, ii) cash flow per share, and iii) net asset value.

- The acquired portfolio generated approximately

$5.6 million of revenue in the three months ended June 20251 and the portfolio generated approximately$16.3 million 1 of revenue in the trailing four quarters ending June 30, 2025, representing an expected revenue growth of approximately200% and150% , respectively2. - Pro-forma, the Transaction represents an increase in revenue per share of approximately

115% 3. - The margins realized by this portfolio have significantly outperformed the underlying price of gold. Comparing the first half of 2022 to the first half of 2025, the average margin per ounce realized on the acquired assets has increased from

$23.10 /oz to$63.10 /oz, representing a relative growth of approximately170% 4, while the underlying realized gold price has increased from$1,807 /oz to$3,099 /oz, or approximately70% 4. Similarly, the ounces delivered by the portfolio within the same comparison period increased by approximately30% , from 111koz to 144koz, while delivering a total of 976koz since January 20224. - Adds immediate cash flow from seven operating mines, with potential embedded growth and upside optionality from exploration success, life of mine extensions, throughput expansions and mine re-starts within the diversified portfolio.

- Provides exposure to assets operated by medium to large-cap operators such as Equinox Gold Corp., Allied Gold Corporation, Gold Fields Limited, B2Gold Corp., and Vault Minerals Limited.

- Weights the portfolio and revenue mix towards precious metals, with a larger proportion of revenue derived from gold, potentially unlocking eligibility to precious metal-based indexes such as the GDXJ.

- The portfolio is expected to provide access to over 300,000 ounces of physical gold per annum, based on FY2025 (to June 30, 2025) actuals of 338,000 delivered ounces 4, as well as CY2024 actuals of 306,000 delivered ounces5.

- The funding package ensures Vox maintains a strong balance sheet to execute on its acquisition pipeline after the closing of the Transaction.

Portfolio Summary

The portfolio includes eight separate gold offtake contracts and two gold royalties, as described below:

| Asset | Key Terms of Interest | Total oz Delivered (to Dec 2024) | Commodity | Jurisdiction | Stage | Operator |

| Fazenda | 364 koz | Gold | Brazil | Producing | Equinox Gold Corp. | |

| RDM(i) | ||||||

| Santa Luz(i) | ||||||

| Greenstone | 58.5 koz | Gold | Canada | Producing | Equinox Gold Corp. | |

| i-80 Assets; Ruby Hill, Cove & Granite Creek | 44 koz | Gold | United States | Producing | i-80 Gold Corp. | |

| Bonikro | 177 koz | Gold | Ivory Coast | Producing(ii) | Allied Gold Corporation | |

| Blyvoor | 64 koz | Gold | South Africa | Producing | Aurous Resources(iii) | |

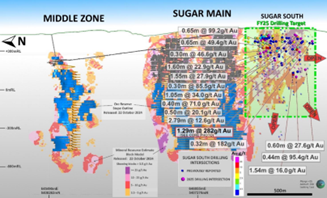

| Sugar Zone | 93 koz | Gold doré | Canada | Development (iv) | Vault Minerals Limited | |

| Los Filos | 512 koz | Gold | Mexico | Suspended(v) | Equinox Gold Corp. | |

| Eagle | 163 koz | Gold | Canada | Suspended(vi) | Victoria Gold Corp. | |

| St. Ives | -- | Gold | Australia | Exploration | Gold Fields Limited | |

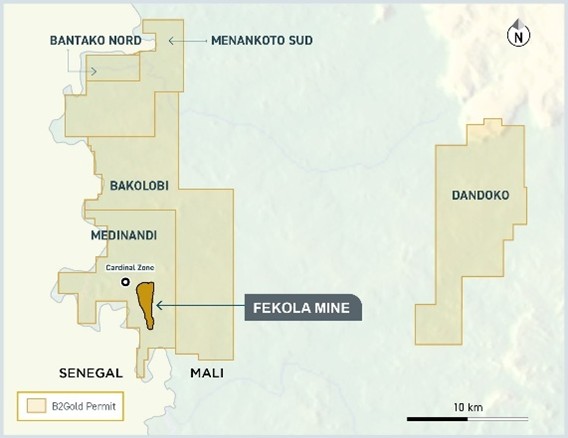

| Dandoko | -- | Gold | Mali | Development | B2Gold Corp. |

Notes:

- This represents a multi-asset offtake.

- The current mine plan extends to 2029. Allied Gold Corporation is targeting a mine life extension.

- Aurous Resources has announced that it is considering a potential listing of its securities on the NYSE with the goal of securing expansion capital.

- The operator is guiding towards a restart of operations at Sugar Zone in 2026, following the receipt of remaining permits and estimated pre-production restart capital expenditures of C

$55 million . - On April 1, 2025, Equinox Gold Corp. announced an indefinite suspension of operations at the Los Filos mine in Mexico, following the expiry of its land access agreement with one of three local communities.

- On June 24, 2024, Victoria Gold Corp. announced the suspension of mine operations following a heap leach containment incident. PricewaterhouseCoopers has been appointed to manage the receivership process.

- The St Ives royalty is a

3.0% GRR, but the Transaction will also include an obligation for Vox Australia Pty Ltd. to pay a1.96% GRR royalty to a third party. - Includes deferred contingent consideration of

$1.25 million upon first royalty receipts, and$1.25 million on receipt of payment on 500koz from the royalty area.

Concurrent Overnight Marketed Underwritten Offering of Common Shares

The Company is pleased to announce that it has commenced an overnight marketed public offering, subject to market conditions, of common shares of Vox (“Common Shares”) in the United States and each of the provinces of Canada, other than Québec (the “Offering”). The Offering is expected to be up to

The Underwriters may elect to purchase up to an additional

Vox intends to use the net proceeds from the Offering to fund the purchase price of the Transaction, subject to certain conditions precedent being satisfied or waived by the parties. If Vox uses less than the full amount of the net proceeds from the Offering to purchase the Portfolio, the Company will reallocate those funds to the acquisition of additional royalties over the next 12-24 months.

The Offering is expected to close on or about September 26, 2025, subject to the satisfaction of customary closing conditions and the receipt of regulatory approvals, including the approval of the Toronto Stock Exchange and The Nasdaq Capital Markets. There can be no assurance as to whether or when the Offering may be completed, or as to the actual size or specific terms of the Offering.

The Offering will only be made by means of prospectus supplements that form part of Vox’s existing short form base shelf prospectus dated February 13, 2025, filed pursuant to the shelf prospectus procedures established by National Instrument 44-102 - Shelf Distributions and National Instrument 44-101 - Short Form Prospectus Distributions, and Vox’s U.S. registration statement on Form F-10, as amended (File No. 333-284746), filed with the United States Securities and Exchange Commission (the “SEC”). Preliminary prospectus supplements together with the accompanying base shelf prospectus or registration statement, as applicable, have been filed with the securities regulatory authorities in all provinces of Canada other than Québec, pursuant to the Multijurisdictional Disclosure System, and with the SEC in the United States, respectively. Copies of these documents will be available on Vox’s profiles on the System for Electric Document Analysis and Retrieval website maintained by the Canadian Securities Administrators at www.sedarplus.ca and the SEC’s website at www.sec.gov, as applicable. Alternatively, copies of the preliminary prospectus supplements and the accompanying base shelf prospectus or registration statement, as applicable, may also be obtained from BMO Capital Markets, at Brampton Distribution Centre c/o The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, by telephone at (905) 791-3151 Ext. 4312 or by email at torbramwarehouse@datagroup.ca, and in the United States by contacting BMO Capital Markets Corp., Attn: Equity Syndicate Department, 3 Times Square, 25th Floor, New York, NY 10036 (Attn: Equity Syndicate), Cantor by telephone at (212) 938-5000 or by email at prospectus@cantor.com, or National at 130 King Street West, 4th Floor Podium, Toronto, Ontario M5X 1J9, by telephone at (416) 869-8414 or by email at NBF-Syndication@bnc.ca.

Upsized Revolving Credit Facility

On September 23, 2025, the Company executed a credit agreement with BMO providing for an upsized

The key terms of the upsized Facility are:

- The purpose of the credit agreement is to assist in funding offtake purchases from the portfolio or offtake contracts to be acquired under the Transaction and for general corporate purposes;

- Secured against substantially all the assets of the Company, including the ten gold offtake contracts and royalty assets to be acquired in the Transaction;

- Interest rate of Secured Overnight Financing Rate plus

2.50% to3.50% (as defined in the Facility), contingent upon the Company’s leverage ratio; - Facility has flexibility to be drawn and repaid, with the undrawn portion subject to a standby fee of

0.5625% to0.7875% per annum based on the undrawn amount; - Upfront fee of

0.25% per annum on the total Facility amount; and - Matures on September 23, 2028, with annual one-year extension options.

Additional Portfolio Information

Fazenda, RDM and Santa Luz – Brazil | Operating | Equinox Gold

Equinox Gold’s Brazilian operations comprise three producing mines: Fazenda and Santa Luz (together the Bahia Complex) are in the State of Bahia, and RDM (Riacho dos Machados) in Minas Gerais. Fazenda has operated for nearly 40 years as both an open pit and underground mine, while Santa Luz achieved commercial production in late 2022 as a conventional open pit. RDM is an open-pit mine with a conventional plant that commenced production in 2014. Equinox provided 2025 production guidance for the Bahia Complex of 125-145koz at cash costs of

https://www.equinoxgold.com/our-mines/fazenda-gold-mine/

https://www.equinoxgold.com/our-mines/santa-luz-gold-mine/

https://www.equinoxgold.com/our-mines/rdm-gold-mine/

Figure 1: Fazenda Mine, Brazil.

Source: Equinox Gold https://www.equinoxgold.com/wp-content/uploads/2023/01/fazendabr_0201_C2A1407-2048x1365.jpg

Figure 2: RDM Mine, Brazil.

Source: Equinox Gold https://www.equinoxgold.com/wp-content/uploads/2023/01/RDM_0671_C2A1601-2048x1365.jpg

Figure 3: Santa Luz Mine, Brazil.

Source: Equinox Gold NI 43-101 Technical Report. https://www.equinoxgold.com/wp-content/uploads/2023/01/2020-SantaLuz.pdf

Greenstone – Ontario, Canada | Operating | Equinox Gold

Greenstone is a large open-pit mine near Geraldton, Ontario, which achieved commercial production in November 2024. Equinox consolidated

Figure 4: Greenstone Mine, Ontario, Canada.

Source: Equinox Gold – Greenstone Mine Site Tour. https://www.equinoxgold.com/wp-content/uploads/2024/10/Greenstone-Site-Tour-Oct-2024-Website.pdf

Ruby Hill, Cove and Granite Creek - Nevada, USA | Operating | i-80 Gold Corp.

i-80 Gold’s Nevada portfolio is anchored by three cornerstone assets: Ruby Hill, a brownfields complex with existing processing infrastructure, now advancing the Archimedes Underground; Cove, a high-grade underground development on the Battle Mountain Trend; and Granite Creek, a permitted underground mine with additional open-pit oxide potential. In September 2025, i-80 announced that they had started underground development at Archimedes (Ruby Hill), following the receipt of the relevant construction permits8. The Company also delivered a positive Preliminary Economic Assessment for the Granite Creek Open Pit9, and an updated PEA for Cove10. https://www.i80gold.com/

Figure 5: Ruby Hill Mill.

Figure 5: Ruby Hill Mill.

Source: i-80 Gold. https://www.i80gold.com/ruby-hill-complex-archimedes-underground/

Figure 6: Portal and Decline at Cove.

Figure 6: Portal and Decline at Cove.

Source: i-80 Gold. https://www.i80gold.com/cove-2/

Figure 7: Underground Portal at Granite Creek.

Source: i-80 Gold. https://www.i80gold.com/granite-creek-underground/

Bonikro – Côte D’Ivoire | Operating | Allied Gold Corporation

Bonikro is Allied Gold’s open-pit operation within the Côte d’Ivoire Complex, operated alongside Agbaou in the Birimian belt with the two mills located 20 km apart. The assets are being managed to lift near-term output while extending a 10+ year strategic mine life. For 2025, Bonikro is guided at 98–105 Koz with cash costs of

Figure 8: Bonikro Gold Mine, Côte d’Ivoire.

Source: https://minedocs.com/17/Newcrest_FS_Bonikro_October2015_LR.pdf

Blyvoor – South Africa | Operating | Aurous Resources

Blyvoor is an underground gold mine located on Johannesburg’s West Rand in South Africa, with operations dating back to 1942. Historically one of South Africa’s most prolific producers, the mine has yielded more than 38 Moz of gold to date. Aurous acquired the asset in 2020, and has since then re-started the operation, supported by a February 2024 technical report that outlines a 34-year life of mine producing approximately 150 koz per annum at an AISC of approximately

Figure 9: Blyvoor Gold Mine, Main Shaft, South Africa

Source: https://www.miningweekly.com

Sugar Zone – Ontario, Canada | Development | Vault Minerals Ltd.

Sugar Zone is Vault Minerals’ high-grade underground gold project in Ontario. The mine was acquired by Silver Lake Resources in 2022 and became part of Vault Minerals following the 2024 merger between Red 5 and Silver Lake. Operations at Sugar Zone were paused in 2023, while the new owners upgraded infrastructure and re-scoped the operating plan. Recently, Vault has indicated plans for a restart in 2026, following an investment of C

Figure 10: Sugar Zone Long Section – Ontario, Canada.

Source: Vault Minerals. https://app.sharelinktechnologies.com/announcement/asx/8e61137c32dd3c131a8f9d23847e9510

Dandoko – Mali | Development | B2Gold Corp.

Dandoko is a gold deposit within B2Gold’s Fekola Complex, acquired in 2022. The operator has been integrating it into its broader Fekola regional strategy. Dandoko is located approximately 25km from the Fekola mill. B2Gold has outlined plans to begin exploiting regional targets around Fekola in 2026, pending the receipt of exploitation permits16.

The acquired royalty is a

https://www.b2gold.com/operations-projects/producing/fekola-mine-mali/

Figure 11: Fekola Project Area incl. Dandoko, Mali.

Source: B2Gold. https://www.b2gold.com/operations-projects/producing/fekola-mine-mali/default.aspx

Los Filos – Mexico | Care & Maintenance | Equinox Gold

Los Filos is a large heap-leach complex in the State of Guerrero comprising three open pits (Los Filos, Bermejal, Guadalupe) plus two underground areas (Los Filos, Bermejal). Operations are indefinitely suspended as of April 1, 2025, after a land-access agreement expired; Los Filos has been excluded from Equinox’s 2025 guidance pending a new agreement and restart plan17.

https://www.equinoxgold.com/growth-projects/los-filos-expansion/

Eagle – Yukon, Canada | Suspended | Formerly Victoria Gold, PricewaterhouseCoopers Inc. Appointed as Receiver

Eagle is an open-pit, heap-leach gold mine near Mayo, Yukon. Following a heap-leach facility failure on June 24, 2024, the Yukon government and an Independent Review Board (“IRB”) oversaw investigations and remediation. PwC acts as court-appointed receiver of the project and project assets, issuing ongoing site and remediation updates and hosting the IRB’s final report18. The site remains in remediation, and a sale process is being managed through the receivership. https://www.pwc.com/ca/victoriagold

St Ives – Western Australia | Exploration | Gold Fields Limited

The acquired royalty is a

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a “Qualified Person” under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty and streaming company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

| Kyle Floyd | Spencer Cole |

| Chief Executive Officer | Chief Investment Officer |

| info@voxroyalty.com (720) 602-4223 | spencer@voxroyalty.com (720) 602-4223 |

Cautionary Statements to U.S. Securityholders

This press release has been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced herein are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”).

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, “inferred mineral resources” have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains “forward-looking statements”, within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate” “plans”, “estimates” or “intends” or stating that certain actions, events or results “ may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox’s mining operator partners, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, requirements for and operator ability to receive regulatory approvals, the terms, timing, receipt and intended use of proceeds from the equity offering, the receipt of proceeds from the credit facility, and the completion of the Transaction, including anticipated timing for completion and satisfaction of the conditions precedent required for completion, the future integration and anticipated contribution of the Transaction assets to the Company’s future revenue, cash flow, production forecasts and the expected strategic and financial benefits to the Company’s business and portfolio diversification. There is no assurance that overnight marketing efforts will result in successful pricing and terms for the equity offering that are acceptable to the Company or that the equity offering and Transaction will be completed.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions, including international trade and tariffs; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox’s dividend policy; epidemics, pandemics or other public health crises, geopolitical events and other uncertainties, such as the changes to United States tariff and import/export regulations, as well as those factors discussed in the section entitled “Risk Factors” in Vox’s annual information form for the financial year ended December 31, 2024 available at www.sedarplus.ca and the SEC’s website at www.sec.gov (as part of Vox’s Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox’s royalty interests. Vox’s royalty interests often cover less than

References & Notes:

| (1 | ) | Deterra – ASX Announcement: June 2025 Quarter Portfolio Update, dated July 31, 2025: https://www.deterraroyalties.com/wp-content/uploads/2025/07/2922636.pdf |

| (2 | ) | Based on actual revenue figures from Deterra and Vox over the periods including the trailing four quarters, and the quarter ended June 2025 |

| (3 | ) | Based on LTM Vox revenues of |

| (4 | ) | Deterra FY25 Full Year Results Presentation, Slide #8 (Offtake Portfolio Overview) – Dated August 19, 2025: |

| https://www.deterraroyalties.com/wp-content/uploads/2025/08/2931000.pdf | ||

| (5 | ) | Deterra Corporate Presentation, Slide 22 (Offtake Portfolio Overview), dated March 2025: |

| https://www.deterraroyalties.com/wp-content/uploads/2025/06/250313-IBD-Final-Presentation.pdf | ||

| (6 | ) | Equinox Gold – Bahia Complex: Santa Luz Gold Mine Overview: |

| https://www.equinoxgold.com/our-mines/santa-luz-gold-mine/ | ||

| (7 | ) | Equinox Gold Provides Updated 2025 Gold Production and Cost Guidance, dated June 11, 2025: https://www.equinoxgold.com/news/equinox-gold-provides-updated-2025-gold-production-and-cost-guidance |

| (8 | ) | I-80 Gold Receives Construction Permits and Initiates Underground Development at Archimedes, dated September 5, 2025: |

| https://www.i80gold.com/i-80-gold-receives-construction-permits-and-initiates-underground-development-at-archimedes/ | ||

| (9 | ) | I-80 Gold Announces Positive Preliminary Economic Assessment on the Granite Creek Open Pit Project, Nevada, dated March 6, 2025: |

| https://www.i80gold.com/i-80-gold-announces-positive-preliminary-economic-assessment-on-the-granite-creek-open-pit-project-nevada/ | ||

| (10 | ) | I-80 Gold Announces Positive Preliminary Economic Assessment on the Cove Project, Nevada, dated February 21, 2025: |

| https://www.i80gold.com/i-80-gold-announces-positive-updated-preliminary-economic-assessment-on-the-cove-project-nevada/ | ||

| (11 | ) | Allied Gold Announces 2025 Guidance and Near-Term Outlook, dated February 20, 2025: |

| https://s203.q4cdn.com/846800919/files/doc_news/2025/02/20/ALLIED-GOLD-PROVIDES-2025-GUIDANCE-AND-OUTLOOK_vf.pdf | ||

| (12 | ) | Blyvoor Gold Resources (Pty) Ltd – S-K 1300 Technical Report Summary on the Blyvoor Gold Mine, South Africa, dated 30 May 2024: |

| https://lexamples.com/exhibits/contents/NTI0NzkwOQ== | ||

| (13 | ) | Aurous Resources – Gold Producer with Industry-Leading Growth Transforming into a Multi-Asset Operation, dated September 2024: |

| https://www.sec.gov/Archives/edgar/data/2025049/000182912624006126/aurousresources_425.htm | ||

| (14 | ) | Aurous to Go Public via Business Combination with Rigel Resource Acquisition Corp, dated March 14, 2024: |

| https://www.sec.gov/Archives/edgar/data/1860879/000182912624001510/rigelresource_ex99-1.htm | ||

| (15 | ) | Vault Minerals – Mining Forum Americas 2025 Presentation, dated September 2025: |

| https://announcements.asx.com.au/asxpdf/20250915/pdf/06p6dsmzk5x47x.pdf | ||

| (16 | ) | B2Gold Corporate Presentation, dated September 2025: |

| https://www.b2gold.com/investors/why-invest/#presentations | ||

| (17 | ) | Equinox Gold Provides Update on the Los Filos Mine, dated April 1, 2025: |

| https://www.equinoxgold.com/news/equinox-gold-provides-update-on-the-los-filos-mine | ||

| (18 | ) | Government of Yukon provides an update on heap leach failure at Victora Gold’s Eagle Gold Mine, dated September 6, 2025: |

| https://yukon.ca/en/news/government-yukon-provides-update-heap-leach-failure-victoria-golds-eagle-gold-mine | ||

| (19 | ) | PwC Victoria Gold Corp – Receivership, updated September 3, 2025: |

| https://www.pwc.com/ca/en/services/insolvency-assignments/victoriagold.html | ||

Photos accompanying this press release are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/b926cdde-7b24-48fb-b23e-3a0d0d96a52f

https://www.globenewswire.com/NewsRoom/AttachmentNg/4cc84284-90c4-4e94-8ce6-727e88869ee0

https://www.globenewswire.com/NewsRoom/AttachmentNg/2cb8304d-a475-4a16-b141-0dc0bb8cd815

https://www.globenewswire.com/NewsRoom/AttachmentNg/5f5490a6-d180-483a-9106-9f9e0414dbe1

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d25779a-89ca-4aa2-944f-4bdf556a8fe2

https://www.globenewswire.com/NewsRoom/AttachmentNg/1c1a212d-4d26-4cc1-9836-364dca78d699

https://www.globenewswire.com/NewsRoom/AttachmentNg/c046723c-3b9c-4998-a04f-23f9eff09c16

https://www.globenewswire.com/NewsRoom/AttachmentNg/19476f5f-ad58-4e05-909b-4ff867d7f9d1

https://www.globenewswire.com/NewsRoom/AttachmentNg/8719400d-4b9c-4938-9ad4-0a2d08c6231f

https://www.globenewswire.com/NewsRoom/AttachmentNg/cde9bff6-5060-4ebf-a437-2e17fadb3938

https://www.globenewswire.com/NewsRoom/AttachmentNg/2242463f-a96b-4961-84d4-3ee11861e33b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e81d1f4e-8d23-4b21-bbdc-da66ccbcf56e

https://www.globenewswire.com/NewsRoom/AttachmentNg/d8a82223-e64f-41e9-9437-7a2e59e8a59c