Vox Provides Project Updates for Plutonic East, Bulong and Koolyanobbing, Including Timing Estimates for First Gold Production

Vox Royalty Corp (TSX:VOXR, NASDAQ:VOXR) announced updates on its mining royalty projects. The Plutonic East and Bulong gold royalties are expected to commence production by Q1 2025, driven by strong AUD gold prices. Black Cat Syndicate has started mining activities at the Bulong project, anticipating first production in September 2024. Catalyst Metals is dewatering the Plutonic East mine, with first production expected in Q1 2025. However, Mineral Resources will ramp down operations at the Yilgarn Hub, including Koolyanobbing, by December 31, 2024, following an assessment. Vox expects significant returns from these projects, having acquired the Plutonic East royalty for US$800,000 and the Bulong royalty for US$545,000.

- Black Cat Syndicate started mining activities at Bulong, expecting first production in September 2024.

- Catalyst Metals is dewatering Plutonic East mine ahead of schedule, with first production expected in Q1 2025.

- Vox expects significant returns from the Bulong project, potentially earning 2x-3x revenue on invested capital.

- Vox acquired the Plutonic East royalty for US$800,000, with the mine restart progressing 6-12 months ahead of expectations.

- Mineral Resources will ramp down operations at the Yilgarn Hub, including Koolyanobbing, by December 31, 2024, impacting Vox's 2.0% FOB revenue royalty.

Insights

Vox Royalty Corp's announcement of project updates for Plutonic East, Bulong and Koolyanobbing highlights significant operational milestones. First gold production at Plutonic East and Bulong by Q1 2025 is ahead of schedule, supported by current high AUD gold prices. This timeline acceleration should translate into earlier cash flow for Vox, enhancing revenue predictability and potentially boosting stock valuation in the short term.

Vox's strategy of acquiring royalties over near-production projects in premium mining jurisdictions is showing results. The Plutonic East gold mine, backed by Catalyst Metals, is in an advanced dewatering phase, anticipated to move into production by early 2025. Black Cat Syndicate’s Bulong gold project commencing mining activities with first ore expected in September 2024 further solidifies Vox's portfolio. This early start should yield a rapid return on Vox's initial investment, noted at $545,000 for the Bulong royalty, with potential revenue multiples of 2x - 3x within 18 months.

The cessation of operations at MinRes's Yilgarn Hub by December 2024 poses a moderate downside. However, Vox's realized returns from its Koolyanobbing royalty, amounting to $5M against a cost base of $2.6M, indicate strong historical performance. Future opportunities might arise if the asset is divested or reactivated by another operator.

Overall, these developments present a mixed outlook. While production progress at Plutonic East and Bulong is favorable and ahead of schedule, the ramp-down at Koolyanobbing introduces some uncertainty. Investors should weigh the immediate positive cash flow potential against the long-term impacts of the Yilgarn Hub conclusion.

From a mining operations perspective, the updates provided by Vox Royalty highlight substantial progress in their royalty-linked projects. The accelerated timeline for first production at Plutonic East and Bulong indicates efficient project management and favorable mining conditions. The dewatering of Plutonic East is a critical step, showing that Catalyst Metals is effectively managing underground water levels, which is essential for safe and productive mining operations.

The initiation of mining activities at Bulong, particularly the Myhree and Boundary deposits, demonstrates a strategic move towards harnessing high-grade ore. The updated study showing positive economic adjustments and sustainable mining costs, such as an all-in sustaining cost of A$1,724/oz, reflects robust project economics, ensuring profitability under current market conditions.

Conversely, the decision to ramp down the Yilgarn Hub operations by MinRes is a downbeat note but reflects a rational approach to capital allocation. It highlights the challenges of sustaining long-term mining operations without substantial new resource development. The exploratory activities planned post-closure suggest potential future opportunities, albeit with a longer-term horizon.

For investors, the operational efficiencies and early production timelines at Plutonic East and Bulong are promising. However, the strategic implications of the Yilgarn Hub closure should be closely monitored, as they may impact overall portfolio value and future income streams.

The updates from Vox Royalty Corp. regarding their royalty-linked gold projects are noteworthy from a market research perspective. The positive momentum in AUD gold prices is a vital external factor bolstering the economic viability of these projects. The market's response to early production announcements is typically favorable, as it promises nearer-term revenue generation and improved financial metrics.

The early commencement of production at Bulong and Plutonic East fits well within the current market trend of seeking low-risk, high-reward investment opportunities in precious metals. The proactive steps by Catalyst and Black Cat Syndicate in expediting these projects align with investor expectations for swift returns on capital deployed.

The decision by MinRes to cease operations at the Yilgarn Hub, while initially disappointing, is mitigated by the overall performance and return on Vox's investments in this asset. The market often views such rationalizations as positive in the long term, as they indicate prudent management and potential for reinvestment in more lucrative opportunities.

Investors should find solace in the accelerating production timelines and the strategic foresight demonstrated by Vox in acquiring rights to high-potential projects. This should contribute to a favorable market sentiment, potentially driving stock performance positively in the near term.

TORONTO, ON / ACCESSWIRE / July 2, 2024 / Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent developments including production and timing updates from royalty operating partners Black Cat Syndicate Ltd. ("Black Cat"), Catalyst Metals Ltd. ("Catalyst") and Mineral Resources Ltd. ("MinRes").

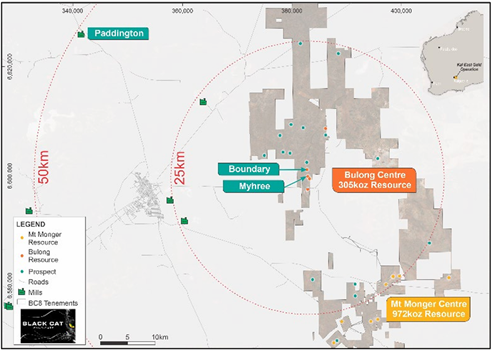

Riaan Esterhuizen, Executive Vice President - Australia, shared: "We're excited to share that both the Plutonic East and Bulong gold royalties are expected to both be in production by Q1 2025, accelerated by a continued buoyancy in AUD gold prices. Black Cat has broken ground at the Bulong gold project this week and flagged first production for September 2024, with the royalty-linked Myhree and Boundary deposits planned to be mined and treated at the nearby Paddington facility. At the Plutonic East gold mine, Catalyst Metals has released a self-funded development restart plan and commenced dewatering of the underground workings ahead of expected first ore production in Q1 2025. These key developments highlight Vox's focus in identifying and acquiring royalties over projects on the cusp of production in some of the best mining jurisdictions globally."

Key Updates

Black Cat announced that key site development activities have commenced at the Myhree Gold Project, following the recent announcement of turn-key contractor mining and third party tolling agreements, which is expected to result in royalty-linked ore being processed at the Paddington processing facility from September 2024 onwards;

Catalyst announced that dewatering activities at the Plutonic East underground gold mine workings were underway and progressing ahead of schedule, ahead of anticipated first production in Q1 2025; and

MinRes announced a decision to ramp down and cease operations at their Yilgarn Hub (including Koolyanobbing) by

December 31, 2024, following the conclusion of a comprehensive evaluation.

Bulong (Construction - Western Australia) - Commencement of Mining Development Activities at Myhree, First Production Expected in September 2024

Vox holds an uncapped

1.0% net smelter royalty over key areas of the Bulong Mining Centre, part of the Kal East Gold Project, including the Myhree and Boundary deposits. Vox purchased this royalty in 2020 for US$545,000. On May 9, 2024, Black Cat announced positive results from an updated study on Kal East:

The May 2024 study update includes two additional underground mines, and adjusts costs to reflect current market conditions, resulting in directionally positive economics and an average life of mine all-in sustaining cost of A

$1,724 /oz (1a) ;Black Cat's base-case consists of initial production from the Myhree and Boundary open pits within the Bulong Mining Centre, later transitioning to the Myhree Underground and Fingals Underground, for a total of 381koz @ 2.1g/t Au, including 79koz mined from underground sources (1a)

On May 20, 2024, Black Cat announced a funding, development and processing package for the fully approved Myhree and Boundary open pits:

Black Cat entered into an Ore Sale Agreement with the owner of the Paddington processing facility commencing in Q3 2024 (1b) ;

The company also executed a term sheet with a mining services firm to develop and haul ore from the Myhree and Boundary open pits, with mining expected to commence imminently and first ore expected to be hauled in September 2024 (1b) ;

On June 26, 2024, Black Cat provided a progress update on the Myhree/Boundary open pits, announcing that work has commenced at Myhree (1c) , including:

Clearing of the open pit and site infrastructure areas;

Haul road construction; and

Site set-up and onboarding of personnel.

Vox Management Summary: Based on Black Cat's guidance, we expect open pit mining and processing of high grade royalty ore from Myhree and Boundary deposits for approximately 18 months from September 2024 onwards, potentially crystallizing an initial 2x - 3x revenue return on invested capital. Subject to the success of the open pit mining and toll-treating at the Paddington mill, Vox management is optimistic that contractor mining could continue for the Myhree underground deposit, which would extend the anticipated mine life significantly, based on the current Myhree/Boundary underground resource as reported in the press release dated June 26, 2024, of

Indicated: 230kt at 4.6g/t Au; and

Inferred: 585kt at 3.8g/t Au.

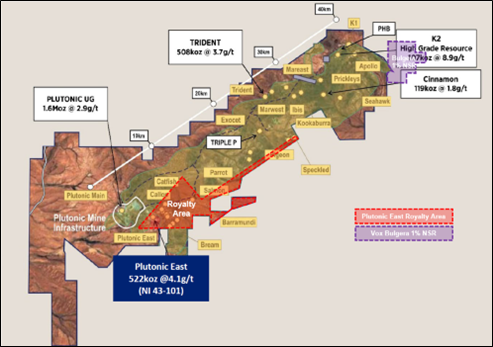

Plutonic East (Development - Western Australia) - Dewatering of underground commenced; first ore expected Q1 2025

Vox holds a sliding-scale grade-linked tonnage royalty over a portion of the Plutonic East Project in Western Australia, acquired in October 2023 for US

$800,000 in cash.On June 24, 2024, Catalyst announced that:

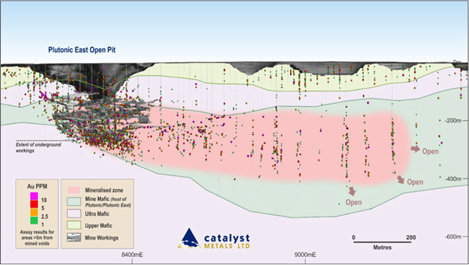

Dewatering activities at the Plutonic East Deposit were underway and progressing ahead of schedule;

Over the last 12 months since Catalyst consolidated the Plutonic belt, cut-off grades at Plutonic (main deposit) were lowered from 2.7g/t to 2.0g/t, strengthening the company's balance sheet and providing supportive operational performance data for Plutonic East (2) ;

Plutonic East's first stoping level is fully permitted and has a lower than anticipated capital requirement; and

The rehabilitation of the decline at Plutonic East will commence in Q3 2024 while dewatering of the lower levels continues, with first ore expected in Q1 2025 (2) .

Vox Management Summary: Vox acquired the Plutonic East gold royalty less than one year ago and the mine restart is progressing 6 - 12 months ahead of Vox management's expectations. Last mined by Barrick Gold in 2012 and located only 2km from an underutilized processing plant, this gold royalty is a great example of the royalty assets we target and acquire. We look forward to further newsflow from Catalyst as the underground workings are dewatered and rapidly advanced towards expected first production in Q1 2025.

Base Map: https://www.investi.com.au/api/announcements/cyl/edf90ee7-872.pdf

https://www.investi.com.au/api/announcements/cyl/edf90ee7-872.pdf

Koolyanobbing (Operating - Western Australia) - MinRes to gradually ramp down operations at the Yilgarn Hub

Vox holds a

2.0% FOB revenue royalty over the Altair open pit and a portion of the Deception open pit which make up key parts of the Koolyanobbing Iron Ore Mine in Western Australia.On June 19, 2024, MinRes announced that:

After a comprehensive assessment of the Yilgarn Hub assets, a decision had been reached to gradually ramp down the operations and cease ore shipments by the end of 2024 (3) , based on factors such as significant capital cost requirements and long lead times to develop new resources;

MinRes will continue to consider future options for the assets, and indicated that exploration drilling and environmental studies at various targets will continue into 2025 (3) ;

Commenting on the decision, MinRes' Managing Director, Chris Ellison, said: "This prudent but difficult decision was not taken lightly and follows years of investment to extend the life of our operations in the Yilgarn. By the end of this year, we will have operated Koolyanobbing for six and a half years, exported almost 45 million tonnes via the Port of Esperance and spent

$4.2 billion running our Yilgarn operation."

In Q1 2024 , MinRes drilled over 8,800m across their Yilgarn Hub assets, including 1,710m drilled across 15 holes at the royalty-linked Deception tenure (4) .

Vox Management Summary: Since our acquisition of the Koolyanobbing royalty in 2020, we have realized approximately US

$5M of royalty receipts, on a total cost base of US$2.6M . Management expects that Vox will have realized over200% on invested capital through the end of 2024, with average annual revenue of over US$1M . Notwithstanding the decision to ramp down production, this asset may be attractive as a potential re-start candidate for MinRes, or another operator, if the asset is divested, due to the likelihood of mineable resources at Koolyanobbing (based on Vox management estimates).

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning seven jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at www.voxroyalty.com .

For further information contact:

Riaan Esterhuizen | Kyle Floyd |

EVP - Australia | Chief Executive Officer |

riaan@voxroyalty.com | info@voxroyalty.com |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards"). In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code (as such term is defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws but is defined in NI 43-101 as an "acceptable foreign code". Readers are cautioned that a qualified person has not carried out independent work to validate any NI 43-101 or JORC Code resource and reserve estimates referenced herein. For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements. The forward-looking statements and information in this press release include, but are not limited to, summaries of operator disclosure provided by management and the potential impact on the Company of such operator disclosure, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the recovery rate from identified mineral resources and reserves, the receipt of expected and potential royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals. In addition, any statements relating to reserves and resources, as well as statements regarding management expectations, are forward-looking statements, as they involve implied assessment based on certain estimates and assumptions, and no assurance can be given that the estimates and assumptions are accurate and that such reserves and resources will be recoverable by the mining operators or realized as royalty or streaming revenue by Vox. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine and Israel, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2023 available at www.sedarplus.ca and the SEC's website at www.sec.gov (as part of Vox's Form 40-F). Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws. None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, acc ess to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

The information referenced in Black Cat Syndicated Ltd's press releases related to geology, exploration results, drill planning, Exploration Targets, and Resources was compiled by Mr. Iain Levy, who is a Member of the AIG and an employee, shareholder and option/rights holder of Black Cat. Referenced press releases available as follows:

Myhree Development Underway - dated 26 June 2024

https://www.investi.com.au/api/announcements/bc8/1b6d5ceb-8f7.pdfTurn-key Funding, Development & Processing - Myhree - dated 20 May 2024:

https://www.investi.com.au/api/announcements/bc8/1bc70f45-658.pdfKal East to Generate Strong Returns - Study Update - dated 9 May 2024:

https://www.investi.com.au/api/announcements/bc8/7a2a242b-622.pdf

The June 2024 Catalyst Metals Ltd - Plutonic East announcement press release references the Plutonic East Underground Mineral Resource and Sliding scale royalty terms, as further described in the Plutonic Gold Mine NI43-101 Technical Report titled "2022 Mineral Resource and Reserve Estimate for the Plutonic Gold Operations" released by Superior Gold Inc. on 5 July 2022 and dated 31 December 2021, as well as the Plutonic UG Mineral Resource Estimate Update released in December 2023, available here:

June 2024 Press Release: https://www.investi.com.au/api/announcements/cyl/edf90ee7-872.pdf

July 2022 Technical Report: https://minedocs.com/23/Plutonic_TR_12312021.pdf

December 2023 Plutonic UG MRE: https://www.investi.com.au/api/announcements/cyl/09744c2d-713.pdf

Mineral Resources Ltd Yilgarn Hub Update in press release dated June 19, 2024 available here: https://clients3.weblink.com.au/pdf/MIN/02819080.pdf

Mineral Resources Exploration and Mining Activity Report press release dated April 24, 2024 available here: https://clients3.weblink.com.au/pdf/MIN/02798599.pdf

SOURCE: Vox Royalty Corp.

View the original press release on accesswire.com

FAQ

When is the first gold production expected for the Bulong project?

What are the Plutonic East production timelines?

How much did Vox pay for the Plutonic East royalty?

When will Mineral Resources cease operations at Koolyanobbing?