Viva Gold Increases Gold Resource and Extends Mineralization at Its Tonopah Gold Project in Nevada

Viva Gold Corp. has announced an updated NI43-101 compliant mineral resource estimate for its Tonopah gold project in Nevada. The estimate shows a 21% increase in measured and indicated gold resources, totaling 394,000 ounces, with an additional 206,000 ounces inferred, marking a 14% rise. The drilling campaign in 2020 and 2021 added 68,000 ounces of measured and indicated resources at a cost of US$12.25/ounce. The mineralization is open in two directions, and future drilling will focus on expanding the resource further.

- Measured and indicated gold resource increased by 21% to 394,000 ounces.

- Inferred resource increased by 14% to 206,000 ounces.

- Cost to add new resources was low at US$12.25/ounce.

- None.

VANCOUVER, BC / ACCESSWIRE / January 25, 2022 / Viva Gold Corp. (TSXV:VAU)(OTCQB:VAUCF) (the "Company" or "Viva") is pleased to provide an updated NI43-101 compliant mineral resource estimate for the Tonopah gold project ("Tonopah"), located near Tonopah, Nevada, on the prolific Walker Lane gold trend. The new resource estimate is based on the addition of 19 new drillholes completed in 2020 and 2021, updated geologic modelling and statistical analysis.

"We are very pleased with these results. Total pit constrained measured and indicated gold resource increased

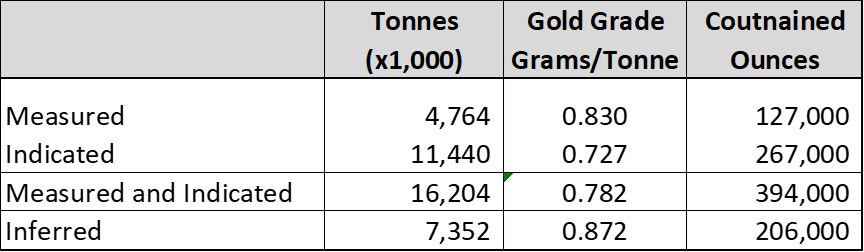

The updated pit-constrained mineral resource estimate for the Tonopah Project follows:

Donald E. Hulse, P.E., SME-RM, Senior Mining Consultant for WSP USA of Lakewood, Colorado, is the independent Qualified Person responsible for the preparation of the resource estimate. Resources are not reserves, and do not include modifying factors which need to be considered to determine whether they are economically viable.

Mineral resources are tabulated at a cutoff grade of 0.15 g/t gold for argillite and 0.20 g/t for volcanic hosted mineralization, which constitutes a reasonable prospect for eventual economic extraction based on a comparison with similar gold deposits in Nevada, and constrained within a US

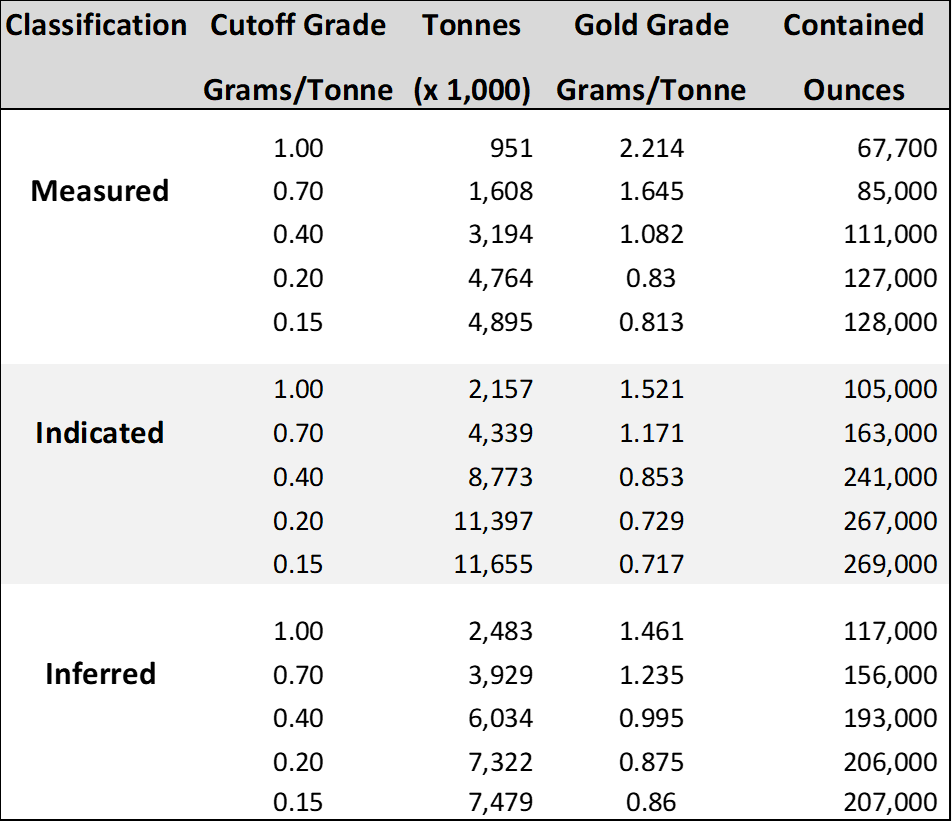

Following is a sensitivity table showing the impact of changing cutoff grade on resource by category:

With additional drilling in 2020, it became apparent that the mineral continuity at Tonopah is controlled by multiple factors, which are different in the TVL than in the underlaying OP. The OP exhibits local north-north-west continuity, along a regional east-south-east trend, while mineralization in the lower volcanics exhibit the dominant east-south-east trend with limited expression on the north-north-west trend. Previously, all mineralization had been modelled along the north-north-west trend. Based on drill results, it can also be observed that the primary mineralized trend follows the OP/TVL contact in a zone ranging between 30- and 60-meters width. A zone of +/- 10 meters around the OP/TVL contact was treated as a separate domain in the model. These modifications to the mineral trends and the addition of lithologic domains developed clean variography and resulted in a well-supported resource model.

Step-out holes were drilled in 2021 to test these observations and were highly successful in intercepting high-grade mineralization. These holes contributed to an increase in inferred mineralization and helped to extend the pit shell to the east-south-east along the principal (110 azimuth) trend of the deposit. The pit also extended to the west along trend based on new drill intercepts from the 2020 drill program. The new model also developed a small pit in the Midway Hills area of the project, located approximately 1.0 kilometers west from the main pit on trend, indicating that the revised geologic model is doing a better job of correlating and connecting existing assay intercepts in that area. In addition, the new model also indicates the possibility of two additional parallel trends to the south of this main zone. The previously modelled south zone currently develops three small interconnected pit bottoms along the east-south-east trend and the third most southerly zone is potentially identified by three drillholes.

We anticipate that the 12 June 2020 NI43-101 Technical Report Preliminary Economic Assessment for the Tonopah Project will be incorporated by reference in a new NI43-101 detailing this updated resource estimate.

James Hesketh, MMSA-QP, has approved the scientific and technical disclosure contained in this press release. Mr. Hesketh is not independent of the Company; he is an Officer and Director.

About Viva Gold Corp:

Viva Gold Corp holds

Viva is committed to Environmental, Social and Responsible Governance ("ESG") of its business. We realize these issues are also important to investors. We strive to operate in a manner that supports environmental and social initiatives and responsible corporate governance. Viva made significant progress in 2021 in working with its regulators to advance the environmental and social baseline study efforts required to support future Mining Plan of Operations review under the National Environmental Policy Act for the Project, and other Nevada State environmental permitting requirements. These efforts demonstrate our focus and commitment to de-risk and add value as detailed in our December 7, 2021 press release.

Viva Gold trades on the TSX Venture exchange "VAU", on the OTCQB "VAUCF" and on the Frankfurt exchange "7PB". Viva has a tight capital structure with 55.6 million shares outstanding and a strong management team and board with both gold exploration and production experience. Viva is building market awareness as the Company advances the high-grade Tonopah Gold Project. For additional information on Viva Gold and the Tonopah Gold Project, please visit our website: www.vivagoldcorp.com.

For further information please contact:

James Hesketh, President & CEO

(720) 291-1775

jhesketh@vivagoldcorp.com

Valerie Kimball, Director Investor Relations

(720) 933-1150

vkimball@vivagoldcorp.com

Renmark Financial Communications Inc.

Daniel Gordon: dgordon@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Forward-Looking Information:

This news release contains certain information that may constitute forward-looking information or forward-looking statements under applicable Canadian securities legislation (collectively, "forward-looking information"), including but not limited to drilling operations and estimates of gold mineral resource at the Tonopah Gold Project. This forward-looking information entails various risks and uncertainties that are based on current expectations, and actual results may differ materially from those contained in such information. These uncertainties and risks include, but are not limited to, the strength of the global economy, inflationary pressures, pandemics, and permitting issues related to ESG initiatives; the price of gold; operational, funding and liquidity risks; the potential for achieving targeted drill results, the degree to which mineral resource estimates are reflective of actual mineral resources; the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with drilling and mining operations; and the ability of Viva to fund its capital requirements. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada available at www.sedar.com. Readers are urged to read these materials. Viva assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by law.

Cautionary Note to U.S. Investors --- The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this report, such as "measured," "indicated," "inferred," and "resources," that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Viva Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/685283/Viva-Gold-Increases-Gold-Resource-and-Extends-Mineralization-at-Its-Tonopah-Gold-Project-in-Nevada

FAQ

What is the significance of the updated mineral resource estimate for VAUCF?

When was the new mineral resource estimate for the Tonopah project announced?

How much did the inferred resources increase at the Tonopah project?