Viva Gold Intersects 58 Meters at 5.0 g/t Gold, Including 11 Meters at 24.0 g/t Gold at Its Tonopah Gold Project, Nevada

Viva Gold Corp. (TSXV:VAU; OTCQB:VAUCF) announced initial assay results from its Reverse Circulation drill program at the Tonopah Gold Project in Nevada. The first six drillholes showed promising results, notably drillhole TG2211 with 58.0 meters of 5.0 g/t gold, including an 11-meter segment at 24.0 g/t gold. The results suggest potential upgrades of resources from inferred to indicated statuses, with plans to extend mineralization along the resource pit. The company is optimistic about its continued drilling success and its positive impact on project economics.

- Drillhole TG2211 intercepted 58.0 meters at 5.0 g/t gold, including 11.0 meters at 24.0 g/t gold.

- Results from TG2209 may convert large blocks of low-grade inferred resource to indicated status.

- Successful extension of mineralization across the PEA pit area may improve project economics.

- Drillhole TG2208 encountered only anomalous gold grades, requiring further work to assess impact.

- Drillhole TG2207 showed low-grade mineralization, which may not significantly enhance resource estimates.

- Some areas suggest potential limits to mineralization, indicating a need for further exploration.

Insights

Analyzing...

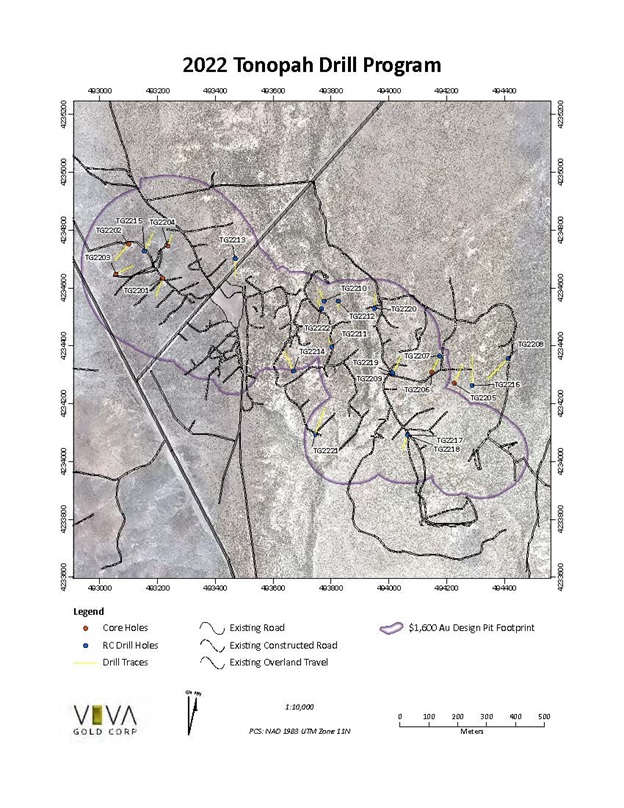

VANCOUVER, BC / ACCESSWIRE / November 28, 2022 / Viva Gold Corp. (TSXV:VAU); (OTCQB:VAUCF) (the "Company" or "Viva") is pleased to provide initial assay results from a Reverse Circulation ("RC") drill program at its Tonopah gold project ("Tonopah") located on the prolific Walker Lane mineral trend in western Nevada. A total of 16 drillholes have been completed in the program and submitted for assay. This release details results from the first six holes.

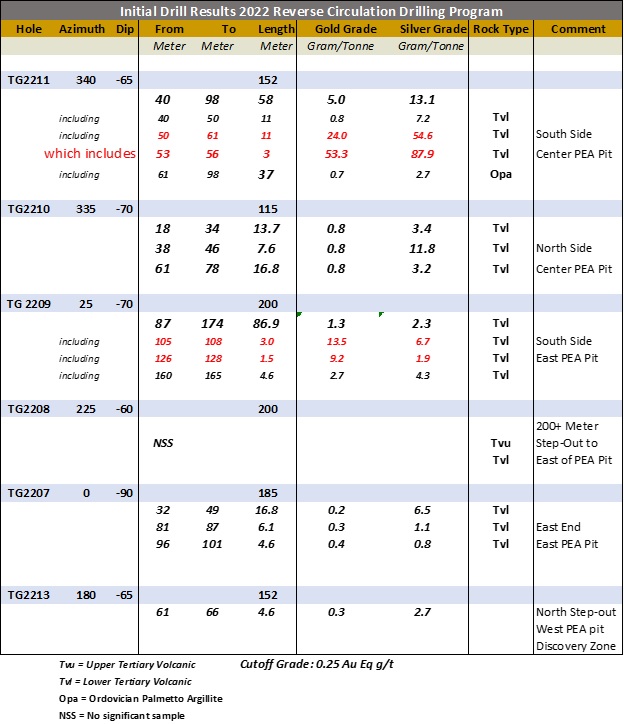

- Drillhole TG2211 intercepted 58.0 meters ("m") grading 5.0 grams per tonne gold ("g/t Au") starting at a depth of 40 meters. Included in this wide high-grade intercept was an 11-m zone at 24.0 g/t Au from 50m depth, that also included a 3.0 m interval at 53.6 g/t Au and 87.9 g/t silver ("Ag"). TG2211 intercepted exceptional grades in a sparsely drilled zone previously carried as low grade inferred mineralization in the resource model. The hole targeted the southern extension of a north-south structural feature in the central area of the PEA1 resource pit. The hole extended mineralization to the south and is likely to add tonnes, increase grade, and convert a number of resource blocks from inferred to indicated category.

- TG2209 intercepted a zone of 86.9m at 1.3 g/t Au starting at 87m depth, including 3.0m at 13.5 g/t Au, and 1.5m at 9.2 g/t Au. This hole targeted the southern extent of a north-south splay structure on the eastern end of the PEA pit. Results from this hole are projected to convert a large block of weakly drilled low-grade inferred resource to indicated status, increase grade, and extend mineralization to the south, while also added both shallow and deep intercepts, below prior drilling. Hole TG2219 was drilled to the south of TG2209 to further extend mineralization on this structural zone to the south. Assays are pending on TG2219.

- TG 2010 intercepted three separate zones cumulatively totaling 38m averaging 0.8 g/t Au starting at 18m depth. Total north-south width of mineralization between holes TG2010 and TG211, drilled at the north and south ends of the same structure, has been increased through the center of the PEA pit to approximately 200-meters. A third hole, TG2222, was drilled in this section to further confirm the resource in this area. Assays are pending on TG2222.

"These initial drill results are exceeding the stated goals of this program. Our program was designed to infill and extend mineralization to the north and south along the strike of the resource pit, and to convert inferred resources in the pit to measured and indicated. Actual results have thus far exceeded these goals by increasing grade with long, unexpected zones of high-grade gold intercepts. Even within the pit shell limits we are still being surprised to the upside with new areas of high-grade mineralization. Results from holes drilled along strike on the north and south margins of the PEA design pit also confirm that the deposit remains open in those dimensions. We believe that continued success in increasing the width of the mineral zone will help to reduce project strip ratio and increase gold resources while also improving project economics. We anxiously await the results from the remainder of our program," states James Hesketh, President & CEO.

- TG 2208 was drilled as a major step-out approximately 200 meters east of the PEA pit to test the potential eastern extent of the main mineral trend in this area. Results indicate that the hole crossed on the eastern side of a fault where only anomalous gold grades were encountered. Additional work will be required to determine if this fault is offsetting or terminating mineralization in that direction.

- TG2207 targeted an area of potential inferred mineralization on the eastern limit of the resource model and encountered a wide zone of low-grade mineralization. This hole is likely to upgrade sparsely drilled inferred mineralization to the east of the PEA pit.

- TG2213 targeted a potential northern extension to the Discovery zone structural splay in the central PEA pit area. Results indicate what may be a northern limit to mineralization on that structure.

James Hesketh, MMSA-QP, has approved the scientific and technical disclosure contained in this press release. Mr. Hesketh is not independent of the Company; he is an Officer and Director.

- PEA: NI43-101 Technical Report, Preliminary Economic Assessment of the Tonopah Project (amended April 12, 2022) authored by Gustavson Associates including Donald E. Hulse, P.E., SME-RM; Christopher Emanuel, SME-RM; Deepak Malhotra, Ph.D., SME-RM; and Edward Bryant, AIPG, CPG.

About Viva Gold Corp:

Viva Gold Corp's (TSXV:VAU); (OTCQB:VAUCF); (Frankfurt:7PB) principal asset is its

Viva has a solid capital structure with 91.6 million shares outstanding and a strong management team and board who can claim both gold exploration and production experience. For additional information on Viva Gold and the Tonopah Gold Project, please visit our website: www.vivagoldcorp.com.

For further information please contact:

James Hesketh, President & CEO

(720) 291-1775

jhesketh@vivagoldcorp.com

Anne Hite, Director Investor Relations

(303) 519-5149

ahite@vivagoldcorp.com

Forward-Looking Information:

This news release contains certain information that may constitute forward-looking information or forward-looking statements under applicable Canadian securities legislation (collectively, "forward-looking information"), including but not limited to drilling operations and estimates of gold mineral resource at the Tonopah Gold Project. This forward-looking information entails various risks and uncertainties that are based on current expectations, and actual results may differ materially from those contained in such information. These uncertainties and risks include, but are not limited to, the strength of the global economy, inflationary pressures, pandemics, and issues and delays related to permitting activities; the price of gold; operational, funding and liquidity risks; the potential for achieving targeted drill results, the degree to which mineral resource estimates are reflective of actual mineral resources; the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with drilling and mining operations; and the ability of Viva to fund its capital requirements. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada available at www.sedar.com. Readers are urged to read these materials. Viva assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by law.

Cautionary Note to Investors --- Investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports in this news release are or will be economically or legally mineable. United States investors are cautioned that while the SEC now recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Under Canadian regulations, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in limited circumstances. Further, "inferred mineral resources" have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that any part or all of an inferred mineral resource will ever be upgraded to a higher category. The mineral reserve and mineral resource data set out in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Viva Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/728694/Viva-Gold-Intersects-58-Meters-at-50-gt-Gold-Including-11-Meters-at-240-gt-Gold-at-Its-Tonopah-Gold-Project-Nevada