Viva Gold Files NI 43-101 Technical Report, Increasing Gold Resource at the Tonopah Gold Project in Nevada

Viva Gold Corp. (TSXV:VAU)(OTCQB:VAUCF) has filed an NI43-101 Technical Report on the Tonopah Gold Project, dated February 25, 2022. The report reveals a 21% increase in measured and indicated mineral resources, demonstrating efficient resource addition with reduced costs. The project, located in Nevada's Walker Lane gold trend, has an estimated resource of 394,000 ounces at a grade of 0.78 g/t. A future work plan includes a $2.4 million budget for drilling and feasibility studies to enhance project viability.

- 21% increase in measured and indicated resources.

- Total mineral resource of 394,000 ounces at 0.78 g/t gold.

- Cost-effective resource addition strategy.

- Ongoing focus on drilling to expand resources.

- $2.4 million work plan includes critical feasibility studies.

- None.

VANCOUVER, BC / ACCESSWIRE / February 28, 2022 / Viva Gold Corp. (TSXV:VAU)(OTCQB:VAUCF) (the "Company" or "Viva") is pleased to announce it has filed a report titled "NI43-101 Technical Report on Mineral Resources, Tonopah Project" with an effective date of January 1, 2022 and a report date of February 25, 2022 on SEDAR for Tonopah gold project ("Tonopah"). The report was completed by Gustavson Associates, a subsidiary of WSP, of Lakewood Colorado. The results of the Technical Report, previously announced on January 25, 2022, increased the measured indicated resource by

"This report documents yet another significant increase in mineral resources in all categories at Tonopah, which demonstrates our ability to add ounces of new gold resource at Tonopah at a very low cost. More importantly, our growing understanding of geology and structure at Tonopah is helping us to clearly identify and target open extensions for resource addition. Our near-term focus will be to drill test open extensions to the deposit to further increase gold resource, while also continuing to de-risk the project through technical and environmental baseline studies," states James Hesketh, President & CEO.

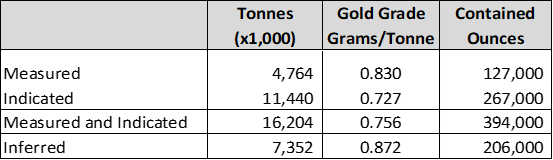

The updated pit-constrained mineral resource estimate announced on January 25, 2022 for the Tonopah Project follows:

Donald E. Hulse, P.E., SME-RM, Senior Mining Consultant for WSP USA of Lakewood, Colorado, is the independent Qualified Person responsible for the preparation of the resource estimate. Resources are not reserves, and do not include modifying factors which need to be considered to determine whether they are economically viable.

Mineral resources are tabulated at a cutoff grade of 0.15 g/t gold for argillite and 0.20 g/t for volcanic hosted mineralization, which constitutes a reasonable prospect for eventual economic extraction based on a comparison with similar gold deposits in Nevada, and constrained within a US

Gustavson recommended work plan, including completion of ongoing drilling, metallurgical, environmental baseline study and Pre-Feasibility Study will cost an estimated US

- A proposed drilling program is recommended to be performed in two programs each of approximately 2,500 meters of reverse circulation drilling. The focus of the exploration will be the eastern and western extension of the Main zone, the southern extent of the Dauntless zone and the western extent of the South Pit trend.

- Metallurgical test work should be completed with the objective of providing information for cost and recovery assumptions to be incorporated into future studies, as well as to refine process design criteria.

- A part of the specific work plan includes long-lead baseline work for environmental monitoring, and biological studies, in support of the development efforts.

- Complete a Pre-Feasibly Study (PFS) with the intention to clarity the economic potential of the project and to potentially declare Mineral Reserves, while also developing a plan of operations for use in permitting efforts.

Recommended Project Budget

Category | Estimated Cost | Notes |

| Exploration | ||

| RC Drilling - Phase 1 | 12 - 14 holes, 2,500 meters drilling, work plan submitted, drilling contract in place | |

| RC Drilling - Phase 2 | 2,500 meters drilling | |

| Metallurgical | ||

| Environmental | ||

| Engineering/Studies | Pre-feasibility study & Plan of Operations | |

| Total |

The technical report incorporates by reference the 12 June 2020 NI43-101 Technical Report Preliminary Economic Assessment for the Tonopah Project. Please note that a Preliminary Economic Assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic consideration applied to them that would enable them to be categorized as mineral reserves, and that there is no certainty that the preliminary economic assessment will be realized.

James Hesketh, MMSA-QP, has approved the scientific and technical disclosure contained in this press release. Mr. Hesketh is not independent of the Company; he is an Officer and Director.

About Viva Gold Corp:

Viva Gold Corp holds

Viva is committed to Environmental, Social and Responsible Governance ("ESG") of its business and strives to operate in a manner that supports environmental and social initiatives and responsible corporate governance. Viva made significant progress in 2021 in working with its regulators to advance the environmental and social baseline study efforts required to support future Mining Plan of Operations review under the National Environmental Policy Act for the Project, and other Nevada State environmental permitting requirements. These efforts demonstrate our focus and commitment to de-risk and add value to the Tonopah project as detailed in our December 7, 2021 press release.

Viva Gold trades on the TSX Venture exchange "VAU", on the OTCQB "VAUCF" and on the Frankfurt exchange "7PB". Viva has a tight capital structure with 55.6 million shares outstanding and a strong management team and board with both gold exploration and production experience. Viva is building market awareness as the Company advances the high-grade Tonopah Gold Project. For additional information on Viva Gold and the Tonopah Gold Project, please visit our website: www.vivagoldcorp.com.

For further information please contact:

James Hesketh, President & CEO

(720) 291-1775

jhesketh@vivagoldcorp.com

Valerie Kimball, Director Investor Relations

(720) 933-1150

vkimball@vivagoldcorp.com

Renmark Financial Communications Inc.

Daniel Gordon: dgordon@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Forward-Looking Information:

This news release contains certain information that may constitute forward-looking information or forward-looking statements under applicable Canadian securities legislation (collectively, "forward-looking information"), including but not limited to drilling operations and estimates of gold mineral resource at the Tonopah Gold Project. This forward-looking information entails various risks and uncertainties that are based on current expectations, and actual results may differ materially from those contained in such information. These uncertainties and risks include, but are not limited to, the strength of the global economy, inflationary pressures, pandemics, and issues and delays related to permitting activities; the price of gold; operational, funding and liquidity risks; the potential for achieving targeted drill results, the degree to which mineral resource estimates are reflective of actual mineral resources; the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with drilling and mining operations; and the ability of Viva to fund its capital requirements. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada available at www.sedar.com. Readers are urged to read these materials. Viva assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by law.

Cautionary Note to Investors --- Investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports in this news release are or will be economically or legally mineable. United States investors are cautioned that while the SEC now recognizes "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", investors should not assume that any part or all of the mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Under Canadian regulations, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in limited circumstances. Further, "inferred mineral resources" have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that any part or all of an inferred mineral resource will ever be upgraded to a higher category. The mineral reserve and mineral resource data set out in this news release are estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Viva Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/690544/Viva-Gold-Files-NI-43-101-Technical-Report-Increasing-Gold-Resource-at-the-Tonopah-Gold-Project-in-Nevada

FAQ

What does the NI43-101 Technical Report for the Tonopah Gold Project indicate?

What is the estimated budget for the work plan at Tonopah?

How does the increase in mineral resources affect Viva Gold Corp's stock (VAUCF)?

When was the NI43-101 Technical Report filed by Viva Gold Corp?