AMERICAN SALARS ANNOUNCES OTC TICKER SYMBOL CHANGED TO “USLIF” AND DTC ELIGIBILITY

Rhea-AI Summary

American Salars Lithium Inc. (CSE: USLI, OTC: USLIF, FWB: Z3P) announces its common shares will trade under the symbol USLIF on OTC Markets starting August 7, 2024. The company has also received DTC eligibility, enhancing liquidity and expanding its potential shareholder base. American Salars' portfolio includes:

1. Pocitos 1 Lithium Project (Argentina): 760,000 tonnes LCE inferred resource (including neighboring Pocitos 2).

2. Candela II Lithium Project (Argentina): 457,500 tonnes in-situ LCE resource.

3. Black Rock South Lithium Project (Nevada): Recent sampling returned an average of 131 PPM lithium.

CEO R. Nick Horsley expressed optimism about lithium market recovery and ongoing M&A activities for strategic opportunities.

Positive

- Received DTC eligibility, potentially increasing liquidity and shareholder base

- Pocitos 1 project has an inferred resource of 760,000 tonnes LCE

- Candela II project has an in-situ resource of 457,500 tonnes LCE

- Black Rock South project sampling returned an average of 131 PPM lithium

- Active engagement in M&A for strategic opportunities

Negative

- None.

News Market Reaction – USLIF

On the day this news was published, USLIF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC, Aug. 07, 2024 (GLOBE NEWSWIRE) -- AMERICAN SALARS LITHIUM INC. ("AMERICAN SALARS" OR THE "COMPANY") (CSE: USLI, OTC: USLIF, FWB: Z3P, WKN: A3E2NY) announces that its common shares will commence trading under the symbol “USLIF” effective today August 7th, 2024, on the OTC Markets, a US trading platform that is operated by the OTC Markets Group in New York. The Company's common shares will continue to trade on its primary market, the Canadian Stock Exchange ("CSE") under the symbol "USLI" as well as on the Frankfurt Stock Exchange (“Frankfurt”) under the symbol “Z3P”.

In addition, the Company is pleased to announce that it has received DTC eligibility by The Depository Trust Company ("DTC"), a subsidiary of the Depository Trust & Clearing Corporation ("DTCC"). Securities that are eligible to be electronically cleared and settled through the DTC are considered "DTC eligible." This electronic method of clearing securities speeds up the receipt of stock and cash, and thus accelerates the settlement process for investors and brokers reducing transactional costs for participating brokerage firms, enabling the stock to be traded over a much wider selection of brokerage firms by coming into compliance with their requirements. DTC provides depository and book entry services, along with a settlement system for equities in the United States and across the globe. The organization is a member of the U.S. Federal Reserve System and a registered clearing agency with the U.S. Securities and Exchange Commission. In addition, major U.S. stock exchanges, including Nasdaq and NYSE, require DTC eligibility to be listed on the respective exchanges.

American Salars CEO & Director R. Nick Horsley states, “The new OTC Markets listing, combined with our DTC eligibility will provide added liquidity and a larger base of potential shareholders for American Salars. We are actively engaged in M&A for strategic opportunities and holds a strong belief in the recovery of the lithium commodity price. The current Lithium Carbonate price is attractive for brine projects and a real challenge for our hard rock competitors.”

The Company’s global lithium portfolio consists of two advanced lithium resources in Argentina and our advancing USA lithium asset in Nevada.

About Pocitos 1 Lithium Deposit – Salta, Argentina

WSP Australia completed an update of the NI 43-101 report initially written by Phillip Thomas QP in June 2023 and estimated on an inferred basis using a block model with

Figure 1. Drilling at Pocitos 1 Lithium Brine Project (Salta, Argentina)

The Pocitos 1 project is located approximately 10 kilometers from the township of Pocitos where there is gas, electricity, and accommodation. Pocitos 1 is approximately 800 hectares (1,977 acres) and is accessible by road. Collective exploration since 2017 totals over US

Lithium values of 169 ppm from drill hole PCT22-03 packer test assayed from laboratory analysis conducted by Alex Stewart were recorded during the project’s December 2022 drill campaigns. A packer sampling system was used in HQ Diamond drill holes that were drilled to a depth of up to 409 metres. The flow of brine was observed to continue for more than five hours with all holes exhibiting exceptional brine flow rates. An NI 43-101 updated report completed by WSP Australia has been released on the Pocitos 1 project.

Ekosolve Ltd. a DLE technology company was able to produce

About Candela II Lithium Deposit – Salta, Argentina

The Candela II Lithium deposit is on the southern and lowest end of the Incahuasi Salar, located in the Province of Salta, Argentina. Candela II is situated approximately 45 kilometers from town of Tolar Grande, 267 kilometers from Salta, and close in proximity to advanced and renowned lithium salars such as Arizaro (Lithium Chile) and Pocitos (Hanaq). Volcanoes Cerro Aracar, Medina and Pular contribute lithium to the Incahuasi salar through aquifers.

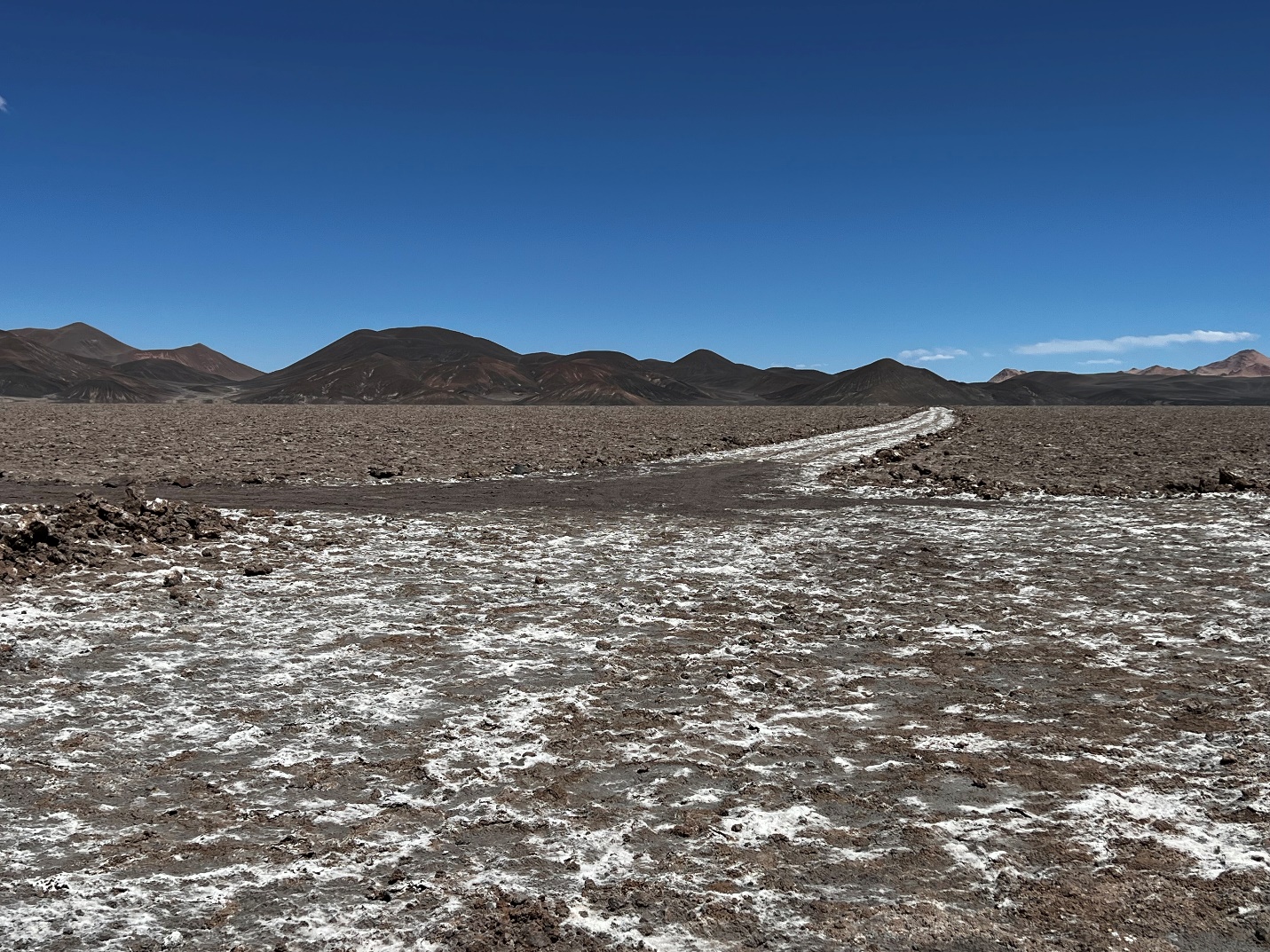

Figure 2. Road on Candela II Lithium Brine Project (Salta, Argentina)

The Candela II Lithium Brine Project contains a National Instrument 43-101 mineral resource estimate (“MRE”) completed by WSP Australia Pty. Ltd. (see Spey Resources Corp. news dated September 26th, 2023). This NI 43-101 resource report estimates the project to contain lithium metal of 86,000 tonnes which equates to 457,500 tonnes of in-situ lithium carbonate equivalent (LCE) and a lithium yield of 48,000 tonnes of LCE from 9,000 tonnes of lithium metal. The calculations assume no losses from lithium metal and a porosity average that will be updated in the next drilling phase.

About Black Rock South Lithium Brine Project - Nevada

The Black Rock South Lithium Brine Project is located 72 Miles North of the Tesla Gigafactory, 93 Miles Southwest of Thacker Pass, and 215 miles Northwest of the United States’ only producing lithium mine, the Silver Peak lithium brine mine owned by Albemarle Corporation. The claims cover a conceptual target for lithium brines which is very similar to the published geology1 of the Clayton Valley lithium brine production area approximately 200 miles to the Southeast. The concept is consistent with generally accepted data and theories about the formation of lithium brine resources. The target area is lithium – brines hosted in basin-fill sediments. Recent 2024 Phase 1 sampling program returned an average grade of 131 PPM with a high of 180.5 PPM lithium.

Figure 3. Black Rock South Lithium Brine Project proximity to Tesla Gigafactory and Albermarle Silver Peak.

Figure 4. Black Rock South Lithium Brine Project during 2024 ground exploration

Qualified Person

Phillip Thomas, BSc Geol, MBusM, FAusIMM, MAIG, MAIMVA, (CMV), a Qualified Person as defined under NI 43-101 regulations, has reviewed the technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr Thomas is a shareholder of American Salars lithium shares.

About American Salars Lithium Inc.

American Salars Lithium is an exploration company focused on exploring and developing high-value battery metals projects to meet the demands of the advancing electric vehicle market. The company's Pocitos 1 and the Candela II lithium salar projects in Argentina both feature a NI 43-101 inferred resource.

All Stakeholders are encouraged to follow the Company on its social media profiles on LinkedIn, Twitter, TikTok, Facebook and Instagram.

On Behalf of the Board of Directors,

“R. Nick Horsley”

R. Nick Horsley, CEO

For further information, please contact:

American Salars Lithium Inc.

Phone: 604.880.2189

E-Mail: info@americansalars.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding American Salar’s intention to continue to identify potential transactions and make certain corporate changes and applications. Forward looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits American Salars will obtain from them. These forward-looking statements reflect managements’ current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including American Salars results of exploration or review of properties that American Salars does acquire. These forward-looking statements are made as of the date of this news release and American Salars assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements, except in accordance with applicable securities laws.

1 Davis J.R. ,Friedman I, Gleason J.D. 1986, Origin Of The Lithium-Rich Brine, Clayton Valley, Nevada;US Geological Survey Bulletin 1622 Chaper L, p132-138