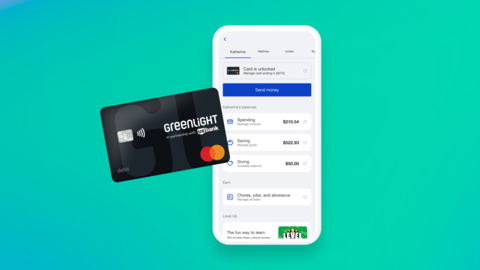

U.S. Bank, Greenlight Partner to Bring Financial Empowerment to Families

Collaboration provides complimentary access to Greenlight debit card and financial literacy tools in the

Eligible

Already trusted by more than 6 million parents and kids, Greenlight provides kids and teens with invaluable money management experience while parents enjoy time-saving convenience and peace of mind. With Greenlight, younger

“U.S. Bank has a long-standing commitment to powering the potential of our clients and communities through financial education. For families, there is no better way for kids and teens to build confidence and money skills than with hands-on experience,” said Tim Welsh, vice chairman of consumer and business banking at

Greenlight brings

“At Greenlight, we’re always looking for new ways to help more young people develop healthy financial habits for a better future,” said Tim Sheehan, CEO and co-founder at Greenlight. “Partnering with

Starting today,

This is the latest client offering related to Bank Smartly, launched in 2022 to simplify the checking account and rewards experience. Bank Smartly comes with benefits and features that empower clients to manage their money easily and get back to priorities. Clients that open a Bank Smartly Checking account can also enroll in the Smart Rewards program and unlock more benefits based on their total qualifying balances throughout the bank.

About U.S. Bancorp

U.S. Bancorp, with more than 70,000 employees and

About Greenlight

Greenlight Financial Technology is the family fintech company on a mission to help parents raise financially-smart kids. Its product, Greenlight, is an award-winning banking app, complete with a debit card for kids and teens and safety features for the whole family. Parents can automate allowance, manage chores, set flexible spending controls, and invest for their family’s future. Kids and teens learn to earn, save, spend wisely, give, and invest. Together, families can also stay safe and connected with location sharing, SOS alerts, crash detection with 911 dispatch, driving scores, reports and real-time trip alerts.

Greenlight partners with more than 50 leading banks, credit unions, and employers to bring its family finance solution to more families through the Greenlight for Banks, Greenlight for Credit Unions, and Greenlight for Work programs.

The Greenlight Debit Card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Greenlight Investment Advisors, LLC, an SEC Registered Investment Advisor, provides investment advisory services to its clients. Investing involves risk and may include the loss of principal. Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Greenlight's bank partners. For more information, please visit: greenlight.com.

Disclosures: Deposit products are offered by

View source version on businesswire.com: https://www.businesswire.com/news/home/20240606291259/en/

Tessa Bajema, Communications Manager, Tessa.bajema@usbank.com

Greenlight:

Jessica Tenny, Director of Communications, comms@greenlight.com

Source: U.S. Bancorp