Stonehenge and UGI Acquire Pine Run Midstream Natural Gas Gathering System

Pine Run Gathering LLC (“Pine Run Gathering”) announced today that it has completed a transaction to acquire Pine Run Midstream, LLC (“Pine Run Midstream”) from an affiliate of PennEnergy Resources, LLC (“PennEnergy”) and minority partners for

PennEnergy, a Pittsburgh-based independent oil and gas company, is a leading Appalachian based producer and anchor customer on the Pine Run system. Stonehenge III is the third partnership between Energy Spectrum Capital and Stonehenge Energy Resources (“Stonehenge”) management. The transaction will be financed with equity capital from both Stonehenge III (

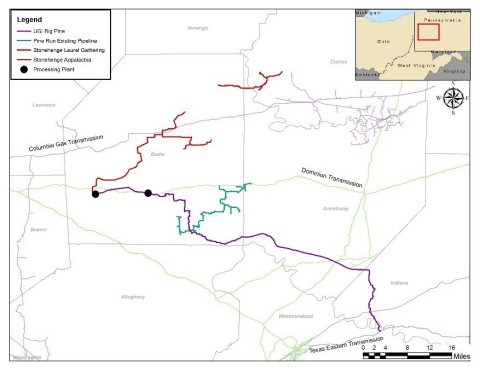

Pine Run Midstream operates 43-miles of dry gas gathering pipeline and compression assets located in Butler and Armstrong counties in western Pennsylvania. The Pine Run Midstream system has been in operation since 2014 and will be operated by Stonehenge. Stonehenge and UGI expect the investment to be immediately accretive to earnings.

Pine Run Gathering is Stonehenge’s fourth venture in the Appalachian basin. “Stonehenge is pleased to add the Pine Run Midstream system to our operations in western Pennsylvania and views the strategic partnership with UGIES as a beneficial step to providing area producers with cost-effective, customer-focused services,” said Patrick Redalen, CEO of Stonehenge. “The Pine Run Midstream system is a high-quality asset that has been well managed and operated by the PennEnergy team. We are very pleased to have the chance to expand our relationship with Rich, Greg and the entire team at PennEnergy.”

This is the second recent investment in Appalachian basin natural gas gathering systems by UGIES as it continues to invest in assets well positioned in highly productive areas of the Marcellus Shale. UGIES will add its ownership stake in Pine Run Gathering to UGI Appalachia, LLC, which operates gathering assets in Pennsylvania, Ohio and West Virginia. “We are very pleased to announce this investment, which complements our existing portfolio of midstream assets,” said Robert F. Beard, Executive Vice President – Natural Gas, UGI. “Adding our stake in Pine Run Gathering to UGI Appalachia enhances and expands our footprint in western Pennsylvania and is consistent with the strategy outlined when we announced our acquisition of Columbia Midstream Group in 2019. Pine Run Midstream has direct connectivity to UGI’s Big Pine Pipeline, which is one of the assets acquired as part of the Columbia Midstream deal, and is well positioned to capture additional production nearby. Importantly, expansion of our natural gas portfolio enables us to provide low-cost, environmentally responsible energy to more consumers.”

Joseph L. Hartz, President of UGIES, stated, “Pine Run Gathering is a great addition to our portfolio. It is well run and has a strong operations team in place that fits nicely with our midstream business.” Hartz added, “This asset will accelerate the growth of our existing western Pennsylvania natural gas gathering business and is a great strategic fit for UGIES.”

In connection with the transaction, Baker Botts L.L.P. served as legal counsel for Pine Run Gathering and Winston & Strawn LLP served as legal counsel for PennEnergy.

Tudor, Pickering, Holt & Co. served as financial advisor for PennEnergy.

About Stonehenge

Headquartered in Westminster, CO and backed by Energy Spectrum Capital, Stonehenge Energy Resources is a private energy company focused on building, owning and operating midstream facilities in the Appalachian basin to support its producer-partners in the optimum development of their resources. Formed in 2007, Stonehenge supported the early Appalachian unconventional shale gas development by gathering and processing NGL-rich gas in Butler County, Pennsylvania. Stonehenge currently operates two natural gas gathering systems in Butler, Clarion and Armstrong Counties, Pennsylvania. For more information about Stonehenge, visit www.stonehengeenergy.com.

About UGI Corporation

UGI Corporation is a distributor and marketer of energy products and services. Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes LPG both domestically (through AmeriGas) and internationally (through UGI International), manages midstream energy assets in Pennsylvania, Ohio and West Virginia and electric generation assets in Pennsylvania, and engages in energy marketing, including renewable natural gas, in twelve states and the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

Comprehensive information about UGI Corporation is available on the Internet at https://www.ugicorp.com.

About Energy Spectrum Capital

Founded in 1995, Energy Spectrum Capital is a Dallas, Texas-based venture capital firm that makes direct investments in well-managed, lower-middle-market companies that acquire, develop and operate energy infrastructure assets in North America. Since inception, Energy Spectrum has raised more than

View source version on businesswire.com: https://www.businesswire.com/news/home/20210216005371/en/