Tesla Maintains Lead but Chinese Automakers Are Closing the Gap in New Wards Intelligence’s SDV Ranking

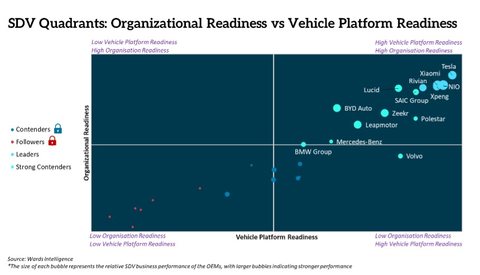

Wards Intelligence's Software-Defined Vehicle (SDV) ranking shows Tesla maintaining overall leadership while Chinese automakers NIO and Xiaomi have surpassed it in technological innovation, securing second and third positions respectively. Xpeng and Rivian complete the Leaders category, which primarily consists of battery-electric-vehicle disruptors with digital-native, software-first approaches.

In the Strong Contenders category, including Zeekr, Lucid, Leapmotor, and BMW, 67% of automakers are now actively commercializing SDVs, showing significant progress from 2023. The Contenders category, featuring Hyundai, Volkswagen Group, and General Motors, shows increased semi-SDV deployment but requires substantial progress for full SDV production.

Notably, 62% of automakers in the Leaders and Strong Contenders categories are Chinese or Chinese-owned, with only three Western incumbents among the top 14 companies, indicating China's growing dominance in the SDV segment.

Il ranking del Veicolo Definito dal Software (SDV) di Wards Intelligence mostra che Tesla mantiene il primato complessivo, mentre i produttori automobilistici cinesi NIO e Xiaomi l'hanno superata in innovazione tecnologica, conquistando rispettivamente il secondo e il terzo posto. Xpeng e Rivian completano la categoria dei Leader, che consiste principalmente in disruptor di veicoli elettrici a batteria con approcci nativi digitali e orientati al software.

Nella categoria dei Forti Contendenti, che include Zeekr, Lucid, Leapmotor e BMW, il 67% dei produttori automobilistici sta ora commercializzando attivamente gli SDV, mostrando progressi significativi rispetto al 2023. La categoria dei Contendenti, che presenta Hyundai, Volkswagen Group e General Motors, mostra un aumento nel dispiegamento dei semi-SDV, ma richiede progressi sostanziali per la produzione completa di SDV.

È significativo notare che il 62% dei produttori automobilistici nelle categorie Leader e Forti Contendenti sono cinesi o di proprietà cinese, con solo tre incumbents occidentali tra le prime 14 aziende, indicando la crescente dominanza della Cina nel segmento degli SDV.

El ranking del Vehículo Definido por Software (SDV) de Wards Intelligence muestra que Tesla mantiene el liderazgo general, mientras que los fabricantes de automóviles chinos NIO y Xiaomi la han superado en innovación tecnológica, ocupando el segundo y tercer puesto respectivamente. Xpeng y Rivian completan la categoría de Líderes, que consiste principalmente en disruptores de vehículos eléctricos de batería con enfoques nativos digitales y centrados en el software.

En la categoría de Fuertes Contendientes, que incluye a Zeekr, Lucid, Leapmotor y BMW, el 67% de los fabricantes de automóviles están ahora comercializando activamente los SDV, mostrando avances significativos desde 2023. La categoría de Contendientes, que incluye a Hyundai, Volkswagen Group y General Motors, muestra un aumento en el despliegue de semi-SDV, pero requiere un progreso sustancial para la producción completa de SDV.

Es notable que el 62% de los fabricantes de automóviles en las categorías de Líderes y Fuertes Contendientes son chinos o de propiedad china, con solo tres incumbentes occidentales entre las 14 principales empresas, lo que indica el creciente dominio de China en el segmento de SDV.

워즈 인텔리전스의 소프트웨어 정의 차량(SDV) 순위는 테슬라가 전반적인 리더십을 유지하고 있으며, 중국 자동차 제조업체인 NIO와 샤오미가 기술 혁신에서 이를 초월해 각각 2위와 3위를 차지하고 있음을 보여줍니다. 샤오펑과 리비안은 주로 소프트웨어 중심의 디지털 네이티브 접근 방식을 가진 배터리 전기차 파괴자가 포함된 리더 카테고리를 완성합니다.

지극히 강력한 경쟁자 카테고리에는 지커, 루시드, 리프모터 및 BMW가 포함되며, 현재 67%의 자동차 제조업체가 SDV를 적극적으로 상용화하고 있으며, 이는 2023년 대비 상당한 진전을 보여줍니다. 현대, 폭스바겐 그룹 및 제너럴 모터스가 포함된 경쟁자 카테고리는 반-SDV 배포의 증가를 보이고 있지만, 완전한 SDV 생산을 위해서는 상당한 진전이 필요합니다.

주목할 만한 점은 리더 및 강력한 경쟁자 카테고리에 있는 자동차 제조업체의 62%가 중국계이거나 중국 소유라는 점으로, 상위 14개 기업 중 서구 기업은 단 3개에 불과하여 SDV 부문에서 중국의 지배력이 커지고 있음을 나타냅니다.

Le classement du Véhicule Défini par Logiciel (SDV) de Wards Intelligence montre que Tesla maintient son leadership global, tandis que les fabricants chinois NIO et Xiaomi l'ont surpassée en innovation technologique, occupant respectivement la deuxième et la troisième place. Xpeng et Rivian complètent la catégorie des Leaders, qui se compose principalement de perturbateurs de véhicules électriques à batterie avec des approches nativement numériques et axées sur le logiciel.

Dans la catégorie des Forts Contendants, qui inclut Zeekr, Lucid, Leapmotor et BMW, 67 % des fabricants automobiles commercialisent désormais activement des SDV, montrant des progrès significatifs par rapport à 2023. La catégorie des Contendants, comprenant Hyundai, le groupe Volkswagen et General Motors, montre une augmentation du déploiement de semi-SDV, mais nécessite des progrès substantiels pour la production complète de SDV.

Il est à noter que 62 % des fabricants automobiles dans les catégories Leaders et Forts Contendants sont chinois ou de propriété chinoise, avec seulement trois acteurs occidentaux parmi les 14 premières entreprises, ce qui indique la domination croissante de la Chine dans le segment des SDV.

Das Ranking von Wards Intelligence für das softwaredefinierte Fahrzeug (SDV) zeigt, dass Tesla die Gesamtführung beibehält, während die chinesischen Automobilhersteller NIO und Xiaomi in der technologischen Innovation überholt haben und die zweiten und dritten Plätze belegen. Xpeng und Rivian vervollständigen die Kategorie der Führenden, die hauptsächlich aus disruptiven Batterie-Elektrofahrzeugen mit digital-nativen, software-zentrierten Ansätzen besteht.

In der Kategorie der Starken Anwärter, zu der Zeekr, Lucid, Leapmotor und BMW gehören, vermarkten nun 67 % der Automobilhersteller aktiv SDVs, was einen erheblichen Fortschritt seit 2023 zeigt. Die Kategorie der Anwärter, in der Hyundai, die Volkswagen Gruppe und General Motors vertreten sind, zeigt einen Anstieg beim Einsatz von Semi-SDVs, erfordert jedoch erhebliche Fortschritte für die vollständige Produktion von SDVs.

Bemerkenswert ist, dass 62 % der Automobilhersteller in den Kategorien Führer und starke Anwärter chinesisch oder chinesischEigentum sind, wobei nur drei westliche Anbieter unter den 14 besten Unternehmen vertreten sind, was auf die wachsende Dominanz Chinas im SDV-Segment hinweist.

- Tesla maintains overall leadership position in SDV ranking

- 67% of Strong Contenders category actively commercializing SDVs, up from 2023

- Chinese automakers showing rapid advancement in SDV technology

- Tesla lost technological innovation lead to NIO and Xiaomi

- Western automakers struggling to compete in SDV segment

- Traditional OEMs facing challenges with SDV implementation

Insights

The latest Wards Intelligence SDV ranking reveals a seismic shift in automotive technology leadership that has profound implications for the industry's future. While Tesla maintains its overall lead, the emergence of NIO and Xiaomi as technological innovators signals a fundamental power shift toward Chinese manufacturers in the critical SDV space.

The dominance of Chinese companies in the top categories (62% of Leaders and Strong Contenders) reflects several key advantages: 1) Their 'clean slate' approach, unburdened by legacy systems and organizational structures 2) Aggressive investment in software development and digital infrastructure 3) A robust domestic market that serves as a testing ground for innovations.

Western incumbents face significant challenges that extend beyond mere technological catching-up. The report highlights a important organizational readiness gap, where traditional automakers' hierarchical structures and hardware-first mindsets impede the agility needed for software-defined innovation. This disparity is particularly evident in the Contenders category, where major Western brands like Volkswagen, GM and Hyundai are still working to bring SDVs to production.

The market implications are substantial. As software-defined capabilities increasingly drive consumer purchase decisions and vehicle monetization opportunities, companies leading in SDV development are positioned to capture a disproportionate share of industry value. The rapid advancement of Chinese manufacturers suggests an accelerating trend toward Eastern technological leadership in the automotive sector, potentially reshaping global supply chains and investment flows.

SDV Quadrants Organizational Readiness vs Vehicle Platform Readiness (Graphic: Business Wire)

Xpeng and Rivian rank third and fourth, respectively, completing the Leaders category. This category mainly consists of battery-electric-vehicle disruptors that are digitally native, prioritize a software-first approach, and are not constrained by legacy platforms, systems, or organizational culture. “Overall, this category includes automakers pushing the boundaries of SDV innovation, as well as those refining and scaling zonal architectures and other SDV-related technologies and practices,” said Maite Bezerra, Principal Analyst at Wards Intelligence, now part of Omdia.

In the Strong Contenders category—featuring Zeekr, Lucid, Leapmotor, and BMW, among others—

The Contenders category, including Hyundai, the Volkswagen Group, and General Motors, among others, saw an uptick in automakers deploying semi-SDVs and outlining more detailed SDV strategies. However, they still need to make substantial progress in bringing SDVs to production. Meanwhile, automakers in the Followers category—which previously included OEMs without a public SDV roadmap or specific timelines—have started setting clear SDV goals in response to the market’s swift evolution.

Measuring SDV progress remains challenging due to inconsistent definitions and lack of clear benchmarks. To address this, Wards Intelligence conducts annual primary and secondary research, utilizing advanced statistical tools to identify the most accurate indicators of SDV advancement. In this edition, 27 automakers were evaluated across five metrics: financial strength, portfolio complexity, vehicle platform readiness, organizational readiness, and SDV performance.

“Notably,

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250205794200/en/

Fasiha Khan - fasiha.khan@omdia.com

Source: Omdia